Professional Documents

Culture Documents

AIS Chapter 2 Handout

Uploaded by

Elle SalengaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AIS Chapter 2 Handout

Uploaded by

Elle SalengaCopyright:

Available Formats

BSAC 322

Accounting Information Systems

Chapter 2

Introduction to Transaction Processing

The Stages in Data Processing Cycle includes

Input

Process

Output

Storage

The data processing cycle determines

What data to be stored

Who has access to the data

How data is organized

How information requirements of user will be met.

DATA INPUT

• As a business activity occurs data is collected about:

1. Each activity of interest

2. The resources affected

3. The people who are participating

Sources of Data:

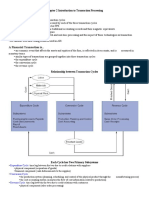

Paper-Based source documents

Source Product Turnaround

Documents Document Document

Documents that

Documents used are created as a

to capture and result of Product

formalize transaction document of one

transaction data. processing. system that

becomes source

document of

another system.

This document Paycheck is an

serves as the example of a

basis for data product

processing document.

• Source Data Automation

– In machine-readable form

– At the time of the business activity

• How to ensure accuracy and completeness of data input?

– The answer: Use Source Data Automation or Well-designed source documents.

– Well-designed source documents and screen can ensure that data captured is

• Accurate

• Provide instructions and prompts

• Check boxes

• Drop-down boxes

• Complete

• Internal control support via pre-numbered documents

DATA STORAGE

Traditional Systems

• Journals

• Special journal

• Register

• General Journal

• Ledgers

• General Ledger

• Subsidiary Ledgers

• CODING TECHNIQUES

• Sequence Codes

• Items are numbered consecutively

• Block Codes

• Blocks of numbers are reserved for specific categories.

• Group Codes

• Positioning of digits in code provide meaning.

• Mnemonics

• Letters and numbers are interspersed to identify an item.

• Code derived from description of item

Guidelines for a better coding scheme:

• Be consistent with intended use.

• Allow for growth.

• Be as simple as possible

• To minimize cost

• Facilitate memorization and interpretation

• Ensure employee acceptance.

• Computer-Based Systems

• Master file

• Contains account data

• The equivalent of the General Ledger

• Transaction File

• Temporary file of transaction records

• Used to update or change data in a master file.

• Reference File

• Stores data that are used as standards for processing transactions.

• Withholding tax table

• Price list

• Archive File

• Contains record of fast transactions.

• Use as reference for Audit trail.

• Database

• DATA PROCESSING

• Four Main Activities

1. Create new records.

• Adding a newly hired employee to the payroll database.

2. Read existing records

• Retrieving or viewing existing files.

3. Update existing records

• Posting journal entries to the ledger will adjust previous account balances to

make it current.

4. Delete records or data from records

• Removing from the list vendors the company no longer does business with.

• DATA UPDATING PROCESS

1. Batch processing

• Updating is done on periodic basis.

• Used only for application that do not need frequent updating. Example: payroll system.

2. On-line, Real-time processing

• Updating is done when the activity happens.

• Advantage: Stored information is always current.

3. Online Batch processing

• Transaction data are entered and edited as they occur and stored for later processing.

INFORMATION OUTPUT

• Information output can be

1. Soft copy output.

• If the output is displayed on monitor or screen

2. Hard copy output

• When the output is printed on paper.

• Forms of information output:

1. Documents

• Records of transactions, product documents.

2. Reports

• Output of FRS and MRS.

• Result of database query which is use to deal with problems that

require immediate action.

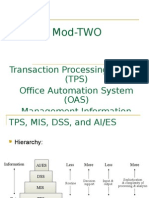

TRANSACTION PROCESSING SYSTEMS CYCLES

• Expenditure Cycle

1. Purchases/Accounts Payable System

2. Cash Disbursement Systems

3. Payroll systems

4. Fixed Assets Systems

• Conversion cycle

1. Production System

2. Cost Accounting Systems

• Revenue Cycle

1. Sales Order Processing Systems

2. Cash Receipt Systems

ENTERPRISE RESOURCE PLANNING SYSTEMS

Enterprise resource planning (ERP) is the integrated management of core business

processes, often in real-time and mediated by software and technology.

Advantages of Implementing an ERP Systems

• Integration of an organization’s data and financial information (Central database)

• Data is captured once

• Greater management visibility, increased monitoring

• Better access controls (consolidated multiple permissions and security models)

• Standardizes business operating procedures

• Improved customer service (quick access to customer order, available inventory etc.)

• More efficient manufacturing (real-time orders lead to increased productivity)

Disadvantages of ERP Systems

• Cost (US$ 50 – 500 million)

• Time-consuming to implement ( years to fully implement)

• Changes to an organization’s existing business processes can be disruptive (occurs

when converting a non-ERP system to ERP)

• Complex (integrating the different business process)

• Resistance to change (A natural reaction to change)

You might also like

- Accounting Information Systems Chapter 2 IntroductionDocument7 pagesAccounting Information Systems Chapter 2 IntroductionElle SalengaNo ratings yet

- Enterprise Directory and Security Implementation Guide: Designing and Implementing Directories in Your OrganizationFrom EverandEnterprise Directory and Security Implementation Guide: Designing and Implementing Directories in Your OrganizationNo ratings yet

- MIS UNIT 5aDocument23 pagesMIS UNIT 5aVaibhav ShrotriNo ratings yet

- Overview of Transaction Processing and Enterprise Resource Planning SystemsDocument15 pagesOverview of Transaction Processing and Enterprise Resource Planning SystemsKim Raven CoNo ratings yet

- Transaction Processing SystemDocument45 pagesTransaction Processing Systemabrar Illahe100% (1)

- Chapter 2: Introduction To Transaction Processing NotesDocument7 pagesChapter 2: Introduction To Transaction Processing NotesGLECYL BACULIO JAQUILMACNo ratings yet

- Overview of transaction processing and enterprise resource planning systemsDocument15 pagesOverview of transaction processing and enterprise resource planning systemsGundamSeedNo ratings yet

- Topic 2 Transaction Processing SystemDocument64 pagesTopic 2 Transaction Processing SystemKimberly Pilapil MaragañasNo ratings yet

- Less Observable in Computer-Based Systems Than TraditionalDocument4 pagesLess Observable in Computer-Based Systems Than TraditionalLala AlalNo ratings yet

- 12 Transaction Processing PDFDocument50 pages12 Transaction Processing PDFkdgNo ratings yet

- Overview of Transaction Processing and ERP SystemsDocument34 pagesOverview of Transaction Processing and ERP SystemsShe RCNo ratings yet

- Overview of Transaction Processing and Enterprise Resource Planning SystemsDocument34 pagesOverview of Transaction Processing and Enterprise Resource Planning SystemsJulius JasisNo ratings yet

- 05 Data Flow DiagramsDocument58 pages05 Data Flow Diagramsdoruk-tufekci-6025No ratings yet

- Introduction To Transaction Processing: A Financial Transaction Is..Document13 pagesIntroduction To Transaction Processing: A Financial Transaction Is..AstxilNo ratings yet

- Transaction Processing and Financial Reporting Systems OverviewDocument75 pagesTransaction Processing and Financial Reporting Systems Overviewaldwin006No ratings yet

- Computer Systems ConceptsDocument30 pagesComputer Systems ConceptsRetno Nilam SariNo ratings yet

- Romney15ege Accessible Fullppt 02Document16 pagesRomney15ege Accessible Fullppt 02Zaldy GunawanNo ratings yet

- c2 Introduction To Transaction ProcessingDocument14 pagesc2 Introduction To Transaction ProcessingLee SuarezNo ratings yet

- Data Warehousing: Defined and Its ApplicationsDocument31 pagesData Warehousing: Defined and Its ApplicationsIndumathi KNo ratings yet

- Overview of Databases and Transaction ProcessingDocument21 pagesOverview of Databases and Transaction ProcessingAhsan JavedNo ratings yet

- CH 2Document44 pagesCH 2Pougessen VenkatachellanNo ratings yet

- Chapter 2 Fundamentals of AISDocument7 pagesChapter 2 Fundamentals of AISTHOTslayer 420No ratings yet

- Various Applications of Data WarehouseDocument30 pagesVarious Applications of Data WarehouseRafiul HasanNo ratings yet

- Unit 2 Data Warehouse NewDocument45 pagesUnit 2 Data Warehouse NewSUMAN SHEKHARNo ratings yet

- Accounting Information System ReportDocument7 pagesAccounting Information System ReportMelody ViernesNo ratings yet

- 2MIS - Foundation of Information System - Part IIDocument30 pages2MIS - Foundation of Information System - Part IIPravakar GhimireNo ratings yet

- Accounting Information Systems: Fourteenth Edition, Global EditionDocument16 pagesAccounting Information Systems: Fourteenth Edition, Global Editionfaris ikhwanNo ratings yet

- Chapter 2 - Transaction Processing and ERPDocument39 pagesChapter 2 - Transaction Processing and ERPLê Thái VyNo ratings yet

- Transaction Processing SystemsDocument26 pagesTransaction Processing SystemsPradeep100% (7)

- Chapter 2-3Document7 pagesChapter 2-3...No ratings yet

- Data Warehouse ComponentsDocument26 pagesData Warehouse Componentsdurai muruganNo ratings yet

- Introduction to Transaction Cycles and ProcessingDocument36 pagesIntroduction to Transaction Cycles and Processinghassan nassereddineNo ratings yet

- Functional, Enterprise, and Inter Organizational SystemsDocument26 pagesFunctional, Enterprise, and Inter Organizational Systemssourabh312No ratings yet

- Data Processing and ManagementDocument28 pagesData Processing and ManagementMaybelleNo ratings yet

- Adapted From Jeffery A. Hoffer's Modern Database Management, 12 EditionDocument23 pagesAdapted From Jeffery A. Hoffer's Modern Database Management, 12 EditionShermeen AdnanNo ratings yet

- Accounting Information Systems OverviewDocument9 pagesAccounting Information Systems OverviewKesiah FortunaNo ratings yet

- Information System and Knowledge ManagementDocument30 pagesInformation System and Knowledge ManagementkuvarabhishekNo ratings yet

- PB1MAT Pertemuan 1-2Document35 pagesPB1MAT Pertemuan 1-2renaldiNo ratings yet

- Transaction Processing, ERP, and E-Commerce Systems SummaryDocument46 pagesTransaction Processing, ERP, and E-Commerce Systems Summarynandini_mba4870No ratings yet

- Accounting 109 SummaryDocument12 pagesAccounting 109 SummaryJay LloydNo ratings yet

- Data Warehousing: Hu Yan Huy@cs - Tut.fiDocument27 pagesData Warehousing: Hu Yan Huy@cs - Tut.fisamiisthereNo ratings yet

- Chapter 2 Introduction To Transaction ProcessingDocument12 pagesChapter 2 Introduction To Transaction ProcessingRizza OlanoNo ratings yet

- IT-1 Overview of Information Technology and SystemsDocument57 pagesIT-1 Overview of Information Technology and SystemsNaman MithalNo ratings yet

- DW ComponentsDocument30 pagesDW ComponentsKalaivani DNo ratings yet

- Financial Transactions, Accounting Systems, and Computer Processing TechniquesDocument2 pagesFinancial Transactions, Accounting Systems, and Computer Processing Techniquesclowreed_johnryan11No ratings yet

- Module 2Document18 pagesModule 2Angel YbanezNo ratings yet

- Database Systems: Transaction ProcessingDocument14 pagesDatabase Systems: Transaction ProcessingHaider AliNo ratings yet

- Basic Accounting Information System in 40 CharactersDocument17 pagesBasic Accounting Information System in 40 CharactersMelady Sison CequeñaNo ratings yet

- 9 CH Bus 304 Enterprise ApplicationsDocument156 pages9 CH Bus 304 Enterprise ApplicationsJasmine Ahmed Joty (161011023)No ratings yet

- MIS Module 3 - Transaction Processing Systems, Office Automation Systems, and Information ReportingDocument129 pagesMIS Module 3 - Transaction Processing Systems, Office Automation Systems, and Information Reportingmohammed jasirNo ratings yet

- UNITyssu 1 LTDocument12 pagesUNITyssu 1 LTSahil KumarNo ratings yet

- Introduction To Data WarehousingDocument24 pagesIntroduction To Data WarehousingObi MagsombolNo ratings yet

- Transaction Processing System (TPS) Office Automation System (OAS)Document66 pagesTransaction Processing System (TPS) Office Automation System (OAS)kimsr100% (17)

- Data and Business Intelligence: Bidgoli, MIS, 10th Edition. © 2021 CengageDocument19 pagesData and Business Intelligence: Bidgoli, MIS, 10th Edition. © 2021 CengageMose MosehNo ratings yet

- Data Warehousing and Data Mining Unit 2Document14 pagesData Warehousing and Data Mining Unit 2Shreedhar PangeniNo ratings yet

- Ais (Module)Document6 pagesAis (Module)justinnNo ratings yet

- 111Document16 pages111Jeric Lagyaban AstrologioNo ratings yet

- Selected Topics of Recent Trends in Information TechnologyDocument21 pagesSelected Topics of Recent Trends in Information TechnologyDolly MehraNo ratings yet

- DBMS Sem 3 Assignment 2020-2021Document3 pagesDBMS Sem 3 Assignment 2020-2021Rohit YadavNo ratings yet

- Description Description: P25Z P25Z P25ZDocument52 pagesDescription Description: P25Z P25Z P25ZLuide CapanemaNo ratings yet

- Cnpilot Enterprise Wi-Fi Access Points 4.1 Release Notes PDFDocument15 pagesCnpilot Enterprise Wi-Fi Access Points 4.1 Release Notes PDFgspolettoNo ratings yet

- phím tắt NXDocument5 pagesphím tắt NXthanhNo ratings yet

- Nutanix - LeetCodeDocument2 pagesNutanix - LeetCodePeeyushNo ratings yet

- Catalog Modicon TM5 High Performance and Safe IP20 Modular IO SystemDocument42 pagesCatalog Modicon TM5 High Performance and Safe IP20 Modular IO Systemtarak7787No ratings yet

- Data - Sheet - c78-727133 Nodo Con Retorno Digital Tecn GanDocument8 pagesData - Sheet - c78-727133 Nodo Con Retorno Digital Tecn GanMary V. LopezNo ratings yet

- Programming Cable Tk503 / Tk504: Usb Driver InstallationDocument11 pagesProgramming Cable Tk503 / Tk504: Usb Driver Installationlun4tic0sNo ratings yet

- 7 ClassDocument72 pages7 ClassAyesha FatimaNo ratings yet

- Quiz 1-Use CaseDocument4 pagesQuiz 1-Use CaseNisma AslamNo ratings yet

- Microprocessors Code ETEE 302 Paper Syllabus and InstructionsDocument1 pageMicroprocessors Code ETEE 302 Paper Syllabus and InstructionsPrableen SinghNo ratings yet

- A Brief History of Internet BankingDocument3 pagesA Brief History of Internet Bankingminzkattan50% (4)

- Sabre Basic Course: ManualDocument100 pagesSabre Basic Course: Manualrishad100% (1)

- 01-09 Basic IPv6 Configuration PDFDocument49 pages01-09 Basic IPv6 Configuration PDFHamoud BourjNo ratings yet

- Process Mining: Overview and Opportunities: ACM Reference FormatDocument16 pagesProcess Mining: Overview and Opportunities: ACM Reference FormatRabensoNo ratings yet

- Release Notes: Lifesize Video Communications Systems Release: V4.0.11Document20 pagesRelease Notes: Lifesize Video Communications Systems Release: V4.0.11l0k0tusNo ratings yet

- Rainmeter ManualDocument119 pagesRainmeter Manualankit_kunduNo ratings yet

- Business Intelligence Dashboards and Improved Performance of Farmers in Bayelsa State, NigeriaDocument7 pagesBusiness Intelligence Dashboards and Improved Performance of Farmers in Bayelsa State, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- PL-900 Microsoft Power Platform Fundamentals Sample QuestionsDocument20 pagesPL-900 Microsoft Power Platform Fundamentals Sample QuestionsFlávio Claro LeonardiNo ratings yet

- ZXSDR R8984E Hardware Description PDFDocument25 pagesZXSDR R8984E Hardware Description PDFK OuertaniNo ratings yet

- Deleting RNL Files Resolves FactoryTalk ErrorsDocument5 pagesDeleting RNL Files Resolves FactoryTalk ErrorsJohan GantivaNo ratings yet

- IT Essentials Chapter 8 Exam Answers 2018 2019 Version 6.0 100% IT Essentials Chapter 8 Exam Answers 2018 2019 Version 6.0 100%Document7 pagesIT Essentials Chapter 8 Exam Answers 2018 2019 Version 6.0 100% IT Essentials Chapter 8 Exam Answers 2018 2019 Version 6.0 100%Egy RenataNo ratings yet

- Public Address and Intercom System Design GuidelinesDocument15 pagesPublic Address and Intercom System Design GuidelinesBill King100% (6)

- Chapter 14 - Game TheoryDocument35 pagesChapter 14 - Game TheoryramixzNo ratings yet

- Punit Training Report 2Document11 pagesPunit Training Report 22K19-EC-004 Aakash SoniNo ratings yet

- AWS Job Q&ADocument3 pagesAWS Job Q&Asoftsen10No ratings yet

- CamScanner Scanned Document CollectionDocument199 pagesCamScanner Scanned Document CollectionAyush jhaNo ratings yet

- Computer Organization Assembly NotesDocument43 pagesComputer Organization Assembly NotesKhizar IqbalNo ratings yet

- Delhi University Entrance Test - 2021 Admit Card-Provisional: Self Declaration (Undertaking)Document4 pagesDelhi University Entrance Test - 2021 Admit Card-Provisional: Self Declaration (Undertaking)Barkha SahNo ratings yet

- 10.2.3.4 Lab - Troubleshooting Advanced Single-Area OSPFv2Document7 pages10.2.3.4 Lab - Troubleshooting Advanced Single-Area OSPFv2Dario ChNo ratings yet

- Blockchain Basics: A Non-Technical Introduction in 25 StepsFrom EverandBlockchain Basics: A Non-Technical Introduction in 25 StepsRating: 4.5 out of 5 stars4.5/5 (24)

- SQL QuickStart Guide: The Simplified Beginner's Guide to Managing, Analyzing, and Manipulating Data With SQLFrom EverandSQL QuickStart Guide: The Simplified Beginner's Guide to Managing, Analyzing, and Manipulating Data With SQLRating: 4.5 out of 5 stars4.5/5 (46)

- Dark Data: Why What You Don’t Know MattersFrom EverandDark Data: Why What You Don’t Know MattersRating: 4.5 out of 5 stars4.5/5 (3)

- Monitored: Business and Surveillance in a Time of Big DataFrom EverandMonitored: Business and Surveillance in a Time of Big DataRating: 4 out of 5 stars4/5 (1)

- ITIL 4: Digital and IT strategy: Reference and study guideFrom EverandITIL 4: Digital and IT strategy: Reference and study guideRating: 5 out of 5 stars5/5 (1)

- THE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE: "THE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE"From EverandTHE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE: "THE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE"Rating: 3 out of 5 stars3/5 (1)

- Agile Metrics in Action: How to measure and improve team performanceFrom EverandAgile Metrics in Action: How to measure and improve team performanceNo ratings yet

- COBOL Basic Training Using VSAM, IMS and DB2From EverandCOBOL Basic Training Using VSAM, IMS and DB2Rating: 5 out of 5 stars5/5 (2)

- Business Intelligence Strategy and Big Data Analytics: A General Management PerspectiveFrom EverandBusiness Intelligence Strategy and Big Data Analytics: A General Management PerspectiveRating: 5 out of 5 stars5/5 (5)

- Grokking Algorithms: An illustrated guide for programmers and other curious peopleFrom EverandGrokking Algorithms: An illustrated guide for programmers and other curious peopleRating: 4 out of 5 stars4/5 (16)

- Big Data Analytics: Disruptive Technologies for Changing the GameFrom EverandBig Data Analytics: Disruptive Technologies for Changing the GameRating: 4 out of 5 stars4/5 (9)

- PostgreSQL for Jobseekers: Introduction to PostgreSQL administration for modern DBAs (English Edition)From EverandPostgreSQL for Jobseekers: Introduction to PostgreSQL administration for modern DBAs (English Edition)No ratings yet

- IBM DB2 Administration Guide: Installation, Upgrade and Configuration of IBM DB2 on RHEL 8, Windows 10 and IBM Cloud (English Edition)From EverandIBM DB2 Administration Guide: Installation, Upgrade and Configuration of IBM DB2 on RHEL 8, Windows 10 and IBM Cloud (English Edition)No ratings yet