Professional Documents

Culture Documents

Tax 467 Common Test July 2022 - SS PDF

Uploaded by

khaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax 467 Common Test July 2022 - SS PDF

Uploaded by

khaiCopyright:

Available Formats

CONFIDENTIAL 1 AC/JULY 2021/TAX467/TEST

UNIVERSITI TEKNOLOGI MARA

TEST

ANSWER SCHEME

COURSE : TAXATION 1

COURSE CODE : TAX 467

EXAMINATION : JULY 2021

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/JULY 2021/TAX467/TEST

QUESTION 1

a.

YA Period of Stay No of Status Section Reasons

Days

2016 15/7 – 26/12 165 NR√

2017 18/5 – 2/7 51 R√ S 7 (1)(b) He stayed in Malaysia less than 182 days √

20/10 – 15/11 27 √ in YA 2017 and the period is linked to√ YA

16/11 – 31/12 (46 TA) 2018 that consist of at least 182 consecutive

78 days inclusive of TA√

2018 1/1 – 2/1 (2 TA) R√ S 7 (1)(a) He stayed in Malaysia for at least 182 days √

3/1 – 28/7 207 √

207

2019 5/1 – 6/4 93 R√ S 7 (1)(c) √ He stayed in Malaysia at least 90 days in YA

7/4 – 31/12 (269 TA) 2019 √ and 3 out of 4 immediatepreceding

93 years (YA 2016, 2017 and 2018) √ he was a

resident or stayed in Malaysia at least 90

days. √

2020 20/2 – 31/4 71 R√ S 7 (1)(d) He was a resident √ in 3 immediate

√ preceding years of assessement √

(YA 2019,2018,2017) and resident in the

following year of assessment (YA 2020) √

2021 7/1 – 30/6 175 R√ S7(1)(c) √ He stayed in Malaysia at least 90 days in

YA2021 √ and 3 out of 4 immediate

preceding years (YA 2020, 2019 and 2018 √

he was a resident or stayed in Malaysia at

least 90 days. √

(24x ½ =12 marks)

QUESTION 2

A. Constructed Building

RM

Cost of land Nil /

Architect fees 12,000 /

Cost of internal road and drainage system 38,000 /

Construction cost 2,000,000 /

Wiring and plumbing 40,000 /

Legal and professional fee 20,000 /

2,110,000

10% Rule:

Office does not fall in the ambit of industrial building. Since the office is 12% which is

more than 10 % of the total space therefore it does not qualify as IB. Therefore.

QE = RM2,110,000 x 88% = RM1,856,800.//

(8 / x ½ = 4)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/JULY 2021/TAX467/TEST

YA RM

2019 QBE 1,856,800

IA (10%) / (185,680)

AA (3%) / (55,704)

RE 1,615,416

2020 AA (3%) (55,704) /

RE 1,559,712

2021 AA (3%) (55,704) /

RE 1,504,008

(4/ x ½ = 2)

Canteen & restroom

YA 2021 QBE 1,200,000

IA (10%) /

AA (3%) /

RE

B. Plant & Machinery

Cutting Machine

RM

Cost of machine 60,000 /

Cost of installation 5,000 /

Cost of preparing site (COPS) 12,000 /

Aggregate cost 77,000

10% Rule

10% x Aggregate cost = 10% x RM77,000 = RM7,700. Since COPS (RM12,000) is

more than / 10% Rule (RM7,700) therefore, COPS does not qualify as QE. QE =

RM77,000 – RM12,000 = RM65,000. //

YA RM

2019 QE 65,000

IA (20%) / (13,000)

AA (3%) / (9,100)

RE 42,900

2020 AA (3%) (9,100)/

RE 33,800

2021 AA (3%) (9,100)/

RE 24,700

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/JULY 2021/TAX467/TEST

Toyota Vellfire

Capital portion = 300,000 – 30,000

60 months

= RM4,500 //

YA RM RM

RQE = 50,000

2019 QE = Deposit + Capital portion

30,000 / + (4,500 x 2) // 39,000 39,000

IA (20% x 39,000) / (7,800)

AA (20% x 39,000) / (7,800)

RE 23,400

2020 QE: (4,500 X 12 =54,000 but restrict to) 11,000 11,000

34,400 50,000

IA (20% X 11,000) (2,200)

AA (20% X 50,000) (10,000)

RE 22,200

2021 Disposal (50,000/300,000 x 180,000) /// (30,000)

Balancing charge / (7,800)

C. Agriculture Allowance

1. Replacing cucumbers with tomatoes is considered as replanting√ and therefore,

qualify for agricultural allowances √

2. The expenditure incurred on the replacement of the rubber trees with oil palm trees

is new planting √ and therefore, qualify for agricultural allowances √.

3. Flower plant (roses) is not crops √ and therefore does not qualify for agriculture

allowances √

(6 √ X ½ = 3 mark)

(Total: 20 marks)

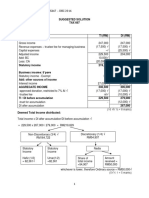

QUESTION 3

a.

RM RM

Provisional Adjusted Income 610,000√

Less: Benefits to partners

Interest on capital

Damia (210,000 x 5%) 10,500 √√

Adam (140,000 x 5%) 7,000√√

Haikal (100,000 x 5% x 4/12√) 1,250√√ (18,750)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/JULY 2021/TAX467/TEST

Salary

Damia (10,000 x 12) 120,000 √√

Adam (8,500 x 12) 102,000√√

Haikal (6,000 x 3) 18,000√√ (240,000)

Travelling Allowance

Damia (1,200 x 12) 14,400√√

Adam (1,000 x 12) 12,000√√

Haikal (1,000 x 3) 3,000√√ (29,400)

Divisional Income √ 321,850

Damia & Associates

Computation of partners Total Income for YA 2018

Damia Adam Haikal

Pre-divisional income (9/12√ x 321,850 = 144,832 96,555 -

241,387.50). 60:40

Post-divisional income (3/12√ x 321,850 = 40,231 26,821 13,410

80,462.50). 3 : 2 : 1

Add: Benefits to partners

Interest on capital 10,500 7,000 5,000

Salary 120,000 102,000 18,000

Travelling Allowance 14,400 12,000 3,000

Adjusted Business Income √ 329,963 244,376 39,410

Add: Balancing charge (6,000)(3:2:1) 3,000√ 2,000√ 1,000√

Less: Capital Allowance (18,000)(3:2:1) 9,000√ 6,000√ 3,000√

Less: Capital Allowance – Damia 10,000√√ - -

Statutory Business Income √ 351,963 252,376 43,410

Add: Other Income

Honorarium 2,000 √

Aggregate Income 351,963 43,410

Total Income √ 351,963 254,376 43,410

(34 √ x ½ = 17 marks)

b. LLP is an alternative business form that is introduced by the Companies Commission of

Malaysia (CCM) to provide options to businesses and entreprenuers to carry out their

business operations to be more competitive. An LLP has hybrid features of

a company√ that provides limited liability to its partners√.

(2 √ x 1 = 2 marks)

(Total:15 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- SEO-Optimized Title for AIS205 Computerized Accounting Exam Answer SchemeDocument4 pagesSEO-Optimized Title for AIS205 Computerized Accounting Exam Answer Schemesyafiah sofianNo ratings yet

- Answer Tutorial 3 Partnership Part 2Document3 pagesAnswer Tutorial 3 Partnership Part 2athirah jamaludin100% (1)

- Answer Tutorial 5 Basis Period ChangesDocument2 pagesAnswer Tutorial 5 Basis Period Changesathirah jamaludinNo ratings yet

- Ocean Management's Modus Operandi: Lease-Purchase is Best OptionDocument25 pagesOcean Management's Modus Operandi: Lease-Purchase is Best OptionNur SyafiqahNo ratings yet

- Tax667 - SS Feb 2023Document13 pagesTax667 - SS Feb 2023hilman100% (2)

- Assignment Maf201Document7 pagesAssignment Maf201miyrasallyNo ratings yet

- AA025 PYQ 2015 - 2014 (ANS) by SectionDocument4 pagesAA025 PYQ 2015 - 2014 (ANS) by Sectionnurauniatiqah49No ratings yet

- Ss - Maf551 Feb 22Document7 pagesSs - Maf551 Feb 22izwanNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Solution Far410 Jun 2019Document9 pagesSolution Far410 Jun 2019Nabilah NorddinNo ratings yet

- TAX317 SS JUN2019. (Rate 2021.for Students)Document10 pagesTAX317 SS JUN2019. (Rate 2021.for Students)izzahNo ratings yet

- Far460 - Set 1 - Feb 2021 - Suggested SolutionsDocument8 pagesFar460 - Set 1 - Feb 2021 - Suggested SolutionsRuzaikha razaliNo ratings yet

- Farm Fresh Group Assignment Analyzes Inventory ValuationDocument25 pagesFarm Fresh Group Assignment Analyzes Inventory ValuationWOO YOKE MEINo ratings yet

- Mgt345 Om Mar2015 Part ADocument8 pagesMgt345 Om Mar2015 Part AYusuv Abdul Rashid100% (2)

- SS1 - Tenang Bhd Financial Statements AnalysisDocument9 pagesSS1 - Tenang Bhd Financial Statements AnalysisAFIZA JASMANNo ratings yet

- Answer Tutorial 6 Capital AllowanceDocument3 pagesAnswer Tutorial 6 Capital Allowanceathirah jamaludin100% (2)

- Aa025 Tutorial Answer Topic 7 AcmcDocument28 pagesAa025 Tutorial Answer Topic 7 Acmccjeipin123No ratings yet

- Assignment - OHD ACC116Document3 pagesAssignment - OHD ACC116Nurul NajihaNo ratings yet

- FAR Revision Answer Scheme Jul 2017Document8 pagesFAR Revision Answer Scheme Jul 2017Nurul Farahdatul Ashikin RamlanNo ratings yet

- Acc106 Feb2021 Question Set 1Document15 pagesAcc106 Feb2021 Question Set 1Fara husna0% (1)

- Acc106 Feb2021 Question Set 1Document15 pagesAcc106 Feb2021 Question Set 1Fara husna0% (1)

- Dec2022 Acc117 Acc106 Test 1 QDocument6 pagesDec2022 Acc117 Acc106 Test 1 Qlailanurinsyirah abdulhalimNo ratings yet

- Windows 101 Bhd StatementsDocument27 pagesWindows 101 Bhd StatementsShuhada Shamsuddin75% (4)

- CT SS For Student Oct2019Document7 pagesCT SS For Student Oct2019Nabila RosmizaNo ratings yet

- FAR270 Common Test 1 QuestionsDocument4 pagesFAR270 Common Test 1 Questionssharifah nurshahira sakinaNo ratings yet

- Tax 267 Feb21 PyqDocument8 pagesTax 267 Feb21 PyqKenji HiroNo ratings yet

- Confidential 1 AC/TEST MAY 2021/FAR270Document5 pagesConfidential 1 AC/TEST MAY 2021/FAR270Lampard AimanNo ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaNo ratings yet

- SS CT DEC 2021 TITLEDocument4 pagesSS CT DEC 2021 TITLEsharifah nurshahira sakinaNo ratings yet

- Tax 467 Common Test July 2022 PDFDocument5 pagesTax 467 Common Test July 2022 PDFkhaiNo ratings yet

- Solution FAR270 NOV 2022Document6 pagesSolution FAR270 NOV 2022Nur Fatin AmirahNo ratings yet

- FAR270 JULY 2022 SolutionDocument8 pagesFAR270 JULY 2022 SolutionNur Fatin AmirahNo ratings yet

- Solution DEC 19Document8 pagesSolution DEC 19anis izzatiNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNo ratings yet

- Solution FAR270 APRIL 2022Document6 pagesSolution FAR270 APRIL 2022Nur Fatin AmirahNo ratings yet

- MAF 451 Suggested SolutionDocument7 pagesMAF 451 Suggested Solutionanis izzatiNo ratings yet

- Solution JUN 2018Document7 pagesSolution JUN 2018anis izzatiNo ratings yet

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- Far160 (CT XXX 2022) QuestionDocument4 pagesFar160 (CT XXX 2022) QuestionFarah HusnaNo ratings yet

- MAF503 Financial AnalysisDocument8 pagesMAF503 Financial Analysisanis izzatiNo ratings yet

- Financial Reporting FrameworkDocument47 pagesFinancial Reporting FrameworkAndi Nabila Anabell100% (1)

- Question 4 JULY2020 MAF251Document5 pagesQuestion 4 JULY2020 MAF251Tengku Ed Tengku ANo ratings yet

- Total Machine Hours:: Suggested Solution Maf451 (June 2016) QUESTION 1: AnswerDocument8 pagesTotal Machine Hours:: Suggested Solution Maf451 (June 2016) QUESTION 1: Answeranis izzatiNo ratings yet

- Question PSPM AA015 1718 by SectionDocument9 pagesQuestion PSPM AA015 1718 by Sectionnur athirahNo ratings yet

- Answer Tax317 Scheme July 2022Document10 pagesAnswer Tax317 Scheme July 2022Kirei RoseNo ratings yet

- Sample Law446Document3 pagesSample Law446Nor Alia ShafiaNo ratings yet

- Project 2 FAR270 SummaryDocument6 pagesProject 2 FAR270 SummaryHaru BiruNo ratings yet

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Zahiratul QamarinaNo ratings yet

- Fin 242 FullDocument5 pagesFin 242 FullIzzaty AffrinaNo ratings yet

- Lala Trading's Profit & Loss, Assets & Equity for 2018Document27 pagesLala Trading's Profit & Loss, Assets & Equity for 2018ummi sabrina100% (1)

- Proposed Answer Scheme ChapterDocument5 pagesProposed Answer Scheme Chapternur athirah100% (1)

- Tutorial 6 QDocument5 pagesTutorial 6 Qmei tanNo ratings yet

- Solution DEC 2018Document7 pagesSolution DEC 2018anis izzatiNo ratings yet

- Skema Trial English Smka & Sabk K1 Set 2Document6 pagesSkema Trial English Smka & Sabk K1 Set 2Genius UnikNo ratings yet

- Group Project ConsolidationDocument15 pagesGroup Project ConsolidationSyahrul Amirul100% (1)

- JULY 2021 STA104 Answer PDFDocument5 pagesJULY 2021 STA104 Answer PDFSiti Hajar KhalidahNo ratings yet

- Accounts Receivable and Payable ReportDocument1 pageAccounts Receivable and Payable ReportDiiptee Saravanan0% (1)

- Assignment 2 - N4am2261a - Group4Document27 pagesAssignment 2 - N4am2261a - Group4zuewaNo ratings yet

- Tutorial 8 PDFDocument12 pagesTutorial 8 PDFtan keng qi100% (2)

- Ss Jan2022Document6 pagesSs Jan2022AFIQAH NAJWA MOHD TALAHANo ratings yet

- July 2022 PDFDocument13 pagesJuly 2022 PDFkhaiNo ratings yet

- Statement of Cashflow AnalysisDocument2 pagesStatement of Cashflow AnalysiskhaiNo ratings yet

- Far410 - Q - Set1 - Fatmawati JusohDocument8 pagesFar410 - Q - Set1 - Fatmawati JusohAFIZA JASMANNo ratings yet

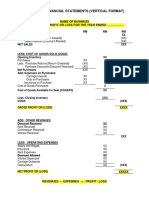

- Format Sopl SofpDocument2 pagesFormat Sopl SofpkhaiNo ratings yet

- TAX467 July 2022 QDocument13 pagesTAX467 July 2022 QkhaiNo ratings yet