Professional Documents

Culture Documents

Mortgages

Uploaded by

William MasterCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortgages

Uploaded by

William MasterCopyright:

Available Formats

Mortgages

o Mortgage: borrowing of money to buy a property, banks ask for it in order to secure

that loan (this means they get various rights.)

o Mortgagor: the borrowe, the one buying the property.

o Mortgagee: the lender.

o Equity of Redemption: is the name that we give to the bundle of rights that the

borrower has.

o Collateral Advantage: only in commercial mortgages, when a business uses it, they

try to give themselves an extra benefit, an extra arrangement, EJ: brewer gives the

pub a mortgage in order for them to sell their beer.

o Foreclosure: a remedy that is rarely used these days, don’t use it in exams. The press

sometimes uses this meaning in the American way when they actually want to say

repossession.

o Arrears: when payments are not made, there is a built of mortgage arreas, when

they become too much – repossession (4-6 months usually)

o Repossession: legal but also personal and family level. They resell it to a new owner

to pay the unpaid mortgage.

o Negative equity: when you owe more than your property is worth. Can happen in

recessions or with devaluation.

Define mortgage.

“a property interest that exists to ensure payment of a debt, more commonly by selling the

land if the debt is unpaid.

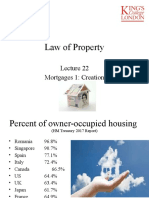

Social Background: the home ownership has risen in the past years, this is due to the easier

avaliabilty of mortgages.

Creation of Mortgages: “ little short of scandalous that there is no modern legislative

statement of what a mortgage or charge is and of the rights which such a mortgage is and of

the rights which such a mortgage or charge confer. Instead, registered charges are described

as having the same effect as mortgages created using old, now obsolete methods.

Legal Mortgages;

o Section 1 of the LPA 1925

o Lists a mortgage as one of the 5 interests that are capable of being a legal

interest. This depends on how you create it.

o Section 23(1) of LRA 2002

o Tells you that a legal charge is now the only way to create a mortgage of

registered land.

o Section 27 & Section 51 of LRA 2002

o If it is going to take effect as a legal interest, it must be registered in the land

register as a registrable charge, if not it will just be an equitable interest.

Equitable Mortgages;

o It will arise when a party only has an equitable interest.

o First National Securities v Hegarty

When a signature is forged in a legal mortgage, they have an

equitable just against the person that has committed the forging.

o When they tried to create a legal mortgage but did not get the formalities right.

(informal mortgage of a legal interest)

o You need a deed to create a legal mortgage, if you do not have one but you

have enough to create a legal contract, you can still have an equitable

mortgage.

o S2 LP (MP) A 1989

o Does not exist anymore

o Before you could trade an equitable mortgage, deposit of title deeds.

o Russel v Russel

You might also like

- Free & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageFrom EverandFree & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageRating: 2 out of 5 stars2/5 (3)

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesFrom EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesNo ratings yet

- The 250 Questions Everyone Should Ask about Buying ForeclosuresFrom EverandThe 250 Questions Everyone Should Ask about Buying ForeclosuresNo ratings yet

- Security Interests in Personal PropertyDocument44 pagesSecurity Interests in Personal Propertyalbtros100% (1)

- Equitable LienDocument29 pagesEquitable LienWave WalkerNo ratings yet

- Foreclosure Fraud in A NutshellDocument8 pagesForeclosure Fraud in A NutshellMichael Kovach100% (7)

- Step 1) Introductory Points: MortgagesDocument5 pagesStep 1) Introductory Points: MortgagesLem sremm100% (1)

- BALANE Obligations and ContractsDocument127 pagesBALANE Obligations and ContractsShishi Lagrosas100% (9)

- Equity & Trust, Contract For SaleDocument13 pagesEquity & Trust, Contract For SaleredcottonstarNo ratings yet

- Unregistered LandDocument7 pagesUnregistered LandVicky TassellNo ratings yet

- Common Law Equity EssayDocument3 pagesCommon Law Equity EssayJaycee HowNo ratings yet

- Nature of Equitable Rights and InterestsDocument3 pagesNature of Equitable Rights and InterestsKityo MartinNo ratings yet

- Ibanez DecisionDocument414 pagesIbanez Decisionmike_engle100% (1)

- Notes On ObliConDocument109 pagesNotes On ObliConMenchie Ann Sabandal Salinas67% (3)

- REM, Antichresis, Chattel Mortgage - Notes and CasesDocument45 pagesREM, Antichresis, Chattel Mortgage - Notes and CasesCelestino LawNo ratings yet

- Equity Will Not Suffer A Wrong To Be Without A RemedyDocument9 pagesEquity Will Not Suffer A Wrong To Be Without A RemedyFemi Erinle50% (2)

- ObliCon Study NotesDocument133 pagesObliCon Study NotesKeith Jasper MierNo ratings yet

- Oblicon Reviewer BalaneDocument134 pagesOblicon Reviewer BalaneJustin HarrisNo ratings yet

- Covenants Running With LandDocument27 pagesCovenants Running With LandDivyanshu GuptaNo ratings yet

- BALANE Obligations and ContractsDocument121 pagesBALANE Obligations and ContractsApple AbadillaNo ratings yet

- Creating Residential Income: How to Get Your Money to Work For YouFrom EverandCreating Residential Income: How to Get Your Money to Work For YouNo ratings yet

- Beware Note Article by - Bill-ButlerDocument7 pagesBeware Note Article by - Bill-ButlerWonderland ExplorerNo ratings yet

- Capacity of ContractDocument5 pagesCapacity of Contractshakti ranjan mohantyNo ratings yet

- Obligation and Contracts - ReviewerDocument203 pagesObligation and Contracts - RevieweryuniNo ratings yet

- Notes On ObliCon by Prof. Ruben BalaneDocument125 pagesNotes On ObliCon by Prof. Ruben BalaneKezia Escario100% (1)

- Lecture Notes - Credit TransactionDocument11 pagesLecture Notes - Credit TransactionResin BagnetteNo ratings yet

- Land Law 2Document6 pagesLand Law 2Richard MutachilaNo ratings yet

- 1 Oblicon RealFamDocument31 pages1 Oblicon RealFamEfrean BianesNo ratings yet

- Credit Finals ReviewerDocument38 pagesCredit Finals ReviewerShua AbadNo ratings yet

- Credit Finals by VanDocument33 pagesCredit Finals by VanMeg MagtibayNo ratings yet

- Bankruptcy Outline - Pottow 2011Document125 pagesBankruptcy Outline - Pottow 2011LastDinosaur1100% (2)

- Mortgages OutlineDocument70 pagesMortgages Outlinemickayla jonesNo ratings yet

- TOP FINAL For KanishkDocument29 pagesTOP FINAL For Kanishksai chandNo ratings yet

- Concept of MortgageDocument7 pagesConcept of MortgagehirenzNo ratings yet

- Relevancy of Quasi ContractDocument9 pagesRelevancy of Quasi ContractAnonymous 2Q60K5kNo ratings yet

- The Doctrine of NoticeDocument3 pagesThe Doctrine of NoticeAdesina TunmiseNo ratings yet

- Student 1 - Land LawDocument12 pagesStudent 1 - Land LawJhagathesswaryNo ratings yet

- Property Law II Life Saver!Document8 pagesProperty Law II Life Saver!Hadi Onimisi TijaniNo ratings yet

- Introduction To ObliConDocument33 pagesIntroduction To ObliConOging mayonoNo ratings yet

- Equity and Trust Assignment MainDocument6 pagesEquity and Trust Assignment MainOkiemute OjumahNo ratings yet

- Mortgages EssayDocument3 pagesMortgages EssayAbdul RafehNo ratings yet

- 5.capacity of PartiesDocument20 pages5.capacity of PartiesKoustubh MohantyNo ratings yet

- 22 Mortgages 1Document25 pages22 Mortgages 1Jonathan ShemaNo ratings yet

- Business Law NotesDocument47 pagesBusiness Law Notesakashprince9876No ratings yet

- 3 Capacity of PartiesDocument16 pages3 Capacity of Partieswajeeha tahirNo ratings yet

- Mortgages Prob QDocument3 pagesMortgages Prob QahsenNo ratings yet

- Land LawDocument2 pagesLand LawpickgirlNo ratings yet

- Lecture 5 - Capacity of Parties PDFDocument15 pagesLecture 5 - Capacity of Parties PDFYahya Minhas100% (1)

- TOPIC 5 - Common Law TOPIC 5 - Common LawDocument5 pagesTOPIC 5 - Common Law TOPIC 5 - Common LawRaquel MartínNo ratings yet

- TOPIC 3 - Common Law TOPIC 3 - Common LawDocument6 pagesTOPIC 3 - Common Law TOPIC 3 - Common LawRaquel MartínNo ratings yet

- Mortgage Law PresentationDocument13 pagesMortgage Law PresentationTia SachdevaNo ratings yet

- Equity and Trust NotesDocument33 pagesEquity and Trust Noteschriswanyonyi0No ratings yet

- Business Law NotesDocument171 pagesBusiness Law NotesShaurya GuptaNo ratings yet

- Part 2-Constructive TrustsDocument68 pagesPart 2-Constructive TrustsHannah LINo ratings yet

- Cartridge Property Final OutlineDocument9 pagesCartridge Property Final OutlineJulie OhNo ratings yet

- Transcript Property Law Lecture 5 Registered and Unregistered LandDocument6 pagesTranscript Property Law Lecture 5 Registered and Unregistered LandShazfa SameemNo ratings yet

- Illegal Contracts 2021Document6 pagesIllegal Contracts 2021Owor GeorgeNo ratings yet

- ACFrOgBgp3NFWIQ8q 9CcNg7UyNCL7K9HzQMGRaWI-70DrNcVkpPj x9NsgFvdB0lkD6 DOc2LeYqxrdGVEaKPlOJ65XrHuVZaW-5Df7OyJeWznH1HW J-Wmuiw8HiGRvCKHIxEJgQ7JcWMOQxmqDocument81 pagesACFrOgBgp3NFWIQ8q 9CcNg7UyNCL7K9HzQMGRaWI-70DrNcVkpPj x9NsgFvdB0lkD6 DOc2LeYqxrdGVEaKPlOJ65XrHuVZaW-5Df7OyJeWznH1HW J-Wmuiw8HiGRvCKHIxEJgQ7JcWMOQxmqKshitiz BhardwajNo ratings yet

- Unit 2 Study MaterialDocument23 pagesUnit 2 Study MaterialPoorna PrakashNo ratings yet

- IBANEZ Decision Case File CompendiumDocument427 pagesIBANEZ Decision Case File CompendiumDeontosNo ratings yet