Professional Documents

Culture Documents

Downloadfile 18 PDF

Uploaded by

MahediOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Downloadfile 18 PDF

Uploaded by

MahediCopyright:

Available Formats

MCAS CA KNOWLEDGE LEVEL: ACCOUNTING

FINANCIAL STATEMENT

1. The following trial balance has been extracted from the nominal ledger of Antigua plc at

31 December 2014.

Note(s) £ £

Sales 8,417,010

Purchases 4,741,400

Land and buildings (1)

Valuation (land £140,000) 1,490,000

Accumulated depreciation at 31 December 2013 90,000

Plant and equipment (1), (2)

Cost 578,000

Accumulated depreciation at 31 December 2013 231,200

Retained earnings at 31 December 2013 15,010

Revaluation surplus at 31 December 2013 757,000

Ordinary share capital (£1 shares) 50,000

Bank account 101,300

Operating expenses (3) 2,017,500

Trade and other receivables 578,700

Trade and other payables 325,100

Income tax (4) 127,000

Inventories at 31 December 2013 678,000

10,098,610 10,098,610

The following additional information is available:

(1) Antigua plc originally measured its land and buildings under the cost model. All

buildings were acquired on 1 January 2006 and had a zero residual value and a total

estimated useful life of 50 years at that date. On 1 January 2011 Antigua plc adopted

the revaluation model for its land and buildings and revalued all its land and buildings at

that date, with no change to total estimated useful lives. No further revaluations have

been necessary since this date.

On 31 December 2014 a building which was surplus to requirements met the “held for

sale” criteria of IFRS 5, Non-current Assets Held for Sale and Discontinued Operations.

The building is included in property, plant and equipment at its carrying amount on

31 December 2013. Details in respect of this building are as follows:

£

Cost on 1 January 2006 76,000

Valuation on 1 January 2011 108,000

Estimated fair value on 31 December 2014 58,000

Estimated costs to sell 5,000

Depreciation for the year ended 31 December 2014 has not yet been charged on any of

Antigua plc’s property, plant and equipment. Depreciation on buildings should be

presented in operating expenses and depreciation on plant and equipment should be

presented in cost of sales. Plant and equipment is depreciated on a reducing balance

basis using a rate of 20% pa.

Antigua plc does not make annual transfers between the revaluation surplus and

retained earnings.

Mahbub 01745-768912 Page 2 of 9

MCAS CA KNOWLEDGE LEVEL: ACCOUNTING

FINANCIAL STATEMENT

(2) On 1 July 2014 Antigua plc paid £103,500 for a piece of high-tech equipment, which

is included in the total for plant and equipment in the trial balance above. A

government grant of 50% of the cost of the equipment was received to help finance

the purchase of this equipment as part of the government’s drive to encourage

investment in new technology. There were no future performance-related conditions

attached to the grant. The grant was debited to cash and credited to purchases,

although Antigua plc’s published accounting policy for government grants is to use

the netting-off method.

(3) On 1 January 2014 Antigua plc entered into a six year finance lease for a machine

with a fair value of £50,250, a zero residual value and a useful life of seven years.

Lease payments of £9,250 are due annually on 1 January. The first payment of

£9,250 was duly made on 1 January 2014 and included in operating expenses. No

other accounting entries have been made in respect of this lease. Antigua plc

allocates finance charges on a sum-of-the-digits basis.

(4) The income tax in the trial balance represents a refund in respect of prior years,

which was made on 15 June 2014, following an appeal to HMRC. The income tax

liability for the year ended 31 December 2014 has been estimated at £497,500.

(5) Inventories at 31 December 2014 were valued at their cost of £752,000. This included

£118,000 for one product line which had a total list price of £142,000 on 31 December

2014. However, on 15 January 2015 the directors discovered that, since December

2014, a number of competitors had been selling an equivalent product for 30% less

than Antigua plc’s list price.

Requirements

Prepare a statement of profit or loss for Antigua plc for the year ended 31 December

2014 and a statement of financial position as at that date, in a form suitable

for publication.

(25 marks)

Mahbub 01745-768912 Page 3 of 9

MCAS CA KNOWLEDGE LEVEL: ACCOUNTING

FINANCIAL STATEMENT

Antigua plc

Financial statements

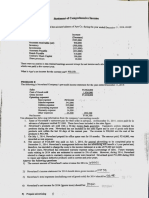

Statement of profit or loss for the year ended 31 December 2014

£

Revenue 8,417,010

Cost of sales (W 1) (4,799,960)

Gross profit 3,617,050

Operating expenses (W 1) (2,044,050)

Profit from operations 1,573,000

Finance cost (W 7) (1,750)

Profit before tax 1,571,250

Income tax expense (497,500 – 127,000) (370,500)

Profit for the year 1,200,750

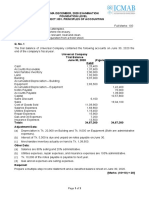

Statement of financial position as at 31 December 2014

£ £

Assets

Non-current assets

Property, plant and equipment (1,271,600 + 283,090) 1,554,690

(W2)

Inventories (W 6) 733,400

Trade and other receivables 578,700

1,312,100

Non-current asset held for sale (58,000 – 5,000) 53,000

1,365,100

Total assets 2,919,790

Mahbub 01745-768912 Page 4 of 9

MCAS CA KNOWLEDGE LEVEL: ACCOUNTING

FINANCIAL STATEMENT

Equity and liabilities £ £

Equity

Ordinary share capital 50,000

Revaluation surplus (W5) 717,400

Retained earnings (W4) 1,185,740

1,953,140

Non-current liabilities

Finance lease liabilities (W7) 33,500

Current liabilities

Finance lease liabilities (W7) 9,250

Trade and other payables 325,100

Borrowings 101,300

Taxation 497,500

933,150

Total equity and liabilities 2,919,790

Workings

(1) Allocation of expenses

Cost of Operating

sales expenses

£ £

Per TB 4,741,400 2,017,500

Opening inventories 678,000

Closing inventories (W 6) (733,400)

Costs to sell held for sale asset 5,000

Loss on held for sale asset (W3) 800

Depreciation charge on buildings 30,000

Depreciation charges on plant and equipment (5,175 + 8,375 62,210

+ 48,660 (W 2))

Add back government grant (103,500 x 50%) 51,750

Lease payment wrongly included (9,250)

4,799,960 2,044,050

(2) PPE

Land and Plant and

buildings equipment

£ £

B/f Valuation/Cost 1,490,000 578,000

B/f Accumulated depreciation (90,000) (231,200)

1,400,000 346,800

Less: Held for sale asset (W3) (98,400)

Depreciation on buildings ((1,490,000 – 140,000) ÷ 45) (30,000)

Less government grant (W1) (51,750)

Depreciation on equipment subject to grant (51,750 x 20% x (5,175)

6/12)

Leased asset 50,250

Depreciation on leased asset (50,250 ÷ 6) (8,375)

Depreciation on other plant and equipment ((346,800 – (48,660)

103,500) x 20%)

1,271,600 283,090

Mahbub 01745-768912 Page 5 of 9

MCAS CA KNOWLEDGE LEVEL: ACCOUNTING

FINANCIAL STATEMENT

(3) Asset held for sale Asset Revaluation

surplus

£ £

Cost on 1 January 2006 76,000

Depreciation to 31 December 2010 (76,000/50 x 5) (7,600)

Carrying amount at 31 December 2010 68,400

Revaluation on 1 January 2011 108,000 39,600

Depreciation to 31 December 2014 (108,000/45 x 4) (9,600)

Carrying amount at 31 December 2014 98,400

Fair value (58,000)

40,400 39,600

Charge to profit/revaluation surplus 800 (39,600)

(4) Retained earnings

£

At 31 December 2013 (15,010)

Profit for the year 1,200,750

At 31 December 2014 1,185,740

(5) Revaluation surplus

£

At 31 December 2013 757,000

Loss on held for sale asset (W3) (39,600)

At 31 December 2014 717,400

(6) Closing inventories

£

At cost 752,000

Less Write down to NRV ((142,000 x 70%) – 118,000) (18,600)

733,400

(7) Finance lease

B/f Payment Capital Interest C/f

£ £ £ £ £

31 December 2014 50,250 (9,250) 41,000 (5/15 x 5,250) 1,750 42,750

31 December 2015 42,750 (9,250) 33,500

SOTD = (5 x 6)/2 = 15

Interest = (9,250 x 6) – 50,250 = 5,250

Mahbub 01745-768912 Page 6 of 9

You might also like

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Financial Accounting and Reporting: IFRS - 2016 June QPDocument11 pagesFinancial Accounting and Reporting: IFRS - 2016 June QPMarchella LukitoNo ratings yet

- The Institute of Chartered Accountants of Nigeria: 2015 Skills ExaminationDocument210 pagesThe Institute of Chartered Accountants of Nigeria: 2015 Skills ExaminationODO NKONANGNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Financial Reporting Questions and AnswerDocument25 pagesFinancial Reporting Questions and AnswerKurt Francis Hendrick S. PascualNo ratings yet

- Financial ReportingDocument287 pagesFinancial ReportingAdebayo OlayinkaNo ratings yet

- QQAA GREEN TECH Comprehensive ExampleDocument7 pagesQQAA GREEN TECH Comprehensive ExampleZulhelmy NazriNo ratings yet

- BF 220 Deferred Test 1 Dec 2015Document4 pagesBF 220 Deferred Test 1 Dec 2015Emmanuel MwapeNo ratings yet

- Specific Financial Reporting Ac413 MAY2016Document5 pagesSpecific Financial Reporting Ac413 MAY2016AnishahNo ratings yet

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- Financial Accounting and Reporting: IFRS - 2016 June MSDocument17 pagesFinancial Accounting and Reporting: IFRS - 2016 June MSMarchella LukitoNo ratings yet

- MAY 2016 SkillsDocument188 pagesMAY 2016 SkillsOnaderu Oluwagbenga EnochNo ratings yet

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudNo ratings yet

- f2 Financial Accounting August 2017Document19 pagesf2 Financial Accounting August 2017Edson Jorge MandlateNo ratings yet

- ACCT2015 Marathon - SOLUTION - April 2014Document5 pagesACCT2015 Marathon - SOLUTION - April 2014Tan TaylorNo ratings yet

- Name Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MDocument4 pagesName Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MSam DizongaNo ratings yet

- ACC01B1 REK1B01 MAIN.pdfDocument10 pagesACC01B1 REK1B01 MAIN.pdfLebohang NgubaneNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- SogaDocument8 pagesSogaMelvin AmohNo ratings yet

- FAC2601 Assignment 02Document4 pagesFAC2601 Assignment 02SibongileNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Compre2 ReviewerDocument6 pagesCompre2 ReviewerMark Joseph OlinoNo ratings yet

- Auditing Problem - Preweek: Cordillera Career Development College College of AccountancyDocument42 pagesAuditing Problem - Preweek: Cordillera Career Development College College of AccountancyGi Ne VaNo ratings yet

- Far Icaew Extra QuestionsDocument8 pagesFar Icaew Extra QuestionsK. Manish45No ratings yet

- Financial Accounting IFRS Student Mark Plan June 2019Document16 pagesFinancial Accounting IFRS Student Mark Plan June 2019scottNo ratings yet

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDocument8 pagesACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNo ratings yet

- Accounting Quiz 1 Solutions and Comprehensive Income CalculationDocument1 pageAccounting Quiz 1 Solutions and Comprehensive Income CalculationDante Nas JocomNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Financial Reporting Novmock2019 PDFDocument21 pagesFinancial Reporting Novmock2019 PDFAndy AsanteNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Ias 1 - Questions..Document8 pagesIas 1 - Questions..Timothy KawumaNo ratings yet

- Tutorial 2 A192 QuestionDocument9 pagesTutorial 2 A192 QuestionMastura Abd HamidNo ratings yet

- Discussion Problems - Consolidation Subsequent To Date of AcquisitionDocument2 pagesDiscussion Problems - Consolidation Subsequent To Date of AcquisitionMikee CincoNo ratings yet

- Accounting Problems and SolutionsDocument17 pagesAccounting Problems and SolutionsLoyalNamanAko LLNo ratings yet

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- ICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFDocument427 pagesICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFOptimal Management Solution100% (4)

- GCA Consultants: Financial Accounting and ReportingDocument261 pagesGCA Consultants: Financial Accounting and ReportingNguyễn Trung ThànhNo ratings yet

- ICAEW Financial Accounting Past Papers Combined 2010-2013Document130 pagesICAEW Financial Accounting Past Papers Combined 2010-2013Ahmed Raza Tanveer100% (3)

- Polytechnic University of The Philippines College of Accountancy Santa Maria, BulacanDocument3 pagesPolytechnic University of The Philippines College of Accountancy Santa Maria, BulacanJudith Batisan100% (1)

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- Nfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Document18 pagesNfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Merliza Jusayan100% (1)

- University of Mauritius: Faculty of Law and ManagementDocument10 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Audit of IntangiblesDocument5 pagesAudit of IntangiblesMae LaglivaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- Tugas Mike P5-3ADocument6 pagesTugas Mike P5-3Awinda dwi lestariNo ratings yet

- Spark Company Financial AnalysisDocument6 pagesSpark Company Financial AnalysisJayvee BalinoNo ratings yet

- Homework For Chapter 8Document6 pagesHomework For Chapter 8Pramit Singh0% (1)

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Statement of Cash FlowDocument7 pagesStatement of Cash Flowvdj kumarNo ratings yet

- Financial Accounting June 2013 Exam Paper ICAEWDocument8 pagesFinancial Accounting June 2013 Exam Paper ICAEWMuhammad Ziaul HaqueNo ratings yet

- Audit of FS QuizDocument3 pagesAudit of FS QuizGwyneth TorrefloresNo ratings yet

- Depreciation of Non-Current AssetsDocument3 pagesDepreciation of Non-Current AssetsMahediNo ratings yet

- Accruals & PrepaymentsDocument7 pagesAccruals & PrepaymentsMahediNo ratings yet

- Exam 3 AnsDocument4 pagesExam 3 AnsMahediNo ratings yet

- Exam 3Document5 pagesExam 3MahediNo ratings yet

- Control AccountsDocument4 pagesControl AccountsMahediNo ratings yet

- Current & Non Current AssetsDocument6 pagesCurrent & Non Current AssetsMahediNo ratings yet

- BankrecDocument6 pagesBankrecMahediNo ratings yet

- Understanding Key Accounting ConceptsDocument3 pagesUnderstanding Key Accounting ConceptsMahediNo ratings yet

- Provisions and Contingencies Slides - FinalDocument5 pagesProvisions and Contingencies Slides - FinalMahediNo ratings yet

- Petty CashDocument4 pagesPetty CashMahediNo ratings yet

- Accounting Records (Compatibility Mode)Document9 pagesAccounting Records (Compatibility Mode)MahediNo ratings yet

- Inventories DefinitionDocument5 pagesInventories DefinitionMahediNo ratings yet

- Accounting Principles (Compatibility Mode)Document8 pagesAccounting Principles (Compatibility Mode)MahediNo ratings yet

- Depreciation DisposalDocument10 pagesDepreciation DisposalMahediNo ratings yet

- Correcting - Entries (Compatibility Mode)Document6 pagesCorrecting - Entries (Compatibility Mode)MahediNo ratings yet

- Chapter 5 Leasee AccountingDocument3 pagesChapter 5 Leasee AccountingMahediNo ratings yet

- Process of Assurance: Planning The Assignment: Topic ListDocument30 pagesProcess of Assurance: Planning The Assignment: Topic ListNAZMUL HOSSAINNo ratings yet

- Calculating account balancesDocument3 pagesCalculating account balancesMahediNo ratings yet

- Chapter 3 Identifying A LeaseDocument3 pagesChapter 3 Identifying A LeaseMahediNo ratings yet

- Chapter 6 TransitionDocument4 pagesChapter 6 TransitionMahediNo ratings yet

- Accounting Equation (Compatibility Mode)Document29 pagesAccounting Equation (Compatibility Mode)MahediNo ratings yet

- 007 - CAASSST07 - CH05 - Amndd Final BW+HS - RP2 - Sec - noPWDocument22 pages007 - CAASSST07 - CH05 - Amndd Final BW+HS - RP2 - Sec - noPWMahediNo ratings yet

- Chapter 1 ScopeDocument4 pagesChapter 1 ScopeMahediNo ratings yet

- Audit and New NormalDocument13 pagesAudit and New NormalMahediNo ratings yet

- 006 - CAASSST07 - CH04 - Amndd Final BW+HS - RP2 - Sec - noPWDocument18 pages006 - CAASSST07 - CH04 - Amndd Final BW+HS - RP2 - Sec - noPWMahediNo ratings yet

- 004 - CAASSST07 - CH02 - Amndd Final BW+HS - RP2 - Sec - noPWDocument20 pages004 - CAASSST07 - CH02 - Amndd Final BW+HS - RP2 - Sec - noPWMahediNo ratings yet

- Chapter 2 Recognition ExemptionDocument3 pagesChapter 2 Recognition ExemptionMahediNo ratings yet

- 003 - CAASSST07 - CH01 - Amndd Final BW+HS - RP2 - SecDocument16 pages003 - CAASSST07 - CH01 - Amndd Final BW+HS - RP2 - SecNAZMUL HOSSAINNo ratings yet

- IAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesIAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsMahediNo ratings yet

- Group AccountingDocument144 pagesGroup AccountingziyuNo ratings yet

- Shivendra CFA Sample QuestionDocument215 pagesShivendra CFA Sample QuestionKishore Ravichandran0% (1)

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- Corporate Finance - GBV PDFDocument12 pagesCorporate Finance - GBV PDFHesty SaniaNo ratings yet

- Top 10 Accounting Interview QuestionsDocument13 pagesTop 10 Accounting Interview QuestionsYusuf RaharjaNo ratings yet

- Land Bank of The Philippines Vs Livioco, G.R. No. 170685, September 22, 2010Document22 pagesLand Bank of The Philippines Vs Livioco, G.R. No. 170685, September 22, 2010Hazel PantigNo ratings yet

- 8 Valuation Techniques to Value Any StockDocument57 pages8 Valuation Techniques to Value Any StockNight Light100% (2)

- 05 Investment PropertyDocument40 pages05 Investment Propertyaprina.sNo ratings yet

- Amad NotesDocument96 pagesAmad NotesDalili Kamilia100% (1)

- Valuation and Rates of Return: Mcgraw-Hill/IrwinDocument11 pagesValuation and Rates of Return: Mcgraw-Hill/IrwinAhmed ShantoNo ratings yet

- ST Charles Tax AssessmentsDocument613 pagesST Charles Tax AssessmentscherylwaityNo ratings yet

- HK DSE 2020 BAFS Paper 1 Section A Multiple-Choice QuestionsDocument21 pagesHK DSE 2020 BAFS Paper 1 Section A Multiple-Choice QuestionswwlNo ratings yet

- Accumulation/Distribution Line: Divergence AnalysisDocument44 pagesAccumulation/Distribution Line: Divergence AnalysismpdharmadhikariNo ratings yet

- Centaurus Metals Limited (Asx: CTM) : Will Thomson and Chip Russell, Managing PartnersDocument11 pagesCentaurus Metals Limited (Asx: CTM) : Will Thomson and Chip Russell, Managing Partnerscarlosmarco87No ratings yet

- AUD 2 Audit of Cash and Cash EquivalentDocument14 pagesAUD 2 Audit of Cash and Cash EquivalentJayron NonguiNo ratings yet

- Dividends per share calculation for preference and ordinary sharesDocument3 pagesDividends per share calculation for preference and ordinary sharesEUBELLE DAVE SOLATARIONo ratings yet

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- Estate Tax Return: MandatoryDocument1 pageEstate Tax Return: MandatoryYna Yna100% (1)

- Subramanyam FSA Chapter 01 - ETJDocument44 pagesSubramanyam FSA Chapter 01 - ETJMaya AngrianiNo ratings yet

- SAP S4 HANA Vs ECCDocument25 pagesSAP S4 HANA Vs ECCDeepak Gupta100% (9)

- Equity Valuation Report - LVMHDocument3 pagesEquity Valuation Report - LVMHFEPFinanceClubNo ratings yet

- Faculty of Commerace: Lcuknow UniversityDocument22 pagesFaculty of Commerace: Lcuknow UniversityAryan KakkarNo ratings yet

- Noida Toll BridgeDocument12 pagesNoida Toll BridgeqleapNo ratings yet

- Valuation of Open Item in Foreign CurrencyDocument12 pagesValuation of Open Item in Foreign CurrencyVivek KumarNo ratings yet

- Actuarial Glossary PDFDocument18 pagesActuarial Glossary PDFmiguelNo ratings yet

- Configuration of Order Type For A Product Cost CollectorDocument2 pagesConfiguration of Order Type For A Product Cost Collectors4hanamm 1809No ratings yet

- SEBI (Real Estate Investment Trusts) Regulations, 2014Document66 pagesSEBI (Real Estate Investment Trusts) Regulations, 2014Shyam SunderNo ratings yet

- Solution Past Paper Higher-Series4-08hkDocument16 pagesSolution Past Paper Higher-Series4-08hkJoyce LimNo ratings yet

- SP Capital IQDocument11 pagesSP Capital IQemirav2100% (1)

- Uncertainty and Risk Analysis in Petroleum Exploration and ProductionDocument12 pagesUncertainty and Risk Analysis in Petroleum Exploration and ProductionHenry Reynolds DarcyNo ratings yet