Professional Documents

Culture Documents

Text 5A80597B7C19 1

Uploaded by

AVOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Text 5A80597B7C19 1

Uploaded by

AVCopyright:

Available Formats

Federal income tax:

On the first $155,625 $32,180

29% × the remainder 35,424 10,273

$191,049 42,453

Deduct personal tax credits:

Basic personal amount $14,398 – (net income $204,709 – taxable income above which

the 29% bracket begins $155,625) × ($1,679/$66,083)*

$(13,151)

Equivalent to spouse (son has lowest income):

(12,151)

CPP/EI ($3,039 + $953) (3,992)

Employment (1,287)

Tuition credit transfer from daughter (below) (5,000)

Total personal tax credit amounts $(35,581)

Tax credit:

$(5,337)

Medical expenses:

(3)

Charitable donations:

(552) (5,892)

Deduct dividend tax credit—Non-eligible:

(312)

Basic federal tax 36,249

Deduct other tax credit:

Political contributions:

(350)

Total federal tax $35,899

You might also like

- W2 2010Document2 pagesW2 2010Rick Nunns100% (2)

- ACC 430 Chapter 17Document13 pagesACC 430 Chapter 17vikkiNo ratings yet

- The Trump Tax Cut: Your Personal Guide to the New Tax LawFrom EverandThe Trump Tax Cut: Your Personal Guide to the New Tax LawNo ratings yet

- W-2 Preview ADPDocument4 pagesW-2 Preview ADPRyan AllenNo ratings yet

- Tax Calculator - Overview: InstructionsDocument9 pagesTax Calculator - Overview: InstructionsphobosanddaimosNo ratings yet

- Total IncomeDocument3 pagesTotal IncomeFaisal AhmedNo ratings yet

- National Savings RateDocument1 pageNational Savings Ratebome76No ratings yet

- Fiscal Deficit Formula Excel TemplateDocument3 pagesFiscal Deficit Formula Excel TemplateJaspreet GillNo ratings yet

- Text 67C92BDA872B 1Document3 pagesText 67C92BDA872B 1AVNo ratings yet

- Tax Rates Alberta 2013Document1 pageTax Rates Alberta 2013pardeep174No ratings yet

- Chapter 4 - Problem 4.7Document3 pagesChapter 4 - Problem 4.7Thanh PhuongNo ratings yet

- Busl320 Week11Document5 pagesBusl320 Week11ZHOU JUNHUINo ratings yet

- Report To The House Committee On Ways and Means Chairman Richard NealDocument40 pagesReport To The House Committee On Ways and Means Chairman Richard Nealcs07x5706No ratings yet

- Income Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Document5 pagesIncome Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Maria PatinoNo ratings yet

- Test 1 Fact SheetDocument2 pagesTest 1 Fact SheetHenry ZhuNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (34)

- Info Card 2016-17Document12 pagesInfo Card 2016-17Nick KNo ratings yet

- IncometaxDocument12 pagesIncometaxje-ann montejoNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (42)

- WWW - Irs.gov: Federal Income Tax Brackets (Ordinary Income)Document3 pagesWWW - Irs.gov: Federal Income Tax Brackets (Ordinary Income)realxvibeNo ratings yet

- Notes Chapter 1 REGDocument7 pagesNotes Chapter 1 REGelmotakeover1No ratings yet

- Income Tax BotswanaDocument15 pagesIncome Tax BotswanaFrancisNo ratings yet

- Indicate The Answer Choice That Best Completes The Statement or Answers The QuestionDocument1 pageIndicate The Answer Choice That Best Completes The Statement or Answers The QuestionThinh DoanNo ratings yet

- Name: Course: Prepared By: Dr. Jessie N. DiazDocument11 pagesName: Course: Prepared By: Dr. Jessie N. DiazPrince Isaiah JacobNo ratings yet

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- Guide To The Completion of The EMPLOYEE Income Tax FormDocument5 pagesGuide To The Completion of The EMPLOYEE Income Tax FormMarz CuculNo ratings yet

- $110,000 2%) $1,375 ($110,000) 1.25% (Tier 2 ($105,001 - $140,000) )Document3 pages$110,000 2%) $1,375 ($110,000) 1.25% (Tier 2 ($105,001 - $140,000) )Umair RaheemNo ratings yet

- An Assignment of Tax Planning On "Tax System in United States of America"Document23 pagesAn Assignment of Tax Planning On "Tax System in United States of America"Akash NathwaniNo ratings yet

- Basic Tax Mini BrewerDocument11 pagesBasic Tax Mini BrewerDev Suniti ChandaniNo ratings yet

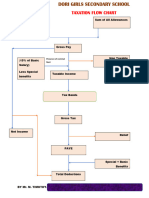

- Taxation Flow ChartDocument3 pagesTaxation Flow Chartpriscandegwa.pnNo ratings yet

- Howie 2012 Updated Financial SHH CGDocument2 pagesHowie 2012 Updated Financial SHH CGDenise MathreNo ratings yet

- Chapter 4Document32 pagesChapter 4music3kzNo ratings yet

- Chapter 14 PDFDocument14 pagesChapter 14 PDFJay BrockNo ratings yet

- NOLCODocument8 pagesNOLCOChristopher SantosNo ratings yet

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfNo ratings yet

- Dis Learning 1Document4 pagesDis Learning 1ABCMARCHNo ratings yet

- PayrollDocument4 pagesPayrollSunil Devdutt ThakoreNo ratings yet

- Rev Law PDFDocument19 pagesRev Law PDFZahi HoqueNo ratings yet

- Tax On Individuals Tax Rate:: Premium Payments On Health And/or Hospitalization Insurance Not To Exceed 2,400Document1 pageTax On Individuals Tax Rate:: Premium Payments On Health And/or Hospitalization Insurance Not To Exceed 2,400arloNo ratings yet

- Tax Reform ExamplesDocument4 pagesTax Reform ExamplesinforumdocsNo ratings yet

- All About TaxDocument26 pagesAll About TaxjabbaarNo ratings yet

- Miller 14e Ppt06 Mac AbbrevDocument50 pagesMiller 14e Ppt06 Mac AbbrevAbdulkerim SadıqovNo ratings yet

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerDocument21 pagesTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerNo ratings yet

- EY - US Personal Tax and Immigration GuideDocument34 pagesEY - US Personal Tax and Immigration Guidexx9No ratings yet

- Computation of Taxation in Hong Kong 2010Document3 pagesComputation of Taxation in Hong Kong 2010Kimi RinNo ratings yet

- Investment & AidDocument14 pagesInvestment & AidKogree Kyaw Win OoNo ratings yet

- Computation of Total Income: Zenit - A KDK Software ProductDocument3 pagesComputation of Total Income: Zenit - A KDK Software ProductAnupam DasNo ratings yet

- Personal Financial PlanningDocument10 pagesPersonal Financial PlanningTam PhamNo ratings yet

- Budget Work Sheet: Income For The Month ofDocument2 pagesBudget Work Sheet: Income For The Month ofAnthony Diaz GNo ratings yet

- Kimberley Hoff PAR711 JDF 1111 Sworn Financial StatementDocument7 pagesKimberley Hoff PAR711 JDF 1111 Sworn Financial StatementlegalparaeagleNo ratings yet

- Occupation GuidelinesDocument160 pagesOccupation Guidelinesjo lamosNo ratings yet

- Statement of EarningsDocument1 pageStatement of Earningscarder2610No ratings yet

- Tax CH7Document3 pagesTax CH7Michaella AndangNo ratings yet

- Form p50Document2 pagesForm p50Carlos ResendeNo ratings yet

- Fiscal Cliff Comments From Andy FriedmanDocument19 pagesFiscal Cliff Comments From Andy FriedmancdietzrNo ratings yet

- Topic 12 - Income Tax PlanningDocument32 pagesTopic 12 - Income Tax PlanningArun GhatanNo ratings yet

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- LEGT2751 Lecture 1Document14 pagesLEGT2751 Lecture 1reflecti0nNo ratings yet

- Ahmad MathsDocument3 pagesAhmad MathsKhawaja TaimoorNo ratings yet

- Text 8C9A5BA97930 1Document1 pageText 8C9A5BA97930 1AVNo ratings yet

- Text FA038E34966F 1Document1 pageText FA038E34966F 1AVNo ratings yet

- Text F0B37182C004 1Document1 pageText F0B37182C004 1AVNo ratings yet

- Text A156CDF68344 1Document1 pageText A156CDF68344 1AVNo ratings yet

- Text 1630853197CB 1Document1 pageText 1630853197CB 1AVNo ratings yet

- Text DAADEFF0DFE6 1Document1 pageText DAADEFF0DFE6 1AVNo ratings yet

- Text F2D63A82F4A4 1Document3 pagesText F2D63A82F4A4 1AVNo ratings yet

- Text 07950AE61213 1Document2 pagesText 07950AE61213 1AVNo ratings yet

- Text 64ADA9077CBA 1Document3 pagesText 64ADA9077CBA 1AVNo ratings yet

- Text 040E509D2756 1Document1 pageText 040E509D2756 1AVNo ratings yet

- Text 9EA398F5F628 1Document1 pageText 9EA398F5F628 1AVNo ratings yet