Professional Documents

Culture Documents

What Is A Fiduciary Duty - Examples and Types Explained

Uploaded by

MaxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is A Fiduciary Duty - Examples and Types Explained

Uploaded by

MaxCopyright:

Available Formats

INVESTING SIMULATOR ECONOMY PERSONAL FINANCE NEWS REVIEWS ACADEMY TRADE

INVESTING LAWS & REGULATIONS

What Is a Fiduciary Duty?

Examples and Types

Table of Contents

Explained

What Is a Fiduciary Duty? By ADAM BARONE Updated August 19, 2022

Fiduciary Relationships Reviewed by JULIUS MANSA

Fact checked by KATRINA MUNICHIELLO

Types of Duties

Breaches in Duty What Is a Fiduciary Duty?

Consequences of a Breach Fiduciary duty refers to the relationship between a fiduciary and the

Elements of a Claim principal or beneficiary on whose behalf the fiduciary acts.

Examples of Breach Cases

The fiduciary accepts legal responsibility for duties of care, loyalty, good

Fiduciary Duty FAQs faith, confidentiality, and more when serving the best interests of a

The Bottom Line beneficiary. Strict care must be taken to ensure that no conflict of

interest arises to jeopardize those interests.

KEY TAKEAWAYS

A fiduciary duty involves actions taken in the best interests of

another person or entity.

Fiduciary duty describes the relationship between an attorney

and a client or a guardian and a ward.

Fiduciary duties include duty of care, loyalty, good faith,

confidentiality, prudence, and disclosure.

It has been successfully argued that an employee may have a

fiduciary duty of loyalty to an employer.

A breach of fiduciary duty occurs when a fiduciary fails to act

responsibly in the best interests of a client.

01:26 / 01:28

How the Fiduciary Rule Can Impact You

Examples of Fiduciary Relationships

Trustee/Beneficiary

A single parent with young children might create a trust to administer

the assets that the children would inherit should the parent die while

the children are still underage.

In this case, the parent will name a person or an entity, such as a law

firm or bank, as trustee of the estate. That person or entity has a

fiduciary duty to the children, who are the beneficiaries of the estate.

In a trustee/beneficiary relationship, the fiduciary (trustee) has legal

ownership of the property and controls the assets held in the trust.

As fiduciary, the trustee must make decisions that are in the best

interest of the beneficiary as the latter holds equitable title to

the property.

The trustee/beneficiary relationship is an important aspect of

comprehensive estate planning. Special care should be taken to

determine who is designated as trustee.

Guardian/Ward

In a guardian/ward relationship, an adult is designated as the legal

guardian of a minor child. The guardian, as the fiduciary, is tasked with

ensuring that all matters related to the daily welfare of the child are

dealt with responsibly and in the best interests of the child. This care

can include such things as deciding where the child will attend school,

arranging for health care, and providing an allowance.

A guardian may be appointed by a state court when a parent dies or is

unable to care for the child for other reasons. In most states, the

guardian/ward relationship remains intact until the minor child reaches

adulthood.

Agent/Principal

Any person, corporation, partnership, or government agency might be

called upon to act as agent without conflict of interest on behalf of a

principal.

A common example of an agent/principal relationship that implies

fiduciary duty is that between the executives of a company and its

shareholders. The shareholders expect that the executives will make

well-considered, prudent decisions on their behalf and in their best

interests as owners.

A similar fiduciary relationship exists between personal investors and

the fund managers they select to manage their assets.

Attorney/Client

The agreement between an attorney and a client is arguably one of the

most stringent of fiduciary relationships.

The U.S. Supreme Court has stated that the highest level of trust and

confidence must exist between an attorney and a client. An attorney, as

a fiduciary, must act with fairness, loyalty, care, and within the law on

behalf of the client.

Attorneys can be sued for breaches of their fiduciary duties by clients.

They are accountable to the court in which a client is represented when

a breach occurs.

Controlling Stockholder/Company

In certain circumstances, fiduciary duties may be required of a

stockholder who possesses a majority interest in a corporation or who

exercises control over its activities. A breach of fiduciary duty may result

in personal legal liability for the controlling shareholder as well as

directors and officers.

Important: The adjective fiduciary means held or given in

trust. A fiduciary commits to acting in the best interests of a

principal or beneficiary.

Types of Fiduciary Duties

Fiduciary duties may differ depending on the type of beneficiary that a

fiduciary serves. However, in general, the legal and ethical obligations

related to protecting the interests of beneficiaries include the following

duties.

Duty of Care

This is the responsibility to inform oneself as completely as possible in

order to exercise sound judgments that protect a beneficiary's interests.

It can involve the thoughtful consideration of options and sensible

decision-making that's based on a careful examination of available

information.

Duty of Loyalty

This pertains to acting in the best interest of the beneficiary at all times,

putting their well-being first and foremost. It includes the duty of the

fiduciary to excuse themself from taking actions when there's a conflict

of interest with the beneficiary's welfare.

Duty of Good Faith

This duty pertains to always acting within the law to advance the

interests of the beneficiary. At no time should the fiduciary take actions

that are outside of legal constraints.

Duty of Confidentiality

A fiduciary must maintain the confidentiality of all information relating

to the beneficiary. They must not use any form of it, whether written or

spoken, for their personal gain.

Duty of Prudence

Fiduciaries must administer matters and make decisions concerning the

interests of beneficiaries with the highest degree of professional skill,

caution, and critical awareness of risk.

Duty to Disclose

Fiduciaries must engage in completely forthright behavior, disclosing

any and all relevant information that could have an impact on their

ability to carry out their duties as fiduciary and/or on the well-being of a

beneficiary's interests.

Breaches in Fiduciary Duty

Fiduciary duties are taken on by individuals and entities for various

types of beneficiaries. Such relationships include, among others,

lawyers acting for clients, company executives acting for stockholders,

guardians acting for their wards, financial advisers acting for investors,

and trustees acting for estate beneficiaries.

An employee may even have a fiduciary duty to an employer. That is,

employers have a right to expect that employees are acting in their best

interests. For example, they are not sharing trade secrets, or using

company equipment for private purposes, or stealing customers from a

competitor.

These expectations may not be actual fiduciary duties but they may be

spelled out in an employee handbook or contract clause.

Case law indicates that breaches of fiduciary duty most often happen

when a binding fiduciary relationship is in effect and actions are taken

which violate or are counterproductive to the interests of a specific

beneficiary.

Typically, the inappropriate actions are alleged to have benefitted the

fiduciary's interests or the interests of a third party instead of a

principal's or beneficiary's interests. In some cases, a breach stems from

a fiduciary's failure to provide important information to a client, which

leads to misunderstandings, misinterpretations, or misguided advice.

Disclosure of any potential conflict of interest is important in a fiduciary

relationship because any conflict can be seen as a cause for a breach of

trust.

Practice trading with virtual money

Find out what a hypothetical investment would be worth today.

SELECT A STOCK

TSLA AAPL NKE AMZN WMT

TESLA INC APPLE INC NIKE INC AMAZON… WALMAR…

SELECT INVESTMENT AMOUNT

$ 1000

SELECT A PURCHASE DATE

5 years ago

CALCULATE

Consequences of a Fiduciary Breach

A breach of fiduciary duty can lead to a number of consequences. Not

all of them are legal consequences.

1. An accusation of a breach of fiduciary duty can hurt the reputation

of a professional. A client can end a professional relationship

because they do not trust in a professional’s care of the required

fiduciary duty.

2. If a breach of duty case proceeds to the courts, steeper

consequences can result. A successful breach of fiduciary duty

lawsuit can result in monetary penalties for direct damages, indirect

damages, and legal costs.

3. A court ruling can also lead to industry discrediting, the loss of a

license, or removal from service.

However, proving a breach of fiduciary duty is not always easy.

Elements of a Fiduciary Breach Claim

A number of legal precedents and elements have been established to

allow claims by those who have been harmed by a breach of fiduciary

duty. Jurisdictions differ, but in general, the following four elements are

essential if a plaintiff is to prevail in a breach of fiduciary duty claim.

A Duty Existed

The plaintiff must show that a legal fiduciary duty existed. Many

professionals are obligated, legally and ethically, to conduct their

businesses honestly. However, that doesn't mean that they are

fiduciaries who must act solely in the interest of a particular client. A

fiduciary duty is accepted as such by a fiduciary, typically in writing.

A Breach Occurred

The plaintiff must show that a fiduciary duty was breached. The type of

breach varies in every case. For example, if an accountant was sloppy in

filling out a client's tax returns, and the client was slapped with an

enormous fine for nonpayment, the accountant may be guilty of a

breach of fiduciary duty. However, if the client was sloppy and failed to

provide complete and necessary information, no breach occurred.

Damage Was Sustained

The plaintiff must show that the breach of trust caused actual damage.

Without damage, there is usually no basis for a breach of fiduciary duty

case. The more specific a principal or beneficiary can be with facts of

damage, the better.

For example, a trustee might be sued for selling a beneficiary's property

too cheaply. If the buyer is a relative of the trustee, it's clearly a conflict

of interest. However, a specific accounting relating to the loss to the

beneficiary is needed to prove a breach of fiduciary duty.

Causation Was Proved

Causation shows that any damages incurred by the plaintiff were

directly linked with the actions taken in breach of fiduciary duty. In the

above example of a property sale, the link appears to be clear. However,

the trustee might argue that a quick sale was in the best interest of the

beneficiary and that no other buyer was interested.

Tip: If you suspect your financial adviser is in breach of their

fiduciary duty, you can file a complaint with FINRA, the SEC,

or both. If your adviser has a professional certification, you

can also notify the entity that provided the credential.

Examples of Fiduciary Breach Cases

A Duty of Loyalty

One example of a breach in fiduciary duty case went to the Virginia

Supreme Court in 2007.

In "Banks v. Mario Industries of Virginia, Inc." a lighting manufacturer

and supplier sued a former employee for establishing a directly

competing business by allegedly using proprietary information

acquired in their previous employment.

The manufacturer did not require its employees to sign a non-compete

or confidentiality clause, although the company handbook outlined

related policies.

In this case, the question of whether the employees had a fiduciary duty

to their former employer, and breached it, was fundamental to the

appeal that brought the case to the state's highest court.

The court affirmed the lower court's ruling that the employees owed

Mario a duty of loyalty. In effect, it supported the claim of a breach of

fiduciary duty, and a penalty of more than $1 million. [1]

A Menswear Store vs. Ex-Employees

In 2006, a high-end menswear store cited a breach of fiduciary duty

when it sued two of its former sales professionals for taking a job with a

competitor, Saks Fifth Avenue. The department store was able to prove

that it suffered actual losses after the salesmen left.

However, the court ruled that the losses could not be attributed directly

to the actions of its former employees. The suit failed.

Aiding and Abetting a Breach of Duty

A comptroller for a corporation embezzled $15 million from his

employer by writing checks against his company's bank account and

depositing them into another account at his own bank.

The company sued the bank that took the deposits, alleging that it

aided and abetted a breach of fiduciary duty. The court ruled that there

was insufficient evidence that the bank was aware of its role in the

scam.

What Does It Mean to Have a Fiduciary Duty?

The adjective fiduciary means held or given in trust. In accepting a

fiduciary duty, an individual or entity accepts a legal commitment to act

in the best interests of a beneficiary.

What Are the Main Fiduciary Duties?

There are several types of fiduciary duties. One is the duty of loyalty

which implies that the fiduciary will always act in the best interests of

the beneficiary or principal. Duty of care is another. It means that a

fiduciary will take special care to make sound, sensible decisions

regarding a beneficiary's well-being. No conflicting interest will be

permitted to influence the fiduciary's actions on behalf of the client.

Duty to disclose is a third. It refers to the duty a fiduciary has to disclose

any conflict of interest they may have when acting on behalf of a

beneficiary.

What Are Some Examples of Fiduciary

Relationships?

The most common fiduciary relationships involve legal or financial

professionals who agree to act on behalf of their clients. For example, a

lawyer and a client have a fiduciary relationship. So do a trustee and a

beneficiary, a corporate board and its shareholders, and an agent acting

for a principal.

However, any individual may, in some cases, have a fiduciary duty to

another person or entity. For example, an employee may be found to

have a duty of loyalty to an employer and may be legally liable if they

cause harm to the employer by misusing information or resources

entrusted to them.

What Does It Mean to Be a Fiduciary?

A fiduciary is entrusted with the authority to act on behalf of another

person or entity and has the legal and ethical obligation to act in the

best interest of them. A fiduciary agrees to put a beneficiary's interest

above their own.

The Bottom Line

Fiduciary duties refer to the ways that a fiduciary is legally committed

to act for a principal or beneficiary. They include a duty of loyalty, a

duty of care, a duty of prudence, a duty of confidentiality, and more.

Fiduciary duties are meant to ensure that the fiduciary acts only in the

best interests of a principal or beneficiary. What's more, the fiduciary

must act diligently to protect those interests.

While you should always expect a high standard of care from a fiduciary,

you can protect yourself by understanding the rights that this

relationship grants you and the responsibilities that are not part of a

fiduciary's duties.

ARTICLE SOURCES

Related Articles

FINANCIAL ADVISOR

5 Common Misconceptions About

Fiduciaries

TRUST & ESTATE PLANNING

Will vs. Trust: What’s the Difference?

401(K)

Are 401(k) Custodians Fiduciaries?

TRUST & ESTATE PLANNING

How to Set Up a Trust Fund

PRACTICE MANAGEMENT

How Financial Advisers Can Protect

Themselves Against Lawsuits

FINDING A FINANCIAL ADVISOR

When Should You Hire a Financial

Advisor?

Related Terms

Fiduciary Definition: Examples and Why They Are

Important

A fiduciary is a person or organization that acts on behalf of a person or persons

and is legally bound to act solely in their best interests. more

General Partnerships: Definition, Features, and

Example

A general partnership is an arrangement in which two or more persons agree to

share in all assets, profits, and liabilities of a business. more

Attorney-in-Fact: Definition, Types, Powers and Duties

An attorney-in-fact is a person who is authorized to represent someone else in

business, financial, and private matters. more

What Is a Trustee? Definition, Role, and Duties

A trustee is a person or firm that holds or administers property or assets for the

benefit of a third party. more

What Is an Agent? Definition, Types of Agents, and

Examples

An agent is a person who is empowered to act on behalf of another. Read about

different agent types, such as real estate, insurance, and business agents. more

What Does Duty of Care Mean in Business and

Financial Services?

Duty of care is a fiduciary responsibility that requires company directors to make

decisions in good faith and in a reasonably prudent manner. more

About Us Terms of Use Dictionary

Editorial Policy Advertise News

Privacy Policy Contact Us Careers

TRUSTe

# A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Investopedia is part of the Dotdash Meredith publishing family.

You might also like

- Engineering CrosswordDocument2 pagesEngineering CrosswordKelly Caldwell100% (1)

- Trusts and Protecting Assets: Creation of An Inter Vivos TrustDocument16 pagesTrusts and Protecting Assets: Creation of An Inter Vivos TrustVlad Zernov100% (1)

- Reservation Confirmation LetterDocument1 pageReservation Confirmation LetterAn-Noor OmaerNo ratings yet

- School Profile 2023-24Document2 pagesSchool Profile 2023-24api-551294547No ratings yet

- Rental Terms: Everything You Need To Know About Your Hertz RentalDocument26 pagesRental Terms: Everything You Need To Know About Your Hertz RentalMarianoVittoriNo ratings yet

- Lesson3 7industrial Robot App QuizbDocument2 pagesLesson3 7industrial Robot App QuizbJairo TanyagNo ratings yet

- Bi CourseoutlineDocument12 pagesBi Courseoutlineapi-293624261No ratings yet

- Mitchell Board of Education Agenda 6-13Document28 pagesMitchell Board of Education Agenda 6-13Erik KaufmanNo ratings yet

- Dayanand FormDocument3 pagesDayanand Form10 More PratikshaNo ratings yet

- 006.FTL Judge & Papaleo Pty LTD: Current and Historical Company ExtractDocument9 pages006.FTL Judge & Papaleo Pty LTD: Current and Historical Company ExtractFlinders TrusteesNo ratings yet

- Gocar Hotel Aston - Stasiun BojonegoroDocument1 pageGocar Hotel Aston - Stasiun BojonegoroAnaNo ratings yet

- CRN6593853793Document3 pagesCRN6593853793ashishNo ratings yet

- The Use of Social Networking Sites For Language Practice and LearningDocument28 pagesThe Use of Social Networking Sites For Language Practice and LearningHendi PratamaNo ratings yet

- VoucherDocument1 pageVoucherDane DadivasNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- SLIPDocument2 pagesSLIPsaleem rasheedNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument8 pagesBajaj Allianz General Insurance Company LTDHarsh PatelNo ratings yet

- ANZ Receipt - Ref 1567548282 - PDFDocument1 pageANZ Receipt - Ref 1567548282 - PDFMercedes SteelNo ratings yet

- 2009 Low Res Annual Report - FullDocument68 pages2009 Low Res Annual Report - FullkasrahedNo ratings yet

- Jurisdiction Merits and Substantiality PDFDocument27 pagesJurisdiction Merits and Substantiality PDFIvel RhaenNo ratings yet

- Ls1e - Adjective Pre & PostDocument4 pagesLs1e - Adjective Pre & PostElvie Joy Taping SeridaNo ratings yet

- Zomato Finaicial ModelDocument16 pagesZomato Finaicial ModelSaubhagya SuriNo ratings yet

- TCS Gems: Frequently Asked QuestionsDocument24 pagesTCS Gems: Frequently Asked QuestionsNandhiniNo ratings yet

- Travel Guard Policy - Policy ScheduleDocument11 pagesTravel Guard Policy - Policy ScheduleTechnetNo ratings yet

- Legal Aspects of Credit and Its ActorsDocument7 pagesLegal Aspects of Credit and Its ActorsJorge NANo ratings yet

- Almosafer Business Booking Reference-NGOOPNDocument1 pageAlmosafer Business Booking Reference-NGOOPNayumeccaNo ratings yet

- About BlankDocument2 pagesAbout Blankसंग्रामसिंह जाखलेकर पाटीलNo ratings yet

- ES LoanStatement 25dec21 24dec22 2Document2 pagesES LoanStatement 25dec21 24dec22 2Sanjeet Singh ThakurNo ratings yet

- Counter Lot 30 Twin BirchDocument5 pagesCounter Lot 30 Twin Birchmissy steinerNo ratings yet

- Accountancy 12th Part-2Document292 pagesAccountancy 12th Part-2King ClasherARNo ratings yet

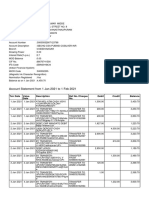

- Account Statement From 1 Jan 2021 To 1 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Jan 2021 To 1 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceKiran KumarNo ratings yet

- Columbia Utilities Letter To Town of MarbletownDocument2 pagesColumbia Utilities Letter To Town of MarbletownDaily FreemanNo ratings yet

- State Bank of IndiaDocument2 pagesState Bank of Indiakiran gemsNo ratings yet

- CertificateDocument1 pageCertificatePriyansh GuptaNo ratings yet

- Your Booking at M Hotel Benzcircle, Vijaywada Is ConfirmedDocument4 pagesYour Booking at M Hotel Benzcircle, Vijaywada Is Confirmedvenkatraman JNo ratings yet

- AAR Corp. ReportDocument15 pagesAAR Corp. Reportakr200714No ratings yet

- Homeless Student PolicyDocument3 pagesHomeless Student PolicyRachel MannNo ratings yet

- Sofi Digital Assets LLC Customer AgreementDocument34 pagesSofi Digital Assets LLC Customer AgreementJohn SmithNo ratings yet

- Your Brain Is Not A Computer. It Is A Transducer Discover MagazineDocument2 pagesYour Brain Is Not A Computer. It Is A Transducer Discover MagazinedariuspetrescribdNo ratings yet

- Anguage Service ProviderDocument29 pagesAnguage Service ProviderrishiNo ratings yet

- Please Note: Organization/ Business NameDocument1 pagePlease Note: Organization/ Business Nameapi-531058700No ratings yet

- Qqyvzu Bafm K Ifjokj Esa Vkidk Lokxr GS: (SMS) : Contact Me' 98457 88800 1800 103 6001 040 4455 6000 8108, - 400051Document12 pagesQqyvzu Bafm K Ifjokj Esa Vkidk Lokxr GS: (SMS) : Contact Me' 98457 88800 1800 103 6001 040 4455 6000 8108, - 400051Charanjeet KohliNo ratings yet

- Deepak Kumar BR3058TW0147747 - 1 - I5858926Document2 pagesDeepak Kumar BR3058TW0147747 - 1 - I5858926Aaditya raj SuryaNo ratings yet

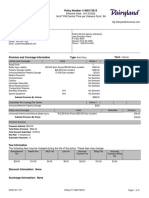

- Action Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELDocument5 pagesAction Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELJulu EmimaryNo ratings yet

- Mira-Bhayandar, Vasai-Virar PoliceDocument1 pageMira-Bhayandar, Vasai-Virar PolicezaigamNo ratings yet

- AIDTauditDocument74 pagesAIDTauditCaleb TaylorNo ratings yet

- List of Writing TechniquesDocument2 pagesList of Writing TechniquesErich Merilles100% (1)

- A Study of Indian Woman's Acceptance of Digital Financial Transactions With Specific Surveyof Woman in Education FieldDocument6 pagesA Study of Indian Woman's Acceptance of Digital Financial Transactions With Specific Surveyof Woman in Education FieldInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fiber Monthly Statement: This Month's SummaryDocument4 pagesFiber Monthly Statement: This Month's SummaryShivang SethNo ratings yet

- Renewal Intimation: Insured Name Chronic Condition Member ID Date of Birth Cumulative Bonus Existing Sum InsuredDocument2 pagesRenewal Intimation: Insured Name Chronic Condition Member ID Date of Birth Cumulative Bonus Existing Sum InsuredZakirKhanNo ratings yet

- Complaint - Mississippi State Conference of The Naacp v. State Board of Election CommissionersDocument95 pagesComplaint - Mississippi State Conference of The Naacp v. State Board of Election CommissionersRuss LatinoNo ratings yet

- College Credit OptionsDocument23 pagesCollege Credit OptionsinforumdocsNo ratings yet

- Annual Report For Bond Fund - Year 2021 - 0Document51 pagesAnnual Report For Bond Fund - Year 2021 - 0Fredwash RichardNo ratings yet

- How Much Money Is EnoughDocument11 pagesHow Much Money Is EnoughBùi Yến NhiNo ratings yet

- Stench of Kerosene Handout 01Document28 pagesStench of Kerosene Handout 01Vi DarshanaNo ratings yet

- Monthly Services: Included at No Extra CostDocument1 pageMonthly Services: Included at No Extra CostRajnish VermaNo ratings yet

- Tushar Gaba Tata InsuranceDocument11 pagesTushar Gaba Tata InsuranceAditya GuptaNo ratings yet

- Og 23 1155 6021 00005597 1Document6 pagesOg 23 1155 6021 00005597 1Honey SharmaNo ratings yet

- Constructive Trust NotesDocument12 pagesConstructive Trust NotesAgitha GunasagranNo ratings yet

- CiNii Books - 九州大学 中央図書館Document1 pageCiNii Books - 九州大学 中央図書館MaxNo ratings yet

- When The King Is Dishonoured (Matthew 11 - 7-11) - Seeking The KingdomDocument1 pageWhen The King Is Dishonoured (Matthew 11 - 7-11) - Seeking The KingdomMaxNo ratings yet

- Principal-Agent Relationship - What It Is, How It WorksDocument1 pagePrincipal-Agent Relationship - What It Is, How It WorksMaxNo ratings yet

- Heraldic Symbols & Colors - A Brief OverviewDocument1 pageHeraldic Symbols & Colors - A Brief OverviewMaxNo ratings yet

- Monzo Warns Job Candidates Not To Use ChatGPT During Application Process - HR Software - HR Grapevine - NewsDocument1 pageMonzo Warns Job Candidates Not To Use ChatGPT During Application Process - HR Software - HR Grapevine - NewsMaxNo ratings yet

- Dominion Governments Under The CrownDocument1 pageDominion Governments Under The CrownMaxNo ratings yet

- Contract Law - The Fundamentals - Paperback and Ebook - ProView - Academic Law - Sweet & Maxwell PDFDocument1 pageContract Law - The Fundamentals - Paperback and Ebook - ProView - Academic Law - Sweet & Maxwell PDFMaxNo ratings yet

- Downloads - Oracle VM VirtualBoxDocument1 pageDownloads - Oracle VM VirtualBoxMaxNo ratings yet

- Demons 55Document19 pagesDemons 55MaxNo ratings yet

- EcoFlow RIVER 2 Portable Power Station - EcoFlow US - EcoFlow US PDFDocument1 pageEcoFlow RIVER 2 Portable Power Station - EcoFlow US - EcoFlow US PDFMaxNo ratings yet