0% found this document useful (0 votes)

764 views6 pagesBank Reconciliation Statement

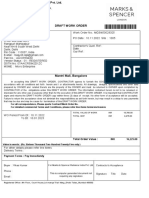

The document discusses bank reconciliation statements, which reconcile a company's cash book balance with its bank balance. Key points include: Bank reconciliation statements list transactions not yet cleared like deposited checks and issued checks. They also account for errors in the cash book or bank statements. Transactions may be out of sync between the books due to timing differences in processing. The example reconciliation statement adjusts the cash book balance of Rs. 8,200 by adding undeposited checks, subtracting outstanding checks, and accounting for other bank fees and interest to calculate the accurate bank balance.

Uploaded by

HarshitaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

764 views6 pagesBank Reconciliation Statement

The document discusses bank reconciliation statements, which reconcile a company's cash book balance with its bank balance. Key points include: Bank reconciliation statements list transactions not yet cleared like deposited checks and issued checks. They also account for errors in the cash book or bank statements. Transactions may be out of sync between the books due to timing differences in processing. The example reconciliation statement adjusts the cash book balance of Rs. 8,200 by adding undeposited checks, subtracting outstanding checks, and accounting for other bank fees and interest to calculate the accurate bank balance.

Uploaded by

HarshitaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd