Professional Documents

Culture Documents

Liberalisation, Privatisation and Globalisation 2

Liberalisation, Privatisation and Globalisation 2

Uploaded by

Dinakar TOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liberalisation, Privatisation and Globalisation 2

Liberalisation, Privatisation and Globalisation 2

Uploaded by

Dinakar TCopyright:

Available Formats

APPENDIX

DEMONETISATION AND GST

DEMONETISATION

Concept

Demonetisation is a situation where the Central Bank of the country (Reserve Bank in

India) withdraws the old currency notes of certain denomination as an official mode

C

of payment.

Demonetisation has been done in various countries of the world in context of

hyperinflation, wars or political upheavals. Countries like Nigeria, Zimbabwe, Australia,

Myanmar etc. have initiated the move in order to curb excess money supply with

respect to black money.

P

After demonetising bank notes on two previous occasions i.e. in the year 1946 and

1978 the Government of India decided to do so again on November 8, 2016, wherein,

higher denomination currency notes of ` 500 and ` 1,000 (together comprising nearly

86% of the currency in circulation) ceased to be legal tender except for a few specified

A

purposes. This currency was to be deposited in the banks by December 30, 2016, while

restrictions were placed on cash withdrawals.

Aim of Demonetisation

India’s economy is relatively cash-dependent and where cash holdings are used for

majority of transactions the chances of cash not being used for legitimate transactions,

but perhaps for other activities such as corruption are high. The recent move of

demonetisation by the Government of India aimed at achieving the following objectives:

• To curb corruption and penalise illicit activities and wealth acquired from it.

• To pave way for digitalisation by shifting transactions out of the cash economy

and into the formal payments system.

• To curtail circulation of counterfeit currency (fake currency).

• To tax unaccounted private wealth maintained in the form of cash. Ensure greater

transparency and reduction in tax evasion by restricting cash transactions and

giving a boost to digital transactions.

• To reduce informal savings and channelize them through formal banking system.

The money deposited in banks could provide a base for giving more loans, at

lower interest rates.

Appendix Demonetisation and GST 225

Impact of Demonetisation

Some of the notable short term impacts of demonetisation are discussed below.

• A slowdown in the growth process was witnessed as demonetisation reduced

both, demand and supply in the market due to lack of liquidity, reduced working

capital availability and increased uncertainty with a major impact on cash-

intensive sectors like agriculture, real estate, jewellery etc.

• A decline in the stock of black money could be seen as some holders came into

the tax net.

• There was a sharp rise in the bank deposits and financial system savings.

• Government’s revenue from taxes increased because of increased disclosure.

C

Payments to local bodies increased as demonetised notes remained legal tender

for tax payments/clearance of arrears.

• There has been a decline in the indirect and corporate taxes, to the extent of

slowdown in the growth process. However, in the long run, taxes are expected

to increase as formalization expands and compliance improves.

P

Demonetisation is an effective tax administration measure as black money holders

are not left with any choice but to declare their wealth and pay taxes as penalty.

Through this measure the government seeks to communicate that tax evasion shall not

be accepted and allowed any further. However, it involves huge cost in the process of

withdrawal of old currency circulating in the economy and printing of new currency

A

notes. The long term benefits of demonetisation can be reaped only if it is followed with

fast, demand-driven remonetisation, digitalisation and growth oriented tax reforms.

226 Indian Economic Development

GOODS AND SERVICES TAX (GST)

Concept

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods

and services. GST Act was passed in the Parliament on 24th March, 2017 and it came

into effect from 1st July 2017.

Goods & Services Tax is a comprehensive, multi-stage, destination-based tax (place

where consumption of the goods or services takes place) that is levied on every value

addition (monetary worth added at each stage) by the Central and State governments.

Before the implementation of Goods and Services Tax (GST), various central, state and

local area taxes were levied in India. These indirect taxes have now been subsumed

C

under GST which is based on the principle of ‘One Nation One Tax’.

Features of GST

(i) GST is a comprehensive tax as various indirect taxes have been merged in this

single tax except Customs duty, taxes on petroleum products, alcoholic drinks

P

and taxes levied by local bodies.

(ii) GST is a multi-stage tax because it is proposed to be levied at all stages starting

from production up to final consumption with a provision of set off of taxes paid

at previous stages.

A

(iii) GST is a Value Added tax because it is levied on value addition at each stage

of the supply chain (from manufacturer to wholesaler to retailer and to the final

consumer).

(iv) GST is a destination-based tax as the tax would accrue to the taxing authority

which has jurisdiction over the place of consumption. For example, if goods are

manufactured in State A and sold to final consumer in State B, the tax revenue

from GST will be collected by the State B and not State A.

Taxes that have been subsumed under the GST are summarised in the following

table:

Taxes subsumed under GST

Central Level Taxes State Level Taxes

Central Excise duty Entertainment Tax

Service Tax VAT

Central Sales Tax Octroi and Entry Tax

Purchase Tax

Taxes on Lotteries

Appendix Demonetisation and GST 227

&

GST structure in India

India has adopted dual GST structure wherein taxes are levied and collected both by

the Union and the States. There are three taxes applicable under GST:

• Central GST (CGST): Where the tax revenue will be collected by the central

government.

• State GST (SGST) or Union Territory GST (UTGST): Where the tax revenue will

be collected by the state governments for intra-state sales i.e. within the same

state.

• IGST: Where the tax revenue will be collected by the central government for

inter-state sales i.e. sale from one state to another.

C

The tax rates, rules and regulations are governed by the GST Council which consists

of the finance ministers of the centre and the states. Goods and services are divided

into following tax slabs for collection of tax namely, 0% (on essential items including

food), 5%, 12%, 18% and 28% (on luxury items and tobacco).

P

Advantages of GST

The GST has been widely heralded for many things, especially its potential to create

one Indian market. Various benefits that shall accrue with the introduction of GST are

discussed below:

• Foster Economic Growth: The subsuming of major Central and State taxes in GST

A

will reduce the cost of locally manufactured goods and services and increase their

competitiveness in the international market thereby giving boost to Indian exports.

An increase in economic activities will also help in increasing the country’s GDP

and generating employment.

• Ease of doing business: In pre GST regime there were multiple indirect taxes and

the firm was required to register itself separately under each such Act. Introduction

of a single tax and automated procedures for registration etc. has led to ease of

doing business for the enterprises.

• Attracting Foreign Investment: Introduction of GST has given a boost to foreign

investment and “Make in India” campaign by harmonising the tax base and

administration procedures across the nation.

• Ensure better tax compliance: The transparent and complete chain of set-offs will

result in widening of tax base and better tax compliance.

• Reduction in the cost of goods: Implementation of GST will prevent cascading

of taxes (i.e. tax on tax) which resulted due to multiplicity of taxes on goods and

services. This will make products cheaper and would benefit the consumers and

increase aggregate demand in the economy.

228 Indian Economic Development

You might also like

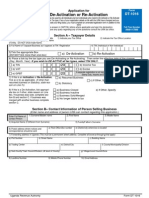

- DT-1016 De-Activation and Re-ActivationDocument2 pagesDT-1016 De-Activation and Re-ActivationIsaka Isse100% (3)

- Hello Canada Account Activation FormDocument6 pagesHello Canada Account Activation FormRomeo Newtown EshalomNo ratings yet

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Essay For Freedom of ServicesDocument4 pagesEssay For Freedom of ServicesJoey WongNo ratings yet

- Demonetisation and GSTDocument5 pagesDemonetisation and GSTheddajyoti1984No ratings yet

- Demonitisation and GSTDocument3 pagesDemonitisation and GSTnakulshali1No ratings yet

- Aryan and Krunal Consumer Affairs Report....................Document17 pagesAryan and Krunal Consumer Affairs Report....................ME16 Krunal DeshmukhNo ratings yet

- Goods and Services TaxDocument6 pagesGoods and Services TaxHARSHULNo ratings yet

- Tax System India Before and After GST PDFDocument4 pagesTax System India Before and After GST PDFvishwajeet singhNo ratings yet

- Tax System India Before and After GSTDocument4 pagesTax System India Before and After GSTmeenakshishrm250No ratings yet

- Taxation Law Assignment by Sushali Shruti 18FLICDDN01144Document10 pagesTaxation Law Assignment by Sushali Shruti 18FLICDDN01144Shreya VermaNo ratings yet

- GST - It's Meaning and ScopeDocument11 pagesGST - It's Meaning and ScopeRohit NagarNo ratings yet

- A Study On Goods & Service TaxDocument15 pagesA Study On Goods & Service Taxgaikwadswapnil0603No ratings yet

- Q GST Divyastra CH 1 - Introduction To GST (R)Document5 pagesQ GST Divyastra CH 1 - Introduction To GST (R)Bharatbhusan RoutNo ratings yet

- Major Issues Reference Notes EnglishDocument202 pagesMajor Issues Reference Notes EnglishLeslie WrightNo ratings yet

- DraftDocument36 pagesDraftAbhinand SadhanandanNo ratings yet

- GST (Taxation)Document15 pagesGST (Taxation)priyayadav001804No ratings yet

- Indirect Taxes: Assignment-2Document27 pagesIndirect Taxes: Assignment-2Arpita ArtaniNo ratings yet

- GST Bhagya-1Document42 pagesGST Bhagya-1Divyasree DsNo ratings yet

- GST Unit 5 BEDocument7 pagesGST Unit 5 BEarunyadav7869No ratings yet

- GST Final IDUDocument10 pagesGST Final IDUmandeep kaurNo ratings yet

- Divyastra - Chapter 1 - Introduction To GSTDocument5 pagesDivyastra - Chapter 1 - Introduction To GSTSona GuptaNo ratings yet

- GST With Examples: GST India - Goods & Service TaxDocument4 pagesGST With Examples: GST India - Goods & Service TaxVipul Priya KumarNo ratings yet

- GST Oct 17Document23 pagesGST Oct 17himanNo ratings yet

- GST PDFDocument7 pagesGST PDFShekhar singhNo ratings yet

- Income TaxDocument3 pagesIncome Taxrahulsthakur22No ratings yet

- Goods & Services Tax - GST: Amar ShawDocument15 pagesGoods & Services Tax - GST: Amar ShawChetan KaushikNo ratings yet

- GST Guide 1Document9 pagesGST Guide 1Harsh ChaudharyNo ratings yet

- Chapter 1 Introduction To GSTDocument5 pagesChapter 1 Introduction To GSTabhay javiyaNo ratings yet

- GST PDFDocument5 pagesGST PDFOMPRAKASH SM EE021No ratings yet

- Goods and Services Tax (GST)Document3 pagesGoods and Services Tax (GST)Saurabh KumarNo ratings yet

- Jyoti Rawat Bsev (Bba - A)Document22 pagesJyoti Rawat Bsev (Bba - A)JyotiNo ratings yet

- Notes - Indirect TaxesDocument18 pagesNotes - Indirect TaxesSajan N ThomasNo ratings yet

- Moving Towards A World-Class GST: Vijay Kelkar Arvind Datar Rahul RenavikarDocument13 pagesMoving Towards A World-Class GST: Vijay Kelkar Arvind Datar Rahul Renavikarmsharma22No ratings yet

- GST Questions and ConceptsDocument52 pagesGST Questions and ConceptsShefali TailorNo ratings yet

- A Short Case Study On The Ten Principles of EconomicsDocument8 pagesA Short Case Study On The Ten Principles of EconomicsRaunak ThakerNo ratings yet

- Ayush PendDocument62 pagesAyush PendPankaj MahantaNo ratings yet

- GST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Document19 pagesGST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Balkrushna ShingareNo ratings yet

- Cheat Sheet TaxDocument6 pagesCheat Sheet TaxShravan NiranjanNo ratings yet

- Goods and Services Tax (GST) in India: Ca R.K.BhallaDocument27 pagesGoods and Services Tax (GST) in India: Ca R.K.BhallaAditya V v s r kNo ratings yet

- Concepts of Demonetisation and GST (Prepared From NCERT Books)Document1 pageConcepts of Demonetisation and GST (Prepared From NCERT Books)Krishna BhattacharyaNo ratings yet

- GST For Indian Economic Development PDFDocument4 pagesGST For Indian Economic Development PDFAnmol D'xharma100% (1)

- Goods and Services TaxDocument4 pagesGoods and Services TaxUrvashi RaoNo ratings yet

- GST VS VatDocument62 pagesGST VS VatMohit AgarwalNo ratings yet

- Ashish TaxDocument20 pagesAshish TaxAshish RajNo ratings yet

- GST in IndiaDocument6 pagesGST in IndiaNaveen SihareNo ratings yet

- Nes Ratnam College of Arts, Science and Commerce Internal Exam - Semester Iv Subject: GST Name: Pooja Maurya Roll No: 26Document10 pagesNes Ratnam College of Arts, Science and Commerce Internal Exam - Semester Iv Subject: GST Name: Pooja Maurya Roll No: 26Pooja MauryaNo ratings yet

- GST Question Bank MergedDocument169 pagesGST Question Bank MergedSaloni BansalNo ratings yet

- GST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Document20 pagesGST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Atul VermaNo ratings yet

- GST in IndiaDocument11 pagesGST in IndiarameshNo ratings yet

- Compendium On GSTDocument5 pagesCompendium On GSTSumit KumarNo ratings yet

- GST - 1 FinalDocument21 pagesGST - 1 FinalswatitankasaliNo ratings yet

- ScribdDocument8 pagesScribdIshika GoyalNo ratings yet

- GST in BankingDocument23 pagesGST in BankingNareshaasatNo ratings yet

- GST Definition, Types, Registration Process Bajaj Finance 2Document1 pageGST Definition, Types, Registration Process Bajaj Finance 2Raman PalNo ratings yet

- Goods and Services Tax - An Overview: Central Board of Excise & CustomsDocument10 pagesGoods and Services Tax - An Overview: Central Board of Excise & CustomsvsaraNo ratings yet

- Concept Of: Goods & Service TaxDocument23 pagesConcept Of: Goods & Service Taxraginikumarithakur45No ratings yet

- PHD Research Bureau PHD Chamber of Commerce and IndustryDocument33 pagesPHD Research Bureau PHD Chamber of Commerce and IndustrySUNIL PUJARINo ratings yet

- GST Main TJ PDFDocument33 pagesGST Main TJ PDFVishal Gopalakrishnan IyerNo ratings yet

- GST ProjectDocument42 pagesGST Projectharmisha narshanaNo ratings yet

- Types of Taxes Under GSTDocument4 pagesTypes of Taxes Under GSTDiya SharmaNo ratings yet

- Types of Supply GSTDocument46 pagesTypes of Supply GSTRajatKumarNo ratings yet

- Foreword: 14/11/17, 2N15 PM Page 1 of 20Document20 pagesForeword: 14/11/17, 2N15 PM Page 1 of 20Anonymous XVUefVN4S8No ratings yet

- Chapter 8 ReviewerDocument4 pagesChapter 8 ReviewerReymar BrionesNo ratings yet

- E-Way Bill: Mode Vehicle / Trans Doc No & Dt. From Entered Date Entered by Cewb No. (If Any) Multi Veh - Info (If Any)Document1 pageE-Way Bill: Mode Vehicle / Trans Doc No & Dt. From Entered Date Entered by Cewb No. (If Any) Multi Veh - Info (If Any)South PointNo ratings yet

- Annex - RMC 137-2016Document14 pagesAnnex - RMC 137-2016Kendi Lu Macabaya Fernandez100% (1)

- Ra 545 PDFDocument15 pagesRa 545 PDFMARK ANGELO CONSULNo ratings yet

- Force Account Mechanism RegulationsDocument7 pagesForce Account Mechanism RegulationsAtwine Anthony100% (1)

- The Rajasthan Societies Registration Act, 1958 With Foot Note PDFDocument12 pagesThe Rajasthan Societies Registration Act, 1958 With Foot Note PDFApurva MathurNo ratings yet

- Roads Authority: Government of The Republic of MalawiDocument92 pagesRoads Authority: Government of The Republic of MalawidyiwombeNo ratings yet

- DARLIPALLIDocument3 pagesDARLIPALLIruchirNo ratings yet

- ATR Answers - 7Document29 pagesATR Answers - 7Christine Jane AbangNo ratings yet

- Delhi To Indore Mzcl4P: Air Asia I5-752Document5 pagesDelhi To Indore Mzcl4P: Air Asia I5-752Piyush Tyagi0% (1)

- (15-00293 203-1) Ex 1 Jones TranscriptDocument94 pages(15-00293 203-1) Ex 1 Jones Transcriptlarry-612445No ratings yet

- Wallstreetjournal 20230728 TheWallStreetJournalDocument40 pagesWallstreetjournal 20230728 TheWallStreetJournalflorin suteuNo ratings yet

- Agency - Sevilla vs. CA 160 SCRA 171Document2 pagesAgency - Sevilla vs. CA 160 SCRA 171Maria Fiona Duran Merquita100% (2)

- Appendix 48 - PCVDocument13 pagesAppendix 48 - PCVHelen Paragas Solivar AranetaNo ratings yet

- (Download PDF) Airline Network Planning and Scheduling Abdelghany Online Ebook All Chapter PDFDocument42 pages(Download PDF) Airline Network Planning and Scheduling Abdelghany Online Ebook All Chapter PDFdonnie.phillips963100% (10)

- Name: Juayno, Esther Address: Phone Number: E-MailDocument4 pagesName: Juayno, Esther Address: Phone Number: E-MailBeth JuaynoNo ratings yet

- Ultra Hni Data 2Document201 pagesUltra Hni Data 2Saumya BhadauriaNo ratings yet

- The New Development Bank and Multilateral Trade FaDocument5 pagesThe New Development Bank and Multilateral Trade FaSelective Coffee IndonesiaNo ratings yet

- Maharlika Fund Position PaperDocument15 pagesMaharlika Fund Position PaperMary InciongNo ratings yet

- National Bank Limited: Sub: Change of Ownership Setup Ack - TransfereeDocument2 pagesNational Bank Limited: Sub: Change of Ownership Setup Ack - TransfereezubishuNo ratings yet

- TESDA Circular No. 054-B-2022Document2 pagesTESDA Circular No. 054-B-2022Roh NaldzNo ratings yet

- Law On CustomsDocument15 pagesLaw On CustomsYukino YukinoshitaNo ratings yet

- LSS 2Document4 pagesLSS 2Ashraf Gading KencanaNo ratings yet

- PAT Ch1 - Litonjua V FernandezDocument1 pagePAT Ch1 - Litonjua V FernandezAlthea M. SuerteNo ratings yet

- Manifesting Winning of Editoryal and Opinyon.Document17 pagesManifesting Winning of Editoryal and Opinyon.Richard CruzNo ratings yet

- Amrapali Spring Meadows 2 3 BHK Flats For Sale Noida Extension 2nd Phase Payment PlanDocument1 pageAmrapali Spring Meadows 2 3 BHK Flats For Sale Noida Extension 2nd Phase Payment PlanAhmad KhanNo ratings yet

- GST Changes With Effect From 01.01.2022Document39 pagesGST Changes With Effect From 01.01.2022Elson Antony PaulNo ratings yet