Professional Documents

Culture Documents

Kotak Mahindra Bank PDF Free PDF

Kotak Mahindra Bank PDF Free PDF

Uploaded by

Sports EnthuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kotak Mahindra Bank PDF Free PDF

Kotak Mahindra Bank PDF Free PDF

Uploaded by

Sports EnthuCopyright:

Available Formats

Kotak Mahindra Bank

A Summer Internship Project Report

On

A study on

Submitted to

Institute Code: 832

Oakbrook Business School

Under the guidance of

Prof. Ankita Srivastava

In partial fulfilment of the Requirement of the award of the Degree of

Master of Business Administration (MBA)

Affiliated to

Gujarat Technology University

Ahmedabad

Prepared by:

Jangid Sunil Prabhudayal

188320592043

MBA (Semester - III)

July 2019

Oakbrook Business School

Kotak Mahindra Bank

OAKBROOK BUSINESS SCHOOL

Plot No. 225, Opp. Maharaja Hotel Lane, Jamiyatpura Road,

Sarkhej

Gandhinagar Highway PO: Jamiyatpura, Gandhinagar-382423

Gujarat-, INDIA

Student’s Declaration

I Undersigned Sunil P. Jangid a student of Oakbrook Business School MBA 3rd semester,

declare that summer internship project titled “A study on people perception toward

investment” at Kotak Mahindra Bank” is a result of my/our own work and my indebtedness

to other work publications, references, if any, have been duly acknowledged. If I found guilty

of copying any other report or published information and showing as my original work, I

understand that I shall be liable and punishable by Institute or University, which may include

‘Fail’ in examination, ‘Repeat study & re-submission of the report’ or any other punishment

that Institute or University may decide.

Enrolment Number Name Sign

188320592043 Sunil P. Jangid

Signature and Date

Oakbrook Business School

Kotak Mahindra Bank

OAKBROOK BUSINESS SCHOOL

Plot No. 225, Opp. Maharaj Hotel Lane, Jamiyatpura Road, Sarkhej

Gandhinagar Highway PO: Jamiyatpura, Gandhinagar-382423

Gujarat-, INDIA

Date: __/__/____

“This is to certify that this Summer Internship Project Report Titled “A study on people

perception toward investment at Kotak Mahindra Bank” is the bonafide work of Sunil P. Jangid

(Enrolment No.188320592043), who has carried out his / her project under my supervision. I also

certify further, that to the best of my knowledge the work reported herein does not form part of any

other project report or dissertation on the basis of which a degree or award was conferred on an

earlier occasion on this or any other candidate.

I have also checked the plagiarism extent of this report which is ……… % and it is

below the prescribed limit of 30%. The separate plagiarism report in the form of html

/pdf file is enclosed with this.

Rating of Project Report [A/B/C/D/E]: ______

(A=Excellent; B=Good; C=Average; D=Poor; E=Worst)

Signature of the Faculty Guide/s

Prof. Ankita Srivastava

Signature of Principal/Director with Stamp of

Institute

Oakbrook Business School

Kotak Mahindra Bank

Company certificate

Oakbrook Business School

Kotak Mahindra Bank

Oakbrook Business School

Kotak Mahindra Bank

Oakbrook Business School

Kotak Mahindra Bank

Preface

Competition is seen in the economy. Now the present scenario of the business world is quite

different from the past. Ethics, conflicts, new ideologies and energy scarcities are just the few

of characteristics that present quite different from the past.

In order to scope up in the ever changing environment, the knowledge of all aspect of business

world is a need today. M.B.A. Programs and management institution provide a global manager

to this Modern business world. But only knowledge is not for the Business but successful

implementation of the knowledge the key to success.

Industrial knowledge is like a coin, which has two sides. One is theoretical and another is

practical knowledge. Both are very important for report. But in fact practical knowledge is

more important than theoretical.

Hence in order to get familiar with the practical knowledge each student is required to

implement the theoretical aspects of the subject into the practical life work. It was a purposeful

and enriching experience for me. Apart from theoretical aspect, we gained a lot of new things

about practical knowledge. I have made this project to implement the theoretical aspects of the

subject in to a practical work.

Oakbrook Business School

Kotak Mahindra Bank

Acknowledgement

This project is the outcome of sincere efforts, hard work and constant guidance of not only

me but a number of individuals. First and foremost, I would like to thanks OBS for giving me

the platform to work with such a company. I am thankful to my faculty guide Prof. Ankita

Srivastava and also thanks to our director Dr. Sourbhi Chaturvedi for providing me help

and support throughout the internship period.

I owe a debt of gratitude to my company guide kinjal divate and Branch manager Garima

Rajput, Kotak Mahindra Bank, mamnagar Ahmedabad who not only gave me valuable

inputs about the industry but was a continuous source of inspiration during these two months,

without whom this project was never such a great success.

I would also take the opportunity to thank the entire staff of Kotak Mahindra Bank,

Ahmedabad who helped and shared their knowledge about the industry fort which I am highly

grateful.

Last but not least I would like to thank all my faculty members, friends and well wishes who

have helped me directly or indirectly in the completion of the project.

Sunil P. Jangid

MBA 2018-20

OBS

Oakbrook Business School

Kotak Mahindra Bank

Table of Content

Sr. No. Particulars Page No.

Part-1

Cover Page & Title Page

Student Declaration

Company Certificate

College Certificate

Turnitin Originality Report & Receipt

Preface I

Acknowledgement II

Executive Summary III

Table of Content Iv

Part-2

1 Industry Overview

2 Company Overview

3 Literature Review

4 Problem Statement

5 Introduction of the topic

6 Research Objectives

7 Research Methodology

8 Data Analysis

9 Hypothesis and Hypothesis Testing

10 Limitations of Study

11 Findings

12 Recommendation

13 Conclusion

14 Bibliography and Reference

15 Annexure

Oakbrook Business School

Kotak Mahindra Bank

1. INDUSTRY OVERVIEW

Oakbrook Business School

Kotak Mahindra Bank

Introduction of Banking Industry

The Indian economy is developing as a one of the most grounded economy of the world with

the GDP development of more than 8 % consistently. A most grounded keeping money industry

is imperative in each nation and can have a huge effect in supporting monetary advancement

through productive budgetary administrations. Managing an account segment assume an

indispensable part in development and improvement of Indian economy. After progression the

managing an account industry in India under gone significant changes. The procedure of

progression and globalization has firmly affected the Indian keeping money segment. A steady

and proficient managing an account area is a fundamental precondition to build the financial

level of a nation. Advancement strategy presented in the keeping money part in India prompted

united rivalry, effective portion of assets and presenting imaginative strategies for assembling

of sparing. The capacity of banks to examine its money related position for enhancing its

aggressive position in the commercial center. Most banks in India are at present centering on

extending their administration organize. A developing Indian economy, extending their

different sections. After the proposals of Narshinham Committee report with the passage of

numerous private players. Indian keeping money industry has changed into a client situated

market. It presently comprises of numerous items and client gatherings and different channels

of conveyance. It is verifiable truth that a powerful and effective saving money framework is

essential for the long-run development and improvement of the economy. Along these lines,

there is expected to make a complete report into execution of banks in India. A Banking Sector

performs three essential capacities in economy, the task of the installment framework, the

preparation of reserve funds and the designation of sparing to speculation products.1 banking

industry has been changed after changes process.

There appears to be no consistency among the business analyst about the root of "Bank"

According to a few creators "Bank", itself is gotten from "Bancus" or "Banquet" that is a seat.

The early financiers, the Jews in Lombardy, executed their business on seats in the commercial

center, when, an investor fizzled, his 'Banco' was separated by the general population; it was

called 'Bankrupt'. This historical background is be that as it may, derided by McLeod on the

ground that "The Italian Money changers accordingly were never called Banchier in the

medieval times”. It is for the most part said that "Bank" has been begun in Italy. Amidst twelfth

century there was an extraordinary monetary emergency in Italy because of war. To meet the

war costs, the legislature of that period a constrained bought in advance on natives of the nation

Oakbrook Business School

Kotak Mahindra Bank

at the enthusiasm of 5% for each annum. Such credits were known as 'Analyze', 'Minto' and so

forth. The most widely recognized name was "Monte'. In Germany the word 'Monte was named

as 'Bank' or 'Banke'. As indicated by a few scholars, the word 'Bank' has been gotten from the

word bank.

It is additionally said that the word 'bank' has been gotten from the word 'Banco' which implies

a seat. The Jews cash loan specialists in Italy used to execute their business sitting on seats at

various commercial centers. At the point when any of them used to neglect to meet his

commitments, his 'Banco' or branch or seat would be broken by the furious loan bosses. The

word 'Bankrupt' is by all accounts started from broken Banco. Since, the managing an account

framework has been begun from cash driving business; it is properly contended that the word

'Bank' has been started from "Banco'. Whatever be the birthplace of the word 'Bank' as

Professor Ram Chandra Rao says, "It would follow the historical backdrop of managing an

account in Europe from the medieval times".

Today the word bank is utilized as a far reaching term for various establishments carrying on

specific sorts of money related business. Practically speaking, the word 'Bank' implies which

gets cash from one class of individuals and again loans cash to another class of individuals for

premium or benefit.

In reality importance of bank isn't indicates in any control or act. In India, diverse individuals

have distinctive sort of importance for bank. Typical pay worker knows methods for bank that

it is a sparing establishment, for current record holder or businessperson knows bank as a

money related foundations and numerous other. Bank isn't revenue driven making, it makes

sparing action in compensation worker.

Oakbrook Business School

Kotak Mahindra Bank

Meaning of Bank:

A Bank is an organization which acknowledges stores from the overall population and stretches

out advances to the family units, the organizations and the legislature. Banks are those

foundations which work in cash. In this manner, they are cash brokers, with the procedure of

advancement elements of banks are additionally expanding and broadening now, the banks are

not almost the merchants of cash, they likewise make credit. Their exercises are expanding and

enhancing. Henceforth it is exceptionally hard to give an all-around satisfactory meaning of

bank. "Keeping money business" implies the matter of getting cash on current or store account,

paying and gathering checks drawn by or paid in by clients, the making of advances to clients,

and incorporates such different business as the Authority may endorse for the motivations

behind this Act.

Definition of Bank:

Indian Banking Regulation act 1949 area 5 (1) (b) of the keeping money Regulation Act 1949

Banking is characterized as.

"Tolerating with the end goal of the arrival of speculation of stores of cash from open repayable

on request or other astute and pull back capable by checks, draft, arrange or something else".

"Bank implies a seat or table for evolving cash'.

- Greek History

"Bank is a foundation for guardianship of cash got from or on Behalf of its clients. Its basic

obligation is to pay their drafts unit. Its benefits emerge from the utilization of the cash left

utilized them".

- Oxford Dictionary

Oakbrook Business School

Kotak Mahindra Bank

History of Bank:

The first banks were probably the religious temples of the ancient world, and were probably

established sometime during the third millennium B.C. Banks probably predated the

invention of money. Deposits initially consisted of grain and later other goods including

cattle, agricultural implements, and eventually Precious metals such as gold, in the form of

easy to-carry compressed plates. Temples and palaces were the safest places to store gold as

they were constantly attended and well built. As sacred places, temples presented an extra

deterrent to would-be thieves. There are extant records of loans from the 18th century BC in

Babylon that were made by temple priests/monks to merchants. By the time of Hammurabi`s

Code, banking was well enough developed to justify the promulgation of laws governing

banking operations.

Ancient Greece holds further evidence of banking. Greek temples, as well as private and civic

entities, conducted financial transactions such as loans, deposits, currency exchange, and

validation of coinage. There is evidence too of credit, whereby in return for a payment from a

client, a moneylender in one Greek port would write a credit note for the client who could

"cash" the note in another City, saving the client the danger of carting coinage with him on his

journey. Pythons, who operated as a merchant banker throughout Asia Minor at the beginning

of the 5th century B.C., is the first individual banker of whom we have records. Many of the

early bankers in Greek city-states were “metics” or foreign residents.

Around the season of Adam Smith (1776) there was an enormous development in the saving

money industry. Banks assumed a key part in moving from gold and silver based coinage to

paper cash, redeemable against the bank's property. Such developing internationalization and

opportunity in money related administrations has totally changed the aggressive scene, as now

numerous banks have shown an inclination for the "all-inclusive saving money" demonstrate

pervasive in Europe. All-inclusive banks are allowed to take part in all types of monetary

administrations, make interests in customer organizations, and capacity however much as could

reasonably be expected as a "one-stop" provider of both retail and discount money related

administrations.

Oakbrook Business School

Kotak Mahindra Bank

History of Banking in India:

Old India

The source of keeping money in goes back to the Vedic time frame. There are rehashed

references in the Vedic writing to cash loaning which was very regular as a side business.

Afterward, amid the season of the Smritis, which took after the Vedic Period and the Epic age,

keeping money turn into a full-time business and got broadened with financiers performing the

greater part of the elements of the present day. The Vaish people group, who directed saving

money business amid this period. As far back as the second or third century A.D. Manu the

considerable Hindu Jurist, committed a segment of his work to stores and propels and set down

tenets identifying with rates important to be charged. Still later, that is amid the Buddhist time

frame, managing an account business was decentralized and turned into a matter of volition.

Therefore, Brahmins and Kshatriyas, who were prior not allowed to take to managing an

account as their calling with the exception of under especially uncommon conditions, likewise

took to it as their business. Amid this period keeping money turned out to be more particular

and deliberate and bills of trade came in wide utilize. "Shresthis" or financiers persuasive in

the public eye and regularly went about as imperial treasurers.

Types of Banks:

In 1935, 'The State Bank of India Act, was passed, appropriately, 'The Imperial Bank of India'

was nationalized and State Bank of India developed with the goal of expansion of saving money

offices on an extensive scale, particularly country and semi – urban zone and for different of

general society purposes. In 1969, fourteen noteworthy Indian Commercial Banks were

nationalized and in 1980, six

More were included to constitute the general population area banks. Business Banks in India

are ordered in Scheduled Bank and Non Scheduled Banks. Planned Banks are including

nationalized Bank, SBI and its auxiliaries, private segment banks and remote banks. Non

Scheduled Banks are those incorporated into the second Scheduled of the RBI Act, 1934.

Oakbrook Business School

Kotak Mahindra Bank

Booked Banks

The second booked of RBI act, make a rundown of banks which are depicted as "Planned Bank"

In the terms of segment 42 (6) of RBI act, 1934, the required sum is just Rs. 5 Lakh. The

Scheduled Banks appreciate a few benefits. It implies that planned banks conveys wellbeing

and eminence esteem contrasted with non-booked banks. It is involved to get renegotiate office

as pertinent.

Nationalized Banks

The nationalized banks incorporate 14 banks nationalized on nineteenth July, 1969 and the 6

more nationalized on fifteenth April, 1980. They are likewise booked banks, after this

nationalization the legislatures attempt to actualize different welfare plans.

Non Scheduled Banks

The business banks excluded in the second timetable of the RBI demonstration are known as

non-booked banks. They are not qualified for offices like renegotiate and rediscounting of bills

and so forth, from RBI. They are occupied with loaning cash reducing and gathering bills and

different organization administrations. They demand higher security for advances.

Old Private Bank

These banks all enlisted under Companies Act, 1956. Essential contrast between Co-agent bank

and Private Banks is its point. Agreeable banks work for its part and private banks are work

for claim benefit.

New Private Banks

These banks lead the market of Indian keeping money business in brief period on account of

its assortment of administrations and way to deal with handle client and furthermore as a result

of long working hours and speed of administrations. This is likewise enrolled under the

Company Act 1956. Amongst old and new private banks there is wide contrast.

Outside Banks

Outside Banks mean multi-nations bank. If there should be an occurrence of Indian remote

banks are such banks which open its branch office in India and their head office are outside of

India. E.g. HSBC Bank, City Bank, Standard Chartered Bank and so on.

Oakbrook Business School

Kotak Mahindra Bank

Co-agent Banks

Co-agent Banks another part of the Indian save money with the sanctioning of the Co-agent

Credit Societies were satiated attributable to the expanding interest of Co-agent Credit, another

Act of the 1994, which accommodate the expanding interest of Co-agent Central banks by an

association of essential credit social orders or by an association of essential credit socialites

and people.

Saving money Product Portfolio:

Stores

There are numerous items in retail saving money like Fixed Deposit, Savings Account, Current

Account, Recurring Account, NRI Account, Corporate Salary Account, Free Demat Account,

Kid's Account, Senior Citizen Scheme, Check Facilities, Overdraft Facilities, Free Demand

Draft Facilities, Locker Facilities, Cash Credit Facilities, and so on. They are recorded and

clarified as takes after:

Settled Deposits

The store with the bank for a period, which is determined at the season of making the store, is

known as settled store. Such stores are otherwise called FD or term store . FD is repayable on

the expiry of a predefined period. The rate of premium and different terms and conditions on

which the banks acknowledged FD were managed by the RBI, in area 21 and 35Aof the

Banking Regulation Act 1949.Each bank has endorsed their own particular rate of premium

and has additionally allowed higher rates on stores over a predefined sum. RBI has likewise

allowed the banks to define FD conspires uniquely implied for senior resident with higher

enthusiasm than ordinary.

Sparing Accounts

Sparing ledger is intended for the general population who wish to spare a piece of their present

pay to meet their future needs and they can likewise acquire in enthusiasm on their investment

funds. The rate of premium payable on by the banks on stores kept up in investment account is

recommended by RBI.

Presently a-days the settled store is additionally connected with sparing record. At whatever

point there is abundance of adjust in sparing record it will consequently move into settled store

Oakbrook Business School

Kotak Mahindra Bank

and if there is deficiency of assets in bank account, by issuing check the cash is exchanged

from settled store to sparing record. Distinctive banks give diverse name to this item.

Current Accounts

A present record is a functioning and running record, which might be worked upon any number

of times amid a working day. There is no limitation on the number and the measure of

withdrawals from a present record. Current record, suit the prerequisites of a major

businesspeople, business entities, establishments, open specialists and open company and so

on.

Repeating Deposit

A variation of the sparing bank a/c is the repeating store or aggregate store a/c presented by

banks as of late. Here, a contributor is required to store a sum picked by him. The rate of

enthusiasm on the repeating store account is higher than when contrasted with the enthusiasm

on the sparing record. Banks open such records for periods going from 1 to 10 years. There

relieving store record can be opened by any number of people, in excess of one individual

mutually or severally, by a watchman for the sake of a minor and even by a minor.

NRI Account

NRI accounts are kept up by banks in rupees and in addition in remote money. Four sorts of

Rupee record can be open in the names of NRI: Apart from this, outside cash account is the

record in remote money. The record can be open typically in US Dollar, Pound Sterling, and

Euro. The records of NRIs are Indian thousand year’s store, Resident remote cash, lodging

money plot for NRI speculation plans.

Corporate Salary account

Corporate Salary account is another item by certain private area banks, outside banks and as of

late by some open part banks moreover. Under this record compensation is kept in the record

of the workers by charging the record of boss. The main thing required is the record number of

the representatives and the sum to be paid them as pay. In specific cases the base adjust required

is zero. Every other office accessible in reserve funds a/c are additionally accessible in

corporate compensation account.

Oakbrook Business School

Kotak Mahindra Bank

Child's Account

Kids are welcomed as client by specific banks. Under this, Account is opened for the sake of

children by guardians or gatekeepers. The highlights of child's record are free customized check

book which can be utilized as a blessing check, web managing an account, speculation

administrations and so on.

Senior Citizenship plot

Senior natives can open a record and on that record they can get loan cost fairly more than the

ordinary rate of intrigue. This is because of some social obligations of banks towards matured

people whose profit are for the most part on the loan cost.

Credits and Advances

The fundamental business of the managing an account organization is loaning of assets to the

constituents, for the most part merchants, business and mechanical undertakings. The

significant segment of a bank's assets is utilized by method for credits and advances, which is

the most productive work of its assets. There are three fundamental standards of bank loaning

that have been trailed by the business banks and they are security, liquidity, and benefit. Banks

concede advances for various periods like here and now, medium term, and long haul and

furthermore for various reason.

Individual Loans

This is one of the significant credits gave by the banks to the people. There the borrower can

use for his/her own motivation. This might be identified with his/her business reason. The

measure of advance is relied upon the wage of the borrower and his/her ability to reimburse

the credit.

Lodging Loans

NHB is the completely claim backup of the RBI which control and manage entire industry

according to the direction and data. The reason for credit is principally for procurement,

augmentation, redesign, and arrive improvement.

Instruction Loans

Advances are given for instruction in nation and abroad.

Oakbrook Business School

Kotak Mahindra Bank

Vehicle Loans

Advances are given for buy of bike, auto-rickshaw, auto, bicycles and so on. Low loan fees,

expanding pay levels of individuals are the variables for development in this area.

Notwithstanding for second hand auto fund is accessible.

Proficient Loans

Advances are given to specialist, C.A, Architect, Engineer or Management Consultant. Here

the credit reimbursement is ordinarily done as compared month to month.

Purchaser Durable Loans

Under this, advances are given for obtaining of T.V, Cell telephones, A.C, Washing Machines,

Fridge and other items.34

Advances against Shares and Securities

Fund against shares is given by banks for various employments. Presently days back against

shares are given for the most part in demate shares. An edge of half is ordinarily acknowledged

by the rely upon showcase esteem. For these advances the records required are ordinarily DP

notes, letter of proceeding with security, vow frame, intensity of lawyer. This advance can be

utilized for business or individual reason.

Keeping money Services

In this evolving situation, the part of banks is essential for the development and improvement

of clients and economy. Keeping money Sector is putting forth conventional and other

administration as under:

• Regular Saving and current records

• Regular settled stores

• ATM administrations

• Credit cards

• Demate cards

• Student managing an account

• Special NRI Services

• Home credit, Vehicle advance

• Tele and web managing an account

Oakbrook Business School

Kotak Mahindra Bank

• Online exchanging

• Business duplicates A/Cs

• Insurance

• Relief securities and common reserve

• Loans against shares

• Retail keeping money

• Special store conspire

• Senior resident – exceptional store conspire

• Other offices for clients

Web based Banking

The antecedent for the cutting edge home internet managing an account administrations

were the separation keeping money benefits over electronic media from the mid-1980s. The

term online wound up mainstream in the late '80s and alluded to the utilization of a terminal,

console and TV (or screen) to get to the saving money framework utilizing a telephone line.

'Home saving money' can likewise allude to the utilization of a numeric keypad to send

tones down a Phone line with guidelines to the bank. Online administrations began in New

York in 1981 when four of the city's significant banks (Citibank, Chase Manhattan,

Chemical and Manufacturers Hanover) offered home keeping money administrations

utilizing the videotext framework. As a result of the business disappointment of videotex

these managing an account benefits never ended up well known aside from in France where

Phone line with directions to the bank. Online administrations began in New York in 1981

when four of the city's real banks (Citibank, Chase Manhattan Chemical and Manufacturers

Hanover) offered home keeping money administrations utilizing the videotex framework.

Due to the business disappointment of videotext these managing an account benefits never

wound up prominent with the exception of in France where the utilization of videotex

(Minitel) was financed by the telecom supplier and the UK, where the Prestel framework

was utilized.

Meaning:

Web based keeping money (or Internet managing an account) enables clients to lead

monetary exchanges on a protected site worked by their retail or virtual bank, credit

association or building society.

Oakbrook Business School

Kotak Mahindra Bank

Value-based

Playing out a money related exchange, for example, a record to account exchange, paying

a bill, wire exchange and applications apply for a credit, new record, and so forth.

• Electronic Bill Presentment and Payment – EBPP

• Funds exchange between a client's own checking and sparing records, or to another

client's record

• Investment buy or deal

• Loan applications and exchanges, for example, reimbursements of enrolments

Non Transactional

(e.g., online explanations, check joins, co perusing, visit)

• Bank explanations

• Financial Institution Administration

• Support of different clients having fluctuating levels of specialist

• Transaction endorsement process

• Wire exchange

Fate of Indian Banking

The Reserve Bank of India in its ‗road delineate' the saving money industry has

demonstrated that the Indian market will be opened for worldwide banks by in closer future.

It is normal that numerous remote banks would pick up section in the Indian markets to tap

the tremendous potential that exists today. These saves money with the assistance of cutting

edge innovation, sufficient capital for venture, and their client driven approach will have

the capacity to pull in the beneficial clients from the current banks. A savage rivalry

between the current banks and the new contestants is probably going to give stimulus to

business development. To successfully address the aggressive difficulties from such banks,

the Indian saving money industry should adapt and receive the worldwide prescribed

procedures, which make them more grounded and practically identical with the universal

banks.

Oakbrook Business School

Kotak Mahindra Bank

The new outside banks entering the Indian market will make progress toward making a solid

client base. These manages an account with their expansive assets accessibility as capital are

probably going to mix the most recent IT based innovative answers for quality money related

administrations. The Indian business banks have encountered the move of inclination of the

new age clients from 'customized keeping money' to 'mechanical managing an account'. This

techno savvy client bunches wants to finish saving money exchanges from their home or

workplaces as opposed to going to the bank office. They have almost no dependability to their

financiers and given a scarcest enhanced innovation to move their keeping money needs from

the current to another bank. Even with the danger of losing beneficial clients to the new

contestants in the keeping money division, the current business; banks should develop

reasonable market systems went for pulling in the current ones.

Oakbrook Business School

Kotak Mahindra Bank

2. COMPANY OVERVIEW

Oakbrook Business School

Kotak Mahindra Bank

Introduction about Kotak Mahindra Bank Ltd.

Set up in 1985, the Kotak Mahindra bunch has been one of India's most rumored monetary

aggregates. In February 2003, Kotak Mahindra Finance Ltd, the gathering's leader

organization was given the permit to bear on saving money business by the Reserve Bank

of India (RBI). This endorsement made saving money history since Kotak Mahindra

Finance Ltd. is the primary non-keeping money fund organization in India to change over

itself in to a bank as Kotak Mahindra Bank Ltd. Today, the bank is one of the quickest

developing bank and among the most respected money related establishments in India.

The bank has more than 323 branches and a client account base of more than 2.7 million.

Spread all finished India, not simply in the metros but rather in Tier II urban communities

and provincial India too, it is reclassifying the span and intensity of managing an account.

By and by it is occupied with business managing an account, stock broking, shared assets,

extra security and venture saving money. It takes into account the budgetary needs of

people and corporate. The bank has a global nearness through its backups with workplaces

in London, New York, Dubai, Mauritius, San Francisco and Singapore that represent

considerable authority in giving administrations to abroad speculators looking to put into

India.

Products and Services

• The bank offers finish money related answers for boundless necessities of all individual

and non-singular clients relying upon the client's need – conveyed through a best in class

innovation stage. Venture items like Mutual Funds, Life Insurance, retailing of gold coins

and bars and so forth are likewise advertised. The bank takes after a blend of both open and

shut design for dissemination of the venture items. This is sponsored by solid, in-house

inquire about on Mutual Funds.

He bank's investment account goes past the customary part of funds, and enables us to set

aside significantly something beyond cash. The straightforward component of bank

account gives a scope of administrations from stores exchange, charge installments, 2-route

clear through our dynamic Money highlight and considerably more. We can put standing

guidelines for speculation alternatives that can be reserved through Internet or through

telephone managing an account administrations. The bank account hence accommodates

alluring returns earned through an exhaustive suite items and administrations that offer

venture choices, all conveyed flawlessly to the client by all around coordinated innovation

stages.

Oakbrook Business School

Kotak Mahindra Bank

• Apart from Phone managing an account and Internet saving money, the bank offers

advantageous keeping money office through Mobile saving money, SMS administrations,

Netc@rd, Home saving money and Bill Pay office among others.

• The Depository administrations offered by the Bank enables the clients to hold value

shares, government securities, bonds and different securities in electronic or Demat

shapes.

• The pay 2 riches offering gives exhaustive managerial answer for Corporate with

highlights, for example, simple and computerized electronic pay transfer process

consequently disposing of the printed material associated with the procedure, a devoted

relationship supervisor to administrations the corporate record, tweaked advancements and

tie – ups and numerous such one of a kind component. The entire extent of venture items

and speculation warning administrations is accessible to the compensation account holders

too.

• For the business network, the bank offer extensive business arrangements that incorporate

the present Account, Trade Services, Cash Management Service and Credit offices. The

bank's discount managing an account items offer business saving money answers for long

haul venture and working capital needs, exhortation on mergers and acquisitions and gear

financing. To address unique issues of the rustic market, the bank has committed business

contributions for farming financing and foundation. Its Agriculture Finance division

conveys tweaked items for capital financing and hardware financing needs of our country

clients.

• For monetary liquidity the bank offers credits that meet individual necessities with speedy

endorsement and adaptable installment choices. To finish the individual budgetary

contributions space, the bank currently offers Kotak Credit Card which is a problem free,

straightforward item that likewise happens to be the principal vertical card in the business.

Kotak Mahindra Bank tends to the whole range of money related necessities of Non-

Resident Indians. The bank has tie-up with the abroad Indian Facilitation Centre(OIFC) as

a vital accomplice, which gives them a stage to share their thorough scope of managing an

account and venture items and administrations for Non Resident Indians NRIs) and Persons

of Indian Origin (PIOs). Their Online Account Opening office and Live Chat benefit

connects at the solace of homes and at the accommodation. These contributions are

Oakbrook Business School

Kotak Mahindra Bank

particularly intended to suit the abroad Indian's Personal budgetary needs and give the

worldwide Indians a close to home feel.

Awards:

• ICAI Award – Excellence in Financial Reporting under Category 1 – saving money

Sector for the year finishing 31st March, 2010

Asia money – Best Local money Management bank 2010

IDG India-Kotak won the CIO 100 'The Agile 100' honor 2010

IDRBT

• Banking Technology Excellence Awards Best Bank Award in IT Framework and

Governance Among Other Banks' - 2009

• Banking Technology Award for IT Governance and esteem Delivery, 2008

• IR Global Rankings – Best Corporate Governance Practices – Ranked among

the best 5 organizations in Asia Pacific, 2009

Finance Asia – Best Private Bank in India, for Wealth Management business, 2009

Kotak Royal Signature Credit Card – was picked 'Result of the Year' in a review

directed by Nielsem in 2009

• IBA Banking Technology Awards

• Best Customer Relationship Achievement – Winner 2008 &2009

• Best general victor, 2007

• Best IT Team of the Year, 4 years in succession from 2006 to 2009

• Best IT Security Policies and Practices, 2007

Euro money – Best Private Banking Services (Overall), 2009

History

1985 Kotak Mahindra Finance Ltd. commences bill discounting business

1987 Enters lease and hire purchase business

1998 Kotak Mahindra Group launches India’s first gilt fund through Kotak Mahindra Asset

Management Company (KMAMC)

1990 Starts auto finance division for financing passenger car

Oakbrook Business School

Kotak Mahindra Bank

1991 Establishes investment banking division

2001 Kotak Mahindra Group launches life insurance business, partners Old Mutual plc to from

Kotak Mahindra Old Mutual life insurance Ltd.

2003 Kotak Mahindra Finance Ltd. (KMFL), the group’s flagship company, receives banking

license from the Reserve Bank of India (RBI). With this, KMFL becomes the first non-banking

finance company in India to be converted into a commercial bank – Kotak Mahindra Bank Ltd.

2004 Kotak Mahindra Group enters alternate assets business with the launch of a private equity

fund

2005 Kotak Mahindra Group realigns joint venture with Ford Credit; takes 100% ownership

of Kotak Mahindra Prime (formerly known as Kotak Mahindra Primus Limited) and sells its

stake in Ford Credit Kotak Mahindra to Ford Kotak Alternate Assets launches a real estate

fund 2006 Kotak Mahindra Bank buys out Goldman sachs’ equity stake in Kotak Mahindra

Capital Company and Kotak securities Ltd.

2008 Kotak Mahindra Bank opens a representative office in Dubai

2009 Kotak Mahindra Group launches a pension fund under India’s National Pension

System

(NPS)

2014 Thrust on digital and social with the launch of innovative solution – first-of-its-kind fully

integrated social bank account – ‘Jifi’, and world’s first bank agnostic instant funds transfer

platform using Facebook – ‘KayPay’. Subsequently in Jan 2015, ‘Jifi Saver’ – a savings bank

account with secure and seamless transactions on popular social networks was launched.

Kotak Mahindra Bank acquires 15% equity stake in Multi Commodity Exchange of India

Limited (MCX) Kotak Mahindra asset Management Company Ltd. acquires schemes of Pine

bridge Mutual Fund

2015 Reserve Bank of India (RBI) approves merger of ING Vysya Bank with Kotak

Mahindra Bank effective April 1, 2015

Kotak Mahindra General Insurance Receives IRDAI Approval to Commence Insurance

Business

2016 Kotak Mahindra Bank Acquires 10,00,000 Equity shares of Institutional Investor

Advisory services India Limited

Kotak Mahindra Bank acquires 9,83,82,022 (19.90%) Equity Shares of Airtel M Commerce

Services Limited Company (AMSL)

Kotak Mahindra Bank launches International Banking Unit in Gujarat International Finance

Tec-City (GIFT City), Gandhinagar, Gujarat

Oakbrook Business School

Kotak Mahindra Bank

Kotak Mahindra bank Acquires BSS Microfinance Private Limited

VISION OF KOTAK BANK

The Global Indian Financial services Brand

• Our customers will enjoy the benefits of dealing with a global Indian brand that best

understands their needs and delivers customized pragmatic solutions across multiple

platforms.

• We will be a world class Indian financial services group. Our technology and best practices

will be bench-marked along international lines while our understanding of customers will

be uniquely India.

• We will be more than a repository of our customers’ savings. We, the group, will be

single window to every financial service in a customer’s universe.

The Most Preferred Employer in Financial Services

• A culture of empowerment and a spirit of enterprise attracts bright minds with an

entrepreneurial streak to join us and stay with us.

• Working with a home grown professionally managed company, which has partnerships

with international leaders, gives our people a perspective that is universal as well as

unique.

The Most Trusted Financial Services Company

• We will create an ethos of trust across all our constituents. Adhering to high standards of

compliance and corporate governance will be an integral part of building trust.

Value Creation

• Value creation rather than size alone will be our business driver.

Kotak Mahindra Bank Other Products

Kotak Mahindra Old Mutual Life Insurance Ltd.

Kotak Mahindra Old Mutual Life Insurance Ltd is a 74:26 joint venture between Kotak

Mahindra Bank Ltd. its affiliates and Old Mutual plc. A Company that combines its

international strengths and local advantages to offer its customers a wide range of

innovative life insurance products, helping them take important financial decisions at every

Oakbrook Business School

Kotak Mahindra Bank

stage in life and stay financially independent. The company over 3 million lives and is one

of the fastest growing insurance companies in India.

Kotak Securities Ltd.

Kotak Securities is one of the largest broking houses in India with a wide geographical

reach. Kotak Securities operations include stock broking and distribution of various

financial products including private and secondary placement of debt, equity and mutual

funds.

Kotak Securities operate in five main areas of business:

• Stock Broking (retail and institutional)

• Depository services

• Portfolio Management Services

• Distribution of Mutual Funds

• Distribution of Kotak Mahindra Old Mutual Life Insurance Ltd. Products

Kotak Mahindra General Insurance Company Ltd.

Kotak Mahindra General Insurance Company Ltd. is a 100% subsidiary of Kotak Mahindra

Bank Ltd., one of the fastest growing banks in India. Kotak Mahindra General Insurance

Company Ltd. was established to service the growing non-life insurance needs of an emerging

India, emphasizing on customer service, quality & innovation.

The company aims to cater to a wide range of customer segment & geographical offering an

array of non-life insurance products like Motor, Health, etc.

As a practice, the company seeks to provide a differentiated value proposition through

customized products 7 services leveraging state of art technology &digital infrastructure.

Kotak Mahindra Capital Company (KMCC)

Kotak Mahindra Banking (KMCC) is a full-service investment bank in India offering a wide

suite of capital market and advisory solutions to leading domestic and Multinational

Corporation, banks, financial institutions and government companies.

Oakbrook Business School

Kotak Mahindra Bank

Our services encompass Equity 7 Debt Capital Markets, M & A Advisory, Private Equity

Advisory, Restructuring and Recapitalization services, Structured Finance services and

Infrastructure Advisory & Fund Mobilization.

Kotak Mahindra Prime Ltd. (KMPL)

Kotak Mahindra Prime Ltd. is among India’s largest dedicated passenger vehicle finance

companies, KMPL offers loans for the entire range of passenger cars, multi-utility vehicles ans

pre-owned cars. Also on offer are inventory funding and infrastructure funding to car dealers

with strategic arrangements via various car manufactures in India as their preferred financier.

Kotak International Business

Kotak International Business specializes in providing a range of services to overseas customers

seeking to invest in India. For institutions and high net worth individuals outside India, Kotak

International Business offers asset management through a range of offshore funds with specific

advisory and discretionary investment management services.

Kotak Mahindra Asset Management Company Ltd. (KMAMC)

Kotak Mahindra Asset Management Company offers a complete bouquet of asset management

products and service that are designed to suit the diverse risk return profiles of each and every

type of investor. KMAMC and Kotak Mahindra Bank are the sponsors of Kotak Mahindra

Pension Fund Ltd., which has been appointed as one of six fund managers to manage pension

funds under the New Pension Scheme (NPS).

Kotak Private Equity Group (KPEG)

Kotak Private Equity Group helps nurture emerging business and mid-size enterprises to evolve

into tomorrow’s industry leaders. With a proven track record of helping build companies,

KPEG also offers expertise with a combination of equity capital, strategic support and value

added services. What differentiates KPEG is not merely funding companies, but also having a

close involvement in their growth as board members, advisors, strategists and fund-raisers.

Kotak Realty Fund

Kotak Realty Fund deals with equity investment covering such as hotels, IT parks, residential

townships, shopping centers, industrial real estate, health care, retail, education and property

management. The investment focus here is on development projects and enterprise level

investments, both in real estate intensive businesses.

Oakbrook Business School

Kotak Mahindra Bank

3. REVIEW OF LITERATURE

Oakbrook Business School

Kotak Mahindra Bank

(jain, 17 may 2003) Argues that designing portfolio for a client is much more than merely

picking up securities for investment. The portfolio manager needs to understand the psyche of

his client while designing his portfolio. According to Gupta, investors in India regard equity,

debentures and company deposits as being in more or less the same risk category and consider

including all mutual funds, including all equity funds, almost as safe as bank deposits.

(W.goetzmann, june 1993)Studied the ability of investors to select funds and found evidence

to support selection ability among active fund investors.

(rajarajan, 1999)Has examined that, the individual investors occupy a prominent place in the

economic development of a nation. Their savings pattern needs considerable attention. This

article examines the relationship between the various stages in the life cycle of individual

investors and their investment size and their investments in risky assets, on the basis of primary

data collected from 450 individual investors. This study finds the existence of systematic

relationship among them.

(SELVI, September 2015)Investors have a lot of investment avenues to park their savings.

The risk and returns available from each of these investment avenues differ from one avenue

to another. The investors expect more returns with relatively lesser risks. In this regard, the

financial advisors and consultants offer various suggestions to the investors. The available

literature relating to the investors' attitude towards investment avenues is very little and failed

to provide a lot of information. An attempt has been made in this study to find out the main

objective of the investors in Coimbatore District towards making investments and to assess the

investors' attitude towards the investment avenues.

(Dr.M.Mohana Sundari, 2016) The person dealing with the planning must know all the

various investment choices and how these can be chosen for the purpose of attaining the overall

objectives. The details of making the investment along with the various ways in which the

investment has to be maintained and managed. The expectations of the investors, their

perception towards various products/ investment avenues, their current pattern of investment

have to be understood to serve them well and also to offer better products.

(M.geetha, may 2012) This study attempts to find out the significance of demographic factors

of population such as gender, age, education, occupation, income, savings and family size over

several elements of investment decisions like priorities based on characteristics of investments,

period of investment, reach of information source, frequency of investment and analytical

abilities. The study was made by conducting a survey in Nagapattinam district of Tamilnadu,

South India and the statistical inferences were deduced using computer software tools. The

study reveals that the demographic factors have a significant influence over some of the

investment decision elements and insignificant in others elements too. The study also discloses

a general view of investor’s perception over various investment avenues.

(Bhushan, January 2014) Diverse financial products have been introduced these days in

Indian market. Each of these financial products offer a range of benefits and varying options

with respect to interest rates, exposure to risk, time period of the contract, fees etc. Most of

the individuals are not able to take advantage of higher returns offered by these products due

to lack of financial awareness. Thus they must be made aware about risk and return

characteristics of these products by designing an appropriate financial education program so

that people can invest in these financial products. For designing an effective financial education

program, current awareness level as well as investment behavior of individuals towards

Oakbrook Business School

Kotak Mahindra Bank

financial products must be known. This paper examines the awareness level and investment

behavior of salaried individuals towards financial products. Results of the study suggest

that respondents are quite aware about traditional and safe financial products whereas

awareness level of new age financial products among the population is low. Also majority of

the respondents park their money in traditional and safe investment avenue.

(sharma, augest 2014)Indian economy is one of the rapidly growing economies of the world

where more than 50% people belong to middle class and lower class, their annual income fall

up to rupees 10 lacs (acc to NCAER’s definition). Middle class population is the key element

for economic development of India. They influence demand and supply of need and comfort

products at a great extent. Their saving and investment pattern gets influenced by their future

needs, have wide scope for researchers due to greater impact on the investment market. In this

paper, researchers want to discuss about investment behavior adopted by middle class as

seeker, included both groups engaged in either service or business, whose income exist between

Rs.2,00,000 to Rs.5,00,000 per annum. The reason behind selecting the particular income

group is to find that how to manage their investment with small income after spend their hug

expenses. The study has conducted to answer few important questions about preferences of the

investment instrument as real estate, bullion, precious stones, money market and capital market

etc.

(Ms.k.j.anju, september 2015) Today the financial services sector has become highly

diversified offering the investor with a wide range of investment avenues. With proper

investment strategies and financial planning investor can increase personal wealth which will

contribute to higher economic growth. Economic growth is among the most vital factors

affecting the quality of life that people lead in a country. Three variables that measure the

growth of an economy are Income, Saving and Investment. In this paper miscellaneous

literature existing globally has been reconnoitered to recognize the investor's behavior. Using

interpretative approach viz., objectives, sample, research methodology and results of the study

have been taken for further enquiry. This study constructs a robust conceptual framework for

the researchers by meticulously analyzing the experimental studies on investor behaviour in

different countries. The paper exhibits that there are numerous variables that direct an investor's

decision to invest. Further, we propose an empirical study to determine the relationship

between the income, saving and investment behaviour among the IT professionals of

Bangalore. The results from the proposed study could be of great relevance to the investors for

their wealth management and to the policy makers, the investment agencies, the researchers as

well as managers of the firms to prepare themselves to respond to the varying behaviour of the

investor.

(kumari, july 2017)Impact of behavioral finance in investment decisions and strategies – A

fresh approach, has mentioned that emotions and cognitive errors influence investors in the

decision making process. Various causes that lead to behavioral finance are anchoring, over-

confidence, herd behavior, over and under reaction and loss aversion. Behavioral finance offers

many useful insights for investment professionals and thus provides a framework for evaluating

active investment strategies for the investors.

Oakbrook Business School

Kotak Mahindra Bank

4. PROBLEM STATEMENT

Oakbrook Business School

Kotak Mahindra Bank

(kumar, 4 Decembar 2015) The development of any economy depends on healthy savings

and proper allocation of capital for the developmental activities of any country. The reduction

of disposable income or increase in per-capita income will contribute to savings. The avenues

of investment and the investors’ opinion based on their preferences vary from person to person.

Liquidity and safety play a major role in the investment decision; tax exemption and other

factors are also taken into consideration. Apart from the above factors, there are demographic

factors which influence the decision on investment. This article discusses the factors which

affect the investment behavior of individuals.

Oakbrook Business School

Kotak Mahindra Bank

5. INTRODUCTION OF THE TOPIC

Oakbrook Business School

Kotak Mahindra Bank

Introduction of investment:

Now-a-days a wide range of investment opportunities are available to the investor. These are

primarily bank deposits, corporate deposits, bonds, units of mutual funds, instruments under

National Savings Schemes, pension plans, insurance policies, equity shares etc. All these

instruments compete with each other for the attraction of investors. Each instrument has its

own return, risk, liquidity and safety profile. The profiles of households differ depending upon

the income-saving ratio, age of the household’s head, number of dependents etc. The investors

tend to match their needs with the features of the instrument available for investment. They do

have varying degrees of preferences for savings vehicles.

Every investor tends to keep some cash balance and maintain a certain amount in the form of

bank deposit to meet his/her transaction and precautionary needs. In the case of salaried people,

contributions to Employees Provident Fund become compulsory. Life Insurance is widely

preferred to meet situations arising out of untimely deaths of the bread earner. Besides these

needs, the surplus income (savings) awaits investment in alternative financial assets. Investors

have to take decisions relating to their investment in competing assets/ avenues. An investor

has a wide array of investment avenues.

DEFINITION OF INVESTMENT

Different thinkers interpret the word ‘Investment’ in their own ways in different periods.

However, the ideology or concept of investment is same in between them.

Some famous definitions of Investment are;

- “Sacrifice of certain present value for some uncertain future value”

-WILLIAM F. SHARPE

- “Purchase of a financial asset that produce a yield that is proportional to the risk assumed

over some future investment period”

-F. AMLING

Oakbrook Business School

Kotak Mahindra Bank

Types of investment:-

1. Mutual fund

2. Fixed deposit

3. Sovereign gold bond scheme

4. Kotak ASBA facility

5. Currency

6. Commodity

7. Insurance

8. Portfolio management service

9. Real estate

10. National Pension System

1. Mutual fund: A mutual fund is a type of financial vehicle made up of a pool of

money collected from many investors to invest in securities such as stocks, bonds,

money market instruments, and other assets. Mutual funds are operated by

professional money managers, who allocate the fund's assets and attempt to produce

capital gains or income for the fund's investors. A mutual fund's portfolio is structured

and maintained to match the investment objectives stated in its prospectus.

Mutual funds give small or individual investors access to professionally managed

portfolios of equities, bonds and other securities. Each shareholder, therefore,

participates proportionally in the gains or losses of the fund. Mutual funds invest in a

vast number of securities, and performance is usually tracked as the change in the

total market cap of the fund—derived by the aggregating performance of the underlying

investments.

Types of mutual fund:

1. Equity Fund: Mutual funds give small or individual investors access to

professionally managed portfolios of equities, bonds and other securities. Each

shareholder, therefore, participates proportionally in the gains or losses of the fund.

Mutual funds invest in a vast number of securities, and performance is usually

tracked as the change in the total market cap of the fund—derived by the

aggregating performance of the underlying investments.

2. Fixed-Income Funds: Another big group is the fixed income category. A fixed

income mutual fund focuses on investments that pay a set rate of return, such as

government bonds, corporate bonds, or other debt instruments. The idea is that the

fund portfolio generates interest income, which then passes on to shareholders.

3. Index Funds: Another group, which has become extremely popular in the last few

years, falls under the moniker "index funds." Their investment strategy is based on

the belief that it is very hard, and often expensive, to try to beat the market

consistently. So, the index fund manager buys stocks that correspond with a major

market index such as the S&P 500 or the Dow Jones Industrial Average (DJIA).

This strategy requires less research from analysts and advisors, so there are fewer

Oakbrook Business School

Kotak Mahindra Bank

expenses to eat up returns before they are passed on to shareholders. These funds

are often designed with cost-sensitive investors in mind.

4. Balanced Funds: Balanced funds invest in both stocks and bonds to reduce the

risk of exposure to one asset class or another. Another name for this type of mutual

fund is "asset allocation fund." An investor may expect to find the allocation of

these funds among asset classes relatively unchanging, though it will differ among

funds. This fund's goal is asset appreciation with lower risk. However, these funds

carry the same risk and can be as subject to fluctuation as other classifications of

funds.

2. Fixed deposit: Fixed deposit is investment instruments offered by banks and non-

banking financial companies, where you can deposit money for a higher rate of interest

than savings accounts. You can deposit a lump sum of money in fixed deposit for a

specific period, which varies for every financier.

Once the money is invested with a reliable financier, it starts earning an interest based

on the duration of the deposit. Usually, the defining criteria for FD is that the money

cannot be withdrawn before maturity, but you may withdraw them after paying a

penalty.

3. Sovereign gold bond scheme: Sovereign Gold Bond Scheme from Kotak

Mahindra Bank are RBI issued securities which are denominated in grams of gold.

Since these are substitutes of physical gold people have to invest in these bonds in cash

and after redemption receive only cash.

4. Kotak ASBA facility: ASBA can be opened with a Self-Certified Syndicate Bank

(SCSB) as per SEBI guidelines. Not all banks are enlisted as SCSB. Kotak Mahindra Bank is

an SCSB. Also, the ASBA IPO Application form can be submitted at the bank branch, which

is designated for the purpose.

5. Currency: The foreign exchange market (forex) is the market where world currencies

are traded 24 hours a day. For some, it's simply a mechanism for changing one currency

into another, such as multinational corporations doing business in various countries.

Here are five ways for a retail investor to participate in this market.

6. Commodity: A commodity is a basic good used in commerce that is interchangeable

with other commodities of the same type. Commodities are most often used as inputs

in the production of other goods or services. The quality of a given commodity may

differ slightly, but it is essentially uniform across producers. When they are traded on

an exchange, commodities must also meet specified minimum standards, also known

as a basis grade.

7. Insurance: Investment Plans are financial products that provide the opportunity to

create wealth for future. Life Insurance products are often used as investment

instruments. These type of saving scheme or investments offer life coverage and returns

but differ in their construct.

Oakbrook Business School

Kotak Mahindra Bank

8. Real estate: Real estate investing involves the purchase, ownership, management,

rental and/or sale of real estate for profit. Improvement of realty property as part of a

real estate investment strategy is generally considered to be a sub-specialty of real estate

investing called real estate development.

9. Portfolio management service: Portfolio Management Services (PMS), service

offered by the Portfolio Manager, is an investment portfolio in stocks, fixed income,

debt, cash, structured products and other individual securities, managed by a

professional money manager that can potentially be tailored to meet specific investment

objectives.

10. National pension system: The National Pension Scheme allows online

investment. It is handled by the Pension Fund Regulatory and Development Authority

(PFRDA). The scheme was launched on 1st January, 2004 with a purpose of reforming

pension in India, it is the cheapest market-linked retirement plan available in India.

Oakbrook Business School

Kotak Mahindra Bank

6. RESEARCH OBJECTIVE

Oakbrook Business School

Kotak Mahindra Bank

Objective of the study

1. A study the investment behavior toward investment in Ahmedabad city.

2. A study perception of different age group toward investment.

3. To know the factors that are influencing investment behavior of the

people.

4. To analyzing the pattern of investment.

5. To know the mode of investment of the various investment.

Oakbrook Business School

Kotak Mahindra Bank

7.RESEARCH METHODOLOGY

Oakbrook Business School

Kotak Mahindra Bank

Research Methodology

Research Methodology is a way systematically to solve the research problem. It may be

understood as a science of studying how research is done scientifically. It is necessary for

the researcher to know not only the method or techniques but also methodology.

Research Method

Descriptive Method

Descriptive studies, primarily concerned with finding out “How is, where is and may also

give different preference according to demographic factor such as age, gender, annual

income, occupation.

Source of Data

Primary Data

Primary data has collected directly from customer through structured questionnaires.

Secondary Data

Secondary data has collected from the various magazines, journal, website of KOTAK

MAHINDRA BANK and various website.

Sampling Method

The population includes male and female customers residing in the area of Ahmedabad

with the criteria: Customers with Kotak Mahindra Bank. In this project convenience

sampling method is followed.

Sampling Size

My sample size was 100, who fulfill the basis criteria-Customers with Kotak Mahindra

Bank.

Sampling Unit

A sample unit is a single individual, who is having Kotak Mahindra Bank accounts.

Oakbrook Business School

Kotak Mahindra Bank

Sampling Technique

Convenience sampling method

Data Collection Method

Self-administered personal survey method used to collect necessary data, for this purpose

appropriate questionnaires were designed.

Structure of Questionnaires

The questions formulated were structured and non-disguised. The questions were asked in

order to get all the necessary information to see that the respondents could answer them

with case. This pattern adopted facilitated in analyzing the data

Oakbrook Business School

Kotak Mahindra Bank

8. DATA ANALYSIS

Oakbrook Business School

Kotak Mahindra Bank

Data analysis

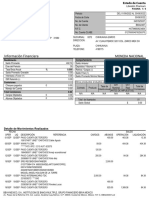

Gender

Gender Respondent Percentage

Male 67 67%

Female 33 33%

Total 100 100%

Gender

male

33%

female

67%

INTERPRETATION:

From the above chart 67% of the respondents are male, 33% of respondents of female. One of

the reasons could be that male are into commercial and business so the more know about the

investment.

Age

Age Responded Percentage

20-25 26 26%

25-30 22 22%

30-35 26 26%

Above 35 26 26%

Total 100 100%

Oakbrook Business School

Kotak Mahindra Bank

Oakbrook Business School

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Best Practices in Credit Union HistoryDocument23 pagesBest Practices in Credit Union HistoryNoobieman100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Training Facility Norms and Standard Equipment Lists: Volume 2---Mechatronics TechnologyFrom EverandTraining Facility Norms and Standard Equipment Lists: Volume 2---Mechatronics TechnologyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Bank of The Philippine Islands v. de Reny Fabric Industries, Inc., 35 SCRA 253Document2 pagesBank of The Philippine Islands v. de Reny Fabric Industries, Inc., 35 SCRA 253mylenesibalNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Technical and Vocational Education and Training in the Philippines in the Age of Industry 4.0From EverandTechnical and Vocational Education and Training in the Philippines in the Age of Industry 4.0No ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Curso Lash Lifting NovoDocument9 pagesCurso Lash Lifting NovoLarissa MarquesNo ratings yet

- The Offshore MoneyDocument339 pagesThe Offshore MoneyjohnNo ratings yet

- The Complete Project Management Exam Checklist: 500 Practical Questions & Answers for Exam Preparation and Professional Certification: 500 Practical Questions & Answers for Exam Preparation and Professional CertificationFrom EverandThe Complete Project Management Exam Checklist: 500 Practical Questions & Answers for Exam Preparation and Professional Certification: 500 Practical Questions & Answers for Exam Preparation and Professional CertificationNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- أسئلة وإجابات فى إدارة المشروعاتFrom Everandأسئلة وإجابات فى إدارة المشروعاتRating: 1.5 out of 5 stars1.5/5 (3)

- Technical Training Management: Commercial skills aligned to the provision of successful training outcomesFrom EverandTechnical Training Management: Commercial skills aligned to the provision of successful training outcomesNo ratings yet

- Workings of Debt Recovery TribunalsDocument25 pagesWorkings of Debt Recovery TribunalsSujal ShahNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Reaping the Benefits of Industry 4.0 Through Skills Development in the PhilippinesFrom EverandReaping the Benefits of Industry 4.0 Through Skills Development in the PhilippinesNo ratings yet

- Revista Mivivienda-9347Document36 pagesRevista Mivivienda-9347Luis Eduardo Yamunaque Gamboa100% (1)

- Practice Standard for Work Breakdown Structures - Third EditionFrom EverandPractice Standard for Work Breakdown Structures - Third EditionRating: 5 out of 5 stars5/5 (1)

- Clases Hacer Cuentas GratisDocument2 pagesClases Hacer Cuentas GratisDarío Recalde100% (2)

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- Enterprise Architect’s Handbook: A Blueprint to Design and Outperform Enterprise-level IT Strategy (English Edition)From EverandEnterprise Architect’s Handbook: A Blueprint to Design and Outperform Enterprise-level IT Strategy (English Edition)No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Comparativo Torre GruaDocument4 pagesComparativo Torre GruaJavier Elias Ortega GonzalezNo ratings yet

- Reaping the Benefits of Industry 4.0 Through Skills Development in IndonesiaFrom EverandReaping the Benefits of Industry 4.0 Through Skills Development in IndonesiaNo ratings yet

- Realizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentFrom EverandRealizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentNo ratings yet

- Redefining the Basics of Project Management: Filling the Practice Gaps by Integrating Pmbok® Guide with a Project Life Span Approach!From EverandRedefining the Basics of Project Management: Filling the Practice Gaps by Integrating Pmbok® Guide with a Project Life Span Approach!No ratings yet

- Working Capital Management and FinanceFrom EverandWorking Capital Management and FinanceRating: 3.5 out of 5 stars3.5/5 (8)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Bouquet of Business Case StudiesFrom EverandA Bouquet of Business Case StudiesRating: 3 out of 5 stars3/5 (1)

- Innovate Indonesia: Unlocking Growth Through Technological TransformationFrom EverandInnovate Indonesia: Unlocking Growth Through Technological TransformationNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)