Professional Documents

Culture Documents

Question On Shares

Question On Shares

Uploaded by

aarifah m0 ratings0% found this document useful (0 votes)

6 views1 pageTheta Company is authorized to issue 7,000 ordinary shares at $2.00 each, 1,200 preference shares at $6.00 each with a par value of $5.00, and 500 debentures with a par value of $100. On January 1, 2005, the company received offers for 6,000 ordinary shares, 1,000 preference shares, and 400 debentures.

Original Description:

Original Title

Question on Shares

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTheta Company is authorized to issue 7,000 ordinary shares at $2.00 each, 1,200 preference shares at $6.00 each with a par value of $5.00, and 500 debentures with a par value of $100. On January 1, 2005, the company received offers for 6,000 ordinary shares, 1,000 preference shares, and 400 debentures.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageQuestion On Shares

Question On Shares

Uploaded by

aarifah mTheta Company is authorized to issue 7,000 ordinary shares at $2.00 each, 1,200 preference shares at $6.00 each with a par value of $5.00, and 500 debentures with a par value of $100. On January 1, 2005, the company received offers for 6,000 ordinary shares, 1,000 preference shares, and 400 debentures.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

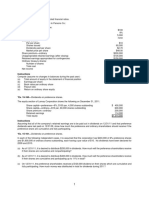

2. Theta Company is authorised to issue 7000 ordinary shares at $2.

00 each,

1200 (6%) $5.00 Preference Shares at an issue price of $6.00 each and 500,

$100 (5%) debentures. On January 1st, 2005, the firm received offers for 6000

ordinary shares and 1000 preference shares and 400 debentures.

Calculate:

1. What is the authorised capital of the company in terms of the number

and value of preference shares and ordinary shares?

Authorized Capital:

Preference Shares – 1200 @ 5.00 - $6000

Ordinary Shares - 7000 @ 2.00 - $14000

2. What is the issued capital of the company in terms of the value and

number of preference and ordinary shares?

Issued:

Ordinary Shares – 6000 @ 2.00 - $12000

Preference Shares – 1000 @ 6.00 - $6000

3. What is the par value of each

a. Ordinary shares $2.00

b. Preference shares $5.00

c. Debentures $100

4. What is the issue price of each – ordinary, preference and debentures?

Ordinary - $2.00

Preference - $6.00

Debentures - $100

5. What is the difference between the issue price and the par value called?

The difference in the preference share was $1.00 and this is called a

Premium.

6. What is the meaning of the 6% in reference to the preference shares?

The Rate of Dividend is 6% of $6.00

7. What is the meaning of the 5% in reference to the debentures?

The Rate of Interest – 5% of $100

You might also like

- SHE Answer KeyDocument29 pagesSHE Answer KeyTerence Jeff Tamondong100% (1)

- Chapter 8 and 10Document4 pagesChapter 8 and 10Glory CrespoNo ratings yet

- 3 and 4 Chapter Problem Solutions SpurgeDocument5 pages3 and 4 Chapter Problem Solutions SpurgeLeonid LeoNo ratings yet

- Tutorial 2Document6 pagesTutorial 2杰克 l孙No ratings yet

- Multiple Choice: - ComputationalDocument4 pagesMultiple Choice: - ComputationalCarlo ParasNo ratings yet

- Company AccountingDocument28 pagesCompany AccountingBeanka PaulNo ratings yet

- PR 5Document7 pagesPR 5vanessagreco17No ratings yet

- Midterm Sample Options and DerivativesDocument2 pagesMidterm Sample Options and DerivativeskevinNo ratings yet

- CF Tutorial 9 - SolutionsDocument9 pagesCF Tutorial 9 - SolutionschewNo ratings yet

- Soal Bab 15Document5 pagesSoal Bab 15suci monalia putriNo ratings yet

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDocument27 pagesChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationAlfi Wahyu TifaniNo ratings yet

- CAPE Recording Capital Stock & Reverses TransactionDocument49 pagesCAPE Recording Capital Stock & Reverses TransactionOckouri BarnesNo ratings yet

- MP Stocks 71-94Document5 pagesMP Stocks 71-94Rej PatnaanNo ratings yet

- Stockholders Equity Number of Preferred Shares Stockholders Equity Number OfcommonsharesDocument4 pagesStockholders Equity Number of Preferred Shares Stockholders Equity Number OfcommonsharesDanny ClintonNo ratings yet

- Chapter 13 14 Review QuestionsDocument6 pagesChapter 13 14 Review QuestionsHERSINo ratings yet

- Solutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 3Document2 pagesSolutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 3Rio Yow-yow Lansang CastroNo ratings yet

- Accounting, Unit 1 - Topic 2 (Students)Document64 pagesAccounting, Unit 1 - Topic 2 (Students)Teal Jacobs100% (1)

- Chapter 10 Subsidiary Preferred StockDocument15 pagesChapter 10 Subsidiary Preferred StockNicolas ErnestoNo ratings yet

- With Owners of The Business, Such As Share Issues and Dividends. The Statement Making The LinkDocument7 pagesWith Owners of The Business, Such As Share Issues and Dividends. The Statement Making The LinkHikmət RüstəmovNo ratings yet

- AK 2 - Exercise Session 5Document1 pageAK 2 - Exercise Session 5Reta AzkaNo ratings yet

- Chapter 18 Shareholders' Equity: Paid-In Capital Fundamental Share RightsDocument9 pagesChapter 18 Shareholders' Equity: Paid-In Capital Fundamental Share RightsSteeeeeeeephNo ratings yet

- Name: Theng Kimay Class: Year: T204Document4 pagesName: Theng Kimay Class: Year: T204ALex LimNo ratings yet

- Accounting For CorporaationsDocument19 pagesAccounting For CorporaationsShaheer KhurramNo ratings yet

- Assignment - Module 2 - Stock and Their Valuation - QuestionDocument4 pagesAssignment - Module 2 - Stock and Their Valuation - QuestionMary Justine PaquibotNo ratings yet

- Assignment - Module 2 - Stock and Their Valuation - QuestionDocument4 pagesAssignment - Module 2 - Stock and Their Valuation - QuestionMary Justine PaquibotNo ratings yet

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDocument27 pagesChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationSteven Andrian GunawanNo ratings yet

- Advanced Accounting 12th Edition Beams Test Bank 1Document31 pagesAdvanced Accounting 12th Edition Beams Test Bank 1leslieNo ratings yet

- Advanced Accounting 12Th Edition Beams Test Bank Full Chapter PDFDocument36 pagesAdvanced Accounting 12Th Edition Beams Test Bank Full Chapter PDFbetty.slaton822100% (16)

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- Stocks and BondsDocument39 pagesStocks and BondsMary Grace Manzano AdevaNo ratings yet

- Cruz Janna Kassandra Midterm Practice ProblemsDocument6 pagesCruz Janna Kassandra Midterm Practice ProblemsMiguel PultaNo ratings yet

- Exercises ValuationDocument3 pagesExercises ValuationQP1100 Nguyen Nhat MinhNo ratings yet

- Chapter 17 Corporate FinanceDocument27 pagesChapter 17 Corporate Financecherryl marianoNo ratings yet

- Af210 WeekDocument30 pagesAf210 WeekAvisha SinghNo ratings yet

- CAPM Problems Advanced, CAPM and DDMDocument2 pagesCAPM Problems Advanced, CAPM and DDMshivushiv8431No ratings yet

- Takehome Quiz On Book Value and EPSDocument2 pagesTakehome Quiz On Book Value and EPSLindsay MadeloNo ratings yet

- Dividends Vs BuybacksDocument2 pagesDividends Vs BuybacksJuhiNo ratings yet

- Target 3 Stock and DividendDocument5 pagesTarget 3 Stock and DividendAjeet YadavNo ratings yet

- Dividend Policy - Solutions To Selected ProblemsDocument6 pagesDividend Policy - Solutions To Selected ProblemsMarina AfrinNo ratings yet

- Fundamentals of Capital StructureDocument42 pagesFundamentals of Capital StructureSona Singh pgpmx 2017 batch-2No ratings yet

- Chapter 13Document11 pagesChapter 13Maya HamdyNo ratings yet

- Finance QuizDocument2 pagesFinance QuizSatyajitNo ratings yet

- FR Ias 32, Ifrs 9Document1 pageFR Ias 32, Ifrs 9Prachanda BhandariNo ratings yet

- LUBS5006M Seminar 4 Questions - TaggedDocument3 pagesLUBS5006M Seminar 4 Questions - Tagged737512lgNo ratings yet

- Managing Member - Tim Eriksen Eriksen Capital Management, LLC 567 Wildrose Cir., Lynden, WA 98264Document6 pagesManaging Member - Tim Eriksen Eriksen Capital Management, LLC 567 Wildrose Cir., Lynden, WA 98264Matt EbrahimiNo ratings yet

- DocxDocument28 pagesDocxSunil KumarNo ratings yet

- GS1129 SBS Tutorial 3 - Dividends and Shares 19 PDFDocument2 pagesGS1129 SBS Tutorial 3 - Dividends and Shares 19 PDFSetsuna TeruNo ratings yet

- Advanced Accounting 12th Edition Beams Test BankDocument14 pagesAdvanced Accounting 12th Edition Beams Test Bankpottpotlacew8mf1t100% (16)

- Financial StockDefinitionsAndStockTransactionsDocument2 pagesFinancial StockDefinitionsAndStockTransactionsShubham RankaNo ratings yet

- Compilation of ProblemsDocument9 pagesCompilation of ProblemsCorina Mamaradlo CaragayNo ratings yet

- Anggita Awidiya 041911333129 AKL 1 Pertemuan 13Document4 pagesAnggita Awidiya 041911333129 AKL 1 Pertemuan 13anggitaawidiyaNo ratings yet

- Beginning Investor Class 3 2010Document24 pagesBeginning Investor Class 3 2010tytnadNo ratings yet

- Exercise Problem 3 - Shareholder's EquityDocument5 pagesExercise Problem 3 - Shareholder's EquityLLYOD FRANCIS LAYLAYNo ratings yet

- Mid Term Mid Term: Applied Business Ethics (Mit Univerzitet) Applied Business Ethics (Mit Univerzitet)Document3 pagesMid Term Mid Term: Applied Business Ethics (Mit Univerzitet) Applied Business Ethics (Mit Univerzitet)dodoNo ratings yet

- BVPS For DiscussionDocument2 pagesBVPS For DiscussionSpongebob SquarepantsNo ratings yet

- Behavioral Finance IDocument50 pagesBehavioral Finance ICosta YtNo ratings yet

- Endowment Payout Process: Posted July 2013Document17 pagesEndowment Payout Process: Posted July 2013Andi Zamakhsyari BaharuddinNo ratings yet

- Dividend Investing with a Splash of Options Trading: Financial Freedom, #224From EverandDividend Investing with a Splash of Options Trading: Financial Freedom, #224No ratings yet

- The Petty Cash BookDocument3 pagesThe Petty Cash Bookaarifah mNo ratings yet

- Adobe Scan Mar 21, 2023Document2 pagesAdobe Scan Mar 21, 2023aarifah mNo ratings yet

- Qulck Ratio Eneassets-Stock: Example: Debtors $3 600X 1.35 Months $32 000Document3 pagesQulck Ratio Eneassets-Stock: Example: Debtors $3 600X 1.35 Months $32 000aarifah mNo ratings yet

- Absorption CostingDocument15 pagesAbsorption Costingaarifah mNo ratings yet