Professional Documents

Culture Documents

Tax Card 2012

Uploaded by

Ch Attique WainsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Card 2012

Uploaded by

Ch Attique WainsCopyright:

Available Formats

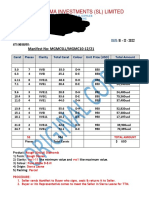

TAX RATES

TAX YEAR 2012

TAX RATES FOR NON-SALARIED INDIVIDUALS TAX ON RETAILERS

[Division I, Part I of the First Schedule]

1. Upto Rs. 350,000 0% Annual Turnover Income Tax

2. Rs. 350,001 to Rs. 500,000 7.50% RETAILER (Individual or AOP) Having annual turnover upto

1.00%

3. Rs. 500,001 to Rs. 750,000 10% Rs. 5 Million (u/s 113-A) Optional

4. Rs. 750,001 to Rs. 1,000,000 15% * RETAILER (Individual or AOP) Having annual Rs. 25,000 + 0.50% of

5. Rs. 1,000,001 to Rs. 1,500,000 20% turnover exceeding Rs. 5 Million but not exceeding turnover exceeding

Rs. 10 Million (u/s 113-B) Rs. 5 Million

6. Exceeding Rs. 1,500,001 25%

Rs. 50,000 + 0.75% of

* RETAILER (Individual or AOP) Having annual

TAX RATE FOR ASSOCIATION OF PERSONS turnover exceeding Rs. 10 Million (u/s 113-B)

turnover exceeding

Rs. 10 Million

[Division IB, Part I of the First Schedule]

The rate of tax imposed on the taxable Retailers u/s 113A & 113B can't claim adjustment of withholding tax

income of Association of Persons for the 25% * S. Tax payable under Chapter II of S. Tax Special Procedure Rules, 2007

tax year 2010 and onward

TAX RATES FOR SALARIED PERSONS * FINAL DISCHARGE OF TAX

[Division I, Part I of the First Schedule]

Sr. # Income Slab Tax Rate MTR (Optional) Nature of Payment Section Rate

1. Upto Rs. 350,000 0% 0% INCOME FROM PROPERTY 15(6) 5% to 10%

2. Rs. 350,001 to Rs. 400,000 1.50% 20% IMPORTS (Commercial) 148 5%

3. Rs. 400,001 to Rs. 450,000 2.50% 20% DIVIDEND (except Companies) 150 7.5% to 10%

4. Rs. 450,001 to Rs. 550,000 3.50% 20% PROFIT on Debt (except Companies) 151 10%

5. Rs. 550,001 to Rs. 650,000 4.50% 30% ROYALTY or Fee for Technical Services

152 (1) 15%

6. Rs. 650,001 to Rs. 750,000 6.00% 30% received by Non-Residents

7. Rs. 750,001 to Rs. 900,000 7.50% 30% SALE of Goods (except

153(1)(a) 3.50%

8. Rs. 900,001 to Rs. 1,050,000 9.00% 30% manufacturing company)

9. Rs. 1,050,001 to Rs. 1,200,000 10.00% 40% SALE of Rice, Cotton Seed & Edible

153(1)(a) 1.50%

10. Rs. 1,200,001 to Rs. 1,450,000 11.00% 40% Oils to prescribed persons

11. Rs. 1,450,001 to Rs. 1,700,000 12.50% 40% SUPPLIES to Zero-rated sectors

12. Rs. 1,700,001 to Rs. 1,950,000 14.00% 40% (Textile, Carpet, Leather, Footwear, 153(1)(a) 1%

13. Rs. 1,950,001 to Rs. 2,250,000 15.00% 40% Surgical & Sports)

14. Rs. 2,250,001 to Rs. 2,850,000 16.00% 50% CONTRACTS (except listed companies) 153(1)(c) 6%

15. Rs. 2,850,001 to Rs. 3,550,000 17.50% 50% SERVICES rendered to Exporter or Export

16. Rs. 3,550,001 to Rs. 4,550,000 18.50% 50% House of Stitching, Dyeing, Printing, 153(2) 0.50%

Embroidery, Washing, Sizing & Weaving

17. Exceeding Rs. 4,550,001 20.00% 60%

ADVERTISEMENT services to non-

153 A 10%

REBATE FOR TEACHERS & RESEARCHERS resident media person

[Clause (2) Part III of the Second Schedule] EXPORTS 154 1%

Reduction of 75% tax for full time Teacher or Researcher, employed in INDENTING COMMISSION 154(2) 5%

Recognized NPE or Research Institution including Govt. Training and research PRIZES & WINNINGS 156 10% to 20%

institutions. COMMISSION on Petroleum Products 156 A 10%

BROKERAGE AND COMMISSION 233(1) 10%

TAX RATES FOR COMPANIES GOODS Transport Vehicles 234 (1) Re. 1 / KG of Laden Weight

[Division II, Part I of the First Schedule] CNG Stations (on amount of Gas Bill) 234 A 4%

Type Tax Rates

PUBLIC / PRIVATE / BANKING Companies 35% * If tax deducted of individuals (covered under FTR) is Rs. 35,000/-

or more, filing of Wealth Statement & Reconciliation is compulsory

SMALL COMPANY 25% u/s 116(4).

MINIMUM TAX WEALTH STATEMENT AND RECONCILIATION U/S 116 (2)

Nature of Payment Section Rate Filing of Wealth Statement alongwith Reconciliation u/s 116(2) is

MINIMUM TURNOVER TAX for Companies compulsory for all individual (including salaried) taxpayers, where

113 1% of turnover

declared income is Rs. 1,000,000/- or more.

(except otherwise specified)

MINIMUM TURNOVER TAX for Ind. (having

annual turnover Rs. 50 M or more in 2009 or SENIOR CITIZEN ALLOWANCE

subsequent year) and AOPs (having annual 113 1% of turnover

turnover Rs. 50 M or more in 2007 or [Clause (1A) Part III of the Second Schedule]

subsequent year) Reduction @ 50% in tax having age of 60 years or above, where

Taxpayers engaged in the business of regular income is upto Rs. 1,000,000/- from all sources except

Distribution of Pharmaceutical, 113 0.2% of turnover income covered under FTR.

Fertilizers & Flour Milling

IMPORTS (edible oil and packing With Compliments from

148 (8) 5%

material)

SERVICES 153(1)(b) 6% FARHAN & ASSOCIATES

ADVOCATES, TAX & CORPORATE LAW CONSULTANTS

SERVICES to Zero-rated sectors (Textile,

153(1)(b) 1%

Carpet, Leather, Footwear, Surgical & Sports) FARHAN SHAHZAD - Advocate High Court

TRANSPORT SERVICES 153(1)(b) 2% B.Com, LL.B., CTC, DIPL, DTL, MABA(USA), MIBA(UK)

COMMISSION earned by member's Stock Joint Secretary Lahore Tax Bar Association 2008-2009

Exchange on Purchase / Sales / Trading of 233A (a),(b) & ('c) 0.01% Suite No. 1, First Floor Kashif Chambers,

Shares (Adjustable) 6-Lodge Road old Anarkali, Lahore.

ELECTRICITY Bill (Ind. & AOPs) 235 (4)(a) upto Bill Rs. 30,000 Ph: 042-37231310, 37113359 Fax: 042-37234404 Mob: 0300-9402599

* A word of caution: Due care and caution has been taken to print this paper and if any error, mistake or omission is found to have crept in, the information would be

gladly accepted and efforts would be made to remove the same in next time. For further detail please consult the relevant Law.

Legal Assistance for Income Tax / SalesTax / FED and Return's CD, feel free to Call or E-mail at lawhouse@live.com (Amendments upto 10-07-2011)

You might also like

- Tax Rates 2010Document1 pageTax Rates 2010Ch Attique WainsNo ratings yet

- Tax Rates 2009Document1 pageTax Rates 2009Ch Attique WainsNo ratings yet

- INCOME TAX RATESDocument1 pageINCOME TAX RATESMuhammad AdeelNo ratings yet

- Income Tax Rates and Deductions for Tax Year 2015Document3 pagesIncome Tax Rates and Deductions for Tax Year 2015Sardar Shahid KhanNo ratings yet

- SWHCC Tax Card - Ty 2019Document1 pageSWHCC Tax Card - Ty 2019Muhammad HaseebNo ratings yet

- Tax Rates For The Tax Year 2015Document1 pageTax Rates For The Tax Year 2015Ghulam HaiderNo ratings yet

- TaxRates2021 22Document2 pagesTaxRates2021 22Amir NazirNo ratings yet

- Tax Rates for the Tax Year 2018 in PakistanDocument1 pageTax Rates for the Tax Year 2018 in PakistanBADER MUNIRNo ratings yet

- Tax Card TY 2022Document8 pagesTax Card TY 2022princecharming14No ratings yet

- Tax Rates For The Tax Year 2016Document1 pageTax Rates For The Tax Year 2016Ghulam HaiderNo ratings yet

- Tax Rates 2009-10Document2 pagesTax Rates 2009-10Mansoor AhmadNo ratings yet

- Tax Card 2019Document1 pageTax Card 2019Waqas AtharNo ratings yet

- Tax Rates and Rules for Individuals, AOPs, Companies in PakistanDocument3 pagesTax Rates and Rules for Individuals, AOPs, Companies in PakistanThe MaximusNo ratings yet

- Minimum Tax Tax Rates For Aop & Business Individuals: Nature of Payment Section Rate (ATL)Document1 pageMinimum Tax Tax Rates For Aop & Business Individuals: Nature of Payment Section Rate (ATL)Anum TariqNo ratings yet

- Tax Rates for Individuals and Companies in Pakistan for Tax Year 2019Document1 pageTax Rates for Individuals and Companies in Pakistan for Tax Year 2019Mubashir RiazNo ratings yet

- Tax Rates - For The Tax Year - 2019Document5 pagesTax Rates - For The Tax Year - 2019nomanjavid88No ratings yet

- Tax Card Global Tax Consultants Tax Year 2019Document3 pagesTax Card Global Tax Consultants Tax Year 2019AqeelAhmadNo ratings yet

- Tax Card TY 2020Document1 pageTax Card TY 2020princecharming14No ratings yet

- Tax Rates Year 2024Document7 pagesTax Rates Year 2024hamidullah415161No ratings yet

- ZJC Tax Rates Tables - Tax Year 2023Document11 pagesZJC Tax Rates Tables - Tax Year 2023Mux ConsultantNo ratings yet

- Tax Rates For Tax Year 2020Document5 pagesTax Rates For Tax Year 2020Ghulam MuhiuddinNo ratings yet

- 2019 Tax Card PakistanDocument9 pages2019 Tax Card PakistanRaja Hamza rasgNo ratings yet

- Investment Declaration Guidelines SummaryDocument1 pageInvestment Declaration Guidelines SummarySunny KhavleNo ratings yet

- TAX RATES FOR 2020Document2 pagesTAX RATES FOR 2020ZeeshanNo ratings yet

- Tax Calculator (Salaried Person) : Monthly SalaryDocument5 pagesTax Calculator (Salaried Person) : Monthly SalarySheeraz Ahmed MemonNo ratings yet

- Income Tax WHT Rates Card 2016-17Document8 pagesIncome Tax WHT Rates Card 2016-17Sami SattiNo ratings yet

- Unit 2 - Scope of Income and Residential Status, Rebate and ReliefDocument25 pagesUnit 2 - Scope of Income and Residential Status, Rebate and ReliefKhushi ThakurNo ratings yet

- WHT Rate Card 2018-19Document2 pagesWHT Rate Card 2018-19taqi1122No ratings yet

- Tax Rate Card For Tax Year 2023 24Document10 pagesTax Rate Card For Tax Year 2023 24srismailNo ratings yet

- Tax Card 2024 (Updated)Document2 pagesTax Card 2024 (Updated)Mansoor AhmadNo ratings yet

- Individual & Corporate Tax Rates in PakistanDocument2 pagesIndividual & Corporate Tax Rates in PakistanFrantsForum DiscussionNo ratings yet

- Set up car showroom business planDocument14 pagesSet up car showroom business planshrish guptaNo ratings yet

- ACCA F6 Taxation Solved Past PapersDocument235 pagesACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- RLA Rate Card 2020 2021Document13 pagesRLA Rate Card 2020 2021Muhammad EjazNo ratings yet

- Rates of Income TaxDocument9 pagesRates of Income TaxAiza KhanNo ratings yet

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- India Budget Highlights Finance Bill, 2021Document861 pagesIndia Budget Highlights Finance Bill, 2021vaishnavi aNo ratings yet

- Tax Rates CompilationDocument1 pageTax Rates Compilationarunvaleraphotos2023No ratings yet

- Tax Tables Starting 2021 - 2022Document3 pagesTax Tables Starting 2021 - 2022Onalenna MdongoNo ratings yet

- EXEMPTIONDocument12 pagesEXEMPTIONprsrivastavNo ratings yet

- HAMEED ASSOCIATES TAX CARD 2019Document1 pageHAMEED ASSOCIATES TAX CARD 2019zohaib shahNo ratings yet

- Taxation Paper F6 (PKNDocument13 pagesTaxation Paper F6 (PKNMashhood AhmedNo ratings yet

- Tax Rates For Individuals: Fast Moving Consumer GoodsDocument1 pageTax Rates For Individuals: Fast Moving Consumer GoodsHakim JanNo ratings yet

- Chapter-1 Basic Concepts PDFDocument11 pagesChapter-1 Basic Concepts PDFBrinda RNo ratings yet

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- Taxation (CHN) - Dec 2020 FinalDocument3 pagesTaxation (CHN) - Dec 2020 FinalALEX TRANNo ratings yet

- Leverages and Profits Analysis for Various CompaniesDocument7 pagesLeverages and Profits Analysis for Various CompaniesVaishnavi ShigvanNo ratings yet

- 21-Spring 2019 - FA - SA - Sp-19Document8 pages21-Spring 2019 - FA - SA - Sp-19Muhammad KashifNo ratings yet

- aditya_labDocument62 pagesaditya_labasthapatel.akpNo ratings yet

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNo ratings yet

- F6 (CHN) Taxation PaperDocument11 pagesF6 (CHN) Taxation PaperALEX TRANNo ratings yet

- Leverage - Financial ManagementDocument7 pagesLeverage - Financial Managementyogeshjhanwar402No ratings yet

- CS Professional DT Revision For Dec 19Document117 pagesCS Professional DT Revision For Dec 19Vineela Srinidhi DantuNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- LEVERAGE - hons.Document7 pagesLEVERAGE - hons.BISHAL ROYNo ratings yet

- Taxation AmendmentsDocument33 pagesTaxation AmendmentscawinnersofficialNo ratings yet

- Donors TaxDocument16 pagesDonors TaxNikkolae LibreaNo ratings yet

- Understanding Key Provisions of NI Act and Dishonour of ChequesDocument134 pagesUnderstanding Key Provisions of NI Act and Dishonour of ChequesAnurag Sawal50% (2)

- Cash & Cash EquivalentsDocument4 pagesCash & Cash Equivalentsralphalonzo100% (5)

- Manifest 232Document2 pagesManifest 232Elev8ted MindNo ratings yet

- Fish Farming Project Proposal in PNGDocument1 pageFish Farming Project Proposal in PNGWillie PayneNo ratings yet

- First InvestmentsDocument4 pagesFirst InvestmentsNitin Kumar0% (1)

- Advantages and Disadvantages of GSTDocument5 pagesAdvantages and Disadvantages of GSTKshitiz TiwariNo ratings yet

- Chi 1Document2 pagesChi 1Syam JamiNo ratings yet

- Calculate Payroll for Mohammed AgencyDocument8 pagesCalculate Payroll for Mohammed AgencyIsrael KifleNo ratings yet

- US Internal Revenue Service: f1040sh - 2005Document2 pagesUS Internal Revenue Service: f1040sh - 2005IRSNo ratings yet

- BOP Credit Card Sales Training Tool Kit (7 Files Merged)Document115 pagesBOP Credit Card Sales Training Tool Kit (7 Files Merged)Shivam KumarNo ratings yet

- Loh Kien SingDocument1 pageLoh Kien SingtotokNo ratings yet

- Pre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimDocument11 pagesPre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimMark MagnoNo ratings yet

- Gavarra-Marie Joy-Bsais-2b-Problem3-No.3Document2 pagesGavarra-Marie Joy-Bsais-2b-Problem3-No.3Nikki Jean Hona50% (2)

- NFJPIA Online Preboard Exam Tax UnformattedDocument22 pagesNFJPIA Online Preboard Exam Tax UnformattedYietNo ratings yet

- Invoice Jail Adhikshak 23.06.2021Document1 pageInvoice Jail Adhikshak 23.06.2021vishaljames PadharNo ratings yet

- Annual Bank Statement SummaryDocument11 pagesAnnual Bank Statement SummaryMichaelNo ratings yet

- 48Document2 pages48Vladimir KrylosovNo ratings yet

- Getting Paid MathDocument3 pagesGetting Paid MathDawson BanksNo ratings yet

- EA-Part - 3Document106 pagesEA-Part - 3aman9936543060No ratings yet

- Education Loan Benefits and RisksDocument3 pagesEducation Loan Benefits and Risksbbanik82No ratings yet

- PayPal - Asia - Research - Report - Digital - Payments - Thinking Beyond TransactionsDocument22 pagesPayPal - Asia - Research - Report - Digital - Payments - Thinking Beyond TransactionsClara LilaNo ratings yet

- Midterm Taxation ExamDocument37 pagesMidterm Taxation ExamANDREA LOIS OTEYZA75% (4)

- Account StatementDocument5 pagesAccount StatementchipfupatsholofeloNo ratings yet

- 9.3M DB - CresDocument2 pages9.3M DB - Cresruby caldeNo ratings yet

- CTG List of Supplied Material & Summary of Payment at Lumina, Camella Pag & Oza City 2021Document38 pagesCTG List of Supplied Material & Summary of Payment at Lumina, Camella Pag & Oza City 2021Rabbie LeguizNo ratings yet

- Assignment 4 - Credit Card Reconciliation - Angela CreagmileDocument6 pagesAssignment 4 - Credit Card Reconciliation - Angela Creagmileapi-471231467100% (1)

- Hotel Saibaba Deluxe: Opp Bus Stand, COIMBATOREDocument5 pagesHotel Saibaba Deluxe: Opp Bus Stand, COIMBATOREteenu joseNo ratings yet

- CIR V Fitness by DesignDocument3 pagesCIR V Fitness by Designsmtm06100% (3)

- Muhammad Nizamuddin Bin Nor Napis NO 5490 MUKIM 16 Jalan Gajah Mati Machang Bubuk 14020 Bukit Mertajam Pulau Pinang MalaysiaDocument7 pagesMuhammad Nizamuddin Bin Nor Napis NO 5490 MUKIM 16 Jalan Gajah Mati Machang Bubuk 14020 Bukit Mertajam Pulau Pinang MalaysiaZamNo ratings yet