Professional Documents

Culture Documents

Project Work Accountancy 47

Uploaded by

Nikunj0 ratings0% found this document useful (0 votes)

14 views1 pagefdsfdsf

Original Title

437570166 Project Work Accountancy 47

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfdsfdsf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageProject Work Accountancy 47

Uploaded by

Nikunjfdsfdsf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

Aud Bu

Particulars

x x

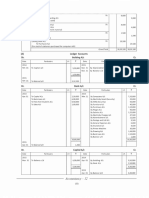

Net Profit before Interest and Tax 530,000 6,00,000

i) nol = Net Prof before interest and Tar. 499 20.000. a £00,000. 00 «:

: Capital Employed 25,00,000 "10° 30,00,000 * 100 = 20%

Net Profi after tax 265,000 300,000

(i) Net Profit Ratio = Net Profit afer 2, 199 285.000. 100 = 10% 0.000 00

Fevenve from Operations 36,50,000 35,06,000 * 100° 10.3%

B Limited is earning better profit margin yet the return on capital employed of A Ltd. is better. It is making better

and efficient use of its financial resources.

Net credit revenue from operations

‘Average trade receivables

_ __Number of days na year

Trade Receivables Turnover Ratio

|. Trade Receivables Turnover Ratio

Debt Collection Period (in days)

Xia. Yuta.

Trade Receivables, = ___#7,00,000 ___ %7,00,000 €10,00,000 ___ @ 10,00,000

Turnover Ratio ©, 20,000 + & 80,000 - %1,00,000 | ®2,80,000 + € 1,20,000 ¥ 2,00,000

2 2

Times Times

Debt Collection Period (in | 365 days. 365 days

aa = 2 82¥8. = 52 days (approx) SEAS 73 days

‘After analysing the above ratios, it is clear that debt collection department of X Ltd. is not working efficiently as

compared Y Ltd. Itis evident from the data given below :

Particular xual vied

z z

Days Granted as 30

‘Actual Days for Collection 52 2B

Delayed Collection Tay =

Days Saved 2 Tas

Accountane)

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Project Work Accountancy 8Document1 pageProject Work Accountancy 8NikunjNo ratings yet

- Project Work Accountancy 52Document1 pageProject Work Accountancy 52NikunjNo ratings yet

- Project Work Accountancy 25Document1 pageProject Work Accountancy 25NikunjNo ratings yet

- Project Work Accountancy 22Document1 pageProject Work Accountancy 22NikunjNo ratings yet

- Project Work Accountancy 51Document1 pageProject Work Accountancy 51NikunjNo ratings yet

- Project Work Accountancy 7Document1 pageProject Work Accountancy 7NikunjNo ratings yet

- Project Work Accountancy 24Document1 pageProject Work Accountancy 24NikunjNo ratings yet

- Project Work Accountancy 53Document1 pageProject Work Accountancy 53NikunjNo ratings yet

- Project Work Accountancy 6Document1 pageProject Work Accountancy 6NikunjNo ratings yet

- Project Work Accountancy 2Document1 pageProject Work Accountancy 2NikunjNo ratings yet

- Annual Report of IOCL 69Document1 pageAnnual Report of IOCL 69NikunjNo ratings yet

- Project Work Accountancy 37Document1 pageProject Work Accountancy 37NikunjNo ratings yet

- Project Work Accountancy 46Document1 pageProject Work Accountancy 46NikunjNo ratings yet

- Rich Dad Poor Dad 188Document1 pageRich Dad Poor Dad 188NikunjNo ratings yet

- Rich Dad Poor Dad 186Document1 pageRich Dad Poor Dad 186NikunjNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)