Professional Documents

Culture Documents

Vinzons

Uploaded by

DarkknightOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vinzons

Uploaded by

DarkknightCopyright:

Available Formats

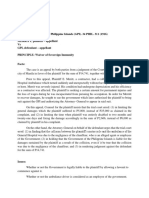

Vinzons-Chato v Fortune Tobacco, 525 SCRA 11

GR No. 141309 June 19, 2007

Ynares-Santiago, J

SUMMARY:

CIR issued RMC 37-93 which effectively reclassified Fortune’s products from 20-45% ad valorem tax

to 55%. CTA declared the issuance defective. Fortune filed with the RTC complaint for damages

against Vinzons-Chato in her private capacity. Chato filed a motion to dismiss. On motion to dismiss,

RTC denied. CA affirmed, SC held that Vinzons Chato liable under Art 32 and no need to prove bad

faith to be liable. Petition denied

However, in the 2008 MR decision, the SC reversed their decision. SC held that petitioner should not

be held liable. For a public officer with a duty owing to the public, officer can only be liable IF

when the complaining individual suffers a particular or special injury on account of the public

officer’s improper performance or non-performance of his public duty. He must show a wrong

which he specially suffers, and damage alone does not constitute a wrong. Petition granted

DOCTRINE:

*see article 32 and sec 38 and 39 at the end part

Article 32 is that the wrong may be civil or criminal. It is not necessary therefore that there

should be malice or bad faith.

When what is involved is a duty owing to the public in general, an individual cannot have a cause

of action for damages against the public officer, even though he may have been injured by the

action or inaction of the officer. Exception to this rule occurs when the complaining individual

suffers a particular or special injury on account of the public officers improper performance or

non-performance of his public duty. He must show a wrong which he specially suffers, and

damage alone does not constitute a wrong

You might also like

- Merritt V Government of The Philippine IslandsDocument2 pagesMerritt V Government of The Philippine IslandsAngelie FloresNo ratings yet

- Torts First DigestDocument16 pagesTorts First Digestricalicious0928No ratings yet

- Actual or Compensatory DamagesDocument28 pagesActual or Compensatory DamagesQuinciano Morillo100% (1)

- Torts FINALS ReviewerDocument37 pagesTorts FINALS ReviewerNea Cecille Valladarez QuiachonNo ratings yet

- Fulfillment of DutyDocument4 pagesFulfillment of DutyShan Khing100% (1)

- LAW OF TORTS Detinations - SEM-1 PDFDocument52 pagesLAW OF TORTS Detinations - SEM-1 PDFSwastik GroverNo ratings yet

- Merritt Vs Government of The Philippine Islands 2Document2 pagesMerritt Vs Government of The Philippine Islands 2RR FNo ratings yet

- Vinzons-Chato v. FortuneDocument8 pagesVinzons-Chato v. FortuneJude Raphael S. FanilaNo ratings yet

- Liwayway v. FortuneDocument2 pagesLiwayway v. FortuneAaron AristonNo ratings yet

- Vinzons Chato Vs Fortune Tobacco PDFDocument21 pagesVinzons Chato Vs Fortune Tobacco PDFpa0l0sNo ratings yet

- 102 Vinzons-Chato V Fortune Corp (Reso)Document3 pages102 Vinzons-Chato V Fortune Corp (Reso)Darrell MagsambolNo ratings yet

- Meritt Vs Government of P.IDocument3 pagesMeritt Vs Government of P.IDan Anthony BarrigaNo ratings yet

- Chato 2007Document6 pagesChato 2007AyenGaileNo ratings yet

- 2 Tayaban Vs PeopleDocument3 pages2 Tayaban Vs PeopleRomeo Boy-ag Jr.100% (1)

- 59.0 Liwayway Vs FortuneDocument2 pages59.0 Liwayway Vs FortunesarmientoelizabethNo ratings yet

- Chato vs. Fortune TobbacoDocument2 pagesChato vs. Fortune TobbacoXyy CariagaNo ratings yet

- Liwayway Vinzons-Chatto vs. Fortune TobaccoDocument2 pagesLiwayway Vinzons-Chatto vs. Fortune TobaccoJerico GodoyNo ratings yet

- Cases Doctrines On Torts and Damages CivDocument22 pagesCases Doctrines On Torts and Damages Civsulpecio virtudazoNo ratings yet

- TORTS AND DAMAGES - Gianna - Ranx.tina - Gi.sam - Katz.alex - Emjo.didy - FINALS REVIEWER - CASIS 1Document102 pagesTORTS AND DAMAGES - Gianna - Ranx.tina - Gi.sam - Katz.alex - Emjo.didy - FINALS REVIEWER - CASIS 1Jamie Del Castillo100% (1)

- Cases Torts 7-29-17 DigestDocument1 pageCases Torts 7-29-17 Digestczabina fatima delicaNo ratings yet

- Torts Notes CompilationDocument91 pagesTorts Notes Compilationautumn moonNo ratings yet

- 8 - MMTC v. CADocument2 pages8 - MMTC v. CAJm SantosNo ratings yet

- Torts and Damages Case DigestsDocument17 pagesTorts and Damages Case DigestsMaricar MendozaNo ratings yet

- PhilTranco Service Enterprises, Inc. v. Court of AppealsDocument2 pagesPhilTranco Service Enterprises, Inc. v. Court of AppealsNoreenesse SantosNo ratings yet

- Chato Vs Fortune Tobacco Corporation 2007Document1 pageChato Vs Fortune Tobacco Corporation 2007Ayidar Luratsi NassahNo ratings yet

- Vinzons-Chato vs. Fortune Tobacco CorporationDocument2 pagesVinzons-Chato vs. Fortune Tobacco CorporationGia RemoNo ratings yet

- Consunji vs. Court of AppealsDocument2 pagesConsunji vs. Court of AppealsPinky SalvadorNo ratings yet

- Vinzons Vs Fortune DigestDocument2 pagesVinzons Vs Fortune Digestangelsu04No ratings yet

- 6 - Vinzons-Chato V FortuneDocument1 page6 - Vinzons-Chato V FortuneiamtikalonNo ratings yet

- Arturo A. Mejorada The Honorable Sandiganbayan and The People of The PhilippinesDocument1 pageArturo A. Mejorada The Honorable Sandiganbayan and The People of The PhilippinesdoraemoanNo ratings yet

- 16 Liwayway Vinzons-Chato Vs Fortune Tobacco Corp GR No. 141309 June 19, 2007Document2 pages16 Liwayway Vinzons-Chato Vs Fortune Tobacco Corp GR No. 141309 June 19, 2007Patrick Dag-um MacalolotNo ratings yet

- 02 Vinzons-Chato vs. Fortune DigestDocument5 pages02 Vinzons-Chato vs. Fortune DigestKath100% (2)

- Cariaga V LTBCo. & MRR, 110 Phil 346 (DIGEST) - KRVDocument3 pagesCariaga V LTBCo. & MRR, 110 Phil 346 (DIGEST) - KRVKhenlie VillaceranNo ratings yet

- Tax Cases 2 DigestDocument12 pagesTax Cases 2 DigestGe MendozaNo ratings yet

- Catuiza V PeopleDocument1 pageCatuiza V PeopleEmilio PahinaNo ratings yet

- Sanchez V Medicard Philippines Inc DigestDocument3 pagesSanchez V Medicard Philippines Inc DigestMarkB15No ratings yet

- Vinzons - Chato V FortuneDocument3 pagesVinzons - Chato V FortunePhilip Leonard VistalNo ratings yet

- K. Liability: vs. Fortune Tobacco Corporation, G.R. No. 141309, June 19, 2007)Document5 pagesK. Liability: vs. Fortune Tobacco Corporation, G.R. No. 141309, June 19, 2007)sujeeNo ratings yet

- Major PurposesDocument13 pagesMajor Purposeshoward almunidNo ratings yet

- 298-Chato v. Fortune Tobacco Corp. G.R. No. 141309 December 23, 2008Document8 pages298-Chato v. Fortune Tobacco Corp. G.R. No. 141309 December 23, 2008Jopan SJNo ratings yet

- CASE 23 - Merritt Vs GPIDocument2 pagesCASE 23 - Merritt Vs GPIAquiline ReedNo ratings yet

- Specific Law Prevails Over General LawDocument34 pagesSpecific Law Prevails Over General LawmjNo ratings yet

- Chato v. Fortune Tobacco Gen Special StatuteDocument14 pagesChato v. Fortune Tobacco Gen Special StatutebrownboomerangNo ratings yet

- LGC Midterm 1Document23 pagesLGC Midterm 1Anne Nicole MacalinoNo ratings yet

- Chato vs. Fortune CLRDocument9 pagesChato vs. Fortune CLRGilbert YapNo ratings yet

- Law of Torts 2020Document85 pagesLaw of Torts 2020Maania AkhtarNo ratings yet

- It Seems That in Effect Both RTC and Ca Ruled in Favor of Fortunetobacco and Held Vinzons-Chato Liable For Damages Under Art. 3 2 O F N C C)Document13 pagesIt Seems That in Effect Both RTC and Ca Ruled in Favor of Fortunetobacco and Held Vinzons-Chato Liable For Damages Under Art. 3 2 O F N C C)AyenGaileNo ratings yet

- Petitioner Filed A Motion To Dismiss12 Contending That: (1) Respondent Has No Cause of Action Against Her BecauseDocument37 pagesPetitioner Filed A Motion To Dismiss12 Contending That: (1) Respondent Has No Cause of Action Against Her BecauseMarga CastilloNo ratings yet

- GuideDocument34 pagesGuideailynvdsNo ratings yet

- Respondent Consequently Moved For The Reconsideration of This ResolutionDocument11 pagesRespondent Consequently Moved For The Reconsideration of This ResolutiongilbertmalcolmNo ratings yet

- CHATO Vs Fortune 2008Document6 pagesCHATO Vs Fortune 2008marwantahsinNo ratings yet

- Merritt Vs Government of The Philippine Islands, G.R. No. L-11154, March 21 1916, 34 Phil. 311Document23 pagesMerritt Vs Government of The Philippine Islands, G.R. No. L-11154, March 21 1916, 34 Phil. 311Xara Paulette Delos ReyesNo ratings yet

- Loyalty, and Efficiency, Act With Patriotism and Justice, and Lead Modest LivesDocument11 pagesLoyalty, and Efficiency, Act With Patriotism and Justice, and Lead Modest LivesJenova JirehNo ratings yet

- 2007 Vinzons Chato - v. - Fortune - Tobacco - Corp.20210505 11 HgzudmDocument11 pages2007 Vinzons Chato - v. - Fortune - Tobacco - Corp.20210505 11 HgzudmDenise BandiolaNo ratings yet

- Case Digest Compendium: Saturday, January 27, 2007Document14 pagesCase Digest Compendium: Saturday, January 27, 2007Mandy CayangaoNo ratings yet

- Second Batch of CasesDocument32 pagesSecond Batch of CasesMarlon BaltarNo ratings yet

- For Corporate Torts Unless TheDocument3 pagesFor Corporate Torts Unless TheJSNo ratings yet

- Case Digest Torts and DamagesDocument10 pagesCase Digest Torts and Damagesfinserglen choclit lopezNo ratings yet

- Petitioner Vs Vs Respondent: Third DivisionDocument10 pagesPetitioner Vs Vs Respondent: Third DivisionKyle AgustinNo ratings yet

- Section 2Document1 pageSection 2DarkknightNo ratings yet

- The Conference of The Parties To The ConventionDocument3 pagesThe Conference of The Parties To The ConventionDarkknightNo ratings yet

- Reform v. Carriedo AgraaDocument8 pagesReform v. Carriedo AgraaDarkknightNo ratings yet

- The Conference of The Parties To The ConventionDocument2 pagesThe Conference of The Parties To The ConventionDarkknightNo ratings yet

- Advocate For Human Rights, Human Rights Basics (June 20,2021, 10:00 PM)Document2 pagesAdvocate For Human Rights, Human Rights Basics (June 20,2021, 10:00 PM)DarkknightNo ratings yet

- Issue: Whether or Not There Was GraveDocument1 pageIssue: Whether or Not There Was GraveDarkknightNo ratings yet

- Capalla vs. Comelec, GR No. 201112, June 13, 2012Document1 pageCapalla vs. Comelec, GR No. 201112, June 13, 2012DarkknightNo ratings yet

- Facto Resigned Therefrom, Upon The Filing of Their Respective Certificates ofDocument1 pageFacto Resigned Therefrom, Upon The Filing of Their Respective Certificates ofDarkknightNo ratings yet

- Pollo vs. Constantino-David (2011) FactsDocument2 pagesPollo vs. Constantino-David (2011) FactsDarkknightNo ratings yet