Professional Documents

Culture Documents

Simple and Compound Interest

Uploaded by

Ian Ray MondidoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simple and Compound Interest

Uploaded by

Ian Ray MondidoCopyright:

Available Formats

HANDOUTS IN GENERAL MATHEMATICS

(Simple and Compound Interest)

Important Terminologies:

• Lender or creditor – person (or institution) who invests the money or makes the funds available.

• Borrower or debtor – person (or institution) who owes the money or avails of the funds from the lender.

• Origin or loan date – date on which the money is received by the borrower.

• Repayment date or maturity date – date on which the money borrowed or loan is to be completely repaid.

• Time or term (t) – amount of time the money is borrowed or invested; length of time between the origin and

maturity dates.

• Principal (P) – amount of money borrowed or invested on the origin date.

• Rate (r) – annual rate, usually in percent, charged by the lender, or rate of increase of the investment.

• Interest (I) – amount paid or earned for the use of money.

• Simple Interest (Is) – interest that is computed on the principal and then added to it.

• Compound Interest (Ic) – interest computed on the principal and also on the accumulated past interest.

• Maturity value or future value (F) – amount after t years; balance at the end of t years; amount received by the

lender from the borrower on the maturity date.

Example 1: Suppose you won ₱100,000 in raffle draw and you plan to invest it in 5 years. A cooperative group in your

community offers you 3% simple interest rate annually. At the same time, the bank offers 3% compounded annually.

Compare the gain of the two investments and decide what offer you will accept and why.

Example 2: Using the data in example 1, what is the trend or behavior of the maturity value of each interest after 5

years (refer to the graph)?

Solution:

The figure shows that the trend of simple interest

is an increasing straight line and increasing curve

line for the compound interest.

Note: Lines and curves are graphs that can be

expressed in function or equation form.

To compute the simple and compound interest, remember the following formula:

I = Prt F=P+I I=F–P F = P (1 + rt) F = P ( 1+r )t

( )

F ln F−ln P F t

1

P= t= r= −1

( 1+ r )t ln(1+r ) P

where:

P = principal or present value

F = maturity (future) value at the end of the term

l = simple interest

r = interest rate

t = number of time periods elapsed

Lets Do This: Fill up the missing box to complete the table below.

1. Simple Interest

Principal Rate Time Interest Final Amount

100 10% Semi-annually

15% Annually 30

300 Quarterly 15

2. Compound Interest

Principal Rate Time Interest Final Amount

100 1 110

200 15% 265

300 20% 3

25% 4 977

3. You deposit ₱50,000 in a savings account that earns 5% interest per year.

a. Copy and complete the first table that shows the balance after 10 years with simple interest.

b. Copy and complete the second table that shows the balance after 10 years with compound interest.

c. Which type of interest gives the greater balance?

You might also like

- Deed of Trust ActDocument6 pagesDeed of Trust ActVincent J. CataldiNo ratings yet

- Simple and Compound InterestDocument26 pagesSimple and Compound InterestCarlos Cary Colon100% (7)

- Your Statement: Ultimate Awards Credit CardDocument3 pagesYour Statement: Ultimate Awards Credit CardDamien Smith100% (2)

- Q2 Gen. Math Simple and Compound InterestsDocument29 pagesQ2 Gen. Math Simple and Compound InterestsAbbygail MatrizNo ratings yet

- Business MathDocument33 pagesBusiness MathAirene CastañosNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- General Math Quarter 2 Simple and Compound Interest Updated 111922Document71 pagesGeneral Math Quarter 2 Simple and Compound Interest Updated 111922Ain lorraine BacaniNo ratings yet

- Gen Math Simple and Compound InterestDocument51 pagesGen Math Simple and Compound InterestMary Grace TolentinoNo ratings yet

- Solution. Investment 1: Simple Interest, With Annual Rate RDocument11 pagesSolution. Investment 1: Simple Interest, With Annual Rate RLucky Gemina67% (3)

- Simple Interest StudentsDocument9 pagesSimple Interest Studentsjudy bernusNo ratings yet

- Bank StatementDocument7 pagesBank Statementrajprince26460No ratings yet

- ADP Earnings StatementDocument1 pageADP Earnings StatementNikhil Almeida50% (4)

- 1 Time Value of MoneyDocument85 pages1 Time Value of MoneySeth D'MelloNo ratings yet

- Module 1wk1 To 2final Term in General Math 2021 2022 PDFDocument15 pagesModule 1wk1 To 2final Term in General Math 2021 2022 PDFateyakayeeNo ratings yet

- Module in Monetary Policy and Central BankingDocument62 pagesModule in Monetary Policy and Central BankingNICOLE DANIELLE BANILANo ratings yet

- CFPB Loan EstimateDocument3 pagesCFPB Loan EstimateRichard VetsteinNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- Unsur Ekorek N CashflowDocument21 pagesUnsur Ekorek N CashflowAlfina RohmaniahNo ratings yet

- Chapter 1 StudentDocument24 pagesChapter 1 Studentmaha aleneziNo ratings yet

- Engg EconDocument6 pagesEngg EconSean Earl NapeNo ratings yet

- Aqua Marketing PlanDocument15 pagesAqua Marketing PlanSHEENA MAY LOPEZ ACUñANo ratings yet

- Compoun Interest LessonDocument6 pagesCompoun Interest Lessonsonamaegarcia23No ratings yet

- GM - Compound InterestDocument12 pagesGM - Compound InterestJohn Joseph FernandoNo ratings yet

- Simple and Compound InterestDocument43 pagesSimple and Compound InterestAnne BergoniaNo ratings yet

- FYI: For Your Interest!Document8 pagesFYI: For Your Interest!Aguila AlvinNo ratings yet

- (18ME51) - Module-3 Inerest FactorsDocument50 pages(18ME51) - Module-3 Inerest FactorsLightNo ratings yet

- Engineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دDocument45 pagesEngineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دRommelBaldagoNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of Moneytrần thị ngọc trâmNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of Moneygar fieldNo ratings yet

- CH 1 and 2Document112 pagesCH 1 and 2DanialNo ratings yet

- Ee SLD Chap 3 4Document39 pagesEe SLD Chap 3 4Khánh ngân Lê vũNo ratings yet

- Bus Math Grade 11 Q2 M2 W1Document7 pagesBus Math Grade 11 Q2 M2 W1Ronald AlmagroNo ratings yet

- Time Value of MoneyDocument47 pagesTime Value of MoneyCyrus ArmamentoNo ratings yet

- Cashflow GradientDocument45 pagesCashflow GradientMauren CruzNo ratings yet

- Compound InterestDocument33 pagesCompound InterestENGLAND DE ASIS ESCLAMADONo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- Lec 8Document3 pagesLec 8Ahmed ShabanNo ratings yet

- Simple and Compound InterestDocument46 pagesSimple and Compound InterestAndres MabiniNo ratings yet

- Eng. Econ Chapter 2 InterestDocument25 pagesEng. Econ Chapter 2 InterestNancy CuevasNo ratings yet

- PDF-Chapter 4 The Time Value of MoneyDocument36 pagesPDF-Chapter 4 The Time Value of MoneyMinh AnhNo ratings yet

- Simple InterestDocument37 pagesSimple InterestIAN TUBALENo ratings yet

- Genmath Las Week1-2Document13 pagesGenmath Las Week1-2Aguila AlvinNo ratings yet

- Gen Math FinalsDocument48 pagesGen Math Finalsjohn christian de leonNo ratings yet

- REVIEWER For PRE-FINALSDocument5 pagesREVIEWER For PRE-FINALSBeaNo ratings yet

- MODULE 1 Math 08 - f2fDocument19 pagesMODULE 1 Math 08 - f2fShiena mae IndacNo ratings yet

- Grade 11 Math MOd 6Document12 pagesGrade 11 Math MOd 6John Lois VanNo ratings yet

- Bus Math Grade 11 q2 m2 w1Document6 pagesBus Math Grade 11 q2 m2 w1Ronald AlmagroNo ratings yet

- Basic of Engineering Economy: University of Jeddah, Faculty of Engineering, Industrial DepartmentDocument24 pagesBasic of Engineering Economy: University of Jeddah, Faculty of Engineering, Industrial Departmentمحمد عبدوNo ratings yet

- Interest Rates, Inflation and PricingDocument45 pagesInterest Rates, Inflation and PricingHaryson NyobuyaNo ratings yet

- Pertemuan 3 Dan 4 TEUSDAYDocument51 pagesPertemuan 3 Dan 4 TEUSDAYItzyoman YomanNo ratings yet

- Interest Money-Time Relationship Part 2Document9 pagesInterest Money-Time Relationship Part 2Carlnagum 123456789No ratings yet

- Money Time Relationships and Equivalence PDFDocument30 pagesMoney Time Relationships and Equivalence PDFpsstnopeNo ratings yet

- Chapter 2 - Compound InterestDocument18 pagesChapter 2 - Compound InterestPrincess Mae AgbonesNo ratings yet

- CHAPTER 2 - Presentation - For - TeachersDocument125 pagesCHAPTER 2 - Presentation - For - TeachersReffisa JiruNo ratings yet

- Chapter 5 - Part 1: Introduction To Valuation: The Time Value of MoneyDocument23 pagesChapter 5 - Part 1: Introduction To Valuation: The Time Value of MoneyJazzy SinghNo ratings yet

- Compound AmountDocument68 pagesCompound AmountKEYDAVE ARNADONo ratings yet

- Arbaminch Distance Chapter 3Document16 pagesArbaminch Distance Chapter 3Gizaw BelayNo ratings yet

- Lec1-Time Value of MoneyDocument27 pagesLec1-Time Value of Moneyhassan baradaNo ratings yet

- Module 3Document5 pagesModule 3RyuddaenNo ratings yet

- Professional & Industrial Studies (Lecture 4: P Matorwa) TopicsDocument8 pagesProfessional & Industrial Studies (Lecture 4: P Matorwa) Topicskundayi shavaNo ratings yet

- Module 5 - Mathematics of FinanceDocument6 pagesModule 5 - Mathematics of FinanceBangunan Mengfie Jr.No ratings yet

- Money Time Relationships and Equivalence PDFDocument21 pagesMoney Time Relationships and Equivalence PDFTaga Phase 7No ratings yet

- Gen Math2Document6 pagesGen Math2JR GamerNo ratings yet

- UNIT 2 Time and Money RelationshipDocument79 pagesUNIT 2 Time and Money Relationshipcuajohnpaull.schoolbackup.002No ratings yet

- Time Value of MoneyDocument37 pagesTime Value of Moneyansary75No ratings yet

- Compound InterestDocument24 pagesCompound Interestsier waltersNo ratings yet

- Module10 1Document22 pagesModule10 1Colleen Mae San DiegoNo ratings yet

- Simple Interest1Document2 pagesSimple Interest1Ian Ray MondidoNo ratings yet

- General Annuity 1Document1 pageGeneral Annuity 1Ian Ray MondidoNo ratings yet

- Find The Period of DeferralDocument1 pageFind The Period of DeferralIan Ray MondidoNo ratings yet

- Compound Interest 1Document2 pagesCompound Interest 1Ian Ray MondidoNo ratings yet

- Fair Market Value and Cash FlowDocument2 pagesFair Market Value and Cash FlowIan Ray MondidoNo ratings yet

- General Math FormulaDocument1 pageGeneral Math FormulaIan Ray MondidoNo ratings yet

- Teachers Portfolio: Ma - Adea D. Baldestamon, PHD Head Teacher IiDocument29 pagesTeachers Portfolio: Ma - Adea D. Baldestamon, PHD Head Teacher IiIan Ray MondidoNo ratings yet

- General Annuity 2Document1 pageGeneral Annuity 2Ian Ray MondidoNo ratings yet

- Rational FunctionsDocument2 pagesRational FunctionsIan Ray MondidoNo ratings yet

- FUNCTIONSDocument2 pagesFUNCTIONSIan Ray MondidoNo ratings yet

- Stocks and Bonds 1Document2 pagesStocks and Bonds 1Ian Ray MondidoNo ratings yet

- General AnnuityDocument2 pagesGeneral AnnuityIan Ray MondidoNo ratings yet

- Contingency PlanDocument3 pagesContingency PlanIan Ray MondidoNo ratings yet

- Simple and Compound InterestDocument4 pagesSimple and Compound InterestIan Ray MondidoNo ratings yet

- Stocks and Bonds 2Document2 pagesStocks and Bonds 2Ian Ray MondidoNo ratings yet

- Simple and Compound Word ProblemsDocument7 pagesSimple and Compound Word ProblemsIan Ray MondidoNo ratings yet

- Worksheet On Simple Annuity General Directions: Read Each Problem Carefully and Answer It SystematicallyDocument2 pagesWorksheet On Simple Annuity General Directions: Read Each Problem Carefully and Answer It SystematicallyIan Ray MondidoNo ratings yet

- Add and Subtract FunctionsDocument2 pagesAdd and Subtract FunctionsIan Ray MondidoNo ratings yet

- Review Worksheet 2nd QuarterDocument2 pagesReview Worksheet 2nd QuarterIan Ray MondidoNo ratings yet

- Functions Ordered-PairsDocument2 pagesFunctions Ordered-PairsIan Ray MondidoNo ratings yet

- Functions Table of ValuesDocument2 pagesFunctions Table of ValuesIan Ray MondidoNo ratings yet

- Composition of Functions AdditionalDocument10 pagesComposition of Functions AdditionalIan Ray MondidoNo ratings yet

- Multiply and Divide Functions AdditionalDocument2 pagesMultiply and Divide Functions AdditionalIan Ray MondidoNo ratings yet

- Composition of FunctionsDocument2 pagesComposition of FunctionsIan Ray MondidoNo ratings yet

- Operations On Integers (Additional Activity Sheet)Document2 pagesOperations On Integers (Additional Activity Sheet)Ian Ray MondidoNo ratings yet

- Functions MappingDocument2 pagesFunctions MappingIan Ray MondidoNo ratings yet

- Add and Subtract Functions AdditionalDocument2 pagesAdd and Subtract Functions AdditionalIan Ray MondidoNo ratings yet

- Week 2 Assignment FNCE UCWDocument14 pagesWeek 2 Assignment FNCE UCWamyna abhavaniNo ratings yet

- CPSPM 8979918 1689405315Document65 pagesCPSPM 8979918 168940531533sensesinfoNo ratings yet

- SC EX 6-1 Bank Account ManagersDocument3 pagesSC EX 6-1 Bank Account ManagersJack WestNo ratings yet

- Sana NTCCDocument40 pagesSana NTCCSana TrannumNo ratings yet

- Banking and Finance F+R CBCS 2016 17Document15 pagesBanking and Finance F+R CBCS 2016 17ABHIJIT SHAWNo ratings yet

- 2.4 Ordinary Annuities: ExercisesDocument2 pages2.4 Ordinary Annuities: ExercisesRinesa SylaNo ratings yet

- Sample of Loancheck+ 2Document8 pagesSample of Loancheck+ 2Mohd MuzammilNo ratings yet

- LESSON 3 Money Market (1)Document10 pagesLESSON 3 Money Market (1)Cleford LangiNo ratings yet

- Acct Statement - XX5271 - 13062022Document5 pagesAcct Statement - XX5271 - 13062022Shital PatilNo ratings yet

- ICICI Bank Deposit SlipDocument1 pageICICI Bank Deposit SlipRadhika MishraNo ratings yet

- Amith Boi 1Document3 pagesAmith Boi 1Law DepotNo ratings yet

- Martin Murimi KariukiDocument2 pagesMartin Murimi KariukiKameneja LeeNo ratings yet

- All Accounts Balance Details: S. No. Account Number Account Type Branch Rate of Interest (% P.a.) BalanceDocument2 pagesAll Accounts Balance Details: S. No. Account Number Account Type Branch Rate of Interest (% P.a.) Balanceshashwatsagar1729No ratings yet

- Minutes of The Meeting As of 11.2019 - 11.26.2020Document5 pagesMinutes of The Meeting As of 11.2019 - 11.26.2020Welbert CornejoNo ratings yet

- Customer Survey Report KCBLDocument66 pagesCustomer Survey Report KCBLKishadahNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummarymerrwonNo ratings yet

- Advising Payslip 18201005 MD Tuhin ShaikhDocument1 pageAdvising Payslip 18201005 MD Tuhin ShaikhTuhin ShaikhNo ratings yet

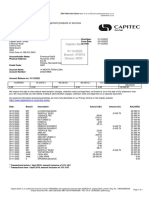

- Loan Statement: Capitec Bank 31/12/2022 Branch: 470010 Device: 9003Document1 pageLoan Statement: Capitec Bank 31/12/2022 Branch: 470010 Device: 9003CINEMA BEST MOVIES BY EK M MAFIFINo ratings yet

- Assignment # 3: Chapter 3-The Time Value of MoneyDocument9 pagesAssignment # 3: Chapter 3-The Time Value of MoneyGenesis E. CarlosNo ratings yet

- Transaction-Dispute-Form NAVEENDocument7 pagesTransaction-Dispute-Form NAVEENSPG CAMPUSNo ratings yet

- Quasi EquityDocument2 pagesQuasi EquitypratikNo ratings yet