Professional Documents

Culture Documents

M8 CHP 12 4 Allocation of Joint Costs

Uploaded by

Queennie Ellam0 ratings0% found this document useful (0 votes)

609 views2 pagesOriginal Title

M8 Chp 12 4 Allocation of Joint Costs

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

609 views2 pagesM8 CHP 12 4 Allocation of Joint Costs

Uploaded by

Queennie EllamCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

Tab: 1. Problem File: 666706196.

xls Page 1 of 2

Lee Co. produces two joint products, BEX and ROM.

Joint production costs for June were $30,000.

During June further processing beyond the split-off point was

needed to convert the products into salable form.

June production costs after split-off were:

$35,000 for 1,600 units of BEX.

$25,000 for 800 units of ROM.

BEX sells for $50 per unit, and ROM sells for $100 per unit.

Lee uses the net realizable value method for allocating joint product costs.

For June, the joint costs allocated to product ROM were

a. $20,000 b. $16,500 c. $13,500 d. $10,000

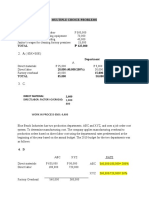

Lee Company-Joint cost allocat Bex Rom Total

Joint Costs $ 30,000

Unit selling price $ 50.00 $ 100.00

Total Sales - in units 1,600 800

Total Revenue $ 80,000 $ 80,000

Costs after split-off

Net realizable value

Ratios

Joint cost allocation

Tab: 2. Answers File: 666706196.xls Page 2 of 2

Lee Co. produces two joint products, BEX and ROM.

Joint production costs for June were $30,000.

During June further processing beyond the split-off point was

needed to convert the products into salable form.

June production costs after split-off were:

$35,000 for 1,600 units of BEX.

$25,000 for 800 units of ROM.

BEX sells for $50 per unit, and ROM sells for $100 per unit.

Lee uses the net realizable value method for allocating joint product costs.

For June, the joint costs allocated to product ROM were

a. $20,000 b. $16,500 c. $13,500 d. $10,000

Lee Company-Joint cost allocat Bex Rom Total

Joint Costs $ 30,000

Unit selling price $ 50.00 $ 100.00

Total Sales - in units 1,600 800

Total Revenue $ 80,000 $ 80,000

Costs after split-off $ 35,000 $ 25,000

Net realizable value $ 45,000 $ 55,000

Ratios 45% 55%

Joint cost allocation $ 13,500 $ 16,500

You might also like

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Assignment - Joint Products and by Products Costing - Without AnswersDocument5 pagesAssignment - Joint Products and by Products Costing - Without AnswersRoselyn LumbaoNo ratings yet

- (02D) Inventories Assignment 02 ANSWER KEYDocument9 pages(02D) Inventories Assignment 02 ANSWER KEYGabriel Adrian ObungenNo ratings yet

- DocDocument6 pagesDocBanana QNo ratings yet

- Chapter 4. AssignmentDocument13 pagesChapter 4. AssignmentAnne Thea AtienzaNo ratings yet

- Answers To Cost Accounting Chapter 10Document15 pagesAnswers To Cost Accounting Chapter 10Raffy Roncales100% (2)

- Cost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualDocument27 pagesCost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualMARIA100% (1)

- Capital Expenditures on Machinery ProblemsDocument3 pagesCapital Expenditures on Machinery ProblemsZes ONo ratings yet

- Cost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Document7 pagesCost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Saarah KylueNo ratings yet

- B 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToDocument4 pagesB 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToKATHRYN CLAUDETTE RESENTENo ratings yet

- Cost Classification GuideDocument12 pagesCost Classification GuideAngelica NatanNo ratings yet

- Mid Term Quiz 2 On Cost Accounting and Control - Manufacturing Overhead - DepartmentalizationDocument3 pagesMid Term Quiz 2 On Cost Accounting and Control - Manufacturing Overhead - DepartmentalizationGabriel Adrian ObungenNo ratings yet

- Chapter 12 1Document8 pagesChapter 12 1Princess Via Ira EstacioNo ratings yet

- Solution Guide - Activity On Accounting For Materials CostDocument4 pagesSolution Guide - Activity On Accounting For Materials CostMirasol100% (2)

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- 2014 Vol 1 CH 4 AnswersDocument11 pages2014 Vol 1 CH 4 AnswersSimoun Torres100% (2)

- Cost - Concepts and ClassificationsDocument23 pagesCost - Concepts and ClassificationsYehetNo ratings yet

- 1Document13 pages1Mikasa MikasaNo ratings yet

- Chapter 2 Multiple Choice Computational Cost Acc Guerrero 2018 EdDocument14 pagesChapter 2 Multiple Choice Computational Cost Acc Guerrero 2018 EdJuan FrivaldoNo ratings yet

- Chap16 ProblemsDocument20 pagesChap16 ProblemsYen YenNo ratings yet

- Cost Acct Answer KeyDocument95 pagesCost Acct Answer KeyCarlaNo ratings yet

- COST ACCOUNTING - Cost Concepts and ClassificationDocument18 pagesCOST ACCOUNTING - Cost Concepts and ClassificationJustine Reine CornicoNo ratings yet

- ABC Company Factory Overhead Allocation MethodsDocument12 pagesABC Company Factory Overhead Allocation MethodsStephNo ratings yet

- Joint Cost and by Product Costing Prac 2 2020Document22 pagesJoint Cost and by Product Costing Prac 2 2020JANISCHAJEAN RECTONo ratings yet

- Chapter 5 True or False, Multiple Choice, and Journal Entries for Alexis and Golden Shower CompaniesDocument12 pagesChapter 5 True or False, Multiple Choice, and Journal Entries for Alexis and Golden Shower Companies?????0% (1)

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsPremium AccountsNo ratings yet

- Intermediate Accounting Chapter 23 To 35Document101 pagesIntermediate Accounting Chapter 23 To 35Blue SkyNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- 625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2Document2 pages625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2El Jehn Grace Babor - Ledesma100% (1)

- Joint Cost Allocation ProblemsDocument3 pagesJoint Cost Allocation ProblemsJune Maylyn MarzoNo ratings yet

- Ia Chapter 11-12Document4 pagesIa Chapter 11-12Marinella LosaNo ratings yet

- CHEER UP Chapter 13 Gross Profit MethodDocument7 pagesCHEER UP Chapter 13 Gross Profit MethodaprilNo ratings yet

- Cost Accounting and Control: Process CostingDocument14 pagesCost Accounting and Control: Process CostingAloha Bu-ucan100% (2)

- Chapter 7-The Balanced Scorecard: A Tool To Implement StrategyDocument3 pagesChapter 7-The Balanced Scorecard: A Tool To Implement StrategyitsmenatoyNo ratings yet

- Bedlam Company December Cash Proof ReportDocument2 pagesBedlam Company December Cash Proof ReportChristy HabelNo ratings yet

- A. Trend Percentages: RequiredDocument5 pagesA. Trend Percentages: RequiredAngel NuevoNo ratings yet

- Cost Accounting and Control Chapter 1-2Document10 pagesCost Accounting and Control Chapter 1-2somethingNo ratings yet

- Midterm ExamDocument20 pagesMidterm ExammhikeedelantarNo ratings yet

- Cost Accounting - Chapter - 7Document8 pagesCost Accounting - Chapter - 7xxxxxxxxx100% (1)

- Cost Accounting Exercise-11Document5 pagesCost Accounting Exercise-11Ki xxiNo ratings yet

- Acc123 Reviewer With AnswerDocument11 pagesAcc123 Reviewer With AnswerLianaNo ratings yet

- Chapter 13 - Gross Profit MethodDocument7 pagesChapter 13 - Gross Profit MethodLorence IbañezNo ratings yet

- PROBLEMS AND EXERCISES ON ACCOUNTING FOR PROPERTY, PLANT AND EQUIPMENTDocument10 pagesPROBLEMS AND EXERCISES ON ACCOUNTING FOR PROPERTY, PLANT AND EQUIPMENTJess SiazonNo ratings yet

- Strategic Cost Management Exercises 12369Document2 pagesStrategic Cost Management Exercises 12369Arlene Diane OrozcoNo ratings yet

- Job Order Costing TheoryDocument3 pagesJob Order Costing TheoryMiscaCruzNo ratings yet

- Job Order Costing - Del Rosario, Jameine SDocument42 pagesJob Order Costing - Del Rosario, Jameine SPatrick LanceNo ratings yet

- Chapter22 BuenaventuraDocument4 pagesChapter22 BuenaventuraAnonnNo ratings yet

- Job Order Costing Multiple Choice QuestionsDocument42 pagesJob Order Costing Multiple Choice QuestionsFerb CruzadaNo ratings yet

- Excel Homework 2015 Fall Product Pricing AnalysisDocument15 pagesExcel Homework 2015 Fall Product Pricing AnalysisHà LêNo ratings yet

- Exercises With Solutions - CH0104Document17 pagesExercises With Solutions - CH0104M AamirNo ratings yet

- Product Production Units Sales Units: Selling Price Per UnitDocument3 pagesProduct Production Units Sales Units: Selling Price Per UnitKamisiro RizeNo ratings yet

- M8 CHP 12 5 PRB Cost AllocationDocument2 pagesM8 CHP 12 5 PRB Cost AllocationQueennie EllamNo ratings yet

- Ch.1Cost Terms, Concepts, and ClassificationsDocument24 pagesCh.1Cost Terms, Concepts, and ClassificationsDeeb. DeebNo ratings yet

- Cost Accounting Hilton 15Document12 pagesCost Accounting Hilton 15Vin TenNo ratings yet

- 4 Cvpbe PROB EXDocument5 pages4 Cvpbe PROB EXjulia4razoNo ratings yet

- Strat Cost ActivityDocument2 pagesStrat Cost ActivityManuelAngeloBernalNo ratings yet

- Cost Behavior Analysis & Variable Costing FormulasDocument7 pagesCost Behavior Analysis & Variable Costing FormulasNaba ZehraNo ratings yet

- Assignment, Managerial AccountingDocument8 pagesAssignment, Managerial Accountingmariamreda7754No ratings yet

- See Zhao Wei U2003083 Costing AnalysisDocument5 pagesSee Zhao Wei U2003083 Costing AnalysiszhaoweiNo ratings yet

- Problem 7-34 AbxcjasidhDocument1 pageProblem 7-34 AbxcjasidhrpztxNo ratings yet

- Compliance Minimum Wage Act agreement BTGDocument1 pageCompliance Minimum Wage Act agreement BTGDaniela CatalinaNo ratings yet

- Top 10 Sample Papers Class 12 Accountancy With SolutionDocument110 pagesTop 10 Sample Papers Class 12 Accountancy With Solutionanagha0890% (1)

- Williams Erica Gb560 UnitDocument7 pagesWilliams Erica Gb560 UnitErica WilliamsNo ratings yet

- Q CH 9Document7 pagesQ CH 9Jhon F SinagaNo ratings yet

- mc30 Mutual Funds PDFDocument3 pagesmc30 Mutual Funds PDFAnkur ShahNo ratings yet

- Midterm Exam-Adjusting EntriesDocument5 pagesMidterm Exam-Adjusting EntriesHassanhor Guro BacolodNo ratings yet

- SSRN Id1155194Document165 pagesSSRN Id1155194achmad100% (1)

- Philippine and International Accounting Standard-Setting OrganizationsDocument6 pagesPhilippine and International Accounting Standard-Setting OrganizationsChocobetternotNo ratings yet

- Decision Theory - I-18Document4 pagesDecision Theory - I-18NIKHIL SINGHNo ratings yet

- BSBSUS501 Sample Sustainability PolicyDocument2 pagesBSBSUS501 Sample Sustainability Policytauqeer akbarNo ratings yet

- Choosing The Project Strategy EPCM EPC PMC Bilfinger TebodinDocument2 pagesChoosing The Project Strategy EPCM EPC PMC Bilfinger TebodinFirasAlnaimi100% (1)

- ECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and SupplyDocument30 pagesECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and Supplyizah893640No ratings yet

- Mark Scheme (Results) January 2011: GCE Accounting (6002/01) Paper 01Document16 pagesMark Scheme (Results) January 2011: GCE Accounting (6002/01) Paper 01Nayeem Hasan AntuNo ratings yet

- Container Logistics Sector - Tarragon Capital AdvisorsDocument54 pagesContainer Logistics Sector - Tarragon Capital AdvisorsSandiipBhammerNo ratings yet

- Building an LGBTQ+ and PWD-staffed sales officeDocument4 pagesBuilding an LGBTQ+ and PWD-staffed sales officeNGNo ratings yet

- List of Companies Indulged in Unauthorized ActivitiesDocument2 pagesList of Companies Indulged in Unauthorized ActivitiesAmsal Asif KasbatiNo ratings yet

- Introduction To Business and Management (IBM) : MA 2020/2021 Week 07aDocument16 pagesIntroduction To Business and Management (IBM) : MA 2020/2021 Week 07a林泳圻No ratings yet

- Chapter IV Capital Structure and Long Term Financing DecisionDocument117 pagesChapter IV Capital Structure and Long Term Financing DecisionLaren KayeNo ratings yet

- Accenture Innovation Strategy PDFDocument16 pagesAccenture Innovation Strategy PDFSergio VinsennauNo ratings yet

- Accounting Reviewer Theory QuestionsDocument16 pagesAccounting Reviewer Theory QuestionsMJ Yacon100% (2)

- PDF Chapter 5 The Expenditure Cycle Part I Summary - CompressDocument5 pagesPDF Chapter 5 The Expenditure Cycle Part I Summary - CompressCassiopeia Cashmere GodheidNo ratings yet

- HDMF Mplaf-Stl SampleDocument2 pagesHDMF Mplaf-Stl SampleHarold Quindica DaronNo ratings yet

- Titman PPT CH18Document79 pagesTitman PPT CH18IKA RAHMAWATINo ratings yet

- Market Analysis of LG Consumer Durables & Dealer DevelopmentDocument95 pagesMarket Analysis of LG Consumer Durables & Dealer DevelopmentHiba NaseerNo ratings yet

- Institutional Contacts:: School InfoDocument79 pagesInstitutional Contacts:: School InfoMatt BrownNo ratings yet

- Risks and Rate of Return PresentationDocument65 pagesRisks and Rate of Return PresentationMira Monica D. VillacastinNo ratings yet

- Measuring Social ValueDocument7 pagesMeasuring Social ValueSocial innovation in Western AustraliaNo ratings yet

- Technical Problems Facing Natural Gas Industry in MalaysiaDocument3 pagesTechnical Problems Facing Natural Gas Industry in MalaysiaApril JuneNo ratings yet

- Introduction to commodity swaps using an oil swap exampleDocument14 pagesIntroduction to commodity swaps using an oil swap exampleMavisNo ratings yet

- RBI NotesDocument443 pagesRBI NotesManish MishraNo ratings yet