Professional Documents

Culture Documents

3.2 Metrobank vs. Centro Development Corp

Uploaded by

I took her to my penthouse and i freaked itCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3.2 Metrobank vs. Centro Development Corp

Uploaded by

I took her to my penthouse and i freaked itCopyright:

Available Formats

METROBANK

vs.

CENTRO DEVELOPMENT CORP.

FACTS:

Centro Development Corporation (Centro), with BOD approval, its president Go Eng Uy

was authorized to mortgage its properties and assets to secure the medium-term loan of

P 84 million

Executed a Mortgage Trust Indenture (MTI) with the Bank of the Philippines Islands

(BPI).

Under the MTI, respondent Centro expressed its desire to obtain from time to time loans

and other credit accommodations from certain creditors for corporate and other

business purposes

To secure these obligations from different creditors, respondent Centro

constituted a continuing mortgage on all or substantially all of its

properties and assets in favor of BPI, the trustee.

Later on, the MTI was amended, appointing Metrobank as the successor-trustee of the

MTI. It is worth noting that this MTI did not amend the amount of the total obligations

covered by the previous MTIs.

On a side note, Chongking Kehyeng, Manuel Co Kehyeng and Quirino Kehyeng, allegedly

discovered that the properties of respondent Centro had been mortgaged, and that the

MTI that had been executed appointing petitioner as trustee

the Kehyengs allegedly questioned the mortgage of the properties through letters

addressed to Go Eng Uy and Jacinta Go

They alleged that they were not aware of any board or stockholders'

meeting when petitioner was appointed as successor-trustee of BPI in

the MTI

Meanwhile, during the period April 1998 to December 1998, San Carlos obtained

additional loans, bringing the total principal amount of P812,793,513.23 from petitioner

Metrobank.

San Carlos failed to pay these outstanding obligations despite demand.

Thus, petitioner, as trustee of the MTI, enforced the conditions thereof and initiated

foreclosure proceedings.

Before the scheduled foreclosure date, on 3 August 2000, respondents herein filed a

Complaint for the annulment of the 27 September 1994 MTI with a prayer for a

temporary restraining order (TRO) and preliminary injunction at Branch 138 of the RTC

of Makati City

The bone of contention in Civil Case No. 00-942 was that since the

mortgaged properties constituted all or substantially all of the corporate

assets, the amendment of the MTI failed to meet the requirements of

Section 40 of the Corporation Code on notice and voting requirements.

Under this provision, in order for a corporation to mortgage all or

substantially all of its properties and assets, it should be authorized by

the vote of its stockholders representing at least 2/3 of the outstanding

capital stock in a meeting held for that purpose.

ISSUE/S: Whether the requirements of Section 40 of the Corporation Code was complied with in

the execution of the MTI

HELD: Sec. 40 is NOT APPLICABLE in this case.

Reading carefully the Secretary's Certificate, it is clear that the main purpose of the

directors' Resolution was to appoint petitioner as the new trustee of the previously executed

and amended MTI. Going through the original and the revised MTI, we find no substantial

amendments to the provisions of the contract. We agree with petitioner that the act of

appointing a new trustee of the MTI was a regular business transaction. The appointment

necessitated only a decision of at least a majority of the directors present at the meeting in

which there was a quorum, pursuant to Section 25 of the Corporation Code.

The second paragraph of the directors' Resolution No. 005, s. 1994, which empowered

Go Eng Uy "to sign the Real Estate Mortgage and all documents/instruments with the said bank,

for and in behalf of the Company which are necessary and pertinent thereto," must be

construed to mean that such power was limited by the conditions of the existing mortgage, and

not that a new mortgage was thereby constituted.

Thus, Section 40 of the Corporation Code finds no application in the present case, as

there was no new mortgage to speak of under the assailed directors' Resolution.

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Metrobankvs CentroDocument12 pagesMetrobankvs CentroCleinJonTiuNo ratings yet

- Metropolitan Bank vs. Centro Corporation: G.R. No. 180974, June 13, 2012Document17 pagesMetropolitan Bank vs. Centro Corporation: G.R. No. 180974, June 13, 2012roseNo ratings yet

- Metrobank vs. Centro DevtDocument2 pagesMetrobank vs. Centro DevtChic PabalanNo ratings yet

- Metropolitan Bank and Trust Company vs. Centro Development Corporation FACTS: in A Special Meeting of The Board of DirectorsDocument3 pagesMetropolitan Bank and Trust Company vs. Centro Development Corporation FACTS: in A Special Meeting of The Board of Directorspoiuytrewq9115No ratings yet

- 73 Metrobank v. Centro Inc.Document3 pages73 Metrobank v. Centro Inc.Rostum AgapitoNo ratings yet

- Pledge Case: Pactum CommissoriumDocument2 pagesPledge Case: Pactum CommissoriumSusie VanguardiaNo ratings yet

- Metropolitan Bank and Trust Company vs. Centro Development PDFDocument20 pagesMetropolitan Bank and Trust Company vs. Centro Development PDFsinigangNo ratings yet

- MFinaliguel Ossorio Pension Foundation v. CA and CIRDocument2 pagesMFinaliguel Ossorio Pension Foundation v. CA and CIRVel JuneNo ratings yet

- Assignment DigestsDocument8 pagesAssignment Digestsmelaniem_1No ratings yet

- METROPOLITAN BANK AND TRUST COMPANY V CENTRO DEVELOPMENTDocument1 pageMETROPOLITAN BANK AND TRUST COMPANY V CENTRO DEVELOPMENTbantucin davooNo ratings yet

- Negotiable Instruments Case Digest: Allied Banking Corp. V. Lim Sio Wan (2008)Document19 pagesNegotiable Instruments Case Digest: Allied Banking Corp. V. Lim Sio Wan (2008)Trina RiveraNo ratings yet

- 192 Lee Vs CA 375 SCRA 579 (2002)Document3 pages192 Lee Vs CA 375 SCRA 579 (2002)Alan GultiaNo ratings yet

- Corpo Cases 2nd BatchDocument10 pagesCorpo Cases 2nd BatchPaulo BurroNo ratings yet

- Sps NGO V Allied BankDocument3 pagesSps NGO V Allied BankTeresa CardinozaNo ratings yet

- Case DigestDocument6 pagesCase DigestDiane AtotuboNo ratings yet

- Lee V Court of Appeals G.R. NO. 117913. February 1, 2002Document37 pagesLee V Court of Appeals G.R. NO. 117913. February 1, 2002Mailah AwingNo ratings yet

- 123 Charles Lee, Et Al Vs CA Phil Bank of Communications, GR 117913, Feb 1, 2002Document2 pages123 Charles Lee, Et Al Vs CA Phil Bank of Communications, GR 117913, Feb 1, 2002Alan GultiaNo ratings yet

- Sections-22-30 Corpo Case DigestsDocument14 pagesSections-22-30 Corpo Case Digestshmn_scribdNo ratings yet

- Filipinas Marble vs. IACDocument6 pagesFilipinas Marble vs. IACTineNo ratings yet

- Asset Privatization Trust Vs Court of Appeals 300 SCRA 379 PDFDocument20 pagesAsset Privatization Trust Vs Court of Appeals 300 SCRA 379 PDFAkimah KIMKIM AnginNo ratings yet

- Credit CasesDocument42 pagesCredit CasesTess LimNo ratings yet

- Case Digest BankingDocument35 pagesCase Digest BankingEKANG0% (1)

- Lee V CA (COMMREV) - Letters of CreditDocument3 pagesLee V CA (COMMREV) - Letters of CreditErrica Marie De GuzmanNo ratings yet

- Republic of The Philippines Manila Third Division: Supreme CourtDocument58 pagesRepublic of The Philippines Manila Third Division: Supreme CourtNanz JermaeNo ratings yet

- Case-Digests - CorpoDocument5 pagesCase-Digests - Corpolaw.school20240000No ratings yet

- Palm Tree Estates vs. PNBDocument20 pagesPalm Tree Estates vs. PNBhlcameroNo ratings yet

- Topic Digested By: Title of Case Case No. & Date of Promulgation Ponente Court Plaintiff/Appellant Defendant/Appellee Doctrine (Syllabus) FactsDocument2 pagesTopic Digested By: Title of Case Case No. & Date of Promulgation Ponente Court Plaintiff/Appellant Defendant/Appellee Doctrine (Syllabus) FactsCali AustriaNo ratings yet

- Lee VS CaDocument3 pagesLee VS CaVebsie D. MolavinNo ratings yet

- Jong - Banking LawsDocument22 pagesJong - Banking LawsJong PerrarenNo ratings yet

- PENTACAPITAL INVESTMENT CORPORRATION VDocument1 pagePENTACAPITAL INVESTMENT CORPORRATION VJayson CutaranNo ratings yet

- NjhmbasdrgaasDocument39 pagesNjhmbasdrgaasApple BottomNo ratings yet

- Ossorio Foundation Vs CADocument10 pagesOssorio Foundation Vs CAMilcah Mae PascualNo ratings yet

- Lee Vs CADocument2 pagesLee Vs CAchaNo ratings yet

- Adriatico v. LBPDocument11 pagesAdriatico v. LBPKristanne Louise YuNo ratings yet

- 13 - Filipinas Marble Corp. Vs IAC, GR L-68010Document5 pages13 - Filipinas Marble Corp. Vs IAC, GR L-68010R.A. GregorioNo ratings yet

- 23 Ossorio PEnsion v. CADocument15 pages23 Ossorio PEnsion v. CAApa MendozaNo ratings yet

- Trans Industrial Utilities, Inc. v. Metropolitan. Bank & Trust CompanyDocument2 pagesTrans Industrial Utilities, Inc. v. Metropolitan. Bank & Trust CompanyJay jogsNo ratings yet

- Functions and Obligations of The ReceiverDocument7 pagesFunctions and Obligations of The ReceiverReangelo MenchavezNo ratings yet

- Cred Trans - GuarantyDocument11 pagesCred Trans - GuarantyKayeNo ratings yet

- Philnico V PMO DigestDocument3 pagesPhilnico V PMO DigestKathNo ratings yet

- Case No. 11Document3 pagesCase No. 11Khristienne BernabeNo ratings yet

- Cases 1-7 CorpoDocument12 pagesCases 1-7 CorpoBrian Jonathan ParaanNo ratings yet

- Charles Lee, Chua Siok Suy, Mariano Sio, Alfonso Yap,: Case No. 2Document2 pagesCharles Lee, Chua Siok Suy, Mariano Sio, Alfonso Yap,: Case No. 2Caroru ElNo ratings yet

- VILLA CRISTA MONTE REALTY Vs BANCO DE ORO UNIBANKDocument3 pagesVILLA CRISTA MONTE REALTY Vs BANCO DE ORO UNIBANKAnonymous hbUJnBNo ratings yet

- Oblicon CasesDocument60 pagesOblicon CasesHeidi Fabillar DimaangayNo ratings yet

- 05-Asset Privatization Trust v. CA G.R. No. 121171 December 29, 1998Document35 pages05-Asset Privatization Trust v. CA G.R. No. 121171 December 29, 1998Noel IV T. BorromeoNo ratings yet

- Town and Country EnterprisesDocument4 pagesTown and Country EnterprisesEliza Den DevilleresNo ratings yet

- Samuel Lee v. Bangkok BankDocument2 pagesSamuel Lee v. Bangkok BankJohney Doe100% (1)

- 09 Task Perfromance 1 Cute KoDocument3 pages09 Task Perfromance 1 Cute Kojerome orceoNo ratings yet

- Tax WK 10 DigestsDocument18 pagesTax WK 10 Digestsjovelyn davoNo ratings yet

- Cred - Tran - Consolidated Bank and Trust Corporation (Solidbank) v. CA 356 Scra 671Document7 pagesCred - Tran - Consolidated Bank and Trust Corporation (Solidbank) v. CA 356 Scra 671myrahjNo ratings yet

- Nature of The Case: Kopeks Holdings SDN BHD v. Bank Islam Malaysia BHD (2009) 1 LNS 785Document2 pagesNature of The Case: Kopeks Holdings SDN BHD v. Bank Islam Malaysia BHD (2009) 1 LNS 785Mohamad Alif IdidNo ratings yet

- Credit Case DigestDocument5 pagesCredit Case DigestAlverastine AnNo ratings yet

- Dona Adela Export v. TIDCORPDocument2 pagesDona Adela Export v. TIDCORPLili MoreNo ratings yet

- D Gamido NA - Corpo Law - Finals DigestsDocument6 pagesD Gamido NA - Corpo Law - Finals DigestsNeil Aubrey GamidoNo ratings yet

- Bernabe August October 2012 DiamlaDocument108 pagesBernabe August October 2012 DiamlaALYANNAH HAROUNNo ratings yet

- 2 Umale V Villamor PDFDocument13 pages2 Umale V Villamor PDFJinnelyn LiNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Abad vs. RTC Manila, 10 - 12 - 1987Document3 pagesAbad vs. RTC Manila, 10 - 12 - 1987I took her to my penthouse and i freaked itNo ratings yet

- Bengzon vs. InciongDocument2 pagesBengzon vs. InciongI took her to my penthouse and i freaked itNo ratings yet

- CIR v. SPCMDocument2 pagesCIR v. SPCMI took her to my penthouse and i freaked itNo ratings yet

- Caltex Philippines Vs COA, 208 SCRA 726, 05 - 08 - 1992Document2 pagesCaltex Philippines Vs COA, 208 SCRA 726, 05 - 08 - 1992I took her to my penthouse and i freaked itNo ratings yet

- CIR Vs CADocument3 pagesCIR Vs CAI took her to my penthouse and i freaked itNo ratings yet

- CIR v. Algue, Inc., 158 SCRA 9 (1988)Document3 pagesCIR v. Algue, Inc., 158 SCRA 9 (1988)I took her to my penthouse and i freaked itNo ratings yet

- Padlan v. Dinglasan, G.R. No. 180321, March 20, 2013Document2 pagesPadlan v. Dinglasan, G.R. No. 180321, March 20, 2013I took her to my penthouse and i freaked itNo ratings yet

- CRUZ v. CRUZDocument2 pagesCRUZ v. CRUZI took her to my penthouse and i freaked itNo ratings yet

- Philex Mining Corp vs. CIRDocument1 pagePhilex Mining Corp vs. CIRI took her to my penthouse and i freaked itNo ratings yet

- Vasquez vs. de BorjaDocument2 pagesVasquez vs. de BorjaI took her to my penthouse and i freaked itNo ratings yet

- 6.9 San Juan Structural and Steel Fabricators Inc Vs CADocument2 pages6.9 San Juan Structural and Steel Fabricators Inc Vs CAI took her to my penthouse and i freaked itNo ratings yet

- CIR vs. CA and ANSCORDocument4 pagesCIR vs. CA and ANSCORI took her to my penthouse and i freaked itNo ratings yet

- 3.1 Lopez Realty vs. Sps. TanjangcoDocument3 pages3.1 Lopez Realty vs. Sps. TanjangcoI took her to my penthouse and i freaked itNo ratings yet

- 2.0 Ramon vs. VillarealDocument2 pages2.0 Ramon vs. VillarealI took her to my penthouse and i freaked itNo ratings yet

- 7.5 Yasuma vs. de Villa NOT FINISHEDDocument1 page7.5 Yasuma vs. de Villa NOT FINISHEDI took her to my penthouse and i freaked itNo ratings yet

- Tan v. SycipDocument11 pagesTan v. SycipI took her to my penthouse and i freaked itNo ratings yet

- Angeles University Foundation Vs City of AngelesDocument4 pagesAngeles University Foundation Vs City of AngelesI took her to my penthouse and i freaked itNo ratings yet

- NTC vs. PLDTDocument2 pagesNTC vs. PLDTI took her to my penthouse and i freaked itNo ratings yet

- 7.3 Aguenza vs. MetrobankDocument2 pages7.3 Aguenza vs. MetrobankI took her to my penthouse and i freaked itNo ratings yet

- TENG Vs SECDocument3 pagesTENG Vs SECI took her to my penthouse and i freaked itNo ratings yet

- Heirs of Fe Tan Uy v. International Exchange BankDocument2 pagesHeirs of Fe Tan Uy v. International Exchange BankI took her to my penthouse and i freaked itNo ratings yet

- PLDT vs. NTCDocument2 pagesPLDT vs. NTCI took her to my penthouse and i freaked itNo ratings yet

- 7.1 Lipat v. Pacific Banking CorpDocument2 pages7.1 Lipat v. Pacific Banking CorpI took her to my penthouse and i freaked itNo ratings yet

- 6.10 Zomer vs. International Exchange BankDocument2 pages6.10 Zomer vs. International Exchange BankI took her to my penthouse and i freaked itNo ratings yet

- UntitledDocument3 pagesUntitledI took her to my penthouse and i freaked itNo ratings yet

- 7.2 People's Aircargo vs. CADocument2 pages7.2 People's Aircargo vs. CAI took her to my penthouse and i freaked itNo ratings yet

- 6.2 Cebu Mactan vs. TsukaharaDocument2 pages6.2 Cebu Mactan vs. TsukaharaI took her to my penthouse and i freaked itNo ratings yet

- 6.3 Phil. Numismatic Ad Antiquarian Society vs. AquinoDocument2 pages6.3 Phil. Numismatic Ad Antiquarian Society vs. AquinoI took her to my penthouse and i freaked itNo ratings yet

- 6.4 Hornilla vs. SalunatDocument1 page6.4 Hornilla vs. SalunatI took her to my penthouse and i freaked itNo ratings yet

- AF Realty Dev., vs. Dieselman Freight Services Co.Document1 pageAF Realty Dev., vs. Dieselman Freight Services Co.I took her to my penthouse and i freaked itNo ratings yet

- BF Reviewer Q2 Module (1-2,4-5)Document3 pagesBF Reviewer Q2 Module (1-2,4-5)Catherine SalasNo ratings yet

- Form 1840sdi-2 - Substantive Procedures Guide - Banking and Finance - LoansDocument17 pagesForm 1840sdi-2 - Substantive Procedures Guide - Banking and Finance - LoanswellawalalasithNo ratings yet

- Uniland Resources V DBPDocument4 pagesUniland Resources V DBPGabe RuaroNo ratings yet

- Language of Commercial Real Estate FinanceDocument6 pagesLanguage of Commercial Real Estate FinanceKaran MalhotraNo ratings yet

- Legal & Regulatory Aspects of Banking - JAIIBDocument18 pagesLegal & Regulatory Aspects of Banking - JAIIBPrasenjit RoyNo ratings yet

- Bangalore Property Buying ChecklistDocument42 pagesBangalore Property Buying ChecklistSudhakar GanjikuntaNo ratings yet

- Philippine National Bank vs. Spouses RocamoraDocument2 pagesPhilippine National Bank vs. Spouses RocamoraAmado EspejoNo ratings yet

- Indian Financial SystemDocument33 pagesIndian Financial SystemVyshNo ratings yet

- National Life Insurance AssignmentDocument13 pagesNational Life Insurance Assignmentshaira kabir100% (1)

- Central Bank of The Philippines vs. Court of Appeals: G.R. No. L-45710 October 3, 1985 FactsDocument2 pagesCentral Bank of The Philippines vs. Court of Appeals: G.R. No. L-45710 October 3, 1985 Factssabrina gayoNo ratings yet

- University of Zimbabwe: (LB021) LL.B (Hons) Part Iii and Iv Conveyancing ExaminationDocument4 pagesUniversity of Zimbabwe: (LB021) LL.B (Hons) Part Iii and Iv Conveyancing Examinationsimdumise magwaliba100% (1)

- New Economic Approaches To The Study Of: Business HistoryDocument23 pagesNew Economic Approaches To The Study Of: Business HistoryRS Praveen KumarNo ratings yet

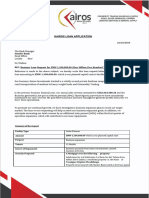

- Kairos LetterDocument2 pagesKairos LettersebeastyforeverNo ratings yet

- T24 Core Banking System Overview PDFDocument31 pagesT24 Core Banking System Overview PDFjunaid73% (15)

- 4) Poliand Industrial Limited v. National20180403-1159-1smfkmbDocument29 pages4) Poliand Industrial Limited v. National20180403-1159-1smfkmbVictoria EscobalNo ratings yet

- Research Methodology of The StudyDocument88 pagesResearch Methodology of The StudyKamalakanta DasNo ratings yet

- 7case Digest Daguhoy Vs PonceDocument2 pages7case Digest Daguhoy Vs PonceJames ScoldNo ratings yet

- Aboite and About - February 18, 2011Document32 pagesAboite and About - February 18, 2011KPC Media Group, Inc.No ratings yet

- 4 Juico v. China Banking CorporationDocument31 pages4 Juico v. China Banking CorporationGia DimayugaNo ratings yet

- Warehouse Loan AgreementDocument167 pagesWarehouse Loan Agreement83jjmack100% (1)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument54 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownUsman NaeemNo ratings yet

- Arts 414-425 Study GuideDocument108 pagesArts 414-425 Study GuidejosefNo ratings yet

- Unit - II: Merchant BankingDocument39 pagesUnit - II: Merchant BankingashishNo ratings yet

- SAP T CodesDocument49 pagesSAP T Codesanilks27No ratings yet

- Sources of FundsDocument20 pagesSources of FundsSigei LeonardNo ratings yet

- Home Loan at Icici Bank For BbaDocument66 pagesHome Loan at Icici Bank For BbaMamidishetty ManasaNo ratings yet

- Teaching Notes-FMI-342 PDFDocument162 pagesTeaching Notes-FMI-342 PDFArun PatelNo ratings yet

- Bpi Investment Corporation Vs CADocument2 pagesBpi Investment Corporation Vs CAJulianNo ratings yet

- Module 2 - The Global EconomyDocument12 pagesModule 2 - The Global EconomyLovely LalagunaNo ratings yet

- RE Appt of Successor Trustee 8-31-2011 With Detailed ExplanationDocument14 pagesRE Appt of Successor Trustee 8-31-2011 With Detailed ExplanationAlice Jean Logan100% (2)