Professional Documents

Culture Documents

Pledge of Accounts Receivable

Uploaded by

Justine Carl Nikko Nakpil0 ratings0% found this document useful (0 votes)

8 views1 pagePledging accounts receivable as collateral for a loan does not require a journal entry. The company must disclose the pledge in the notes to the financial statements. When the company receives a 2.4 million loan secured by accounts receivable on October 1, 2022, it records a 2.16 million cash receipt and 240,000 discount on the notes payable. As the year progresses, the company amortizes the discount over the 1-year term of the loan by debiting interest expense and crediting the discount for the portion used up that period.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPledging accounts receivable as collateral for a loan does not require a journal entry. The company must disclose the pledge in the notes to the financial statements. When the company receives a 2.4 million loan secured by accounts receivable on October 1, 2022, it records a 2.16 million cash receipt and 240,000 discount on the notes payable. As the year progresses, the company amortizes the discount over the 1-year term of the loan by debiting interest expense and crediting the discount for the portion used up that period.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pagePledge of Accounts Receivable

Uploaded by

Justine Carl Nikko NakpilPledging accounts receivable as collateral for a loan does not require a journal entry. The company must disclose the pledge in the notes to the financial statements. When the company receives a 2.4 million loan secured by accounts receivable on October 1, 2022, it records a 2.16 million cash receipt and 240,000 discount on the notes payable. As the year progresses, the company amortizes the discount over the 1-year term of the loan by debiting interest expense and crediting the discount for the portion used up that period.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Pledge of Accounts Receivable

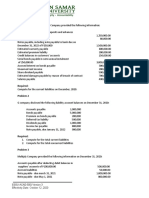

Pledging Accounts receivable as a collateral for the payment of

obligations. No journal entry should be made when pledging A/Rs

But should be made disclosure in the notes of Financial Statements

Record the loan received Oct 1, 2022

Cash 2,160,000

Discount on Notes payable 240,000

Notes payable 2,400,000

Discount of notes payable only occurs when stated in the problem, if the

problem is silent then disregard the discount.

When accounting period ends while the loan is still maturing, adjusting

the discount balance by multiply the months passed and dividing it to

the total months of the loan til maturing (12 months since its 1 year

agreement) to indicate the remaining discount on notes receivable,

and is amortized as interest expense.

Dec 31 2022

Interest Expense 60,000 (240,000x3/12)

Discount on Notes Payable 60,000

Disclosure; the carrying amount of the loan for Dec 31 2022

Face value 2,400,000

Discount on Notes payable 180,000

Carrying amount 2,220,000

You might also like

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Mama Mo Lily I AbilitiesDocument39 pagesMama Mo Lily I AbilitiesjdNo ratings yet

- Pup Auditofreceivable1 Bsa4 2Document6 pagesPup Auditofreceivable1 Bsa4 2Makoy BixenmanNo ratings yet

- Quiz ReceivablesDocument6 pagesQuiz ReceivableswesNo ratings yet

- Ar Problems HandoutsDocument18 pagesAr Problems Handoutsxjammer100% (1)

- Week 1 Output-KingDocument4 pagesWeek 1 Output-KingAlexis KingNo ratings yet

- Week 1 OutputDocument4 pagesWeek 1 OutputFria Mae Aycardo AbellanoNo ratings yet

- Receivables ProblemsDocument4 pagesReceivables ProblemsLarpii MonameNo ratings yet

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- M2.2e Diy-Problems (Answer Key)Document13 pagesM2.2e Diy-Problems (Answer Key)Liandrew MadronioNo ratings yet

- FABM1 AS09 Week 5 AcctgcycleDocument8 pagesFABM1 AS09 Week 5 Acctgcyclecaniedojanelle2No ratings yet

- Diy-Problems (Questionnaires)Document11 pagesDiy-Problems (Questionnaires)May Ramos100% (1)

- IllustrationDocument10 pagesIllustrationAmaris AyeshaNo ratings yet

- Accounting For Account ReceivableDocument15 pagesAccounting For Account ReceivableGizaw BelayNo ratings yet

- Intermediate Accounting 2: Financial LiabilitiesDocument63 pagesIntermediate Accounting 2: Financial LiabilitiesLyca Mae CubangbangNo ratings yet

- Template - Assignment - Audit of ReceivablesDocument6 pagesTemplate - Assignment - Audit of ReceivablesEdemson NavalesNo ratings yet

- Audit of LiabilitiesDocument4 pagesAudit of LiabilitiesJhaybie San BuenaventuraNo ratings yet

- Other Terms For Stated Interest Rate Include Nominal Rate, Coupon Rate, and Face RateDocument3 pagesOther Terms For Stated Interest Rate Include Nominal Rate, Coupon Rate, and Face RateEvonie Amor Arcillas HueteNo ratings yet

- HW On ReceivablesDocument4 pagesHW On ReceivablesGian Carlo RamonesNo ratings yet

- 19 Notes PayableDocument3 pages19 Notes Payableangelienacion8No ratings yet

- Problems Bonds-PayableDocument8 pagesProblems Bonds-PayableKezNo ratings yet

- Current Liabilities StudentsDocument7 pagesCurrent Liabilities StudentsEmmanuelNo ratings yet

- Day 1A - Receivables - AM SeatworkDocument7 pagesDay 1A - Receivables - AM SeatworkdgdeguzmanNo ratings yet

- Adjusting Entries and Worksheet Practice Set 2 Sept 19 AssignmentDocument3 pagesAdjusting Entries and Worksheet Practice Set 2 Sept 19 Assignmenthngrc29No ratings yet

- Accounts Receivable MaterialDocument4 pagesAccounts Receivable Materialkookie bunnyNo ratings yet

- Chapter 8 Financial Liability - Notes PayableDocument35 pagesChapter 8 Financial Liability - Notes Payablewala akong pake sayoNo ratings yet

- M7B Adjusting Process Overview and Accrued IncomeDocument3 pagesM7B Adjusting Process Overview and Accrued IncomeCharles Eli AlejandroNo ratings yet

- Aud Rev - Accounts ReceivableDocument4 pagesAud Rev - Accounts ReceivablexjammerNo ratings yet

- 06.1 - Liabilities PDFDocument5 pages06.1 - Liabilities PDFDonna AbogadoNo ratings yet

- Midterm Answer KeyDocument6 pagesMidterm Answer Keyazzenethfaye.delacruz.mnlNo ratings yet

- Classification & Accounts PayableDocument4 pagesClassification & Accounts PayableRodolfo Jr. LasquiteNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/23Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/23Avikamm AgrawalNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/23Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/23Maaz KhanNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- HW On Receivables CDocument5 pagesHW On Receivables CAmjad Rian MangondatoNo ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- Prelim Review Docx 427399963 Prelim ReviewDocument42 pagesPrelim Review Docx 427399963 Prelim ReviewMarjorie PalmaNo ratings yet

- LiabilitiesDocument14 pagesLiabilitiesKaye Choraine NadumaNo ratings yet

- Activity: Type of Transactions Proper Journal Entry (Entries)Document2 pagesActivity: Type of Transactions Proper Journal Entry (Entries)Joannah maeNo ratings yet

- AP - A05 Audit of LiabilitiesDocument7 pagesAP - A05 Audit of LiabilitiesJane DizonNo ratings yet

- Drill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormDocument3 pagesDrill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormKaye GonxalesNo ratings yet

- Prelim ReviewDocument41 pagesPrelim ReviewKrisan Rivera100% (1)

- Irrecoverable Debts & Provision For Irrecoverables DebtsDocument5 pagesIrrecoverable Debts & Provision For Irrecoverables DebtsYomi AmvNo ratings yet

- Module 5-NOTE PAYABLE AND DEBT RESTRUCTUREDocument13 pagesModule 5-NOTE PAYABLE AND DEBT RESTRUCTUREJeanivyle Carmona100% (1)

- ACCCOB2 Quiz 1 SolutionsDocument20 pagesACCCOB2 Quiz 1 SolutionsShilla Mae BalanceNo ratings yet

- Audipra Substantive Test of Liabilities ILLUSTRATION 1 (Classification of Liabilities)Document5 pagesAudipra Substantive Test of Liabilities ILLUSTRATION 1 (Classification of Liabilities)Girl lang0% (1)

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Audit of ReceivablesDocument5 pagesAudit of ReceivablesandreamrieNo ratings yet

- Accounting For Promissory NotesDocument36 pagesAccounting For Promissory NotesAlyson Jane ConstantinoNo ratings yet

- Accounting For Promissory NotesDocument36 pagesAccounting For Promissory NotesAlyson Jane ConstantinoNo ratings yet

- IntAcc-1 Accounting For ReceivablesDocument13 pagesIntAcc-1 Accounting For ReceivablesShekainah BNo ratings yet

- Audit of Accounts ReceivablesDocument5 pagesAudit of Accounts ReceivablesIzza Mae Rivera KarimNo ratings yet

- Fabm1 PPT Q2W1Document62 pagesFabm1 PPT Q2W1giselle100% (1)

- Unit - TWO EdtdDocument14 pagesUnit - TWO EdtdHaileNo ratings yet

- Module 2f DiscountingDocument16 pagesModule 2f DiscountingChen HaoNo ratings yet

- Unit 3Document23 pagesUnit 3Nigussie BerhanuNo ratings yet

- Receivables ExerciseDocument3 pagesReceivables ExerciseJERICKO LIAN DEL ROSARIONo ratings yet

- HW On Receivables B PDFDocument12 pagesHW On Receivables B PDFJessica Mikah Lim AgbayaniNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Notes ReceivableDocument5 pagesNotes ReceivableJustine Carl Nikko NakpilNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableJustine Carl Nikko NakpilNo ratings yet

- Equity InvestmentsDocument4 pagesEquity InvestmentsJustine Carl Nikko NakpilNo ratings yet

- Inventory Cost FlowDocument3 pagesInventory Cost FlowJustine Carl Nikko NakpilNo ratings yet

- Investment (Financial Asset at Fair Value)Document3 pagesInvestment (Financial Asset at Fair Value)Justine Carl Nikko NakpilNo ratings yet