Professional Documents

Culture Documents

BIR Form No. 1948final

Uploaded by

dave torredaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form No. 1948final

Uploaded by

dave torredaCopyright:

Available Formats

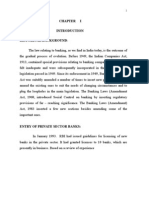

BIR Form No.

Republika ng Pilipinas Application for BIR International

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas Carriers Release Certificate 1948

August 2022

Fill in applicable spaces. Mark all appropriate boxes with an "X".

1. Type of Application 2. Registering Office

New Old (with previous transaction/s) Head Office Branch Office

PART I - International Carrier's Information

3. Type Air Sea 4. TIN - - - 5. RDO Code

6. Taxpayer Name ( If Individual , Last Name, First Name, Middle Name,Suffix) ( If Non-individual , Registered Name)

7. Business/Trade Name

8. Business Address

9. Contact No. (Landline/Mobile No.) 10. Email Address

11. Nationality 12. With Applicable tax Treaty? If yes, specify

Yes No

PART II - Flight/Voyage Information

13. Name of Aircraft/Vessel 14. Registry Number

15. Nationality 16. Port of Arrival

17. Date of Arrival (MM/DD/YYYY) 18. Last Port of Call

19. Date of Departure (MM/DD/YYYY) 20. Foreign Destination

21. Kind of Cargo 22. Volume of Cargo (in metric tons)

23. Freight Rate per Metric 24. Total Freight Revenue 25. Distance of Philippine Port to Foreign Port of Destination

Ton (if applicable) Earned (in nautical miles)

PART III - Domestic Agent Information

26. Taxpayer Identification Number (TIN) - - - 27. RDO Code

28. Withholding/Domestic Agent's Name ( If Individual , Last Name, First Name, Middle Name,Suffix) (If Non-individual , Registered Name)

29. Business/Trade Name 30. SEC/DTI Registration Number

31. Registered Address

32. Contact No. (Landline/Mobile No.) 33. Email Address

34. Name of Authorized Representative

PART IV - Computation of Tax Dues / Proof of Payment

A. INCOME TAX (Gross Philippine Billings Tax) B. PERCENTAGE TAX (Common Carrier's Tax)

Alphanumeric Tax Code (ATC) IC 080 Alphanumeric Tax Code (ATC) PT 041

1 Gross Philippine Billings 1 Gross Receipts

2 Foreign Exchange Conversion Rate x 2 Foreign Exchange Conversion Rate x

3 Tax Base (Item 1 x Item 2) 3 Tax Base (Item 1 x Item 2)

4 Applicable Tax Rate (2.5% / 1.5%) % 4 Applicable Tax Rate 3%

5 Income Tax Due (Item 3 x Item 4) 5 Percentage Tax Due (Item 3 x Item 4)

6 BIR Tax Payment Deposit Slip(s)/Confirmation Numbers 6 BIR Tax Payment Deposit Slip(s)/Confirmation Numbers

7 Issued By/Authorized Agent Bank's Name 7 Issued By/Authorized Agent Bank's Name

8 Date of Payment (MM/DD/YYYY) 8 Date of Payment (MM/DD/YYYY)

9 Total Amount Paid 9 Total Amount Paid

35 Declaration Stamp of Receiving Office and

I, ________________________________________, with TIN ____________________, Filipino, of legal age, with address at Date of Receipt

________________________________________________________________________________ and presently connected with

_______________________________________________________________ hereby certify that (1) the above stated information

are true and correct, and (2) this application is being submitted in order to secure an International Carriers Release Certificate as

required in the Memorandum of Agreement between the Bureau of Internal Revenue and the Bureau of Customs dated April 22,

1974 and September 7, 1979.

Attachments Complete?

Applicant/Authorized Representative YES NO

(Signature over Printed Name)

You might also like

- BIR Form NoDocument1 pageBIR Form NoAlden Christopher LumotNo ratings yet

- Application For Registration: BIR Form NoDocument1 pageApplication For Registration: BIR Form NoNy Li NamNo ratings yet

- Documentary Stamp Tax BIR Form 200-OTDocument1 pageDocumentary Stamp Tax BIR Form 200-OTNGITPANo ratings yet

- 0901-PR Final 03.2021 2Document2 pages0901-PR Final 03.2021 2Yuri LopezNo ratings yet

- 0901-T Final2 03.2021 2Document2 pages0901-T Final2 03.2021 2Yuri LopezNo ratings yet

- 0619-E Jan 2018 Rev Final-1-1Document8 pages0619-E Jan 2018 Rev Final-1-1cahiligjoyceNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument1 pageApplication For Registration: Kawanihan NG Rentas InternasGorgeousNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument1 pageApplication For Registration: Kawanihan NG Rentas InternasRyan TamondongNo ratings yet

- 1904 Jan 2000 Encs PDFDocument1 page1904 Jan 2000 Encs PDFRyan TamondongNo ratings yet

- BIR Form No. 0901-S1Document2 pagesBIR Form No. 0901-S1Aldrinn BenamirNo ratings yet

- BIR Form No. 0902 December 2020 Final3corrDocument3 pagesBIR Form No. 0902 December 2020 Final3corrJayson MercadoNo ratings yet

- 1604CDocument1 page1604CNguyen LinhNo ratings yet

- Certificate of Residence (For Tax Treaty Relief)Document3 pagesCertificate of Residence (For Tax Treaty Relief)Nancy VelascoNo ratings yet

- Pagsinag RA Forms March 2022Document15 pagesPagsinag RA Forms March 2022Angelica Perlyn AurelioNo ratings yet

- Application For Registration: Burce, Maryen Ammiel AbacanDocument1 pageApplication For Registration: Burce, Maryen Ammiel AbacanLalyn PasaholNo ratings yet

- Documentary Stamp Tax Declaration/ReturnDocument4 pagesDocumentary Stamp Tax Declaration/ReturnPajarillo Kathy AnnNo ratings yet

- 0901-O Final2 03.2021 2Document2 pages0901-O Final2 03.2021 2Edward FederisoNo ratings yet

- 1913 Final2 03.2023434341 2Document1 page1913 Final2 03.2023434341 2LandsNo ratings yet

- 1904 - LUBIDDocument1 page1904 - LUBIDLalyn PasaholNo ratings yet

- 1600Document9 pages1600jbabellarNo ratings yet

- Bir 1904Document2 pagesBir 1904Ann C PalomoNo ratings yet

- Monthly Remittance Return for VAT and Percentage TaxesDocument9 pagesMonthly Remittance Return for VAT and Percentage TaxesVincent De GuzmanNo ratings yet

- Application For Treaty Purposes: BIR Form NoDocument2 pagesApplication For Treaty Purposes: BIR Form NoEdward FederisoNo ratings yet

- BIR Form 1904 Application RegistrationDocument2 pagesBIR Form 1904 Application Registrationregine rose bantilanNo ratings yet

- Bir 1701a FormDocument2 pagesBir 1701a FormChe CacatianNo ratings yet

- BIR Form 1904 Application RegistrationDocument1 pageBIR Form 1904 Application RegistrationMariko DavidNo ratings yet

- 1604E Jan 2018 ENCS Final Annex BDocument2 pages1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Enhanced Voluntary Assessment Program Payment Form: Kawanihan NG Rentas InternasDocument3 pagesEnhanced Voluntary Assessment Program Payment Form: Kawanihan NG Rentas InternasNepean Philippines IncNo ratings yet

- Bir Form 1904Document2 pagesBir Form 1904luizzasharraNo ratings yet

- 2306 Jan 2018 ENCS v4Document33 pages2306 Jan 2018 ENCS v4nicky tampocNo ratings yet

- Annual Information Return for Withholding TaxesDocument2 pagesAnnual Information Return for Withholding TaxesTESSA SHINo ratings yet

- TM Application Form PDFDocument1 pageTM Application Form PDFIan LaynoNo ratings yet

- Bir Form 1600Document44 pagesBir Form 1600Jerel John CalanaoNo ratings yet

- Direct Emigrant Registration FormDocument2 pagesDirect Emigrant Registration FormSyed Muhammad MohsinNo ratings yet

- RMC No. 73-2019 - Annex ADocument1 pageRMC No. 73-2019 - Annex ALeo R.No ratings yet

- BIR Form 0616 Amnesty Tax Payment Form PDFDocument1 pageBIR Form 0616 Amnesty Tax Payment Form PDFLeichelle BautistaNo ratings yet

- BIR FORM 1604-F New FormDocument2 pagesBIR FORM 1604-F New FormJhen S. DomingoNo ratings yet

- For Self-Employed and Mixed Income Individuals, Estates and TrustsDocument2 pagesFor Self-Employed and Mixed Income Individuals, Estates and TrustsJeffrey TolentinoNo ratings yet

- BIR Form No. 0622 - Rev - Guidelines2correctedDocument2 pagesBIR Form No. 0622 - Rev - Guidelines2correctedjomarNo ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- Tax Amnesty Return On DelinquenciesDocument3 pagesTax Amnesty Return On DelinquenciesIML2016No ratings yet

- Bir Form 1901 New VersionDocument4 pagesBir Form 1901 New Versionchato law office80% (5)

- Monthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Document4 pagesMonthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)docdocdeeNo ratings yet

- RMC No. 73-2019 - Annex CDocument2 pagesRMC No. 73-2019 - Annex CLeo R.No ratings yet

- 0901-S3 Final 03.2021 2Document2 pages0901-S3 Final 03.2021 2Edward FederisoNo ratings yet

- Bir FormsDocument25 pagesBir FormsAngel Mae ToreniadoNo ratings yet

- Annex A - Application Form BIR Form 2119Document2 pagesAnnex A - Application Form BIR Form 2119Antonio Reyes IVNo ratings yet

- 82310BIR Form 1700Document4 pages82310BIR Form 1700TenNo ratings yet

- BIR Form 1701-Jan-2018-Encs.-FinalDocument6 pagesBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoNo ratings yet

- Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 pageMonthly Remittance Return: of Income Taxes Withheld On CompensationSafferon SaffronNo ratings yet

- Annex A - 1701A Jan 2018Document2 pagesAnnex A - 1701A Jan 2018jeffrey josol100% (2)

- BIR Form 2306 Certificate of Final Tax Withheld At SourceDocument4 pagesBIR Form 2306 Certificate of Final Tax Withheld At SourceBen Carlo RamosNo ratings yet

- Application For Registration: Combong Julius Paolo Noot PaoloDocument1 pageApplication For Registration: Combong Julius Paolo Noot PaoloJulius Noot CombongNo ratings yet

- International Applications of U.S. Income Tax Law: Inbound and Outbound TransactionsFrom EverandInternational Applications of U.S. Income Tax Law: Inbound and Outbound TransactionsNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Drafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsFrom EverandDrafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsRating: 1 out of 5 stars1/5 (2)

- Ch14 Bonds - Intermediate 2Document103 pagesCh14 Bonds - Intermediate 2BLESSEDNo ratings yet

- Assess credit worthinessDocument14 pagesAssess credit worthinessAsim MahatoNo ratings yet

- RBI's NEFT System GuidelinesDocument29 pagesRBI's NEFT System GuidelinesVickyNo ratings yet

- Accounting SummaryDocument39 pagesAccounting SummarySteph WynneNo ratings yet

- Veeresh - DCCBank - FinalDocument80 pagesVeeresh - DCCBank - FinalSangamesh BagaliNo ratings yet

- Computation of Shankar Sharma V2Document2 pagesComputation of Shankar Sharma V2akhil kwatraNo ratings yet

- IMIS Info Bulletin 2023 - The B-School that thinks aheadDocument16 pagesIMIS Info Bulletin 2023 - The B-School that thinks aheadAl OkNo ratings yet

- Statement of Cash Flows - CRDocument24 pagesStatement of Cash Flows - CRMzingaye100% (1)

- Soal Assignment Financial Audit IiDocument2 pagesSoal Assignment Financial Audit IiEunice ShevlinNo ratings yet

- CIR v. Bank of CommerceDocument6 pagesCIR v. Bank of Commerceamareia yapNo ratings yet

- 10 1108 - MF 06 2020 0300Document20 pages10 1108 - MF 06 2020 0300fenny maryandiNo ratings yet

- Introduction Historical Background: The Law Relating To Banking, As WeDocument125 pagesIntroduction Historical Background: The Law Relating To Banking, As WeBalaji Rao N100% (2)

- Functional Definition of Insurance: MeaningDocument6 pagesFunctional Definition of Insurance: MeaningShubham DhimaanNo ratings yet

- 50 Kpis Cheat Sheet by Nicolas BoucherDocument1 page50 Kpis Cheat Sheet by Nicolas Boucherniah100% (1)

- Questions On Mariott Case StudyDocument1 pageQuestions On Mariott Case StudyKaran BaruaNo ratings yet

- Form Vat-52Document2 pagesForm Vat-52khajuriaonlineNo ratings yet

- CH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Document71 pagesCH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Lina SakhiNo ratings yet

- d8cx8lqt6 Activity Chapter 13 Partnership DissolutionDocument1 paged8cx8lqt6 Activity Chapter 13 Partnership DissolutionLyra Mae De BotonNo ratings yet

- Working Capital Finance AdvisoryDocument18 pagesWorking Capital Finance AdvisoryAnnaNo ratings yet

- Different Between Conventional Economics & Islamic EconomicsDocument1 pageDifferent Between Conventional Economics & Islamic EconomicsFieza Kyrana100% (2)

- Dusty R BouthilletteDocument16 pagesDusty R Bouthillettedanw5646No ratings yet

- Allen Stanford Criminal Trial Transcript Volume 11 Feb. 6, 2012Document317 pagesAllen Stanford Criminal Trial Transcript Volume 11 Feb. 6, 2012Stanford Victims CoalitionNo ratings yet

- VanShop rental (1 year)Total:39,300Document51 pagesVanShop rental (1 year)Total:39,300Abdullah Muhammad0% (1)

- BUS 6140 module 1 AssignmentDocument4 pagesBUS 6140 module 1 AssignmentvertmeddNo ratings yet

- FRM Exam SampleDocument3 pagesFRM Exam SamplePriyanka AgarwalNo ratings yet

- Investment Guide Market Outlook Year End 2022 enDocument52 pagesInvestment Guide Market Outlook Year End 2022 enAurora Ferreira GonzalezNo ratings yet

- Qingdao Thundsea Marine Technology Proforma InvoiceDocument1 pageQingdao Thundsea Marine Technology Proforma InvoiceLiu AllieNo ratings yet

- Case Study (ENT530)Document12 pagesCase Study (ENT530)Nur Diyana50% (2)

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- Problem SetDocument105 pagesProblem SetYodaking Matt100% (1)