Professional Documents

Culture Documents

Formulas For Eco

Uploaded by

Devishi C0 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

Formulas for Eco

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageFormulas For Eco

Uploaded by

Devishi CCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

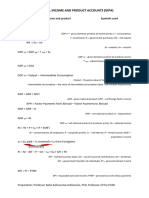

NATIONAL INCOME AND RELATED AGGREGATES

Gross Domestic Product at Market Price (GDPMP)

Gross Domestic Product at Factor Cost(GDPFC)

Net Domestic Product at Market Cost(NDPMP)

Net Domestic Product at Factor Cost(NDPFC or Domestic Income)

Gross National Product at Market Price(GNPMP)

Gross National Product at Factor Price(GNPFC)

Net National Product at Market Price(NNPMP)

Net National Product at Factor Cost(NNPFC or National Income)

Gross Net ( - Depreciation )

Net Gross (+ Depreciation)

Domestic National (+ NFIA)

National Domestic (-NFIA)

Market Price Factor Cost (-NIT)

Factor Cost Market Price (+NIT)

NIT(Net indirect Tax)=Indirect Taxes-Subsidies

NFIA(Net Factor Income from Abroad)=FIFA(Factor Income from Abroad)-FIPA(Factor Income Paid Abroad)

Ways to measure National Income:

1. Value added

2. Income Method

3. Expenditure Method

1. Value added=Value of Output-Intermediate Consumption

Calculating Value of Output

1.when the entire product is sold in the accounting year

Value of output =Sales+Production for self consumption

2.When the entire output is not sold in the accounting year

Value of output=Sales+change in stock(Closing stock-Opening stock)+Production for self consumption

3. Value of Output=(Quantity x Price)+Change in Stock

2. Income Method

NDPFC=Compensation of employees+Operating Surplus +Mixed Income of Self-Employed+Pro t

(wages+salaries in cash+ (Rent+Royalty+ (corporate tax+

wages+salaries in kind + Interest+Pro t) Dividend+

Employer’s contribution Retained Earning)

To social security scheme )

3. Expenditure Method

GDPMP=Private Final Government Final Gross Domestic Capital

Consumption + Consumption + Formation + Net exports

Expenditure Expenditure

Private Final Consumption Expenditure:

Household Final Consumption expenditure+Private Non-pro t Institution+Serving Households

Final Consumption Expenditure

Gross Domestic Capital Formation

Gross Fixed Capital Formation + Inventory Investment

(Net Fixed Capital Formation

Depreciation)

fi

fi

fi

You might also like

- Café Management System Full and Final ReportDocument18 pagesCafé Management System Full and Final ReportMuhammad Xalman Xhaw100% (3)

- Court Documents From Toronto Police Project Brazen - Investigation of Alexander "Sandro" Lisi and Toronto Mayor Rob FordDocument474 pagesCourt Documents From Toronto Police Project Brazen - Investigation of Alexander "Sandro" Lisi and Toronto Mayor Rob Fordanna_mehler_papernyNo ratings yet

- ACA 122-My Academic Plan (MAP) Assignment: InstructionsDocument5 pagesACA 122-My Academic Plan (MAP) Assignment: Instructionsapi-557842510No ratings yet

- Economics Grade Xii National Income and Related Aggregates - Formulae SheetDocument3 pagesEconomics Grade Xii National Income and Related Aggregates - Formulae SheetCharu GeraNo ratings yet

- Chapter 1 Economis For FinanceDocument6 pagesChapter 1 Economis For FinancePratham AgarwalNo ratings yet

- Important Formulas in Macroeconomics - Class 12 - GeeksforGeeksDocument16 pagesImportant Formulas in Macroeconomics - Class 12 - GeeksforGeeksPiyush vermaNo ratings yet

- Macroeconomics Measurement: Part 2: Measurement of National IncomeDocument17 pagesMacroeconomics Measurement: Part 2: Measurement of National IncomeManish NepaliNo ratings yet

- Eco Marathon Shubham AbadDocument38 pagesEco Marathon Shubham AbadBineetaNo ratings yet

- Chapter 2 MacroDocument26 pagesChapter 2 MacroHijo LepuNo ratings yet

- Economic Envt - National IncomeDocument30 pagesEconomic Envt - National IncomeRajat NigamNo ratings yet

- CH - 8 NATIONAL INCOME ACCOUNTING - FINALDocument35 pagesCH - 8 NATIONAL INCOME ACCOUNTING - FINALdeepakNo ratings yet

- National Income Accounting - Contd Eep-IDocument25 pagesNational Income Accounting - Contd Eep-IanonymousNo ratings yet

- National Income - DPP 02 - (Kautilya)Document4 pagesNational Income - DPP 02 - (Kautilya)Name SNo ratings yet

- CHAPTER 2 National Income 1 OnlineDocument28 pagesCHAPTER 2 National Income 1 OnlineMuhammad SyazwanNo ratings yet

- Macroeconomics Measurement: Part 2: Measurement of National IncomeDocument13 pagesMacroeconomics Measurement: Part 2: Measurement of National IncomeManish NepaliNo ratings yet

- National IncomeDocument16 pagesNational IncomeShreya KumariNo ratings yet

- Formula - Sheet Chapter 2Document6 pagesFormula - Sheet Chapter 2Sireen IqbalNo ratings yet

- Lecture 4-5-6 National Income Accounting1Document37 pagesLecture 4-5-6 National Income Accounting1Deepak KapaNo ratings yet

- National Income FINALDocument23 pagesNational Income FINALSanchit GargNo ratings yet

- Chapter 12Document6 pagesChapter 12bellavdbergNo ratings yet

- Chapter 6 (Part 1) Measuring Domestic Output, National Income and The Price LevelDocument31 pagesChapter 6 (Part 1) Measuring Domestic Output, National Income and The Price Levelchuojx-jb23No ratings yet

- Chapter-2 GDP, Inflation and UnemplyementDocument61 pagesChapter-2 GDP, Inflation and Unemplyementpapia rahmanNo ratings yet

- Index: Economics For FinanceDocument32 pagesIndex: Economics For FinanceJoseph PrabhuNo ratings yet

- Measuring National Income Chap 9 BEEB1013Document24 pagesMeasuring National Income Chap 9 BEEB1013Delvwynn Chin Dik WaiNo ratings yet

- Macroeconomics: Lecturer: Mr. AllicockDocument32 pagesMacroeconomics: Lecturer: Mr. AllicockPrecious MarksNo ratings yet

- National Income Isc NotesDocument5 pagesNational Income Isc NotesAbhinav SinghNo ratings yet

- Eco Revision BookDocument37 pagesEco Revision BookYaman AgarwalNo ratings yet

- National Income AccountingDocument37 pagesNational Income Accountingnavya.cogni21No ratings yet

- National Income & Methods To CalculateDocument13 pagesNational Income & Methods To Calculateshanmastan781No ratings yet

- JK Shah Economics Revisionery NotesDocument54 pagesJK Shah Economics Revisionery Notesकनक नामदेवNo ratings yet

- Market EquilibriumDocument169 pagesMarket EquilibriumnadidawaunionthekkekadNo ratings yet

- Economics Lesson NotesDocument10 pagesEconomics Lesson NotesyeroonrNo ratings yet

- Inter Ca: Revision NotesDocument55 pagesInter Ca: Revision NotesRaghavanjNo ratings yet

- Macroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)Document48 pagesMacroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)RohanNo ratings yet

- IncomeDocument7 pagesIncomeSumaira LaghariNo ratings yet

- Unit II: National Income: - NI ApproachesDocument24 pagesUnit II: National Income: - NI ApproachesÛbř ÖňNo ratings yet

- NIacctgapproachDocument3 pagesNIacctgapproachAin ShafikahNo ratings yet

- CH 2 MacroeconomicsDocument63 pagesCH 2 MacroeconomicsYidid GetachewNo ratings yet

- Chapter 1 NATIONAL INCOME AND RELATED AGGREGATES RNDocument5 pagesChapter 1 NATIONAL INCOME AND RELATED AGGREGATES RNSrishty VermaNo ratings yet

- Brief Notes National Income and Related AggregatesDocument1 pageBrief Notes National Income and Related AggregatesKeshvi AggarwalNo ratings yet

- Economic Environment of Business-GdpDocument42 pagesEconomic Environment of Business-GdpBalajiNo ratings yet

- Economic - Analysis For - Business - Unit - IVDocument35 pagesEconomic - Analysis For - Business - Unit - IVViswanath ViswaNo ratings yet

- The Related Aggregates of National Income AreDocument12 pagesThe Related Aggregates of National Income Aretransport bassNo ratings yet

- Presented By: Syndicate 6Document37 pagesPresented By: Syndicate 6suasiveNo ratings yet

- National Income PPT 2Document33 pagesNational Income PPT 2Maanya SharmaNo ratings yet

- Lecture 3 NI AccountingDocument21 pagesLecture 3 NI AccountinganonymousNo ratings yet

- National Income & Related Aggregates (UNIT 1-CHAPTER-3) 1. Gross, Net & DepreciationDocument3 pagesNational Income & Related Aggregates (UNIT 1-CHAPTER-3) 1. Gross, Net & DepreciationGeeta BhattNo ratings yet

- Net National Product and Net Domestic IncomeDocument3 pagesNet National Product and Net Domestic IncomeLalithya Sannitha MeesalaNo ratings yet

- Eco 200 - Principles of Macroeconomics: Chapter 6: National Income AccountingDocument10 pagesEco 200 - Principles of Macroeconomics: Chapter 6: National Income AccountingElaine MateoNo ratings yet

- 2 C Nipa BKSDocument1 page2 C Nipa BKSHusniyor AbdumalikovNo ratings yet

- MACROECONOMICS Chap. 2Document3 pagesMACROECONOMICS Chap. 2ASTA ACHIEVERS TUITIONSNo ratings yet

- Formula Chapter 2 National Income AccountingDocument1 pageFormula Chapter 2 National Income AccountingwongNo ratings yet

- Lec 15. National Income Accounting V3 REVISEDDocument33 pagesLec 15. National Income Accounting V3 REVISEDAbhijeet SinghNo ratings yet

- National Income: Deval B PatelDocument26 pagesNational Income: Deval B PatelPankaj ParsaniaNo ratings yet

- EconomicsDocument66 pagesEconomicsSangeeta YadavNo ratings yet

- National Income AcctgDocument7 pagesNational Income AcctgPreethi MendonNo ratings yet

- HSN-01ECONOMICS National Income - PPTDocument28 pagesHSN-01ECONOMICS National Income - PPTVimal GuptaNo ratings yet

- (CHAPTER 2 National Income Aggregates.Document16 pages(CHAPTER 2 National Income Aggregates.AshishNo ratings yet

- National Income: - by Shikha SinghDocument40 pagesNational Income: - by Shikha SinghPrashastiNo ratings yet

- National Income and Related AggregatesDocument18 pagesNational Income and Related AggregatesRishika SinghNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Rectification of Errors Accounting Workbooks Zaheer SwatiDocument6 pagesRectification of Errors Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- PT3 Liste PDFDocument2 pagesPT3 Liste PDFSiti KamalNo ratings yet

- Research Article: Old Sagay, Sagay City, Negros Old Sagay, Sagay City, Negros Occidental, PhilippinesDocument31 pagesResearch Article: Old Sagay, Sagay City, Negros Old Sagay, Sagay City, Negros Occidental, PhilippinesLuhenNo ratings yet

- 130004-1991-Maceda v. Energy Regulatory BoardDocument14 pages130004-1991-Maceda v. Energy Regulatory BoardChristian VillarNo ratings yet

- Stdy RCD PDFDocument204 pagesStdy RCD PDFBol McSafeNo ratings yet

- Bba 2ND Year Business Communication NotesDocument11 pagesBba 2ND Year Business Communication NotesDivya MishraNo ratings yet

- HARRISON 1993 - The Soviet Economy and Relations With The United States and Britain, 1941-45Document49 pagesHARRISON 1993 - The Soviet Economy and Relations With The United States and Britain, 1941-45Floripondio19No ratings yet

- MigrationDocument6 pagesMigrationMaria Isabel PerezHernandezNo ratings yet

- Jao Vs Court of Appeals G.R. No. 128314 May 29, 2002Document3 pagesJao Vs Court of Appeals G.R. No. 128314 May 29, 2002Ma Gabriellen Quijada-TabuñagNo ratings yet

- Chessboard PDFDocument76 pagesChessboard PDFAlessandroNo ratings yet

- Life Without A Centre by Jeff FosterDocument160 pagesLife Without A Centre by Jeff Fosterdwhiteutopia100% (5)

- Checklist of Requirements of Special Land Use PermitDocument1 pageChecklist of Requirements of Special Land Use PermitAnghelita ManaloNo ratings yet

- Romeuf Et Al., 1995Document18 pagesRomeuf Et Al., 1995David Montaño CoronelNo ratings yet

- Jeoparty Fraud Week 2022 EditableDocument65 pagesJeoparty Fraud Week 2022 EditableRhea SimoneNo ratings yet

- Albert Einstein's Riddle - With Solution Explained: October 19, 2009 - AuthorDocument6 pagesAlbert Einstein's Riddle - With Solution Explained: October 19, 2009 - Authorgt295038No ratings yet

- John Wick 4 HD Free r6hjDocument16 pagesJohn Wick 4 HD Free r6hjafdal mahendraNo ratings yet

- How To Play Casino - Card Game RulesDocument1 pageHow To Play Casino - Card Game RulesNouka VENo ratings yet

- PFASDocument8 pagesPFAS王子瑜No ratings yet

- Cyber Ethics IssuesDocument8 pagesCyber Ethics IssuesThanmiso LongzaNo ratings yet

- Architect Magazine 2023 0506Document152 pagesArchitect Magazine 2023 0506fohonixNo ratings yet

- Disciplinary Literacy Strategies To Support Transactions in Elementary Social StudiesDocument11 pagesDisciplinary Literacy Strategies To Support Transactions in Elementary Social Studiesmissjoseph0803No ratings yet

- Due Date: 29-12-2021: Fall 2021 MTH104: Sets and Logic Assignment No. 1 (Lectures # 16 To 18) Total Marks: 10Document3 pagesDue Date: 29-12-2021: Fall 2021 MTH104: Sets and Logic Assignment No. 1 (Lectures # 16 To 18) Total Marks: 10manzoor ahmadNo ratings yet

- Bed BathDocument6 pagesBed BathKristil ChavezNo ratings yet

- Sokkia GRX3Document4 pagesSokkia GRX3Muhammad Afran TitoNo ratings yet

- Brief For Community Housing ProjectDocument5 pagesBrief For Community Housing ProjectPatric LimNo ratings yet

- Coaching Manual RTC 8Document1 pageCoaching Manual RTC 8You fitNo ratings yet

- Math 3140-004: Vector Calculus and PdesDocument6 pagesMath 3140-004: Vector Calculus and PdesNathan MonsonNo ratings yet