Professional Documents

Culture Documents

Baook 1

Baook 1

Uploaded by

Cece Castro0 ratings0% found this document useful (0 votes)

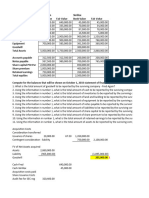

11 views1 pageThe document shows the accounting entries for a sale-leaseback transaction where a company sold machinery for $700,000 and leased it back for 4 years of payments of $150,000 per year. It calculates that the gain on the sale portion of the transaction is $26,973, which is recognized immediately.

Original Description:

Original Title

Baook1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows the accounting entries for a sale-leaseback transaction where a company sold machinery for $700,000 and leased it back for 4 years of payments of $150,000 per year. It calculates that the gain on the sale portion of the transaction is $26,973, which is recognized immediately.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageBaook 1

Baook 1

Uploaded by

Cece CastroThe document shows the accounting entries for a sale-leaseback transaction where a company sold machinery for $700,000 and leased it back for 4 years of payments of $150,000 per year. It calculates that the gain on the sale portion of the transaction is $26,973, which is recognized immediately.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

Cash (700,000-150,000) 550,000.

00

Right- -of Use Machinery 432,568.00

Machinery 50,000.00

Gain on Sale Leaseback 26,973.00

Lease Liability (605,595 150,000) 455,595.00

Net cash received (700,000 – 150,000) 550,000.00

Present value of lease payments (150,000 x 4.0373) 605,595.00

Lease liability after 1st – payment (605,595 150,000) 455,595.00

Fair value of right transferred (700,000 605,595) 94,405.00

Carrying amount of rights retained (605,595/700,000) x 500,00 432,568.00

Carrying amount of right transferred (500,000 432,568) 67,432.00

Total gain (700,000 – 500,000) 200,000.00

Recognized gain:

(94,405/700,000) x 200,000 26,973.00

Gain may also be computed as:

Selling price 700,000.00

Fair value of asset retained 605,595.00

Fair value of asset transferred 94,405.00

Carrying amount of rights transferred 67,432.00

Gain on sale leaseback 26,973.00

You might also like

- Pilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocument1 pagePilsudski Coal Company-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib Dahal50% (2)

- Chapter 1 Abc Suggested SolutionsDocument7 pagesChapter 1 Abc Suggested SolutionsAlthea Lyn ReyesNo ratings yet

- Activity6 1Document3 pagesActivity6 1Prince ArañasNo ratings yet

- Cash Flow Q PDFDocument1 pageCash Flow Q PDFSyed Farhan AliNo ratings yet

- Advanced Accounting - PART 1Document6 pagesAdvanced Accounting - PART 1Akira Marantal ValdezNo ratings yet

- ACCTAX2 Business Case RecentDocument5 pagesACCTAX2 Business Case RecentHazel Joy DemaganteNo ratings yet

- Current AssetsDocument2 pagesCurrent AssetsHRH PasigNo ratings yet

- Problem 15 - 1 Books of German CompanyDocument3 pagesProblem 15 - 1 Books of German CompanyCOCO IMNIDANo ratings yet

- Budget ControllingDocument1 pageBudget ControllingLester ErlanoNo ratings yet

- The Answer For Movie ThetareDocument2 pagesThe Answer For Movie ThetareSajakul SornNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Three Year Projected Comprehensive Income StatementDocument3 pagesThree Year Projected Comprehensive Income StatementKin-Aleth Damiles AragonNo ratings yet

- Budget Template With ChartsDocument1 pageBudget Template With ChartsAli ErlanggaNo ratings yet

- 1Document2 pages1Trixie IdananNo ratings yet

- Kaya Koto Merchandise WorksheetDocument4 pagesKaya Koto Merchandise WorksheetAeron John MORALESNo ratings yet

- Answer Key Midterm Examination LabDocument9 pagesAnswer Key Midterm Examination LabAMIKO OHYANo ratings yet

- Suka at Patis Company Statement of Cash Flows For The Year Ended December 31, 2020Document23 pagesSuka at Patis Company Statement of Cash Flows For The Year Ended December 31, 2020Von Andrei MedinaNo ratings yet

- Comp 4Document7 pagesComp 4PunchedASnail klo.No ratings yet

- Problem 1 A Cost of Machinery 285,000.00Document10 pagesProblem 1 A Cost of Machinery 285,000.00Leilalyn NicolasNo ratings yet

- Answer Key - Midterm ExamDocument5 pagesAnswer Key - Midterm ExamSilvermist AriaNo ratings yet

- Chapter 7 - Compound Financial Instrument (FAR6)Document5 pagesChapter 7 - Compound Financial Instrument (FAR6)Honeylet SigesmundoNo ratings yet

- Sale and LeasebackDocument3 pagesSale and LeasebackQueen ValleNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Advanced Accounting - PART 1Document6 pagesAdvanced Accounting - PART 1Akira Marantal ValdezNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Cash Flow Direct IndirectDocument18 pagesCash Flow Direct IndirectTalha HassanNo ratings yet

- Cash Flow Statement Template in ExcelDocument5 pagesCash Flow Statement Template in ExcelOyewale OyelayoNo ratings yet

- Financial StatementDocument3 pagesFinancial StatementSanchit SharmaNo ratings yet

- Term Paper F-206Document2 pagesTerm Paper F-206samsuNo ratings yet

- v2 Assignment Due 26.3.2023Document24 pagesv2 Assignment Due 26.3.2023alisa rachelNo ratings yet

- Item Surplus AccountDocument3 pagesItem Surplus Accountbadette PaningbatanNo ratings yet

- Solution ADV GMDocument14 pagesSolution ADV GMsherlockNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- FV Differential: Amortization TableDocument17 pagesFV Differential: Amortization TableBeenish JafriNo ratings yet

- Assignment 5Document17 pagesAssignment 5Beenish JafriNo ratings yet

- Compe SolutionDocument10 pagesCompe SolutionRianell Andrea AsumbradoNo ratings yet

- 5,655.00 Additional Investment Needed/financingDocument23 pages5,655.00 Additional Investment Needed/financingMPCINo ratings yet

- Please Kindly Joint With Us For More:: - Facebook Group: Cambodia Accounting and TaxDocument2 pagesPlease Kindly Joint With Us For More:: - Facebook Group: Cambodia Accounting and TaxLay TekchhayNo ratings yet

- Activity 2Document1 pageActivity 2John Michael Gaoiran GajotanNo ratings yet

- Mount Carmel School of Maria Aurora, Inc. Maria Aurora, 3202 AuroraDocument5 pagesMount Carmel School of Maria Aurora, Inc. Maria Aurora, 3202 AuroraZoe Vera S. AcainNo ratings yet

- LQ3 FinalDocument6 pagesLQ3 FinalRaz MahariNo ratings yet

- Quiz AE 120Document10 pagesQuiz AE 120Katrina MalecdanNo ratings yet

- Accounting Fundamentals Practice-ASH - IVADocument12 pagesAccounting Fundamentals Practice-ASH - IVAalitohdezsalNo ratings yet

- Accounting Fundamentals PracticeDocument9 pagesAccounting Fundamentals PracticealitohdezsalNo ratings yet

- Chicken Sisig La-Buffalo Projected Statement of Cash Flow For The Month Ended May 31, 2021Document2 pagesChicken Sisig La-Buffalo Projected Statement of Cash Flow For The Month Ended May 31, 2021Anime TV'sNo ratings yet

- Balance Comprob (Youtube)Document5 pagesBalance Comprob (Youtube)luisNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- LeaseDocument1 pageLeaseAlona MeladNo ratings yet

- Monthly Company Budget1Document4 pagesMonthly Company Budget1Brian SetterNo ratings yet

- Budget Template With ChartsDocument3 pagesBudget Template With ChartsAhmedNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationJaira ClavoNo ratings yet

- Business Combination - Date of Acquisition - SolManDocument9 pagesBusiness Combination - Date of Acquisition - SolManTrace ReyesNo ratings yet

- Accounting For Business Combi SolutionDocument4 pagesAccounting For Business Combi SolutionSophia Anne Margarette NicolasNo ratings yet

- Problem 3&5Document17 pagesProblem 3&5panda 1No ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Chapter 1 Afar (Bus Com)Document24 pagesChapter 1 Afar (Bus Com)jajajaredredNo ratings yet

- Financial Projections For The Next Three YearsDocument1 pageFinancial Projections For The Next Three Yearsskincareby511No ratings yet

- Trial Balance (Group 6) PDFDocument1 pageTrial Balance (Group 6) PDFLiam SantosNo ratings yet

- Suggested Answers Assignment Notes PayableDocument4 pagesSuggested Answers Assignment Notes PayableKeikoNo ratings yet

- Report 2Document11 pagesReport 2Cece CastroNo ratings yet

- Book 16Document1 pageBook 16Cece CastroNo ratings yet

- Lesson ObjectiveDocument1 pageLesson ObjectiveCece CastroNo ratings yet

- Activity 8Document2 pagesActivity 8Cece CastroNo ratings yet

- Book 1Document1 pageBook 1Cece CastroNo ratings yet

- Book 12Document1 pageBook 12Cece CastroNo ratings yet

- Book 19Document1 pageBook 19Cece CastroNo ratings yet

- Activity 7Document2 pagesActivity 7Cece CastroNo ratings yet

- Book 13Document1 pageBook 13Cece CastroNo ratings yet

- Ayon Kay BorjaDocument1 pageAyon Kay BorjaCece CastroNo ratings yet

- Book 7Document1 pageBook 7Cece CastroNo ratings yet

- Activity 6Document1 pageActivity 6Cece CastroNo ratings yet

- Book 22Document1 pageBook 22Cece CastroNo ratings yet

- Book 5Document1 pageBook 5Cece CastroNo ratings yet

- Book 3Document1 pageBook 3Cece CastroNo ratings yet

- 11Document1 page11Cece CastroNo ratings yet

- Book 18Document1 pageBook 18Cece CastroNo ratings yet

- ADocument2 pagesACece CastroNo ratings yet

- Activity 5Document1 pageActivity 5Cece CastroNo ratings yet

- Ayon Sa Inquirer LifestyleDocument1 pageAyon Sa Inquirer LifestyleCece CastroNo ratings yet

- Automate Consumer Complaints HandlingDocument1 pageAutomate Consumer Complaints HandlingCece CastroNo ratings yet

- Aquatic ActivitiesDocument2 pagesAquatic ActivitiesCece CastroNo ratings yet

- Book 6 ADocument1 pageBook 6 ACece CastroNo ratings yet

- R 4Document1 pageR 4Cece CastroNo ratings yet

- Book 1Document1 pageBook 1Cece CastroNo ratings yet

- Establish A Unified Penology and Corrections SystemDocument1 pageEstablish A Unified Penology and Corrections SystemCece CastroNo ratings yet

- R 2Document1 pageR 2Cece CastroNo ratings yet

- Problem #4Document1 pageProblem #4Cece CastroNo ratings yet

- Problem #3Document1 pageProblem #3Cece CastroNo ratings yet

- 13Document1 page13Cece CastroNo ratings yet