Professional Documents

Culture Documents

AFAR - Standard Costing

AFAR - Standard Costing

Uploaded by

lender kent alicante0 ratings0% found this document useful (0 votes)

38 views23 pagesOriginal Title

AFAR_standard costing

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views23 pagesAFAR - Standard Costing

AFAR - Standard Costing

Uploaded by

lender kent alicanteCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 23

sis

Chapter 10- Standard Costing

MULTIPLE CHOICE — Theory of Accounts

TOA 10-1 (AICPA)

A standard cost system may be used in

a. Job order costing but not process costing.

b. Either job order costing or process costing.

¢. Process costing but not job order costing.

d. Neither process costing nor job order costing.

TOA 10-2 (AICPA)

Which of the following is 2 purpose of standard costing?

a. Determine breakeven production level,

b. Control costs,

¢. Eliminate the need for subjective decisions by management.

d. Allocate cost with more accuracy.

TOA 10-3 (AICPA)

Which of the following is true concerning standard costs?

a. — Standard costs are estimates of Costs attainable only under the most ideal

conditions, but rarely Practicable,

b. Standard costs are difficult to use with a process costing system.

c. If properly used, standard can help motivate employees.

d. _ Unfavorable variances, material in amount, should be investigated, but

large favorable variances need not be investigated.

TOA 10-4 (Adapted)

Which one of the following is least likely to be involved in establishing standard

Costs for evaluation purposes? .

a. Budgetary accountants

b. Industrial engineers

¢. Top management

d. Quality control Personnel

trol and budgeted costs

cont

the budget us

TOA 10-5 (Adapted) used for Cetermined afte

A difference betwoen standard COPE og . ts should be,

4. Can exist because st represent what costs § aly

sts \dard

completed standard costs expected a whereas stan

rele a pete ee roots are histor

wi

Can exist because budgete Fs mounts.

$ jineering studies.

one

TOA 10-6 (Adapted) sd hy 2 firm in conjunction swith

: ost often us

A standard costing system is m

jectives.

&. Management by objective

Target (hurdle) rates of return.

: :

¢. Participative management programs.

4. Flexible budgets

TOA 10-7 (Adapted)

tandards should be set to measure Controllable

The best basis upon which cost si

ion inefficiencies is

2 eis tec performance.

5. Normal capacity,

c. Recent average historical Performance.

d Engineering Standards based on attainable performance,

TOA 10-8 (AICPA)

osting System, how, if at all, are

When Standard costs are used in a Process cx

equivalent units of Production (EUP) involved Or used in the cost Teport at

9

& Equivalent units are not used,

b. Equivalent Units are Computed Using a Special approach,

The actual equivalent units are multiplied by the Standard cost Per unit.

The standard equivalent units are multiplied by the actual cost per unit.

TOA 10-9 (AICPA) ink

Standard costing will produce the same income before extraordinary

actual costing when standard cost variances are assigned to

Work in process and finished goods inventories.

‘An income or expense account.

Cost of goods sold and inventories.

Cost of goods sold.

b.

G

d.

TOA 10-10 (AICPA)

Differences in product costs resulting from the application of actual overhead

rates rather than predetermined overhead rates could be immaterial if

a. Production is not stable,

b, Fixed factory overhead is a significant cost.

©. Several products are produced simultaneously.

d. Overhead is composed only of variable costs.

TOA 10-11 (Adapted)

Under Standard Costing System, when cost of direct material or cost of direct

labor will be journalized, the work in Process account will be debited at

a. Actual cost

b. Standard cost :

¢. Future cost

d. Historical cost

TOA 10-12 (Adapted)

The difference between the actual amounts an il

eateecr ne aot and the flexible budget amounts for

a. Production volume variance,

b. Flexible budget variance,

© Sales volume variance.

d. Standard cost Variance.

TOA 10-13 (Adapted)

i mount.

The sales volume variance equals asa sai ae eee hecages

il ant mini ti a

a. A flexible budget amount mint in Bes the actual units

b. Actual operating income minus HEN) ie,

ice minus budget ;

¢. Actual unit price minus aE ays

luced. :

4. Badgered unit price times the difference Bet.

: budgeted inputs for the actual activity le’

TOA 10-14 (Adapted)

An efficiency variance equals :

a. A flexible budget amount minus « static budget eee eee

Actual operating income minus flexible budget operating .

b oe A s

¢. Actual unit price minus budgeted unit price, times the actual units

produced, :

d. Budgeted unit price times the di*ference between actual inputs and

budgeted inputs for the actual activity leve! achieved.

TOA 10-15 (AICPA)

Which i ite ?

ais eee 4S customarily hold responsible for an unfavorable materials

@ Quality control.

5. Purchasing.

c. Engineering,

d. Production,

TOA 10-16 (Adapted)

Under a standard

Responsibility of “St S¥stem, the materials ficiency vari

. ; : ne

f ation and industria engineer CES are the

Parchasin® industria 78.

a hasing and es,

Sales and ing

TOA 10-17 (Adapted)

ion control

Which of the following variances is most controllable by the production

supervisor?

a. Material price variance

Material usage variance

Variable overhead spending variance

b

©.

d. Fixed overhead budget variance

TOA 10-18

a.. Actual price of di n

6. Actual Price of direct material is lower than the standard price

¢. Actual direct materials used in higher than the standard quantity of

direct materials f

d. Actual direct materials used is lower than the standard quantity of direct

materials.

TOA 10-19 (AICPA)

An unfavorable price Variance occurs because of

a. Price increases for raw materials.

b. Price decreases for Taw materials,

¢. Less than anticipated levels of waste in the manufacturing process,

a. More than anticipated levels of waste in the manufacturing procece

TOA 10-20 (Adapted)

The difference between the actual and standard pri f an ii multipliedby

the actual quantity equals the eee ae

a Price (rate) Variance

6. Controllable variance

¢ Spending variance

d, Quantity (usage) variance

$20 variance shall be

ial price

ter

I mat

TOA 10-21 (Adapted) syste, direct

Standard Costs

r

vad ety compte 8

ar Actual iret trial? ra yin process

} i : on

7 anil inet materi “onverted 10 ™

. inect materi

d. Actual direct mé

‘d with the

; -d compares

jals use N Operati,

Tan AICPA se al cat of equied) fice mdunaget

materials varianes Tint of mate! ted as tO ifitis

Se oe er cioigandard amo O further vale variance if it is

ite the tot

is variance

hb ble, why must this variance 7

is favoral Ta a noed to further eval

i ul

oaniy ena accounting principles req}

it for

analyzed in three stages. inthe annual report to equity owners

All variances must appear

d. Detem fatness and usage variances allows raat to evaluate

. terminin, C ; a

the efficiency of the purchasing and production fun

a re that all variances be

b

c

TOA 10-23 (Adapted)

Price variances and efficiency variances can be key to the Performance

‘measurement within a company, In evaluating the py erformance within a

Company, a materials efficiency variance can be caused by all of the following

except the

a. Performance of the workers using the material,

5. Actions of the Purchasing department,

¢. Design of the Product.

Sales volume Of the product,

TOA 10-24 Adapted)

The journal entry to

A Tecord the

Pant itludes a debit tg direct mayo 2" Purchase of di ;

8 statements jg come 'al efficiency "ance Wg ding the

” . o

ie

521

10 Standard Costing

Gespier

ne the standard

The actual direct material used in production is higher than

a ei

rect materials that should have been used, itis -

b. The actual direct materials used in production is lower than

"direct materials that should have been aed atta eet

The actual purchase price of direct materials is higher

ice of direct materials. : ass aadard

d. The actual purchase price of direct materials is lower than

price of direct materials.

©

TOA 10-25 (AICPA)

i . indicates that

A debit balance in the direct labor efficiency variance account indicates

a, Standard hours exceed actual hours,

b. Actual hours exceed standard hours. :

c- Standard rate and standard hours exceed actual rate and actual ious

d. Actual rate and actual hours exceed standard rate and standard

TOA 10-26 (AICPA)

a. Materials mix.

b. Materials price,

¢. Labor rate.

4. Labor efficiency,

TOA 10-27 (Adapted)

Variable overhead is applied on the basis of standard direct labor hours. If, fora

given period, the direct labor efficiency variance is unfavorable, the variable

overhead efficiency variance will be

a. Favorable

Unfavorable

c. Zero

a. The same amount as the labor efficiency variance

TOA 10-28 (Adapted)

Under Standard Costing System, if the actual direct labor hours i

er Stan i rs is more

Standard direct labor hours, the Journal entry to Tecord the incurring a

labor cost wil] Tesult to

$22

variance

a. Debit to labor efficiency

b. Credit to labor rate vananr |

| Gredit to labor efficiency ©

Debit to labor rate varian

TOA 10-29 (AICPA) um will be disclosed in

Excess direct labor wages resulting

which type of variance?

a. Yield

b. Quantity

¢. Labor efficiency

d. Labor rate

from overtime premi

TOA 10-30 (AICPA)

The difference between the actual-labor rate multiplied by fe actual hours

worked and the standard labor rate multiplied by the standard labor hours is the

a." Total labor variance.

b. Labor rate variance,

¢. Labor usage variance.

d. Labor efficiency variance.

TOA 10-31 (Adapted)

Which of the following fac

a. Spending variance

Controllable Variance

¢. Efficiency Variance

4. Volume Variance

tory overhead variances is Pure variable?

TOA 10-32 (aicpay

The fixed fac :

a ity level Teneeait ication Tate

ay level for g Biven period i for g

Zero, ; the vo} : t equal thi: i

b Favorabye “me Variance will be T!S Predetermined

. Unfavorable,

@_ Either favorable or unfavorable, depending on the budgeted overhead.

TOA 10-33 (AICPA)

Which of the following standard

a production supervisor?

a. Overhead volume.

b. Overhead efficiency.

c. Labor efficiency.

d. Materials usage.

costing ' variances would be least controllable by

TOA 10-34 (Adapted)

Which of the following factory overhead variances is pure fixed?

2 Spending variance

b. Controllable variance

c. Efficiency variance

4. Volume variance

TOA 10-35 (AICPA)

Unde. the two-variance method for analyzing factory overhead, the difference

between the actual factory Overhead and the factory overhead applied to

Production is the ,

a.. Controllable variance.

b. . Net overhead variance,

¢. Efficiency variance,

d. Volume variance.

ous

blems

MULTIPLE CHOICE - Pro!

hour but shouig

10 per

PROB. 10-1 (Adapted) a cost of P

is the proper journa}

ete at _ What is

ject required $0 hours to COMPIY YF our

A project equired 50 hou oor 540

have taken only

entry to record the costs? 100

a. Work in process _ 2 500

DL efficiency variane

DL Price variance 440

Accrued payroll 60

b. Wage expenses 500

DL efficiency variance 460

‘Accrued payroll 100

©. Work in process 60

DL price variance

DL effceney variance 500

Accrued payroll 500

4. Work in process $00

Accrued payroll

PROB, 10-2 (Adapted)

have applied P31,500 of fixed factory overhead if Capacity

mee eae Given that 2,000 standard hours were allowed

for the actual Output, that actual fixed factory overhead equaled the budgeteg

amount, and that overhead was applied at a rate of PIS per hour, what is the

Journal entry to Close the fixed factory overhead accounts?

a. Fixed overhead contro]

30,000

Production volume Variance 1,500

Fixed overhead applied 31,500

Cost of, 800ds sold 31,500 :

Fixed overhead contro] ,

(ork in process 31,500

Overhead price Variance 30,000

. Fixed overhead applied 1.500

Fixed overhead *Dplied 31,500

Production Vol Variance 30,000

Fixed over contro} 1,500

31,500

“Chapter 10 stanaara Costing

PROB, 10-3 (Adapted)

, The

eealn the production area.

Pp on cbr oom

tors.

Company pai s Ps

dommpany ot standard dort of jenic

May, 530 hours were worked by the j

is janitorial expenses

a) What is the proper journal entry to record this janit

worked by the janitors?

0

a. Salaries expense 2,65 2,650

aa 2,650

b. Variable overhead control z 2650

Variable overhead applied heap

©. Variable overhead control ; 650

Payroll payable Sao

4. Variable overhead applied ; Sean

Payroll payable

icatic ‘0

b) What is the appropriate journal entry to record the application of the 53

hours worked by the janitors?

a. Work in process 2,385 ae

Variable overhead applied a

b. Work in process 2,385

Variable overhead control 2,385

c. Variable overhead control 265

Work in process 2,385

' Variable overhead applied : 2,650

d. Cost of goods sold 2,385

Variable overhead applied : 2,385

PROB. 10-4 (Adapted)

Process Co. uses a standard Cost system that carries materials at actual Price

until they are transferred to the work in process account. In Project A, 500 units

of Material X were used at a cost of P10 per unit. Standards Tequire 450 units to

complete this project, The standard price. is established at P9 per unit. What is

the journal entry to record direct materials issued?

a. Work in Process 4,950

DM price variance 500

DM quantity variance 450

Inventory 5,000

1 10 Standard Costin

$26 a ee

S00

7 450

b. Work in process

DM price variance ste

DM quantity variance aah

Inventory 00

©. Work in process ao

DM price variance ; %

DM quantity variance : 000

Inventory 000 2

d. Work in process 000

Inventory

PROB. 10-5 (AICPA)

costs for the month of January was a,

Information on Cox Co.’s direct material

follows:

18,000

Actual quantity purchased P 3.60

Actual unit purchase price .

Materials purchase price variance - unfavorable

(based on purchases) 4 P 3,600

Standard quantity allowed for actual production 16,000

Actual quantity used 15,000

For the month of Jam i : 4

ee uary, there was a favorable direct material usage variance of

& 3,375

© 3,400

4 3,800

PROB, 10-6 (AICPA)

Carr Co, had an

is vari: unfavorable materi, i

this variance should be charged be ey deparinee ae of P900. What amount

t? for

Purchasin,

Purchasing “Warehousing

oe Mecho Manufacturing

a.

i 0

fe 300 900 00

| 500

- 0 300 -

0

‘ili

SGheetee 10= speneers cum

PROB. 10-7 (Adapted)

chase. What is the journal

ice variances are recorded at the time of purchase. eis

By to tooo a direct materials price variance if materials are purcha:

per unit for P650 and their standard price is P4 per unit? 650

a, Inventory 650

Accounts payable a

b. Inventory 130

DM price variance ‘sa

Accounts payable ie

c. Inventory 20

Work in process He

Cash

d. Finished goods oa

DM price variance a

as

PROB. 10-8 (AICPA)

The standard direct material cost to produce a unit of Lem is 4 meters of material

at P2.50 per meter. During May, 4,200 meters of material costing P10,080 were

purchased and used to produce 1,000 units of Lem. What was the material price

variance for the month of May?

a. 400 favorable

b. 420 favorable

c. 80 unfavorable

d. 480 unfavorable

*ROB. 10-9 (AICPA)

Perkins Co., which has a standard cost sys

in its inventory at June 1, purchased in

standard cost of P1.00. The following int

stem, had 500 units of raw materials X

May for P1.20 per unit and carried at a

formation pertains to raw material X for

the month of June:

Actual number of units purchased 1,400

Actual number of units used , 1,500

Standard number of units allowed for actual production 1,300

Standard cost per unit P 1.00

Actual cost Per unit

1.10

ee

ial X for June

raw materi:

: iance for

terials purchase price vari

fe ma

The unfavorabl

0

a

b& 130

a 140

4d 150

PROB. 10-10 (AICPA)

‘ i facture of a

is tion with the manu ‘

ing system in connection vs roduct contains 2

soe sie ain costing sys Oi of direct matorale renee calculated

“one size fits al d a 20% of direct ‘Ost Of the

ir ls. However, ing process. The ci

yards of direct material ing the manufactur 1g ea t Per unit of

dee 9p ye saa a mes, Tec

irect mat

finished product is

a 4.80

b& 6.00

© 720

4 750

PROB, 10-11 (AICPA)

Each radio Tequires three

Which has a stan 'd cost of P] 45 per unit, During

le following with Tespect to Part XBEZ52,

Units

Purchases (P18,000) 12,000

Onsumed in m; facturing 10,000

dios manufac, d 3,000

ie 1g May, Blaster, Ing Incurred a direct Materials Purchase price Variance

a 50 unfavorable,

450 favorabl

¢. Vorabl

d,

nape 10 Standard Coming

. During May, Blaster, Inc. incurred a materials efficiency variance of

o 1,450 unfavorable.

b. 1,450 favorable.

4,350 unfavorable.

d. 4,350 favorable.

PROB. 10-12 (AICPA)

ChemKing uses a standard costing system in the manufacture of ee

product. The 35,000 units of raw materials in inventory were ae

P105,000, and two units of raw materials are required to produce one uni ct. The

product. In November, the company produced 12,000 units of protic 2Pe.

standard allowed for materials was P60,000, and there was an

quantity variance of P2,500.

a. ChemKing’s standard price for one unit of material is

a. 2.00

b. 2.50

c. 3.00

d, 5.00

b. The units of materials used to produce November output totaled

a. 12,500 units

b. 23,000 units

¢. 24,000 units

d. 25,000 units

¢. The materials price variance for the units used in November was

a. 2,500 unfavorable. .

b. 11,000 unfavorable,

¢. 12,500 unfavorable.

d. 3,500 unfavorable.

PROB. 10-13 (A. uthor)

An entity recently Set-up its standard costs for its direct materials. The entity sets, j

the benchmark at 3 units of direct materials per product at a standard Price of P5)

Per unit of direct material, :

530

materials at a total cost of

units of direct "7 250 units of direct

During the year, the entity acquired a art sproduels Gai

2,400. The entity also manufactur

materials.

4 2

a. What is the direct material price variance"

‘a. 250 unfavorable 7

b. 300 favorable

cc, 350 favorable

d. 400 unfavorable

b. What is the direct material usage variance?

a. 150 unfavorable

b. 300 unfavorable

c. 250 favorable

a.

350 favorable

PROB. 10-14 (AICPA)

Yola Co. manufactures one product with a standard direct manufacturing labor

cost of 4 hours at P24.00 per hour. During June, 1,000 units were produced

using 4,100 hours at P24.40 per hour. The unfavorable direct labor efficiency

variance was

a 2,440

b. 2,400

c 1,640

a 800

PROB. 10-15 (AICPA)

Harper Co. uses a standard cost system. Data relating to direct labor for the.

month of August is as follows:

Direct labor efficiency variance

— fa

Sundar ee favorable P 5,250

cual direct labor rate a

tandard hours allowed for actual production ies

9,000

53.

chapter 10 - Standard Costing

What are the actual hours worked for the month of August?

75

a.

8,400

b.

©, 8,300

d. 8,250

PROB. 10-16 (AICPA)

May was for 9,000 units with direct

Dudgeted at 45 minutes per unit for a

The flexible budget for the month of

8,500 units with P127,500 in

materials at P15 per unit. Direct labor was

total of P81,000. Actual output for the month was ,

direct materials and P77,775 in direct labor expense. The direct labor sundae ae

45 minutes was maintained throughout the ‘month, Variance analysis ©!

performance for the month of May would show a (an)

7,500 favorable materials usage variance.

a.

b. 1,275 favorable direct labor efficiency variance.

c. 7,500 unfavorable material usage variance.

d. 1,275 unfavorable direct labor price variance.

PROB. 10-17 (RPCPA)

Information on San Edilberto Co.’s direct labor costs for the month of August is

as follows:

Actual rate P. 7.50

Standard hours 11,000

Actual hours 10,000

Direct labor price variance - unfavorable P 5,000

What was the standard rate for August?

a. 8.00

b. 6.95

c 8.05

d 7.00

PROB. 10-18 (AICPA)

facturing

following direct manu!

maeeced of product Glu: ;

direct workers : 30

Time equied to make one unit 0

er

Nenber of productive hours per week, Per work' ps

wages per worker labor 20% of wages

workers penefits treated as direct manufacturing

costs

What is the standard direct manufacturing labor cost

labor information pertains tthe

per unit of product Glu?

PROB. 10-19 (AICPA)

The following information pertains to Bates Co.'s direct labor for March:

Standard direct labor hours 21,000

Actual direct labor hours 20,000

Favorable direct labor rate variance P8,400

Standard direct labor rate per hour 6.30

What was Bate’s total actual direct labor cost for March?

a. 117,600

b. 118,000

c. 134,000

d. 134,400

PROB. 10-20

An entity recently set-up its standa its di i

ae Se Pe rd costs for its direct labor. The entity sets the

direct labor hour. Durin, ‘abor hours per product at a standard rate of P100 per

F ig the year, the entity manuf: 0

direct labor hours at total direct labor costs of Pai 10 products using 30

333

cnapee 10 = Standard Conting

‘What is the direct labor rate variance?

a. 600 favorable

b. 400 unfavorable

c. 200 favorable

800 unfavorable

400 favorable

1,000 unfavorable

600 unfavorable

a.

b. What is the direct labor efficiency variance?

a.

b.

&

d. 200 favorable

PROB. 10-21 (AICPA)

The following information pertains to Roe Co.'s manufacturing operations:

Standard direct manufacturing labor hours per unit Po

Actual direct manufacturing labor hours 10,

Number of units produced i 5,000

Standard variable overhead per standard direct manufacturing

labor hour P 3.00

Actual variable overhead P 82,000

Roe’s unfavorable variable overhead efficiency variance was

a. 0

b. 1,500

c. 2.000

d. 3,500

PROB. 10-22 (AICPA)

John Player Corp. employs a standard absorption system for product costing. The

standard vost of its product is as follows:

Direct materials P 14.50

Direct labor (2 direct labor hours @ P8) 16.00

Manufacturing overhead (2 direct labor hours @Pll) 22.00

Total standard cost P_ 52.50

Chapler Jo~ seaman sweatin,

S34 gS as ee |

ivity level of 600,000

Co a rican arti td

d rate is based 4pe00 units each month

is rhea luce 25, has

The manufacturing overhead Pte overhead is

direct labor hoi

i manus P 3,600,000

ee 3,000,000

Variable P-6,600,000

Fixed

Total

i bor hours in

it d 53,500 direct lal

oounits, Pens ead for the month was

Daring October, 1? produced 26,000 manufacturing over ea fee aeeeh e

October at a cost of Tea variable. What’ is the

250,000 fixed an , :

eee variance for October?

a. 10,000 unfavorable

b. 3,000 unfavorable

c 9,000 unfavorable

d. 10,000 favorable

PROB. 10-23 (AICPA)

Jordan Co. manufactures Product X with the following standard Costs of direct

materials and direct labor:

Direct materials, 20 yards @ P13.50 Per yard P 270.00

Direct labor, 4 hours @ P90,00 Per hour 360.00

The following information Pertains to the month Of May:

Direct materials Purchased, 18,009 yards @ P13. 89 Peryard p 248,400

Direct labor, 2,100 hours @ P91.50 Per hour

; 192,150

Direct materials used, 9,500 Yards

ction during May ; 500 units

What is the direct Material price Vari: '

a San Senate ‘ance (based on Purchases)?

b& S400 unfavorable

& 61750 fevorabie

4° 6,750 Unfavorable

332

Chapter 10 Standard Costing.

b What is the material usage variance?

5,400 favorable

b 5,400 unfavorable

e. 6,750 favorable

d. 6,750 unfavorable

What is the direct labor rate variance?

3,150 favorable

9,000 favorable

3,150 unfavorable

9,000 unfavorable

a.

b.

d.

What is the direct labor efficiency variance?

3,150 favorable

9,000 favorable

3,150 unfavorable

9,000 unfavorable

a

b.

c.

d.

PROB. 10-24 (AICPA)

‘A manufacturing firm planned to manufacture and sell 100,000 units of product

f P4,00 and a fixed cost per unit of

during the year at a variable cost per unit o

2.00. The firm fell short of its goal and-only manufactured 80,000 units at a

total incurred cost of P515,000. The firm’s manufacturing cost variance was

a. 85,000 favorable.

b. 35,000 unfavorable.

c. 5,000 favorable.

d. 5,000 unfavorable.

PROB. 10-25 (RPCPA)

The U.R. Good Co. produces a product using standard costs as follows:

1. Standard cost per unit .

ae : 7 kilos at P3.50 per kilo

i bor : 8 hours at P1.75 per kilo

vethead: Fixed P1.15 per hour or P9.20 per unit

Variable PO.85 per hour or P6.80 per unit

the following:

determine

From the given informat ‘

fateria variance is

een 40.00 favorable ic

6. 2,800.00 unfavorab!

© 240,00 unfavorable

4 360.00 favorable

. Labor rate variance is

4 400.00 favorable

b. 315.00 unfavorable

© 175.00 favorable

d 500.00 unfavorable

Total material Variance is

2 2,800.00 favorable

6. 2,800.00 unfavorable

¢. 3,000.00 unfavorable

4d 3,040.00 favorable

d. Material quantity variance is

a4 200.00 favorable

250.00 unfavorable

©. 240.00 favorable

4. 2,800.00 favorable

PROB. 10-26 (AICPA)

AB Manuf;

“

6.300

13,209

P3.45 per

P80 per ki,

4.800 kilos

337

Chapter 10~ Standard Costing

.00 and for

30,000 units. The estimated sales price per unit for Product A io aes mn ae

Product B was P8.00. The actual demand for Product A was 8.0 nt 20

Product B was 33,000 units, The actual price per unit for Product A it bo

and for Product B was P7.70, What amount would be the tot

variance for AB Manufacturing Corp?

a. P3,700 unfavorable

b. 8,300 unfavorable

c. P3,700 favorable

d. P14,100 favorable

PROB. 10-27 (AICPA)

Union Co. uses a standard cost accounting system, The following factory

overhead and production data are available for May:

Standard fixed overhead rate per direct labor hour P 1,00

Standard variable overhead rate per direct labor hour P_. 4.00

Budgeted monthly direct labor hours 40,000

Actual direct labor hours worked 39,500

Standard direct labor hours allowed for actual production 39,000

Overall overhead variance - favorable P 2,000

What is the applied factory overhéad for May?

a. 195,000

b. 197,000

c. 197,500

d. 199,500

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- At Reviewer PT 2Document42 pagesAt Reviewer PT 2lender kent alicanteNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- RFBT ExamsDocument16 pagesRFBT Examslender kent alicanteNo ratings yet

- 100 Question Law On Sales PDF Free - 115047Document11 pages100 Question Law On Sales PDF Free - 115047lender kent alicanteNo ratings yet

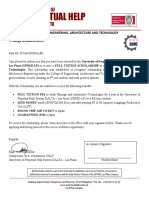

- SCHOLARSHIPDocument10 pagesSCHOLARSHIPlender kent alicanteNo ratings yet

- Forex SummaryDocument8 pagesForex Summarylender kent alicanteNo ratings yet

- C10 ReviewerDocument14 pagesC10 Reviewerlender kent alicanteNo ratings yet

- Forex Pt.4Document10 pagesForex Pt.4lender kent alicanteNo ratings yet

- FOREX Part1Document1 pageFOREX Part1lender kent alicanteNo ratings yet

- At Reviewer PT 1Document18 pagesAt Reviewer PT 1lender kent alicanteNo ratings yet

- At Reviewer PT 3Document22 pagesAt Reviewer PT 3lender kent alicanteNo ratings yet