Professional Documents

Culture Documents

Denish Ashok Sherdiwala

Uploaded by

Denish SherdiwalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Denish Ashok Sherdiwala

Uploaded by

Denish SherdiwalaCopyright:

Available Formats

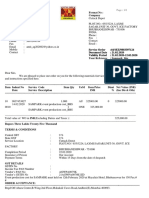

Date : 26/05/2022 Branch Code : 251

MR DENISH ASHOK SHERDIWALA

205 LAXMI APPARTMENT,SHANTI NAGAR

SOCIETY OPP DARGAH,DAGINA NAGAR

UDHNA SURAT CITY UDHNA SURAT SURAT

SURAT - 394210

GUJARAT - IN

Dear Sir/Madam,

Your Fixed Deposit(s) / Recurring deposit(s) /Saving Account / Current Account - Customer

ID 131551417 PAN : DNPPS7222K

Short Name : MR DENISH Branch : RING ROAD - SURAT

Following are the details of the depositwise / accountwise interest earned / compounded

and tax deducted on your deposits/accounts :

(AMOUNT IN RUPEES)

---------------------------------------------------------------------------------------------

DEPOSIT NUMBER/ PRINCIPAL INTEREST AMOUNT TAX

DEDUCTED INTEREST

ACCOUNT NUMBER Amount as of

ACCRUED

31/03/2022

01/04/2021 to 31/03/2022

31/03/2022

---------------------------------------------------------------------------------------------

Term Deposit

50300438554387/1 0.00 1,672.00 0.00

0.00

50300530274954/1 150,000.00 5,585.00 0.00

21.00

----------------------------------------------------------------------------------------------

150,000.00 7,257.00 0.00

21.00

----------------------------------------------------------------------------------------------

Total Interest earned :Rs. 7,257.00

Total Interest Accrued :Rs. 21.00

as of 31/03/2022

Total Tax deducted :Rs. 0.00

NOTES:

1. As per current IT regulations, w.e.f. 1st April 2019, tax for the total

amount of interest earned /accrued by the customer on all resident

deposits held across all branches is deducted when the total interest

earned/accrued exceeds the threshold limit of Rs.40,000/- in a financial

year (Rs.50,000/- for Senior Citizen w.e.f 1st April 2018). In case, the

interest amount is insufficient for meeting the tax amount, tax is deducted

from the principal to the extent of the shortfall. The balance principal

would continue at the contracted rate and for the contracted period. TDS

will get apportioned to each FD in proportion to its contribution to the

interest on breaching the minimum threshold limit of Rs.40,000/- (Rs.50,000/-

for Senior Citizen).

2. In case of part/full redemption of the deposit or where sweepin facility

has been availed against a deposit, the interest amount and the tax

deducted(account-wise) will not match since TDS for interest earned during

the financial year is calculated/deducted at the original contracted rate

of interest and adjustments, if any, are made from any subsequent interest

pay-out/compounding during the same financial year, if available.

3. Deposit with Principal Amount shown as 0.00 indicate that the deposit is

closed.

4. For saving and current account principal amount will be displayed as 0.

5. TDS Recovery rate is 10% till 13th May 2020. TDS recovery rate is reduced from 10% to

7.5% w.e.f

from 14-May-20 till 31-March-21 for Resident deposits.

For HDFC Bank Limited

Authorized signatory.

You might also like

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- View ReportDocument4 pagesView ReportShahabuddin HashmiNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PayslipDocument3 pagesPayslipkarnancy100% (1)

- Soa TN3004CD0230097Document2 pagesSoa TN3004CD0230097SaravananNo ratings yet

- Loan SoaDocument2 pagesLoan Soakishan bhalodiyaNo ratings yet

- TN3004TW0099998Document2 pagesTN3004TW0099998Dhanaseelan PeriyasamyNo ratings yet

- NullDocument2 pagesNullKishore NithyaNo ratings yet

- Continue To Next Pagee ...Document2 pagesContinue To Next Pagee ...Javed MojanidarNo ratings yet

- Tvs CreditDocument1 pageTvs CreditorugalluNo ratings yet

- Statement of Account SummaryDocument4 pagesStatement of Account SummaryRitesh GawaliNo ratings yet

- Milkfood Annual Report 2021Document108 pagesMilkfood Annual Report 2021Kamalapati BeheraNo ratings yet

- Soa Ap3019cd0077477Document2 pagesSoa Ap3019cd0077477ajayjai333No ratings yet

- Form 16Document1 pageForm 16tdsbolluNo ratings yet

- 11 05 17-31 12 17Document1 page11 05 17-31 12 17daya141079No ratings yet

- TDS PresentationDocument16 pagesTDS Presentationgamers SatisfactionNo ratings yet

- Payslip February 2023Document2 pagesPayslip February 2023Abdul Khadar Jilani ShaikNo ratings yet

- Phe Batagram Payroll 01-2021Document97 pagesPhe Batagram Payroll 01-2021Fayaz KhanNo ratings yet

- CS2022 (15)Document2 pagesCS2022 (15)gst65206No ratings yet

- Merchant Transaction Report: The City Bank LimitedDocument1 pageMerchant Transaction Report: The City Bank LimitedNahid SultanaNo ratings yet

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanNo ratings yet

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanNo ratings yet

- TVS CreditDocument1 pageTVS CreditaryanNo ratings yet

- RamasDocument2 pagesRamasRis Samar100% (1)

- WENDESN FANTU 2012 (1)Document3 pagesWENDESN FANTU 2012 (1)Muhedin HussenNo ratings yet

- TN3004TW0093130Document2 pagesTN3004TW0093130Dhanaseelan PeriyasamyNo ratings yet

- 111110120003621ffd PSPDocument3 pages111110120003621ffd PSPPranay JainNo ratings yet

- Tax invoice for Jio installationDocument4 pagesTax invoice for Jio installationRaj Chhetri0% (1)

- Insurance PolicyDocument36 pagesInsurance PolicyPulkit RohillaNo ratings yet

- Business Information Report: ReferenceDocument7 pagesBusiness Information Report: ReferenceAlina AlinaNo ratings yet

- CS2022 PDFDocument2 pagesCS2022 PDFHardeep MannNo ratings yet

- Dec 23 PayslipDocument1 pageDec 23 Payslipuslprocess1No ratings yet

- AgreementDocument5 pagesAgreementSrinandiniNo ratings yet

- 1650125254402Document2 pages1650125254402Halo HaloNo ratings yet

- C Invoices 20190708 SLF02W142040003643Document3 pagesC Invoices 20190708 SLF02W142040003643Vasanthi RamyaNo ratings yet

- TVS Credit Statement BreakdownDocument1 pageTVS Credit Statement BreakdownShrikant KeskarNo ratings yet

- Statement of AccountDocument3 pagesStatement of AccountdhruvidNo ratings yet

- Jan-23 PayslipDocument1 pageJan-23 Payslipuslprocess1No ratings yet

- 160000818390Document2 pages160000818390Ashok FerraoNo ratings yet

- My - Invoice - 28 Sep 2022, 10:23:54Document2 pagesMy - Invoice - 28 Sep 2022, 10:23:54tanya mishraNo ratings yet

- 0661682135166102122021Document2 pages0661682135166102122021Shivam YadavNo ratings yet

- TED7156724012023Document3 pagesTED7156724012023Chaitanya ZirkandeNo ratings yet

- Individual ITR for AY 2021-22Document2 pagesIndividual ITR for AY 2021-22Sachin ChopraNo ratings yet

- PO Event PDN Cost SAMPARK - BbsDocument2 pagesPO Event PDN Cost SAMPARK - BbsIndia's TalentNo ratings yet

- Repayment ScheduleDocument2 pagesRepayment Schedulens282360No ratings yet

- Bfwqfuzceyzvwjfwueujjeijdudwvuequie JDocument1 pageBfwqfuzceyzvwjfwueujjeijdudwvuequie JRonie SuarezNo ratings yet

- Revival LetterDocument2 pagesRevival Letterbichitra_mohapatra11547No ratings yet

- ROOPRANGFAB OutstndngDocument5 pagesROOPRANGFAB Outstndnginfo.kanhapackagingNo ratings yet

- LO4194 PayrollDocument431 pagesLO4194 Payrollhammad016No ratings yet

- PO Event PDN Cost SAMPARK - RklaDocument2 pagesPO Event PDN Cost SAMPARK - RklaIndia's TalentNo ratings yet

- CS726514213427 656047BFLDocument1 pageCS726514213427 656047BFLPANKAJ GANGWARNo ratings yet

- Print JPGDocument1 pagePrint JPGfebe viernezaNo ratings yet

- Inventmum E48077 Jan 2022 Payslip E48077Document1 pageInventmum E48077 Jan 2022 Payslip E48077Dr Aakanksha SwapnilNo ratings yet

- TVS Credit account statement summaryDocument1 pageTVS Credit account statement summaryMathanNo ratings yet

- DuplicateDocument4 pagesDuplicatevishnu sri koppulaNo ratings yet

- XXXXXDocument2 pagesXXXXXvivek tiwariNo ratings yet

- GURPREETDocument1 pageGURPREETGurpreet SinghNo ratings yet

- Salary Bill For Gazetted Government ServantsDocument2 pagesSalary Bill For Gazetted Government Servantsمحمد حمزة الشاذلي100% (1)

- 2020 PNLDocument1 page2020 PNLParthNo ratings yet

- 005MSOG1924200GTDocument2 pages005MSOG1924200GTV.MUNUSWAMY MUSANo ratings yet

- Bank StatementDocument2 pagesBank Statementnurulamin00023No ratings yet

- FICO Credit ScoreDocument4 pagesFICO Credit ScoreCarol100% (1)

- Annual Percentage RateDocument8 pagesAnnual Percentage Ratetimothy454No ratings yet

- Simple Deposit MultiplierDocument3 pagesSimple Deposit MultiplierQuennie Guy-abNo ratings yet

- Simple InterestDocument9 pagesSimple Interestclear conceptsNo ratings yet

- ProductsDocument7 pagesProductsDnyana RaghunathNo ratings yet

- Statement Bank MBBDocument12 pagesStatement Bank MBBminyak bidara01No ratings yet

- Alexander Bin Austin PoaDocument1 pageAlexander Bin Austin Poapurwanto PastiBisaNo ratings yet

- Lot 38, Jalan Bunga Raya KG Lancung Jaya Shah Alam 40400: Nurul Ellisa Binti Mohd RamliDocument8 pagesLot 38, Jalan Bunga Raya KG Lancung Jaya Shah Alam 40400: Nurul Ellisa Binti Mohd Ramliellisa ramliNo ratings yet

- Saving Account Statement JuneDocument4 pagesSaving Account Statement Junejonathan awNo ratings yet

- PNBONE Mpassbook 114911 5-5-2023 28-11-2023 1780XXXXXXXX83Document5 pagesPNBONE Mpassbook 114911 5-5-2023 28-11-2023 1780XXXXXXXX83jattkhatri4No ratings yet

- y H27 WPGXG NAV7 TWDocument15 pagesy H27 WPGXG NAV7 TWAyush yadavNo ratings yet

- DIY Credit Repair GuideDocument21 pagesDIY Credit Repair GuideAnthony VinsonNo ratings yet

- NZ 4 DM OAUp RDRBLFDocument8 pagesNZ 4 DM OAUp RDRBLFdipak kumarNo ratings yet

- PFP Retirement Planning Unit 3 Bba IIIDocument13 pagesPFP Retirement Planning Unit 3 Bba IIIRaghuNo ratings yet

- FormDocument1 pageFormAnkush KumarNo ratings yet

- Sba 2.0Document1 pageSba 2.0Operation BluepayNo ratings yet

- Pension Fund in NepalDocument7 pagesPension Fund in Nepalbikash rana100% (1)

- Class 10 BankingDocument3 pagesClass 10 BankingPATASHIMUL GRAM PACHAYATNo ratings yet

- Bank of Scotland StatementDocument1 pageBank of Scotland StatementEnrique PastorNo ratings yet

- PROOF OF CASH - DIT and OC - Answers in Sample ProbsDocument4 pagesPROOF OF CASH - DIT and OC - Answers in Sample ProbsGilbert MoralesNo ratings yet

- AccountStatement 2023 03 31Document6 pagesAccountStatement 2023 03 31STEPHEN NICHOLSONNo ratings yet

- Banking ...Document8 pagesBanking ...Ashwani KumarNo ratings yet

- 1 15556010Document1 page1 15556010Yana So NanaNo ratings yet

- Saint Ferdinand College Accounting Review ProblemsDocument2 pagesSaint Ferdinand College Accounting Review ProblemsRhea Mae CarantoNo ratings yet

- Subquery (New)Document15 pagesSubquery (New)Shubham PatilNo ratings yet

- Exam 3 February 2018, Questions and AnswersDocument6 pagesExam 3 February 2018, Questions and AnswersjohnNo ratings yet

- MBBcurrent 564548147990 2022-04-30 PDFDocument7 pagesMBBcurrent 564548147990 2022-04-30 PDFAdeela fazlinNo ratings yet

- BharatPe - Reactivation (OD Flow)Document11 pagesBharatPe - Reactivation (OD Flow)Mahendra SNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet