Professional Documents

Culture Documents

Atif Data

Uploaded by

Usama Saad0 ratings0% found this document useful (0 votes)

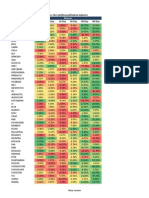

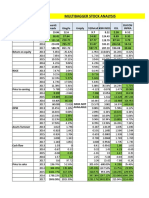

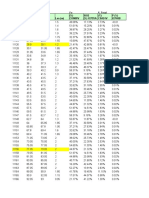

5 views9 pagesThe document shows financial data for various Pakistani banks from 2010 to 2019 including return on equity, return on assets, earnings per share, non-performing loans and non-performing investments. It includes data for 20 different banks with annual figures for each bank over the 10 year period.

Original Description:

Original Title

Atif-Data

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows financial data for various Pakistani banks from 2010 to 2019 including return on equity, return on assets, earnings per share, non-performing loans and non-performing investments. It includes data for 20 different banks with annual figures for each bank over the 10 year period.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views9 pagesAtif Data

Uploaded by

Usama SaadThe document shows financial data for various Pakistani banks from 2010 to 2019 including return on equity, return on assets, earnings per share, non-performing loans and non-performing investments. It includes data for 20 different banks with annual figures for each bank over the 10 year period.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 9

Sr No.

Bank names Years ROE ROA EPS Non-performiNPLs to share

1 NBP 2010 16.78% 1.71% 13.18 16.08% 82.20%

2 NBP 2011 15.73% 1.53% 10.54 14.84% 78.45%

3 NBP 2012 14.49% 1.19% 0.01 12.59% 85.50%

4 NBP 2013 5.08% 0.39% 2.49 16.28% 111.05%

5 NBP 2014 14.09% 1.04% 7.55 16.62% 106.72%

6 NBP 2015 16.57% 1.13% 9.03 18.40% 109.71%

7 NBP 2016 18.96% 1.13% 10.69 15.28% 99.50%

8 NBP 2017 18.32% 0.92% 10.82 14.10% 96.11%

9 NBP 2018 13.63% 0.72% 9.41 12.59% 90.79%

10 NBP 2019 9.74% 0.51% 7.43 12.92% 91.61%

11 ALBaraka 2010 -17.00% -1.71% -1.16 12.96% 61.08%

12 ALBaraka 2011 5.63% 0.57% 0.46 15.09% 61.23%

13 ALBaraka 2012 -9.70% -0.87% -0.72 19.34% 91.65%

14 ALBaraka 2013 -0.62% -0.05% -0.05 13.35% 79.54%

15 ALBaraka 2014 2.18% 0.15% 0.16 8.38% 62.40%

16 ALBaraka 2015 3.46% 0.28% 0.27 8.00% 58.09%

17 ALBaraka 2016 -1.42% -0.12% -0.12 10.05% 65.05%

18 ALBaraka 2017 -3.68% -0.32% -0.3 10.14% 72.25%

19 ALBaraka 2018 -2.45% -0.20% -0.19 8.80% 67.82%

20 ALBaraka 2019 -1.66% -0.12% -0.01 11.38% 80.12%

21 BOP 2010 56.91% -1.77% -7.65 51.56% -1088.36%

22 BOP 2011 -4.23% 0.10% 0.56 48.00% -1055.60%

23 BOP 2012 -27.83% 0.53% 3.3 39.42% -1106.11%

24 BOP 2013 234.71% 0.54% 1.81 32.76% 7344.61%

25 BOP 2014 33.24% 0.68% 1.83 28.22% 650.49%

26 BOP 2015 38.30% 1.01% 3.05 22.80% 460.36%

27 BOP 2016 28.17% 0.89% 3.18 18.70% 318.62%

28 BOP 2017 -12.37% -0.51% -1.27 14.91% 189.80%

29 BOP 2018 21.95% 1.06% 2.89 11.60% 143.31%

30 BOP 2019 19.97% 0.95% 3.15 11.98% 124.33%

31 Allied 2010 26.56% 1.84% 10.59 6.96% 59.91%

32 Allied 2011 27.02% 1.99% 11.92 7.80% 53.89%

33 Allied 2012 26.68% 1.87% 12.52 7.15% 46.55%

34 Allied 2013 27.28% 2.01% 14.2 6.81% 35.84%

35 Allied 2014 24.23% 1.80% 13.28 7.03% 36.54%

36 Allied 2015 22.25% 1.52% 13.2 6.43% 32.23%

37 Allied 2016 19.37% 1.35% 12.6 5.87% 27.43%

38 Allied 2017 16.19% 1.02% 11.12 4.64% 22.95%

39 Allied 2018 15.29% 0.95% 11.25 3.54% 19.07%

40 Allied 2019 15.76% 0.95% 12.32 3.17% 17.71%

41 Askari 2010 6.20% 0.29% 1.43 12.82% 145.74%

42 Askari 2011 10.33% 0.50% 2.41 14.13% 143.29%

43 Askari 2012 7.32% 0.37% 1.59 16.28% 149.82%

44 Askari 2013 -31.92% -1.36% -4.27 17.23% 196.62%

45 Askari 2014 20.91% 0.91% 3.25 15.79% 160.27%

46 Askari 2015 23.12% 0.94% 4 13.78% 144.34%

47 Askari 2016 20.68% 0.84% 4.14 10.89% 113.01%

48 Askari 2017 19.30% 0.79% 4.18 9.41% 98.02%

49 Askari 2018 13.91% 0.63% 3.52 7.22% 83.67%

50 Askari 2019 18.49% 0.84% 5.57 7.06% 74.12%

51 AL-HABIB 2010 24.88% 1.22% 5.01 2.28% 19.97%

52 AL-HABIB 2011 25.54% 1.18% 5.16 2.67% 18.03%

53 AL-HABIB 2012 26.08% 1.22% 5.46 2.41% 17.51%

54 AL-HABIB 2013 22.24% 1.13% 5.14 2.13% 15.83%

55 AL-HABIB 2014 23.16% 1.11% 5.79 2.67% 18.08%

56 AL-HABIB 2015 23.36% 1.16% 6.66 2.72% 18.53%

57 AL-HABIB 2016 22.76% 1.06% 7.31 2.12% 16.02%

58 AL-HABIB 2017 21.04% 0.90% 7.65 1.52% 13.09%

59 AL-HABIB 2018 18.19% 0.80% 7.57 1.08% 11.31%

60 AL-HABIB 2019 20.13% 0.86% 10.05 1.46% 13.08%

61 ALFALAH 2010 6.77% 0.28% 0.86 8.13% 102.74%

62 ALFALAH 2011 26.30% 1.27% 4.41 9.03% 84.44%

63 ALFALAH 2012 17.87% 0.85% 3.38 8.93% 86.98%

64 ALFALAH 2013 16.54% 0.76% 3.47 6.55% 63.49%

65 ALFALAH 2014 14.91% 0.76% 3.55 6.37% 51.32%

66 ALFALAH 2015 17.73% 0.83% 4.73 5.27% 43.50%

67 ALFALAH 2016 16.07% 0.85% 4.95 4.80% 38.69%

68 ALFALAH 2017 13.96% 0.82% 5.08 4.21% 30.04%

69 ALFALAH 2018 14.87% 1.01% 5.72 3.63% 27.57%

70 ALFALAH 2019 16.56% 1.19% 7.14 4.23% 29.24%

71 BANKISLAMI 2010 0.87% 0.09% 0.08 3.73% 15.67%

72 BANKISLAMI 2011 7.95% 0.70% 0.78 3.35% 16.27%

73 BANKISLAMI 2012 5.71% 0.42% 0.59 4.31% 22.07%

74 BANKISLAMI 2013 3.42% 0.22% 0.36 2.85% 20.10%

75 BANKISLAMI 2014 4.97% 0.31% 0.54 2.55% 16.85%

76 BANKISLAMI 2015 -1.89% -0.11% -0.19 18.49% 147.13%

77 BANKISLAMI 2016 4.18% 0.25% 0.45 16.16% 134.25%

78 BANKISLAMI 2017 12.61% 0.72% 1.56 12.11% 127.72%

79 BANKISLAMI 2018 1.68% 0.10% 0.21 11.87% 121.63%

80 BANKISLAMI 2019 7.22% 0.38% 0.99 10.63% 102.11%

81 DUBAIISLAMIC 2010 0.13% 0.02% 0.01 7.90% 30.73%

82 DUBAIISLAMIC 2011 3.05% 0.40% 0.28 8.71% 34.12%

83 DUBAIISLAMIC 2012 5.07% 0.54% 0.51 9.21% 36.72%

84 DUBAIISLAMIC 2013 1.98% 0.17% 0.2 7.08% 37.56%

85 DUBAIISLAMIC 2014 7.97% 0.59% 0.86 3.93% 31.46%

86 DUBAIISLAMIC 2015 5.41% 0.27% 0.62 2.07% 27.78%

87 DUBAIISLAMIC 2016 7.10% 0.56% 0.84 2.52% 20.04%

88 DUBAIISLAMIC 2017 10.64% 0.87% 1.37 1.90% 15.33%

89 DUBAIISLAMIC 2018 14.28% 1.08% 2.15 1.89% 16.72%

90 DUBAIISLAMIC 2019 16.01% 1.26% 2.87 2.51% 21.73%

91 FAYSAL BANK 2010 7.16% 0.45% 1.63 16.34% 148.71%

92 FAYSAL BANK 2011 7.19% 0.44% 1.55 15.74% 146.25%

93 FAYSAL BANK 2012 7.56% 0.45% 1.53 14.44% 146.63%

94 FAYSAL BANK 2013 8.99% 0.52% 1.77 13.52% 134.15%

95 FAYSAL BANK 2014 11.35% 0.64% 2.37 14.31% 134.17%

96 FAYSAL BANK 2015 16.20% 0.98% 3.52 14.75% 116.39%

97 FAYSAL BANK 2016 14.79% 0.95% 3.59 13.07% 103.25%

98 FAYSAL BANK 2017 13.47% 0.92% 3.43 10.68% 81.23%

99 FAYSAL BANK 2018 12.60% 0.81% 3.19 8.33% 69.49%

100 FAYSAL BANK 2019 13.57% 0.96% 3.98 9.11% 68.31%

101 HABIB BANK 2010 19.62% 1.84% 17 10.67% 61.73%

102 HABIB BANK 2011 22.30% 1.96% 20.26 11.23% 56.47%

103 HABIB BANK 2012 19.20% 1.42% 18.8 10.30% 47.37%

104 HABIB BANK 2013 17.63% 1.34% 17.27 12.67% 61.15%

105 HABIB BANK 2014 21.61% 1.70% 21.69 12.03% 54.03%

106 HABIB BANK 2015 23.78% 1.67% 24.18 10.35% 46.23%

107 HABIB BANK 2016 20.08% 1.32% 21.69 8.88% 43.31%

108 HABIB BANK 2017 5.11% 0.30% 5.27 7.76% 44.27%

109 HABIB BANK 2018 7.17% 0.41% 8.04 6.61% 43.51%

110 HABIB BANK 2019 8.53% 0.49% 10.27 6.34% 41.00%

111 MCB BANK 2010 23.69% 2.96% 22.2 8.95% 34.46%

112 MCB BANK 2011 23.87% 2.96% 23.23 10.67% 32.76%

113 MCB BANK 2012 23.25% 2.75% 23.09 9.73% 27.98%

114 MCB BANK 2013 21.91% 2.67% 21.69 8.67% 23.23%

115 MCB BANK 2014 22.50% 2.63% 22.26 6.79% 19.90%

116 MCB BANK 2015 22.57% 2.54% 22.95 6.32% 18.00%

117 MCB BANK 2016 18.56% 2.04% 19.67 5.90% 18.39%

118 MCB BANK 2017 16.45% 1.67% 18.95 9.47% 35.72%

119 MCB BANK 2018 15.31% 1.43% 18.02 8.95% 35.09%

120 MCB BANK 2019 16.51% 1.58% 20.23 9.15% 34.03%

121 MCB ISLAMIC 2015 0.52% 0.19% 0.05 0.00% 0.00%

122 MCB ISLAMIC 2016 0.79% 0.28% 0.08 0.00% 0.00%

123 MCB ISLAMIC 2017 -2.67% -0.51% -0.26 0.00% 0.00%

124 MCB ISLAMIC 2018 -11.03% -1.15% -0.98 0.00% 0.00%

125 MCB ISLAMIC 2019 -2.43% -0.23% -0.02 0.74% 3.80%

126 MEEZAN BANK 2010 17.69% 1.23% 2.72 6.74% 40.21%

127 MEEZAN BANK 2011 25.45% 1.69% 4.22 6.14% 34.88%

128 MEEZAN BANK 2012 22.64% 1.28% 3.88 5.30% 32.27%

129 MEEZAN BANK 2013 22.09% 1.20% 3.95 3.63% 27.03%

130 MEEZAN BANK 2014 19.65% 1.04% 4.56 3.77% 29.72%

131 MEEZAN BANK 2015 19.65% 0.94% 5.01 3.27% 27.64%

132 MEEZAN BANK 2016 19.76% 0.84% 5.55 2.14% 24.32%

133 MEEZAN BANK 2017 18.38% 0.80% 5.94 1.54% 19.24%

134 MEEZAN BANK 2018 22.20% 0.96% 7.67 1.34% 17.30%

135 MEEZAN BANK 2019 30.70% 1.36% 11.84 1.78% 18.13%

136 SCB 2010 7.74% 1.14% 0.97 13.79% 46.71%

137 SCB 2011 10.78% 1.52% 1.43 16.35% 50.65%

138 SCB 2012 11.94% 1.52% 1.56 16.21% 54.26%

139 SCB 2013 20.33% 2.64% 2.76 14.81% 47.39%

140 SCB 2014 17.94% 2.34% 2.54 15.39% 42.21%

141 SCB 2015 16.88% 2.08% 2.4 18.42% 43.66%

142 SCB 2016 16.91% 2.03% 2.48 0.00% 0.00%

143 SCB 2017 14.38% 1.59% 2.13 12.46% 34.16%

144 SCB 2018 18.21% 1.95% 2.9 9.30% 28.20%

145 SCB 2019 23.72% 2.58% 4.14 7.54% 26.27%

146 UNITED BANK 2010 17.24% 1.52% 9 13.58% 80.01%

147 UNITED BANK 2011 19.79% 1.84% 12.16 10.46% 53.13%

148 UNITED BANK 2012 22.96% 2.00% 15.72 12.32% 63.27%

149 UNITED BANK 2013 20.66% 1.82% 16.12 11.28% 54.53%

150 UNITED BANK 2014 23.55% 2.03% 19.63 10.55% 53.20%

151 UNITED BANK 2015 24.30% 1.84% 21.02 9.42% 44.24%

152 UNITED BANK 2016 23.71% 1.73% 22.65 8.09% 38.11%

153 UNITED BANK 2017 19.83% 1.24% 20.57 7.80% 41.14%

154 UNITED BANK 2018 11.31% 0.81% 12.44 8.83% 50.91%

155 UNITED BANK 2019 13.36% 1.01% 15.63 10.90% 53.48%

156 ZARAI TARAQIATI 2010 8.94% 1.59% 1.49 18.65% 82.66%

157 ZARAI TARAQIATI 2011 9.32% 1.75% 1.71 21.65% 86.60%

158 ZARAI TARAQIATI 2012 10.12% 1.96% 2.07 20.90% 77.84%

159 ZARAI TARAQIATI 2013 6.06% 1.21% 1.44 17.39% 59.66%

160 ZARAI TARAQIATI 2014 9.19% 1.79% 2.34 16.16% 58.59%

161 ZARAI TARAQIATI 2015 14.30% 2.81% 4.21 12.27% 44.80%

162 ZARAI TARAQIATI 2016 8.22% 1.52% 2.61 16.10% 57.06%

163 ZARAI TARAQIATI 2017 8.22% 1.52% 2.61 16.10% 57.06%

164 ZARAI TARAQIATI 2018 8.22% 1.52% 2.61 16.10% 57.06%

165 ZARAI TARAQIATI 2019 8.22% 1.52% 2.61 16.10% 57.06%

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

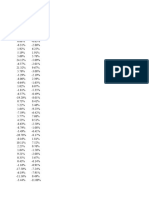

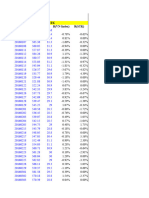

Cash & cash equi

Investment to totalAdvances net of provi

Total equity Total assets

14.10% 29.01% 46.13% 105,687,665 1,038,018,467

13.85% 27.65% 45.73% 112,671,683 1,154,966,422

14.41% 26.05% 50.04% 108,137,645 1,316,349,257

12.87% 28.89% 45.19% 104,546,005 1,372,249,263

7.15% 36.25% 40.67% 114,023,205 1,549,659,081

10.02% 48.60% 33.88% 116,011,433 1,706,361,383

8.66% 44.66% 33.22% 120,014,623 2,008,854,940

7.44% 51.72% 29.53% 125,692,679 2,505,320,968

9.28% 45.89% 33.09% 146,882,410 2,798,566,188

9.79% 46.06% 32.27% 162,369,773 3,124,388,870

19.53% 25.70% 44.27% 6,115,886 60,763,664

15.88% 36.09% 38.06% 7,293,731 72,545,064

14.80% 37.12% 38.97% 6,648,336 73,866,558

25.40% 25.25% 41.61% 6,598,050 87,759,404

10.82% 20.73% 49.84% 6,693,291 94,348,78

14.27% 19.97% 54.81% 6,959,238 86,932,510

15.31% 19.11% 51.89% 10,984,841 128,712,056

9.66% 15.81% 58.05% 10,590,487 122,652,393

12.26% 16.57% 58.23% 10,351,871 128,813,039

18.01% 14.94% 46.58% 11,546,024 161,982,226

7.57% 24.60% 52.72% 7,111,043 229,131,774

7.23% 32.93% 45.25% 6,976,480 280,889,692

6.14% 39.01% 45.03% 6,267,811 332,110,474

7.96% 35.15% 44.58% 815,765 352,674,257

6.15% 36.86% 40.50% 8,549,166 420,400,438

6.50% 37.27% 46.45% 12,396,699 472,283,654

7.22% 36.49% 47.87% 17,247,585 547,424,027

7.38% 36.87% 44.97% 26,845,158 657,737,145

6.91% 29.41% 53.46% 34,459,979 714,379,592

7.33% 41.60% 44.11% 41,311,127 868,927,780

7.08% 26.93% 56.25% 31,191,174 449,966,408

7.39% 37.94% 47.36% 37,954,155 516,109,752

7.00% 42.22% 42.76% 44,398,033 634,091,755

6.23% 49.51% 36.34% 54,191,068 734,761,815

5.00% 50.93% 36.30% 62,728,275 843,097,566

6.13% 54.89% 32.43% 67,968,647 991,665,512

6.91% 55.18% 30.83% 74,474,468 1,068,945,748

6.88% 55.86% 29.77% 78,643,302 1,249,665,658

7.53% 49.70% 32.45% 84,227,659 1,350,606,103

8.14% 51.17% 32.75% 89,542,175 1,481,121,252

8.37% 32.44% 48.54% 14,819,933 314,780,129

9.42% 38.87% 43.83% 16,502,392 343,839,283

9.43% 41.16% 40.70% 17,700,366 353,182,401

8.92% 41.99% 41.40% 16,844,299 395,096,761

5.86% 48.53% 38.09% 19,576,410 447,611,701

7.09% 50.02% 37.31% 21,811,804 535,866,714

7.77% 47.50% 37.75% 25,249,836 622,868,699

7.16% 47.53% 39.04% 27,293,237 662,691,395

7.54% 36.83% 48.56% 31,859,710 706,532,042

8.51% 36.66% 44.76% 37,955,418 833,208,006

7.00% 45.47% 41.67% 14,744,106 301,796,346

7.72% 58.02% 29.87% 17,764,531 384,525,614

8.21% 55.13% 32.61% 21,166,991 453,353,942

7.56% 52.06% 36.35% 23,377,134 461,021,913

6.66% 57.26% 31.31% 27,787,510 579,310,440

6.53% 55.73% 32.39% 31,697,833 639,973,214

6.96% 52.74% 34.04% 35,672,945 768,018,417

6.86% 50.43% 35.99% 40,408,589 944,133,780

7.86% 39.55% 45.62% 46,283,478 1,048,239,003

9.50% 45.13% 37.63% 55,489,294 1,298,682,111

13.93% 27.59% 50.30% 17,238,003 411,803,882

14.59% 35.56% 42.38% 22,616,390 468,294,146

15.80% 35.31% 43.60% 25,501,657 536,567,969

15.70% 35.93% 42.65% 28,265,616 11,427,624

8.46% 43.64% 39.10% 37,823,827 743,128,293

8.74% 46.88% 37.02% 42,424,778 902,607,521

8.98% 41.85% 40.74% 49,155,049 929,645,744

7.42% 40.12% 40.11% 58,514,493 998,827,939

8.57% 27.59% 49.85% 68,263,925 1,006,217,843

9.90% 28.09% 48.02% 76,660,572 1,064,672,085

8.00% 30.49% 43.44% 4,734,004 45,035,703

8.91% 35.57% 42.00% 5,149,904 58,728,501

7.75% 38.87% 37.00% 5,459,724 74,145,355

6.80% 36.21% 44.13% 5,517,324 86,800,938

7.07% 29.92% 40.29% 6,301,246 101,991,917

6.21% 20.60% 39.44% 10,351,802 174,230,745

5.51% 25.38% 42.65% 10,826,268 182,473,423

5.78% 19.33% 54.71% 12,400,129 217,792,397

7.01% 18.00% 54.96% 12,664,168 215,743,256

5.83% 19.50% 46.55% 15,069,968 283,096,494

16.68% 14.90% 57.61% 6,048,321 39,888,736

9.43% 26.84% 49.56% 6,244,902 48,199,768

15.52% 33.59% 41.43% 6,793,362 63,509,562

8.89% 31.21% 44.28% 6,929,614 80,256,612

10.84% 17.98% 57.94% 7,530,265 101,552,999

11.49% 15.16% 66.79% 7,962,751 157,131,182

9.56% 17.89% 61.73% 12,046,524 152,133,399

6.27% 22.42% 64.61% 15,054,436 184,993,881

8.19% 19.78% 66.13% 17,570,841 231,822,753

7.81% 18.58% 67.23% 20,897,410 264,638,618

8.66% 32.33% 50.02% 16,614,625 267,320,923

7.91% 31.94% 50.64% 17,808,183 292,582,582

8.21% 28.11% 55.03% 18,788,030 313,123,471

8.28% 31.90% 51.84% 20,587,722 355,279,707

5.59% 39.99% 46.69% 21,832,218 388,125,784

6.31% 45.46% 42.11% 26,058,692 430,072,860

8.49% 37.66% 45.31% 29,090,229 452,022,301

8.03% 36.31% 46.78% 33,633,227 494,933,882

7.50% 35.70% 49.41% 38,404,848 599,914,183

10.03% 32.40% 49.15% 44,515,793 629,852,657

12.87% 27.57% 49.72% 86,842,059 924,699,403

13.23% 36.73% 40.14% 100,147,132 1,139,554,205

12.74% 49.49% 31.04% 118,717,213 1,610,474,474

11.24% 48.16% 32.86% 130,634,311 1,715,271,378

10.87% 49.51% 31.89% 147,265,429 1,867,003,389

8.65% 58.19% 28.50% 149,156,407 2,124,909,707

10.50% 54.25% 29.61% 158,457,896 2,405,084,040

10.06% 51.90% 31.11% 151,423,488 2,573,950,243

10.17% 46.57% 35.28% 164,486,591 2,879,494,859

12.10% 44.27% 35.14% 176,611,091 3,053,733,753

8.23% 37.82% 44.62% 71,225,105 570,481,863

8.45% 48.56% 34.64% 81,392,159 656,873,876

7.60% 52.58% 31.08% 91,350,484 771,458,246

7.49% 55.26% 30.26% 100,165,491 821,278,304

5.29% 54.90% 32.29% 110,095,383 941,606,486

6.39% 56.32% 30.28% 113,186,073 1,004,410,140

7.33% 51.84% 32.46% 117,946,240 1,072,365,190

8.24% 48.91% 34.94% 136,493,130 1,343,237,891

7.68% 50.02% 33.61% 139,530,625 1,498,130,061

9.59% 49.42% 32.78% 145,219,342 1,515,152,015

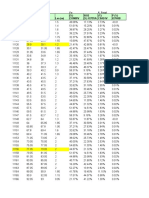

26.20% 22.30% 46.39% 10,014,614 26,887,541

14.92% 20.20% 56.47% 10,094,531 28,564,193

11.78% 17.75% 60.51% 9,832,379 51,745,997

8.87% 13.40% 66.29% 9,937,242 94,894,435

18.16% 15.53% 48.86% 10,044,475 105,017,261

14.68% 35.52% 38.94% 10,740,123 154,752,425

9.47% 49.11% 35.09% 13,323,888 200,550,394

8.37% 55.55% 32.31% 15,493,638 274,436,510

9.75% 45.98% 38.71% 17,908,150 329,724,631

8.05% 26.08% 40.17% 23,262,157 437,405,958

10.32% 27.51% 39.03% 25,556,784 531,849,934

10.28% 19.66% 47.06% 28,149,073 662,055,454

8.80% 15.12% 53.25% 34,338,420 788,808,000

7.81% 13.19% 54.65% 40,378,938 937,915,405

9.59% 20.12% 44.04% 49,614,577 1,121,258,254

7.64% 22.09% 44.22% 48,339,869 327,297,400

8.10% 28.57% 37.70% 51,535,761 364,187,812

8.57% 33.01% 36.32% 50,631,418 399,055,450

8.37% 36.11% 36.08% 52,618,375 405,329,850

5.21% 45.03% 30.63% 54,716,071 419,723,331

7.55% 51.82% 24.33% 55,016,165 447,347,791

9.78% 51.78% 24.00% 56,871,970 474,752,219

6.90% 52.42% 26.48% 57,335,131 519,832,148

9.14% 48.44% 29.43% 61,709,698 576,081,336

10.45% 40.19% 35.18% 67,533,662 619,970,585

12.95% 31.90% 47.01% 63,919,969 726,422,551

12.73% 37.25% 42.20% 75,219,724 808,352,989

12.14% 39.62% 40.09% 83,845,615 962,346,358

11.28% 42.34% 38.32% 95,499,445 1,083,632,716

8.25% 43.94% 39.53% 102,035,541 1,182,453,113

9.20% 51.37% 32.51% 105,867,061 1,400,650,843

9.15% 50.39% 31.87% 116,942,573 1,600,632,390

8.71% 53.70% 30.86% 127,001,081 2,032,933,934

98.32% 41.62% 37.89% 134,682,882 1,889,599,146

13.55% 44.38% 33.60% 143,231,740 1,893,694,707

11.62% 6.67% 72.11% 20,862,475 117,585,949

11.62% 9.84% 69.20% 23,007,624 122,467,960

9.50% 13.56% 66.78% 25,597,151 131,859,354

8.74% 15.84% 64.12% 29,786,659 148,650,116

6.35% 17.84% 66.25% 31,853,510 163,846,901

10.09% 10.54% 69.07% 36,884,029 187,574,120

10.93% 17.22% 62.98% 39,856,596 215,560,984

10.93% 17.22% 62.98% 39,856,596 215,560,984

10.93% 17.22% 62.98% 39,856,596 215,560,984

10.93% 17.22% 62.98% 39,856,596 215,560,984

You might also like

- Fin 213 Assignment ExcelDocument47 pagesFin 213 Assignment ExcelMICHEALA JANICE JOSEPHNo ratings yet

- Csec-Poa-Formulae and DefinitionsDocument11 pagesCsec-Poa-Formulae and DefinitionsAiden100% (3)

- Lap Rasio Keuangan BSM & Bank Mandiri Tahunan 2011-2020Document4 pagesLap Rasio Keuangan BSM & Bank Mandiri Tahunan 2011-2020Reinn DayiNo ratings yet

- Nguyễn Xuân Nam - Số Liệu Nghiên CứuDocument80 pagesNguyễn Xuân Nam - Số Liệu Nghiên CứuPhu 2 NickNo ratings yet

- Var RINDocument2 pagesVar RINRaul Ronaldo Romero TolaNo ratings yet

- Nifty Beat 02 Nov 2010Document1 pageNifty Beat 02 Nov 2010FountainheadNo ratings yet

- Assignment Regression Beta 03Document5 pagesAssignment Regression Beta 03John DummiNo ratings yet

- Multi Bagger AnalysisDocument3 pagesMulti Bagger AnalysisKrishnamoorthy SubramaniamNo ratings yet

- Índices INPC Tabela HistóricaDocument5 pagesÍndices INPC Tabela HistóricaMarcelo BandeiraNo ratings yet

- Rendimientos Mensuales - Portafolios 2023-1Document2 pagesRendimientos Mensuales - Portafolios 2023-1Lucero ÁlvarezNo ratings yet

- Date Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfDocument5 pagesDate Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfJohn DummiNo ratings yet

- China Gas (Operation Statistics)Document6 pagesChina Gas (Operation Statistics)ckkeicNo ratings yet

- Indic AdoresDocument4 pagesIndic AdoresVicit LainezNo ratings yet

- Port. de InvDocument7 pagesPort. de InvAdrian Duran ValenciaNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Planilha (Aulas Iniciais) Curso Avançado de ExcelDocument8 pagesPlanilha (Aulas Iniciais) Curso Avançado de ExcelluanaNo ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Resumen Mercados Junio 2021Document10 pagesResumen Mercados Junio 2021Axel VarelaNo ratings yet

- ProjectDocument14 pagesProjectSameer BhattaraiNo ratings yet

- Portofolio Correlation - Kaunang, MarioDocument3 pagesPortofolio Correlation - Kaunang, Mariomario kaunangNo ratings yet

- Portofolio Correlation - Kaunang, MarioDocument3 pagesPortofolio Correlation - Kaunang, Mariomario kaunangNo ratings yet

- Mostrarreporte Merval Junio 2020Document15 pagesMostrarreporte Merval Junio 2020enriqueNo ratings yet

- Reporte de Ratios ArgentinaDocument15 pagesReporte de Ratios Argentinawalter_lezcano164501No ratings yet

- PortfolioModelDocument4 pagesPortfolioModelSem's IndustryNo ratings yet

- Simulador Interes CompuestoDocument15 pagesSimulador Interes CompuestoiuNo ratings yet

- Date Adj Close CCR CCR Adj Close CCR CCR CCRDocument17 pagesDate Adj Close CCR CCR Adj Close CCR CCR CCRRanjith KumarNo ratings yet

- Empresas de EnergiaDocument2 pagesEmpresas de EnergiaBruno Henrique CardosoNo ratings yet

- Beta CalculationDocument2 pagesBeta CalculationvarunsardaindoreNo ratings yet

- Portofolio Efficient Frontier - Kaunang, MarioDocument3 pagesPortofolio Efficient Frontier - Kaunang, Mariomario kaunangNo ratings yet

- Caso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALDocument12 pagesCaso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALMARLEN GUADALUPE MEDINA SERRANONo ratings yet

- Accounts (A), Case #KE1056Document25 pagesAccounts (A), Case #KE1056Amit AdmuneNo ratings yet

- Rendimiento de AccionesDocument6 pagesRendimiento de AccionesFrancis Ariana Cervantes BermejoNo ratings yet

- Data 2 Inflation RateDocument1 pageData 2 Inflation RateYoussef NabilNo ratings yet

- Common Size P&L - VEDANTA LTDDocument20 pagesCommon Size P&L - VEDANTA LTDVANSHAJ SHAHNo ratings yet

- Fundamental LQ45 PilihanDocument7 pagesFundamental LQ45 PilihanDewaNyomanSutanayaNo ratings yet

- FIN 615 Fall 2022 Quiz 2 Solution 20221008Document17 pagesFIN 615 Fall 2022 Quiz 2 Solution 20221008sigit luhur pambudiNo ratings yet

- 3.2.2b Tính Beta Và Chi Phi Von ChuDocument10 pages3.2.2b Tính Beta Và Chi Phi Von ChuLê TiếnNo ratings yet

- SN Date Wipro Kotak Bank TechmahindrDocument7 pagesSN Date Wipro Kotak Bank TechmahindrnavNo ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- Industry AveragesDocument5 pagesIndustry AveragesNuwani ManasingheNo ratings yet

- s&p500 Rentab S&P Date Bancolombia Rentab BancolDocument4 pagess&p500 Rentab S&P Date Bancolombia Rentab Bancolanonimo centenarioNo ratings yet

- Artigo CesurgDocument4 pagesArtigo CesurgiutnrNo ratings yet

- Track Valle de AlarcónDocument35 pagesTrack Valle de AlarcónDiana del C. Rodriguez Garcia.No ratings yet

- Solución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Document6 pagesSolución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Yessica MacedaNo ratings yet

- Year % % % Total %: Growth Growth Growth Rate Rate RateDocument4 pagesYear % % % Total %: Growth Growth Growth Rate Rate RateBHARATHITHASAN S 20PHD0413No ratings yet

- Sample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BDocument6 pagesSample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BjuliaNo ratings yet

- Sample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BDocument6 pagesSample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BjuliaNo ratings yet

- Mutual Fund Student DataDocument10 pagesMutual Fund Student DataJANHVI HEDANo ratings yet

- Caso #4 Port A Folio de ADocument18 pagesCaso #4 Port A Folio de Aapi-3747777100% (2)

- Vix Hedges: Institute of Trading & Portfolio ManagementDocument9 pagesVix Hedges: Institute of Trading & Portfolio ManagementHakam DaoudNo ratings yet

- Tahun Nama/Kode Perusahaan Womf Yule Kias Close Dividen Close Dividen Close DividenDocument4 pagesTahun Nama/Kode Perusahaan Womf Yule Kias Close Dividen Close Dividen Close DividenRendy AlbarsyaNo ratings yet

- Investment SettingDocument41 pagesInvestment SettingAnju tpNo ratings yet

- (Poject) Portofolio Optimization & Capm, Beta, Intrinsic Value (Amanullah and Naik Bakth)Document137 pages(Poject) Portofolio Optimization & Capm, Beta, Intrinsic Value (Amanullah and Naik Bakth)Sabia Gul BalochNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- T2 Rodriguez Valladares JuniorDocument4 pagesT2 Rodriguez Valladares JuniorRosa AzabacheNo ratings yet

- Edad FR Fra Fra% Cuatrimestre FR Fra FR% Peso FR Fra Fra% Estatura FR Fra Fra% Calzado FR Fra Fra%Document1 pageEdad FR Fra Fra% Cuatrimestre FR Fra FR% Peso FR Fra Fra% Estatura FR Fra Fra% Calzado FR Fra Fra%Johanny RoseNo ratings yet

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Document5 pagesPakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNo ratings yet

- Capm - STKDocument54 pagesCapm - STKduaenguyen1102No ratings yet

- Currency (Yearly) TrendDocument3 pagesCurrency (Yearly) Trendismun nadhifahNo ratings yet

- Apuntes 29-Oct-2020Document13 pagesApuntes 29-Oct-2020Gabriel D. Diaz VargasNo ratings yet

- Inventory Management Concepts and Implementation S A Systematic ReviewDocument23 pagesInventory Management Concepts and Implementation S A Systematic ReviewUsama SaadNo ratings yet

- Atif ProjectDocument2 pagesAtif ProjectUsama SaadNo ratings yet

- Article No 8Document12 pagesArticle No 8Usama SaadNo ratings yet

- Article No 5Document13 pagesArticle No 5Usama SaadNo ratings yet

- Case Study of HRMDocument5 pagesCase Study of HRMUsama SaadNo ratings yet

- Fiscal PolicyDocument31 pagesFiscal PolicyUsama SaadNo ratings yet

- 30 116 2 PBDocument23 pages30 116 2 PBUsama SaadNo ratings yet

- The Influence of Organizational Culture On Employees' Performance Based On A Telecommunication Company Telone HeadquarterDocument55 pagesThe Influence of Organizational Culture On Employees' Performance Based On A Telecommunication Company Telone HeadquarterUsama SaadNo ratings yet

- Example Intros: Web DeveloperDocument2 pagesExample Intros: Web DeveloperUsama SaadNo ratings yet

- Organizational Politics and Turnover Intention A Study From Private Colleges of PakistanDocument16 pagesOrganizational Politics and Turnover Intention A Study From Private Colleges of PakistanUsama SaadNo ratings yet

- The Awesome Notes: Prohibited Services SEC. 54Document40 pagesThe Awesome Notes: Prohibited Services SEC. 54Eda HernandezNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2021/MAF653Document8 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2021/MAF653Azfar HazaziNo ratings yet

- Financial AccountingDocument18 pagesFinancial AccountingSimmi KhuranaNo ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementAngeline RamirezNo ratings yet

- Corporate Income Tax AssignmentDocument1 pageCorporate Income Tax AssignmentNhi Trần ThảoNo ratings yet

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument25 pagesAdvanced Accounting 6th Edition Jeter Solutions Manualjasonbarberkeiogymztd100% (51)

- Intimation of Allotment Under ESOP Scheme 17th July 2021Document2 pagesIntimation of Allotment Under ESOP Scheme 17th July 2021Subbarao CvrkNo ratings yet

- Ch-2 FINANCIAL STATEMENTS ANALYSIS ANDocument10 pagesCh-2 FINANCIAL STATEMENTS ANALYSIS ANAnamika TripathiNo ratings yet

- A Study On Funds Flow Analysis at Siflon Drugs, AnantapurDocument10 pagesA Study On Funds Flow Analysis at Siflon Drugs, AnantapurEditor IJTSRDNo ratings yet

- Dokumen - Tips 6018 p3 SPK Lembar Kerja Menyelesaikan Siklus AkuntansiDocument22 pagesDokumen - Tips 6018 p3 SPK Lembar Kerja Menyelesaikan Siklus AkuntansiM IkhsanNo ratings yet

- Problem 1Document23 pagesProblem 1Kearn CercadoNo ratings yet

- Equity Analysis and Valuation: AnalyzeDocument13 pagesEquity Analysis and Valuation: AnalyzeElfrida YulianaNo ratings yet

- Consolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundDocument4 pagesConsolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundPuneet GeraNo ratings yet

- Chapter 3 Comp. ProblemsDocument9 pagesChapter 3 Comp. ProblemsIrish Gracielle Dela CruzNo ratings yet

- Coca-Cola and Pepsi Economic Analysis ReportDocument39 pagesCoca-Cola and Pepsi Economic Analysis ReportJing Xiong67% (3)

- Zimbabwe Stock Exchange Pricelist: 20 June, 2019Document1 pageZimbabwe Stock Exchange Pricelist: 20 June, 2019Research BoyNo ratings yet

- Lahore University of Management Sciences: List of Cases/Industry Notes March 2017Document178 pagesLahore University of Management Sciences: List of Cases/Industry Notes March 2017Tanveer AhmedNo ratings yet

- Understanding GAAP - AccountingDocument9 pagesUnderstanding GAAP - Accountingshanu104100% (1)

- (505 (B) ) Analysis of Financial Statemnets BB223039 Shirke Kartiki RatnadeepDocument26 pages(505 (B) ) Analysis of Financial Statemnets BB223039 Shirke Kartiki RatnadeepRohan KashidNo ratings yet

- Audit Pengendalian Intern Dan KepatuhanDocument32 pagesAudit Pengendalian Intern Dan KepatuhanDedi Pramono100% (1)

- Depreciation p946Document120 pagesDepreciation p946akedia_6No ratings yet

- Course-Outline-Corporate Housekeeping PDFDocument3 pagesCourse-Outline-Corporate Housekeeping PDFred_inajNo ratings yet

- 6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Document13 pages6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Marlito Joshua AmistosoNo ratings yet

- Instant Download Ebook PDF Fundamental Accounting Principles Volume 1 16th Canadian Edition PDF ScribdDocument42 pagesInstant Download Ebook PDF Fundamental Accounting Principles Volume 1 16th Canadian Edition PDF Scribdjudi.hawkins744100% (40)

- TTS - Merger Model PrimerDocument4 pagesTTS - Merger Model PrimerKrystleNo ratings yet

- Pfrs 13 Fair Value MeasurementDocument22 pagesPfrs 13 Fair Value MeasurementShane PasayloNo ratings yet

- Pre-Feasibility Study: Car ShowroomDocument20 pagesPre-Feasibility Study: Car Showroomzaheer100% (1)

- Name Suhail Abdul Rashid TankeDocument9 pagesName Suhail Abdul Rashid TankeIram ParkarNo ratings yet

- Valuation of Bonds and Shares: Problem 1Document15 pagesValuation of Bonds and Shares: Problem 1anubha srivastavaNo ratings yet