Professional Documents

Culture Documents

CaracteristicsandFeesEaccount en

Uploaded by

Charlie BobOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CaracteristicsandFeesEaccount en

Uploaded by

Charlie BobCopyright:

Available Formats

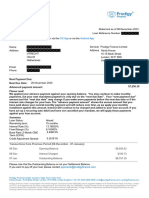

BRA535

Characteristics and Fees of

E-ACCOUNT

ACCOUNT OPENING AND USAGE

Minimum deposit needed to open account $0.00

Not applicable if you perform ONE of the following:

1. Receive a Direct Deposit in the statement period.

Monthly service fee $5.95 2. A connection through Internet Banking in the statement period.

3. An electronic payment through the answering machine (VRU) or by Internet Banking

in the statement period.

Dormant account fee $10.00 Per month charge after 6 months with no deposits, withdrawals, or payments.

For replacement due to loss, theft, damage and /or additional card. This fee does not

ATH / International ATH card replacement $5.00

apply to automatic renewals.

For cancelling an electronic payment and to avoid future account debits from a specific

Electronic debit cancellation (EFT) $15.00

merchant.

Automated Teller Machine (ATM) Fees

Withdrawals at ATMs belonging to Banco Popular

in Puerto Rico (BPPR), in United States Virgin

Islands (USVI) and in British Virgin Islands Withdrawals at ATMs (non PCB’s) in the United States may be subject to charges from

$0.00

(Tortola). Withdrawals at ATMs belonging to the ATM owner.

Popular Community Bank (PCB) or to other banks

in the United States (US).

Withdrawals at ATMs belonging to other banks

that are members of the ATH Network (Banks

$0.50 Applies to each withdrawal. The ATM owner may assess other fees.

and Credit Unions associated to the ATH

Network)

Withdrawals at privately owned ATMs that are

$2.00 Applies to each withdrawal. The ATM owner may assess other fees.

not members of the ATH Network

Applies to the total withdrawal amount at ATMs and purchases outside the US, PR, USVI

Withdrawals at ATMs and purchases and at non-BPPR ATMs in Tortola. Charge applies per withdrawal and purchase. The

2.00%

in foreign countries ATM owner may assess other fees. This fee includes 1% charged by VISA® and 1%

charged by BPPR after conversion to USD Currency.

Check related fees

Each drawn check $0.50 Charge for each check drawn.

Checkbook Order Varies Depending on the style you select plus shipping costs.

Stop payment for 6 months $10.00 Per check or group of checks in sequence.

Stop payment extension $10.00 For extending the original stop payment period for 6 additional months.

Stop payment for 12 months (simultaneous

$15.00 Per check or group of checks in sequence.

stop payment and renewal)

OVERDRAFT POLICIES*

You will not incur in overdraft fees in Automated Teller Machines (ATM) transactions and / or

Option 1: Standard

purchases with debit cards.

ATM transactions and / or Debit Card If you do not opt-in for the Overdraft Service to pay ATM transactions and / or Debit Card

$0.00

Purchases purchases when you have insufficient funds or non-available funds.

The Bank may, at its discretion, pay these transactions without requiring your

Electronic Transaction (Pay by Phone and / or authorization.

Electronic Debit) and / or paid or returned $15.00 Per overdraft. Will be charged if the Bank pays or returns an electronic transaction (Pay

check by Phone and / or Electronic Debit) and / or pay or return a check against insufficient

funds or non-available funds.

You authorize the Bank to pay Automated Teller Machines (ATM) transactions and / or purchases

Option 2: Overdraft Service

with Debit Cards

At its discretion, the Bank reserves its right to pay the transaction. You will be

charged per overdraft if the Bank decides to pay the transaction at an ATM or payments

with your ATH® Debit Card against insufficient funds or non-available funds. This fee

Automated Teller Machines transactions and / applies only if you authorize it.

$15.00

or Purchases Paid with Debit Cards

If you want the Bank to authorize and pay overdrafts for automated teller machine

transactions and purchases with your ATH® Debit Card, access www.popular.com and

P1

complete the application or visit your nearest branch.

The Bank may, at its discretion, pay these transactions without requiring your

BRA-535A / 05-18

Electronic Transaction (Pay by Phone and / or authorization.

Electronic Debit) and / or paid or returned $15.00 Per Overdraft. Will be charged if the Bank pays or returns an electronic transaction (Pay

check by Phone and / or Electronic Debit) and / or paid or returned check against insufficient

funds or non-available funds.

Options 1 and 2: The Bank will not assess you more than 5 charges per day (maximum $75.00) for transactions or paid or returned cheks regardless it is

by Overdraft Service, Insufficient Funds and / or Non-Available Funds. In addition, the Overdraft Maintenance fee described below may also apply.

Overdraft Maintenance

If your account remains overdrawn for more than 5 days, a daily charge will be applied

Overdraft Maintenance $5.00 from the 6th day in negative balance, excluding Saturday, Sunday, and federal holidays.

The fee will be applied up to a maximum of 15 days.

PROCESSING POLICIES

Order in which your transactions are processed

1. Deposits and Credits.

2. Debits, based on category, by the date and time, in the following order:

a. Withdrawals with a debit card in our branches or at Automated Teller Machines.

b. Checks cashed at our branches.

c. Purchase transactions with a debit card.

d. Other Debits (Pay by Phone ®, transfers between accounts, wire transfers, and debit notices).

In the event a transaction is received without a time stamp, it will be processed based on the category after the transactions that have time stamps.

3. ACH debits (electronic payments) in the order in which they are received.

4. Checks based on the order of the check number. Checks with no sequence number will be processed from highest to lowest dollar amount.

When your funds will be available *

Available for withdrawal the same date of the deposit: Electronic funds transfers such as Social Security benefits and Direct Deposit payroll.

Available for withdrawal on the next business day: Cash, Wire Transfer, and Checks drawn against any Banco Popular branch located in

Puerto Rico or the US and British Virgin Islands; US Treasury Checks; Postal Money

Orders; Federal Home Loan Bank Checks; and Federal Reserve Bank Checks, Certified

Checks, Official Checks and Checks from the Government of the Commonwealth of

Puerto Rico made payable to the owner of the account and presented directly to a Bank

Representative using the Bank’s Special Deposit Slip and the first $200 of the total

deposit of other checks drawn on banks other than Banco Popular.

Availability for other deposited checks: The first $200 of the aggregate sum of other checks deposited on any business day will

be available in the following manner: If the $200 or less, the entire amount will be

available on the next business day. If the total is more than $200, $200 will be available

on the next business day, $400 will available on the second business day after the

deposit date, and the remainder of the deposited funds will be available on the third

business day following the deposit date.

ERROR AND DISPUTE RESOLUTION*

If you believe that there is an error in your account statement or the receipt issued by an ATM or POS terminal:

Call Us at 787-724-3659 (Mobiles and PR Metropolitan Area) or toll-free 1-888-724-3659 (Outside PR Metropolitan Area, USVI and BVI). Telephone

available for the hearing impaired (TDD): 787-753-9677 (PR Metropolitan Area) or toll-free 1-800-981-9666 (Outside PR Metropolitan Area, USVI and BVI).

You can also send your claim to the following address: Banco Popular de Puerto Rico, Customer Resolution Center (685), PO Box 362708, San Juan,

Puerto Rico 00936-2708. The Bank must have knowledge of the complaint within sixty (60) days following the day the first account statement containing the

error was sent.

In the event a dispute shall arise between the parties to Banco Popular de Puerto Rico’s Deposit Accounts Agreement eligible to be resolve in our court

system, you may pursue the claim accordingly.

* For more details or information, refer to the Deposit Accounts Agreement for Individuals.

You can cancel your e-Account and/or U-Save by email, mail, fax, visiting the branch of your preference or calling Telebanco Popular® at (787) 724-3659

(mobiles and PR Metropolitan Area) or 1-888-724-3659 (outside PR Metropolitan Area, USVI and BVI). Telephone available for the hearing impaired (TDD):

787-753-9677 (PR Metropolitan Area) or toll-free: 1-800-981-9666 (outside PR Metropolitan Area, USVI and BVI). To begin the closing account process,

access Mi Banco Online and select the Contact Us option and follow the instructions. Your account must be in $0 balance to close it. If your account is not in

$0 balance, it will be required that you contact us to validate certain information. The Bank will send an official check by mail for the available balance in your

account or will make a credit to another account that you have with the Bank. If the payment method is an official check, a fee will apply for the issuance of

the check.

For updated information, call Telebanco Popular at (787) 724-3659 (mobiles and PR Metropolitan Area) or 1-888-724-3659 (outside PR Metropolitan Area, USVI and

BVI). Telephone available for the hearing impaired (TDD): 787-753-9677 (PR Metropolitan Area) or toll-free: 1-800-981-9666 (outside PR Metropolitan Area, USVI

and BVI).

Terms, conditions and fees for accounts, products, programs and services are subject to change.

Copyright 2018, ©Popular, Inc. All Rights Reserved. Member FDIC.

P2

BRA-535A / 05-18

GENERAL TIPS

How to avoid charges in your account

• Pay through more than 5,000 business in Pay by Phone, obtain a confirmation number of the payment made and avoid charges for drawn checks.

• If a check was lost, try to locate it before proceeding with the suspension. In case of loss or theft of more than on check, be sure to include them all in the

same request if they are in the same sequence.

• Withdraw cash at over 600 ATMs owned by BPPR to avoid charges at other ATMs. Find the nearest ATM from you through www. http://locator.popular.com

• Make transfers between your accounts through Internet banking.

• Make sure you receive and verify your monthly statement or use Telebanco or Mi Banco Online to validate your transactions. If the required account

balance is maintained you will avoid overdrafts charges.

• Use Mi Banco Alerts where you will be notified by text message or email every time you use your ATH or exceed your budget.

• Avoid photocopy fees; use Internet Banking to obtain up to 13 months of payment history and up to 18 months of transaction history with images of checks

and deposit slips.

• Never provide personal information over the phone, of your accounts or cards.

• If you change your address be sure to notify the bank.

• Keep your ATH in a safe place. Also, use the envelope provided and this will prevent damaging the magnetic stripe.

• Cancel your electronic transactions (EFT) directly with the business.

AVAILABLE OPTIONAL SERVICES

SERVICE FEE WHICH SERVICES ARE PROVIDED?

Wire Transfers*

Fund transfers to your account from any place in the US and

Incoming Domestic and International $15.00

foreign countries.*

Commissions: For accounts in Puerto Rico, minimum:

$25; maximum: $35, based on the amount. For

accounts in USVI and Tortola, minimum: $25; Fund transfers from your account to any place in the US and

Outgoing Domestic and International

maximum: $40, based on the amount. foreign countries.*

Transmission: For PR, USVI, and Tortola: $25

Foreign Currency

1% of the equivalent in dollars

Purchase and Sale of Foreign Currency exchange from U.S. currency to foreign currency or

Minimum: $10

Currency vice versa.

Maximum: Based on the amount

Foreign Currency Checks $15.00 Check issuance in foreign currency.

Official or Provisionals Checks / Check Books / Debit Cards

Official Checks $10.00 Official Check Purchase.

Fluctuates from $4 to $10, based on the amount. For

Money Orders Acceso Popular and Acceso Universitario it fluctuates A money order can be used instead of a check.

from $3 to $10, based on the amount.

Checks are provided at the branch when the customer does not

Provisional Checks** $2 each page of 4 checks

have available checks.

$25 Cost may vary depending on the international

Urgent request for International ATH FedEx delivery could take between 1-2 business days.

address destination

Confirmation Letters / Processing Charges

To certify that the customer receives Direct Deposit service in

Direct Deposit Certification $5.00

the account.

To certify that the customer maintains a deposit account with

Account Balance Certification $5.00

the Bank and to inform the balance amount.

To certify that the customer has an account with the Bank, but

Active Account Certification $5.00

without the balance information.

A balance certification required by a Consulate for a customer

Consulate Letter $10.00 that has deposit accounts with the Bank and requests entrance

to the United States and Puerto Rico.

The letter certifies that the person does not have an account

Non-Customer Certification $15.00

with the Bank.

Applies to any garnishment issued by the Court, CRIM-PR

(Centro de Recaudación Municipal), Internal Revenue Service

Garnishment $75.00 (IRS), Treasury Department-PR(Departamento de Hacienda),

ASUME-PR (Administración para el Sustento de Menores) and

any other goverment agency.

Photocopies

This charge is per page. For the CD/DVD, must request 10

Check Photocopy $5 in paper / $4 in CD/DVD

items or more.

This charge is per page. Does not apply to IRA statements

Account Statement Photocopies $5 in paper / $4 in CD/DVD photocopies neither Payroll Cards. For the CD/DVD option,

must request 10 statements or more.

P3

Among others, applies to deposit slips, credit or debit notices,

Miscelaneous Photocopies $5 in paper / $4 in CD/DVD

savings withdrawals and deposited checks.

BRA-535A / 05-18

* Wire transfers to or from sanctioned countries are not permitted by the Department of Treasury of the United States (OFAC).

** The provisional checks applies to the following accounts: Cuenta Popular, Multicuenta, Popular Plus, Popular Securities Investor Plus, Private

Management Account, e-account.

You might also like

- Christian Walters explains New Trust TechnologyDocument15 pagesChristian Walters explains New Trust Technologyjohnrose52180% (5)

- MT799 Blocked Funds MessageDocument1 pageMT799 Blocked Funds MessageAdaikalam Alexander Rayappa100% (2)

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocument5 pagesCommon Loan Application Form Under Pradhan Mantri MUDRA YojanaBijay TiwariNo ratings yet

- Oracle R12 CE Cash Management New FeaturesDocument22 pagesOracle R12 CE Cash Management New Featuressanjayapps86% (7)

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- Learn payroll card fees and alternativesDocument4 pagesLearn payroll card fees and alternativesJonathan GameroNo ratings yet

- List of All Fees Associated With Your Paypal Prepaid MastercardDocument1 pageList of All Fees Associated With Your Paypal Prepaid Mastercardmira bucketNo ratings yet

- List of All Fees For Primary Card Brightwell Visa Prepaid Card All Fees Amount DetailsDocument3 pagesList of All Fees For Primary Card Brightwell Visa Prepaid Card All Fees Amount DetailsIvan MilosavljevicNo ratings yet

- Utah Unemployment 103583581 Disclosure Client.V3Document6 pagesUtah Unemployment 103583581 Disclosure Client.V3Tracee GoffNo ratings yet

- Metabank Terms and ConditionsDocument17 pagesMetabank Terms and ConditionsMoses MillerNo ratings yet

- Rapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Document12 pagesRapid Meta Visa Fixed 2 - 194007202 - CHA Online Bundle - 05935-30-900Valeria M.SNo ratings yet

- BofA CoreChecking en ADADocument2 pagesBofA CoreChecking en ADAFrank TilemanNo ratings yet

- Netspend All-Access Account: Monthly UsageDocument2 pagesNetspend All-Access Account: Monthly UsageSam BojanglesNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- Prepaid Disclosures: We Charge 8 Other Types of Fees. Here Are Some of ThemDocument3 pagesPrepaid Disclosures: We Charge 8 Other Types of Fees. Here Are Some of ThemKrista PressleyNo ratings yet

- PaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Document8 pagesPaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Jeshua CaballeroNo ratings yet

- SFLF 720320418 enDocument1 pageSFLF 720320418 enMelinda R. FranciscoNo ratings yet

- Netspend All-Access AccountDocument35 pagesNetspend All-Access Accountchristopherhowell269100% (1)

- SFLF 730372319 en PDFDocument1 pageSFLF 730372319 en PDFHenri BlankNo ratings yet

- Cont'dDocument24 pagesCont'dAurora Ma'atNo ratings yet

- 001 891 Business Liability Card FeesDocument1 page001 891 Business Liability Card FeesLuke HarbeckNo ratings yet

- SFLF 730449321 enDocument1 pageSFLF 730449321 enkatyaNo ratings yet

- PREPAID EN COB (02/21) Important info about BMO® Prepaid MastercardDocument1 pagePREPAID EN COB (02/21) Important info about BMO® Prepaid MastercardBobNo ratings yet

- De 5617 PDDocument2 pagesDe 5617 PDUS ARMY VERIFIEDNo ratings yet

- List of All Fees For The Green Dot Special Edition Prepaid Mastercard or Visa CardDocument7 pagesList of All Fees For The Green Dot Special Edition Prepaid Mastercard or Visa CardJamie AuslanderNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Deposit Checking Account GuideDocument2 pagesDeposit Checking Account GuideMarilena HapcaNo ratings yet

- cardholder-agreement-edv01odcashDocument54 pagescardholder-agreement-edv01odcashTruLuv FaithNo ratings yet

- Consumer Banking Schedule of Service Fees and ChargesDocument1 pageConsumer Banking Schedule of Service Fees and ChargesGerman HuizarNo ratings yet

- ServePayGo Summary of FeesDocument4 pagesServePayGo Summary of Feeshersheyschwartz1No ratings yet

- Manage Your Attain Checking AccountDocument2 pagesManage Your Attain Checking AccountieatpinktacozNo ratings yet

- Money Account Fee Schedule: All Fees Amount DetailsDocument2 pagesMoney Account Fee Schedule: All Fees Amount DetailsCarmen PeñaNo ratings yet

- 730462222Document20 pages730462222Tank ZillaNo ratings yet

- Pricing and Fees: Item Price Unit DetailsDocument2 pagesPricing and Fees: Item Price Unit DetailsFarahatNo ratings yet

- Fee ScheduleDocument3 pagesFee ScheduleJamesNo ratings yet

- BankMobile Full Fee Schedules PDFDocument2 pagesBankMobile Full Fee Schedules PDFminipower50No ratings yet

- Go2bankdaa PDFDocument44 pagesGo2bankdaa PDFJose FernandezNo ratings yet

- GO2BANK DEPOSIT ACCOUNT AGREEMENTDocument40 pagesGO2BANK DEPOSIT ACCOUNT AGREEMENTHank MacsNo ratings yet

- Woodforest Checking Account OverviewDocument42 pagesWoodforest Checking Account Overviewoloyede jamiuNo ratings yet

- Business Bonus Account v79.0Document3 pagesBusiness Bonus Account v79.0prabeshmanNo ratings yet

- Terms Basic Checking PDFDocument2 pagesTerms Basic Checking PDFMilton DavidsonNo ratings yet

- Everyday Group1 PDFDocument3 pagesEveryday Group1 PDFGabriel Montez SchwergNo ratings yet

- Reloadable Visa debit card agreementDocument54 pagesReloadable Visa debit card agreementSameer AryaNo ratings yet

- Cardholder AgreementDocument8 pagesCardholder AgreementAdriana MendozaNo ratings yet

- Easy Checking SnapshotDocument2 pagesEasy Checking SnapshotsupportNo ratings yet

- Deposit ProductsDocument14 pagesDeposit ProductssupportNo ratings yet

- Deposit Account Fees and ServicesDocument1 pageDeposit Account Fees and ServicesPlus CompNo ratings yet

- All Fees Amount Details: Fee ScheduleDocument17 pagesAll Fees Amount Details: Fee ScheduleLuke EvansNo ratings yet

- Cardholder AgreementDocument8 pagesCardholder AgreementyaNo ratings yet

- BoA - Deposit Form 05731Document2 pagesBoA - Deposit Form 05731Coy IngramNo ratings yet

- Frequently Asked Questions: Banking Currency Foreign Exchange Government Securities Market Nbfcs Others Payment SystemsDocument2 pagesFrequently Asked Questions: Banking Currency Foreign Exchange Government Securities Market Nbfcs Others Payment SystemsNasim MunshiNo ratings yet

- Convenience enDocument3 pagesConvenience enJaidan FreitesNo ratings yet

- Welcome To Bank of The West!Document7 pagesWelcome To Bank of The West!Derek SharmanNo ratings yet

- HBL Credit Card Summary BoxDocument2 pagesHBL Credit Card Summary Boxshani908No ratings yet

- MyVanilla Visa CFPB Long Form PDFDocument1 pageMyVanilla Visa CFPB Long Form PDFOzell Stanley0% (1)

- TD Simple Savings Account GuideDocument3 pagesTD Simple Savings Account GuideMery MelendezNo ratings yet

- $0 $0 N/A N/A: Paypal Cash Short Form DisclosureDocument1 page$0 $0 N/A N/A: Paypal Cash Short Form DisclosureJimmy McJohnsonNo ratings yet

- $0 $0 N/A N/A: Paypal Cash Short Form DisclosureDocument1 page$0 $0 N/A N/A: Paypal Cash Short Form DisclosureJimmy McJohnsonNo ratings yet

- HBL Credit Card SummaryDocument3 pagesHBL Credit Card SummaryMubin AshrafNo ratings yet

- Fetch PDFDocument3 pagesFetch PDFcute babyNo ratings yet

- TD Convenience Checking Account GuideDocument3 pagesTD Convenience Checking Account GuideMuhammad AliNo ratings yet

- Ae SP Price Guide Conventional English v3Document13 pagesAe SP Price Guide Conventional English v3Shaikh Hassan AtikNo ratings yet

- October 2023Document5 pagesOctober 2023isaiahdesmondbrown1No ratings yet

- Payment Collection for Small Business: QuickStudy Laminated Reference Guide to Customer Payment OptionsFrom EverandPayment Collection for Small Business: QuickStudy Laminated Reference Guide to Customer Payment OptionsNo ratings yet

- Personal LoanDocument49 pagesPersonal Loantodkarvijay50% (6)

- Traditional KYC Process PDFDocument5 pagesTraditional KYC Process PDFvivxtractNo ratings yet

- IND AS 7 Cash Flow Statement GuideDocument13 pagesIND AS 7 Cash Flow Statement Guidevishwas jagrawalNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- Export Import Process DocumentationDocument13 pagesExport Import Process Documentationgarganurag12No ratings yet

- The Impact of Integrated Financial Management Systems on Economic GrowthDocument20 pagesThe Impact of Integrated Financial Management Systems on Economic GrowthLaMine N'tambi-SanogoNo ratings yet

- The Effect of Customer Satisfaction On Service Quality: The Case of Iraqi BanksDocument8 pagesThe Effect of Customer Satisfaction On Service Quality: The Case of Iraqi BankspushpakaNo ratings yet

- Managing Early Growth Strategies & IssuesDocument13 pagesManaging Early Growth Strategies & IssuesDhananjay Parshuram SawantNo ratings yet

- 4.budgetory ControlDocument66 pages4.budgetory ControlSrinivas ReddyNo ratings yet

- Summer internship in Greenply's plywood and laminates businessDocument16 pagesSummer internship in Greenply's plywood and laminates businessVanshika MaheswaryNo ratings yet

- Official Sample Paper For Phase 2 Exam: With Answers and Detailed SolutionsDocument21 pagesOfficial Sample Paper For Phase 2 Exam: With Answers and Detailed SolutionsAadeesh JainNo ratings yet

- Debt Recovery and Collection Procedure With Reference To PNBDocument66 pagesDebt Recovery and Collection Procedure With Reference To PNBshreya27_desh100% (9)

- Telephone Banking ExplainedDocument8 pagesTelephone Banking ExplainedPhilip ThomasNo ratings yet

- Loan StatementDocument2 pagesLoan StatementTien NguyenNo ratings yet

- Account Statement 01 May 2023-22 May 2023Document3 pagesAccount Statement 01 May 2023-22 May 2023Shivam VermaNo ratings yet

- Forex BourseDocument7 pagesForex Boursepial02020No ratings yet

- Annex F-ICQ (Cashier) DraftDocument5 pagesAnnex F-ICQ (Cashier) DraftRussel SarachoNo ratings yet

- Jennifer MDocument2 pagesJennifer Mapi-432375458No ratings yet

- Financial Analysis of Commercial BankDocument86 pagesFinancial Analysis of Commercial Bankjitendra jaushik67% (6)

- Energy Advances in EnvironmentDocument243 pagesEnergy Advances in EnvironmentUSERNAMEMATRIXNo ratings yet

- Orn AssignmentDocument5 pagesOrn AssignmentWhatsapp MessageNo ratings yet

- KeyBank Rollover FormDocument1 pageKeyBank Rollover FormmicheleNo ratings yet

- 208 - Umer - What Ails The MSME Sector in India Is It Poor Access To FundsDocument7 pages208 - Umer - What Ails The MSME Sector in India Is It Poor Access To FundsnomadisnoNo ratings yet

- Current AccountDocument17 pagesCurrent AccountBabarNo ratings yet

- Capital FormationDocument76 pagesCapital FormationAnonymous 45z6m4eE7pNo ratings yet

- QB IiiDocument33 pagesQB IiisaketramaNo ratings yet