Professional Documents

Culture Documents

Exercises 14.2 and 14.5

Uploaded by

malena muloniaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises 14.2 and 14.5

Uploaded by

malena muloniaCopyright:

Available Formats

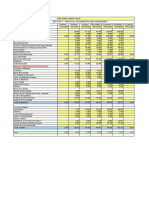

Incremental cash flows

yr 0 1 2 3

profit before tax 0.20 0.30 0.30

depreciation 0.20 0.20 0.20

tax (cost) 0.04 0.06 0.06

tax (cash out) 0.04 0.06

net cash from sales after tax 0.40 0.46 0.44

change in working capital -0.60

non-current asset investment -1.00

incremental cash flow -1.60 0.40 0.46 0.44

interest factor 1 1.1 1.21 1.3310

discount factor 1 0.9091 0.8264 0.7513

present value -1.600 0.3636 0.3802 0.3306

Net present value 0.387

Net present value 386,796 project should be accepted

4 5 6

0.30 0.30

0.20 0.20

0.06 0.06

0.06 0.06 0.06

0.44 0.44 -0.06

0.60

0.44 1.04 -0.06

1.4641 1.6105 1.7716

0.6830 0.6209 0.5645

0.3005 0.6458 -0.0339

per unit (old) per unit new difference = cost savings

costs 10.13 9.10

labour 3.30 1.20 2.10

materials 3.65 3.20 0.45

overheads var 1.58 1.40 0.18

overheads fixed 1.60 3.30

2.73

YR 0 1 2 3 4

cost savings 136500 136500 136500 136500

new equipment -670000 70000

old equipment 150000 -40000

working capital 130000 -130000

incremental cash flow -390000 136500 136500 136500 36500

interest factor 1.0000 1.1200 1.2544 1.4049 1.5735

discount factor 1.0000 0.8929 0.7972 0.7118 0.6355

present values -390,000.00 121,875.00 108,816.96 97,158.00 23,196.41

net present value -38,953.62 project should be rejected

You might also like

- Latest Quarterly/Halfyearly As On (Months)Document3 pagesLatest Quarterly/Halfyearly As On (Months)mansi07No ratings yet

- Total Sales 4800 8000 Gross Profit 1968 3200Document28 pagesTotal Sales 4800 8000 Gross Profit 1968 3200lika rukhadzeNo ratings yet

- FAP - Bodie Industrial Supply - LT 2Document16 pagesFAP - Bodie Industrial Supply - LT 2Marcus McWile MorningstarNo ratings yet

- Sage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFDocument2 pagesSage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFcaplusincNo ratings yet

- Latest Quarterly/Halfyearly As On (Months) : %OI %OI %OI (OI)Document6 pagesLatest Quarterly/Halfyearly As On (Months) : %OI %OI %OI (OI)amruta_2612No ratings yet

- Difference in Balance Sheet 0.00 0.00 0.00 0.00 0.00Document1 pageDifference in Balance Sheet 0.00 0.00 0.00 0.00 0.00MAツVIcKYツNo ratings yet

- Estimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Document5 pagesEstimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Somlina MukherjeeNo ratings yet

- Annual Financials For Tata Motors LTD: All Amounts in Millions Except Per Share AmountsDocument8 pagesAnnual Financials For Tata Motors LTD: All Amounts in Millions Except Per Share AmountsPawanLUMBANo ratings yet

- TsefaDocument4 pagesTsefaAhmed SaeedNo ratings yet

- Jacen Co.: Comparative Balance SheetDocument4 pagesJacen Co.: Comparative Balance Sheetnina pascualNo ratings yet

- Maruti Suzuki Financial StatementDocument5 pagesMaruti Suzuki Financial StatementMasoud AfzaliNo ratings yet

- FS TRIALDocument7 pagesFS TRIALJosephine ButalNo ratings yet

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Assessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedDocument11 pagesAssessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedVivek SharmaNo ratings yet

- Finance Assignment Reviewed FinalDocument19 pagesFinance Assignment Reviewed FinalpranalraiNo ratings yet

- Alhaj Textile Mills LTDDocument22 pagesAlhaj Textile Mills LTDMohammad Sayad ArmanNo ratings yet

- MSN BalacesheetsDocument16 pagesMSN BalacesheetsnawazNo ratings yet

- Income Statement Balance Sheet Latest Quarterly/Halfyearly Ratio AnalysisDocument1 pageIncome Statement Balance Sheet Latest Quarterly/Halfyearly Ratio AnalysisSandy SinghNo ratings yet

- Net Present ValueDocument6 pagesNet Present ValueIshita KapadiaNo ratings yet

- Financial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak AggarwalDocument6 pagesFinancial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak Aggarwalsehrawat009mNo ratings yet

- Value Forecasting 13 04 23Document10 pagesValue Forecasting 13 04 23Dani MagarzoNo ratings yet

- Income StatementDocument2 pagesIncome StatementRyan DizonNo ratings yet

- Group B&D Case 19 FonderiaDocument12 pagesGroup B&D Case 19 FonderiaVinithi ThongkampalaNo ratings yet

- BodieDocument8 pagesBodieLinh NguyenNo ratings yet

- 4.2 - Cost of Equity - ExerciseDocument7 pages4.2 - Cost of Equity - ExerciseHTNo ratings yet

- Profit & Loss: Mar 10E Mar 11E Mar 12EDocument15 pagesProfit & Loss: Mar 10E Mar 11E Mar 12Ebhavesh_mankani7373No ratings yet

- EOQ, CSL, ESC, FR CalculationsDocument4 pagesEOQ, CSL, ESC, FR CalculationsPrakhar GuptaNo ratings yet

- Revised Financial Results For December 31, 2016 (Result)Document4 pagesRevised Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Summary of Operating Assumptions (For Example)Document5 pagesSummary of Operating Assumptions (For Example)Krishna SharmaNo ratings yet

- Afa Assignment: Ratio AnalysisDocument7 pagesAfa Assignment: Ratio AnalysisKathir VelNo ratings yet

- The Financial Evaluation of Yanzhai Hydropower Project: Feasibility Study DesignDocument53 pagesThe Financial Evaluation of Yanzhai Hydropower Project: Feasibility Study DesignPriya More BasuNo ratings yet

- Numbers Sheet Name Numbers Table Name Excel Worksheet NameDocument15 pagesNumbers Sheet Name Numbers Table Name Excel Worksheet NameSridhar KatnamNo ratings yet

- Al Fajar Ply Board Factory OrgDocument22 pagesAl Fajar Ply Board Factory OrgFINAC GROUPNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument4 pagesApollo Hospitals Enterprise Limitedpaigesh1No ratings yet

- FinmanDocument4 pagesFinmanAngel ToribioNo ratings yet

- MGAC2 Sensitivity AnalysisDocument6 pagesMGAC2 Sensitivity AnalysisJoana TrinidadNo ratings yet

- Acc133 PQ4Document8 pagesAcc133 PQ4Karina Barretto AgnesNo ratings yet

- Project - 8: Finance &risk Analytics - India Credit RiskDocument28 pagesProject - 8: Finance &risk Analytics - India Credit RiskpsyishNo ratings yet

- CMA Data Analysis - BranchDocument9 pagesCMA Data Analysis - BranchKunal SinghNo ratings yet

- Cma SreekumarDocument35 pagesCma Sreekumarapi-19728905No ratings yet

- Pirhot JuanDocument2 pagesPirhot Juanmutiya andiniNo ratings yet

- IBM Daksh Buzz - PL - FY 2012-13 and 2013-14Document4 pagesIBM Daksh Buzz - PL - FY 2012-13 and 2013-14bharath289No ratings yet

- Estados Financieros - Parte 1Document16 pagesEstados Financieros - Parte 1Laura CarolinaNo ratings yet

- 3.2 FCFE Exercise PartDocument4 pages3.2 FCFE Exercise PartHTNo ratings yet

- 250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Document9 pages250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Kai ZhaoNo ratings yet

- Amit Agarwal BankingDocument6 pagesAmit Agarwal BankingPreetam JainNo ratings yet

- Tech Mahindra LTD: Profit & LossDocument5 pagesTech Mahindra LTD: Profit & LossJay ReddyNo ratings yet

- Shinepukur Ceramics Limited: Balance Sheet StatementDocument9 pagesShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- Single CSTR-Concentration VS Reduced TimeDocument17 pagesSingle CSTR-Concentration VS Reduced TimeRiazNo ratings yet

- Final Exam (May 2020) UOG 00145145Document10 pagesFinal Exam (May 2020) UOG 00145145JiaFengNo ratings yet

- Standard - Income STMNT - Jul To FebDocument1 pageStandard - Income STMNT - Jul To Febumer plays gameNo ratings yet

- P14-5A. Selected Financial Data For Black & Decker and Snap-On Tools For 2003 Are Presented HereDocument6 pagesP14-5A. Selected Financial Data For Black & Decker and Snap-On Tools For 2003 Are Presented HereEvie ASMRNo ratings yet

- Tutorial 5 - Mini Case Study Correct SolutionDocument2 pagesTutorial 5 - Mini Case Study Correct Solutionapi-3708231No ratings yet

- FINAN204-21A Tutorial 11 Week 14Document2 pagesFINAN204-21A Tutorial 11 Week 14Danae YangNo ratings yet

- CashflowDocument3 pagesCashflowMuhammad Amir AmirNo ratings yet

- Attribute Coeffs S.E. Wald Z P-ValueDocument8 pagesAttribute Coeffs S.E. Wald Z P-Valuesarthak mendirattaNo ratings yet

- SARRIDADocument2 pagesSARRIDAmutiya andiniNo ratings yet

- Ambey Trading CorporationDocument9 pagesAmbey Trading Corporationgbv bbbNo ratings yet