Professional Documents

Culture Documents

Solutions Process Costing Exercises

Uploaded by

Zoltan SzarvasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions Process Costing Exercises

Uploaded by

Zoltan SzarvasCopyright:

Available Formats

1.

Abnormal loss

Normal loss (units): 20000kg x 5% = 1000kg

Expected output (units) = 19000kg (20-1)

Average unit cost: (26000+12000+5700): $43700/19000kg = $2.3/ kg

Abnormal loss ($): 19000kg(expected) – 18800kg(actual): 200kg x $2.3 = $460

2. Unit valuation

Normal loss(units): 2000 x 5% = 100

expected output(units): 2000 – 100 = 1900

Unit cost: [($9000material + $13340conversion) - $300 scrap value of normal loss] / 1900 units =

=$11.6/ unit

3. Valuation of completed units

WIP EU: 3000 x 60% = 180 EU

Current EU: (2000 – 180) = 1820 EU (note: deduct opening EU because of FIFO)

Cost of current EU: 1820 x $10 = $18200

Cost of WIP: $18200 + $1710 = $19910 (note: add the value of opening WIP to current cost in one

block)

4. Percentage degree of completion of closing WIP

Cost of EU: $480000/ 1000units = $48

WIP EU: $144000/ $48 = 3000units

Degree of completion: 3000units/ 4000units = 75%

5. Units of output and closing WIP (FIFO)

a) Units: 14000complete – 2000opening – 3000closing = 15000input units

b) Value of closing WIP under FIFO:

Material cost per unit: $51000/ 15000 = $3.40

Conversion cost per EU: [14000 – (2000 x 60%fifo!)] + (3000 x 30%) = 13700 EU ->

$193170/13700EU = $14.10

Value of closing WIP:

o Material: 3000 x $3.40 = $10200

o Conversion: (3000 x 30%)900 x $14.10 = $12690

o Mat + Conv = $22890

6. Closing WIP and completed units (no losses)

a) Cost of closing WIP:

Units: 200opening + 1000input – 1040completed = 160closing WIP

(160 X $20) x 40% = $1280

b) Cost of completed units:

EU of current cost: 1040 – (200 x 40%fifo!) = 960

960 x $20 = $19200

$19200 + $1530fifo = $20730

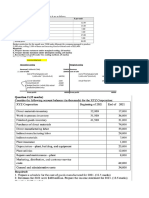

7. Loss in process (weighted average)

Expected production: 36000input – 8000closing WIP = 28000kg

Normal loss: 28000kg x 10% = 2800kg

Abnormal loss: 3600actual – 2800normal = 800kg

Actual completed production: 28000 – 3600 = 24400kg

input cost complete abnormal closing Total EU cost/ kg closing

$ d units loss WIP $ WIP $

Previous 166000 24400 800 8000 33200 5 40000

Conversion 73000 24400 800 4000 29200 2.50 10000

239000 (50%!) 7.50 50000

Completed units: 24400kg x $7.50 = $183000

Abnormal loss: 800kg x $7.50 = $6000

Closing WIP: $50000

Total: $239000

Process account ($)

Previous 166000 Completed 183000

Conversion 73000 Abnormal loss 6000

Closing WIP 50000

239000 239000

8. Equivalent product with losses (FIFO)

Normal loss: 12500units x 8% = 1000units

Scrap value of normal loss: 1000 x $3 = $3000 (deduct from material costs incurred at $99600)*

Expected output: 2000opening WIP + 12500input – 1000normal loss = 13500units

Actual output: 10000completed + 3000closing WIP = 13000units

Abnormal loss: 13500 – 13000 = 500units @$22.20 in table below=> $11100

current cost complete closing WIP abnormal total EU cost per

$ units less loss unit $

opening

WIP

Materials 96600 8000 3000 500 11500 8.40

Conversion 155250 9400 1350 500 11250 13.80

99600-3000* 10000-2000x30%

22.20

Cost of completed units:

(8000material x $8.40) + (9400conversion x $13.80) = $196920

Add opening WIP directly as a separate block: $24600

Total: $221520

Cost of closing WIP:

(3000 x $8.40) + (1350 x $13.80) = $43830

Process account

Opening WIP 24600 Completed production 221520

Material input 99600 Normal loss scrap value 3000

Conversion input 155250 Abnormal loss 11100

Closing WIP 43830

279450 279450

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- MANAC Pre MidDocument9 pagesMANAC Pre MidAbhay KaseraNo ratings yet

- Job Order Costing & Process Costing: Seminar QuestionsDocument18 pagesJob Order Costing & Process Costing: Seminar QuestionselmudaaNo ratings yet

- Accounts Assignment 104Document6 pagesAccounts Assignment 104busybeefreedomNo ratings yet

- Revision Class Notes 6 Jun 21Document7 pagesRevision Class Notes 6 Jun 21Rania barabaNo ratings yet

- Submitted by Nisar Ahmed Registration# 44150: Visic Corporation Cost of Goods Manufactured StatementDocument4 pagesSubmitted by Nisar Ahmed Registration# 44150: Visic Corporation Cost of Goods Manufactured StatementHaris KhanNo ratings yet

- Unit One Process CostingDocument9 pagesUnit One Process CostingDzukanji SimfukweNo ratings yet

- Day 4Document8 pagesDay 4um23328No ratings yet

- Dorrit and Dorrbie Maufacturig AccountDocument5 pagesDorrit and Dorrbie Maufacturig AccountToniann GordonNo ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- 1 2 2006 Jun ADocument8 pages1 2 2006 Jun AcyoteditorNo ratings yet

- CVP Analysis Class Exercise SolutionsDocument4 pagesCVP Analysis Class Exercise Solutionsaryan bhandariNo ratings yet

- MA1 Sample of Midterm TestDocument4 pagesMA1 Sample of Midterm TestLoan VũNo ratings yet

- Relevant Approach Price Quantity RevenueDocument4 pagesRelevant Approach Price Quantity RevenueAngelica MaeNo ratings yet

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisShambhawi SinhaNo ratings yet

- Trout Inc. Prepared The Following Production Report-Weighted AverageDocument4 pagesTrout Inc. Prepared The Following Production Report-Weighted AverageJalaj GuptaNo ratings yet

- Scenario Summary: Changing CellsDocument18 pagesScenario Summary: Changing CellsReagan SsebbaaleNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Abnormal Loss and Abnormal Gain AnswerDocument8 pagesAbnormal Loss and Abnormal Gain AnswerAbdulwasiq BaigNo ratings yet

- (M-5) Budgeting 2Document26 pages(M-5) Budgeting 2Yolo GuyNo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- Name-Niraj Tawde Class - FY - MMS Roll No-55: Rohidas Patil Institute of Management StudiesDocument16 pagesName-Niraj Tawde Class - FY - MMS Roll No-55: Rohidas Patil Institute of Management StudiesmaheshNo ratings yet

- SS Process Ac Jun19 Dec16jun16Document8 pagesSS Process Ac Jun19 Dec16jun16anis izzatiNo ratings yet

- Marco SADocument4 pagesMarco SAДенис ЗаславскийNo ratings yet

- Tuto 1Document9 pagesTuto 1Rara MignonneNo ratings yet

- Additional Chapter AssignmentDocument4 pagesAdditional Chapter AssignmentM GualNo ratings yet

- Rigel. T. F. Rotinsulu - C3 - Tugas AKM2Document3 pagesRigel. T. F. Rotinsulu - C3 - Tugas AKM2Rigel RotinsuluNo ratings yet

- Q-6 Spr-08 (Yahya Limited) Q ADocument2 pagesQ-6 Spr-08 (Yahya Limited) Q AiamneonkingNo ratings yet

- A. Break-Even Point 25000: Data Unit Revenue Fixed Cost Marginal Cost Sales ForecastDocument4 pagesA. Break-Even Point 25000: Data Unit Revenue Fixed Cost Marginal Cost Sales ForecastDương Thúy NgânNo ratings yet

- Problem 4 Process CostingDocument3 pagesProblem 4 Process CostingKloie SanoriaNo ratings yet

- PROBLEM 2-45:: Particulars Case A Case B Case CDocument6 pagesPROBLEM 2-45:: Particulars Case A Case B Case CSrihari KumarNo ratings yet

- Cma Budget ExcelDocument6 pagesCma Budget ExcelDristi SinghNo ratings yet

- Day 4 - Class ExerciseDocument10 pagesDay 4 - Class Exerciseum23328No ratings yet

- 2276 Chapter 35Document3 pages2276 Chapter 35tinotendazhuwao63No ratings yet

- Consignment Sales: Problem 9-1: True or FalseDocument4 pagesConsignment Sales: Problem 9-1: True or FalseVenz LacreNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 10Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 10Roshan RamkhalawonNo ratings yet

- Cost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaDocument7 pagesCost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaShambhawi SinhaNo ratings yet

- Assignment 2 - CMADocument9 pagesAssignment 2 - CMAVivek SharanNo ratings yet

- Homework For ABCDocument6 pagesHomework For ABCLikey CruzNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- Cutting Dept.: Perusahaan Menggunakan Asumsi Arus Biaya FIFO. Tidak Ada Kerusakan/kehilangan/tambahan Unit DiprosesDocument3 pagesCutting Dept.: Perusahaan Menggunakan Asumsi Arus Biaya FIFO. Tidak Ada Kerusakan/kehilangan/tambahan Unit DiprosesYoelPurba FlashNo ratings yet

- Answers To Multiple Choices - TheoreticalDocument29 pagesAnswers To Multiple Choices - TheoreticalMaica GarciaNo ratings yet

- Homework No.1Document17 pagesHomework No.1Danna ClaireNo ratings yet

- Flow of Sequence of All Costs Including Work in ProgressDocument7 pagesFlow of Sequence of All Costs Including Work in ProgressUmesh AroraNo ratings yet

- Activity Based CostingDocument2 pagesActivity Based CostingChristian AlcaparasNo ratings yet

- Mock Exam Tasks 1 and 2Document3 pagesMock Exam Tasks 1 and 2ArnonPannebakkerNo ratings yet

- Chapter 9 Teachers Manual Afar Part 1Document9 pagesChapter 9 Teachers Manual Afar Part 1Aimee Diaz100% (3)

- Example 3:: Nguyễn Thị Mỹ Nương-197TC20300 Bài tập ACCADocument2 pagesExample 3:: Nguyễn Thị Mỹ Nương-197TC20300 Bài tập ACCANương NguyễnNo ratings yet

- Lê Phương Linh - HW #6Document16 pagesLê Phương Linh - HW #6Linh LêNo ratings yet

- Production and CostDocument31 pagesProduction and CostKiệt ChâuNo ratings yet

- Manufacturing Account FormatDocument5 pagesManufacturing Account FormatCandice BoodooNo ratings yet

- Supply Chain 7, 8, 9Document10 pagesSupply Chain 7, 8, 9Mei XinNo ratings yet

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- Mô HìnhDocument7 pagesMô HìnhThanh Tâm Lê ThịNo ratings yet

- F5 Solution 1 & 2Document2 pagesF5 Solution 1 & 2dy sovathNo ratings yet

- Solution Cost AccountingDocument3 pagesSolution Cost AccountingHaris KhanNo ratings yet

- Contents Creation Optimizing Construction Project Management Processes For Improved Cost and Time EfficiencyDocument2 pagesContents Creation Optimizing Construction Project Management Processes For Improved Cost and Time Efficiencyhtetmyatag 2014No ratings yet

- Cnc-Mc-And-Automation 5th Sem121755-May-2019Document2 pagesCnc-Mc-And-Automation 5th Sem121755-May-2019Lovelysingh LovelyNo ratings yet

- Axis Bluechip Fund Attribution Analysis PDFDocument7 pagesAxis Bluechip Fund Attribution Analysis PDFYasahNo ratings yet

- AnswerDocument39 pagesAnswerALMACHIUS RWERENGELA86% (7)

- 2014 Qatar QoS Policy and QoS REgulatory FrameworkDocument7 pages2014 Qatar QoS Policy and QoS REgulatory FrameworkHộp Thư Điện TửNo ratings yet

- Quality of Conformance - Definition, Example & Benefits - Top 6Document7 pagesQuality of Conformance - Definition, Example & Benefits - Top 6ghoshsan909No ratings yet

- Pluma Chapter I-IIDocument20 pagesPluma Chapter I-IIRated SpgNo ratings yet

- CLAC 030 MaterialDocument43 pagesCLAC 030 MaterialMoath AlhajiriNo ratings yet

- MGO 660 Syllabus - Spring 2023Document7 pagesMGO 660 Syllabus - Spring 2023Jasleen KaurNo ratings yet

- UK-eCommerce ListDocument16 pagesUK-eCommerce ListSheel ThakkarNo ratings yet

- Chapter 35 Business Law PowerpointDocument18 pagesChapter 35 Business Law PowerpointJohn JonesNo ratings yet

- Costco WholesaleDocument17 pagesCostco WholesaleMahnaz KasaeianNo ratings yet

- UnicornHRO Premium Services OverviewDocument5 pagesUnicornHRO Premium Services OverviewEliot BernsteinNo ratings yet

- Case Study Mango - QuestionDocument7 pagesCase Study Mango - QuestionVi Phạm Thị HàNo ratings yet

- Communication Management Plan PDFDocument17 pagesCommunication Management Plan PDFUmair BaigNo ratings yet

- International Management Culture Strategy and Behavior 9th Edition Luthans Test Bank 1Document62 pagesInternational Management Culture Strategy and Behavior 9th Edition Luthans Test Bank 1yvonne100% (48)

- Từ Loại: Designed By Nguyễn Đăng HảiDocument107 pagesTừ Loại: Designed By Nguyễn Đăng HảiThanh Tú ĐặngNo ratings yet

- Pink Rose Watercolor Organic Creative Project PresentationDocument8 pagesPink Rose Watercolor Organic Creative Project PresentationLenesia AgathaNo ratings yet

- 08.LAMPIRAN 3 - BDD Lampiran 27 Senarai Semak Audit Dalaman ABMS ABMS Internal Audit Checklist30 Dan 31 Jan2024Document53 pages08.LAMPIRAN 3 - BDD Lampiran 27 Senarai Semak Audit Dalaman ABMS ABMS Internal Audit Checklist30 Dan 31 Jan2024Yusoff Sya JajaNo ratings yet

- Can A Catholic Be A Socialist (Trent Horn Catherine R Pakaluk)Document146 pagesCan A Catholic Be A Socialist (Trent Horn Catherine R Pakaluk)Frankle BrunnoNo ratings yet

- ISAK 35 Non Profit Oriented EntitiesDocument48 pagesISAK 35 Non Profit Oriented Entitiesnabila dhiyaNo ratings yet

- Incident Handling Response Plan-ExampleDocument3 pagesIncident Handling Response Plan-ExampleCharag E ZindgiNo ratings yet

- Lecture 7-Break Even Analysis - UQUDocument10 pagesLecture 7-Break Even Analysis - UQUmidoNo ratings yet

- BIM and Digital - ILEKTRA PAPADAKIDocument30 pagesBIM and Digital - ILEKTRA PAPADAKIKonstantinos PapaioannouNo ratings yet

- Mini Project - QuestionsDocument28 pagesMini Project - QuestionsMuskan Rathi 5100No ratings yet

- Mobile Virtual Network Operators in The Sultanate of OmanDocument9 pagesMobile Virtual Network Operators in The Sultanate of Omanknpsingh7092No ratings yet

- Sample Request Letter For DemolitionDocument20 pagesSample Request Letter For DemolitionKalahi LibacaoNo ratings yet

- Most Important One Liner Questions and Answers May 2022Document15 pagesMost Important One Liner Questions and Answers May 2022pradeepNo ratings yet

- Joint Affidavit of UndertakingDocument1 pageJoint Affidavit of UndertakingMarlon RondainNo ratings yet

- Together We Fight Society Vs AppleDocument20 pagesTogether We Fight Society Vs AppleLia JoseNo ratings yet