0% found this document useful (0 votes)

2K views4 pagesOnline Statement

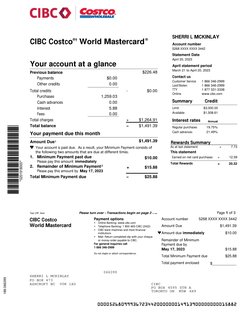

This document is a credit card statement for an account holder. It provides details of the previous balance, recent transactions, payment due and interest rates. It lists purchases made on two dates totaling $1,259.03. The total balance due is $1,491.39 with a minimum payment of $25.88 required by the due date.

Uploaded by

Sherri MckinlayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views4 pagesOnline Statement

This document is a credit card statement for an account holder. It provides details of the previous balance, recent transactions, payment due and interest rates. It lists purchases made on two dates totaling $1,259.03. The total balance due is $1,491.39 with a minimum payment of $25.88 required by the due date.

Uploaded by

Sherri MckinlayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd