Professional Documents

Culture Documents

4520 34XX XXXX 4501: Statement Date

Uploaded by

Matthew WilsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4520 34XX XXXX 4501: Statement Date

Uploaded by

Matthew WilsonCopyright:

Available Formats

.

CONTACT INFORMATION

Customer Service/Lost & Stolen 1-800-983-8472

TTY Inquiries (with hearing loss) 1-866-704-3194

138651

TD Cash Back Dollars

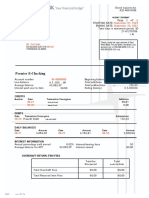

TD CASH BACK CARD Summary

Previous Balance + 3.33

MR MATTHEW WILSON 4520 34XX XXXX 4501 Earned this statement period + 2.27

TDSTM21000_1349531_003 0108898 HRI - - 02 - 02 - 18 - -

Bonus, Accelerators & - 0.00

STATEMENT DATE: December 13, 2022 1 OF 2 Adjustments

PREVIOUS STATEMENT: November 14, 2022

Total Cash Back Dollars = 5.60

STATEMENT PERIOD: November 15, 2022 to December 13, 2022 Balance

PAYMENT INFORMATION

TRANSACTION POSTING

DATE DATE ACTIVITY DESCRIPTION AMOUNT($) Minimum Payment $4.74

PREVIOUS STATEMENT BALANCE $585.66 Payment Due Date Jan. 09, 2023

Credit Limit $1,000

NOV 14 NOV 15 PROFESSIONAL ENGINEERS ON $406.80

Available Credit $995

416-2241100

Annual Interest Rate: Purchases 19.99%

NOV 14 NOV 15 PAYMENT - THANK YOU -$519.44 Cash Advances 22.99%

NOV 16 NOV 18 YUUGI IZAKAYA TORONTO $48.08

DEC 6 DEC 7 PAYMENT - THANK YOU -$521.10

DEC 13 DEC 13 RETAIL INTEREST $4.68

DEC 13 DEC 13 BALANCE PROTECTION (INCL TAX) $0.06

NET AMOUNT OF MONTHLY -$580.92

ACTIVITY

TOTAL NEW BALANCE $4.74

TD MESSAGE CENTRE:

-

CALCULATING YOUR BALANCE

Previous Balance $585.66

Payments & Credits $1,040.54

Purchases & Other Charges $454.94

Cash Advances $0.00

Interest $4.68

Fees $0.00

Sub-total $459.62

NEW BALANCE $4.74

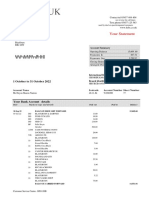

NEW BALANCE MINIMUM PAYMENT PAYMENT DUE DATE AMOUNT PAID

TD CANADA TRUST $4.74 $4.74 Jan. 09, 2023 $

P.O.B /C.P. 611

AGINCOURT, ONTARIO M1S 5J7

TD CASH BACK CARD

Account Number: 4520 34XX XXXX 4501

TDSTM21000_1349531_003 E D 1. Payments can be made via:

MR MATTHEW WILSON

TM

EasyLine Telephone Banking

1607-10 KENNETH AVE

TM

EasyWeb Internet banking

NORTH YORK ON M2N 6K6 The Green Machine

TD Canada Trust Branch

Mail

2. Make cheques payable to TD Canada Trust.

3. Detach and return with payment

4520340066004501 0000474 0000474 4

2 OF 2

What is the minimum payment and the Payment Due Date? Your minimum payment and the Payment Due Date is set out on the front of the statement under

the heading "Payment Information". It is also found on the payment slip. The Primary Cardholder must pay at least the minimum payment amount by the Payment

Due Date shown on this statement. You must make payments in the currency of the Account. If you make a payment to the Account in a foreign currency, we may

reject this payment or convert your payment to the currency of the Account. To learn more about how we will convert a payment that is not made in the currency

of the Account, see your Cardholder Agreement. For customers with an active TD Payment Plan, you must pay your Required Payment (which is your

Minimum Payment less any Monthly Plan Payment Amounts due by the Minimum Payment Due Date).

How do you make a payment? See the front of the statement or your Cardholder Agreement to learn how you can make a payment. The Primary Cardholder

must select a payment method that makes sure we receive the payment so that we can post it to the Account on or before the Payment Due Date. We must

receive your payment so that we can post it to the Account on or before each Payment Due Date shown on the Account statement.

How do we apply your payment? See your Cardholder Agreement (and TD Payment Plan Amending Agreement if you have any Payment Plans) to learn

138652

how we apply payments to the Account.

What happens if the Payment Due Date falls on a Saturday, Sunday or public holiday? If the Payment Due Date falls on a Saturday, Sunday or a public

holiday recognized by us, we will extend the Payment Due Date to the following business day. However, any applicable interest will still apply to an outstanding

TDSTM21000_1349531_003 0108898

Balance during this period.

What is the amount that must be paid to get the benefit of a Grace Period? You have a minimum 21-day interest-free Grace Period for new Purchases and

fees (other than Cash Advance fees or Balance Transfer fees) that appear for the first time on the Account statement ("New Purchases"). This means that if you

pay the outstanding New Balance shown on the Account's statement in full on or before the Payment Due Date shown on such Account statement, you will not be

charged interest on New Purchases. The Grace Period does not apply to:

• Purchases and fees that appear on previous Account statements,

• Cash Advances (including Balance Transfers, TD Visa Cheques and Cash-Like Transactions), Cash Advance fees, Balance Transfer fees and TD Visa

Cheque fees.

For Payment Plans Only: If you have Payment Plan(s), you will receive an interest-free Grace Period on New Purchases (excluding New Purchases that you

have put into a Payment Plan) if you pay the "Grace Period Payment Amount" on or before the Payment Due Date. If you have any active Payment Plans, your

"Grace Period Payment Amount" will be calculated as follows:

• New Balance on your monthly statement, minus your Total Payment Plans balance that is shown on your monthly statement, plus your Total Monthly

Payment Plan Amount(s) that are due on your monthly statement.

However, if you move a purchase that has already appeared on your monthly statement into a TD Payment Plan prior to the Payment Due Date of that monthly

statement, the Grace Period Payment Amount will be:

1. If you do not have an active Payment Plan on your current monthly statement: The New Balance shown on that monthly statement minus the

purchase amount(s) converted into a Payment Plan; or

2. If you have active Payment Plan(s) on your current monthly statement: The Grace Period Payment Amount will be the Grace Period Payment

Amount figure that is already shown on your monthly statement minus the new purchase amounts(s) moved into a Payment Plan. For greater certainty,

after you convert the new purchase into a new TD Payment Plan, the amount of the new TD Payment Plan will not be included in the TD Payment Plans

balance that is used to calculate the Grace Period Payment Amount that is due by the Payment Due Date of that monthly statement.

For TD Venture Line of Credit Only: We charge interest on the amount of all Transactions including Purchases, Cash Advances (including Balance Transfers,

Cash-Like Transactions, and TD Visa Cheques) and all fees or other amounts charged to the Account from the transaction date until that amount is paid in full.

There is no interest-free Grace Period.

How do we calculate and charge interest? If interest applies, you can find the total interest charged, and the associated interest rates, on the front of your

monthly statement. To learn more about how we calculate your interest, see your Disclosure Statement and Cardholder Agreement.

What is your estimated time to pay? Paying more than the minimum payment will decrease the amount of interest you pay and reduce the time it takes to repay

your Balance. If you have a Balance, we provide you an estimate of the length of time it will take you to pay the Balance in full as of the statement date. You can

find this on the front of the statement. If you only pay the minimum payment, the estimate is based on the following assumptions: (i) that we receive the minimum

payment on this statement, and the minimum payment on all subsequent statements, on the Payment Due Date on those statements (not prior to that date);

(ii) that each month, we receive on more than the minimum payment; and (iii) a 360-day year. Our estimate is based on the current interest rates that apply to your

Balance as a statement date (including any promotional rates for any promotional period and the rate that will apply after that promotional period has expired).

This estimate will change each month if any other assumptions in (i) and (ii) are not met, the Balance that appears on your statement changes or if the rates that

apply to your Account changes. Our estimate does not include any Transactions that have not yet posted to your Account and that are not included in the Balance

that appears on this statement.

What are your rights and obligations regarding any billing error found on this statement? This statement describes each Transaction and discloses each

amount credited or charged, including interest, and the dates when those amounts were posted to the Account. You must review the Account statements and

contact us about any errors within 30 days from the statement date so that we can immediately investigate them. If you do not contact us about errors within

30 days from the statement date, then:

• We will consider all Transactions and payments to be correctly posted to the Account and our Records to be correct (except for any amount that we

credited to the Account in error); and

• You may not make a claim against us at a later date in respect of any items or amounts posted to the Account.

If you have a dispute with a merchant relating to a Transaction posted to the Account that appears on this statement, you must first attempt to settle the problem

directly with the merchant. To learn how to manage a dispute with a merchant, see your Cardholder Agreement or visit www.td.com.

How do you contact us for more information about the Account or if you would like to report a lost/stolen Card?

Call us:

• Toll-free: 1-800-983-8472

• Collect: 416-307-7722

All trade-marks are the property of their respective owners.

®/ The TD logo and other trade-marks are the property of The Toronto-Dominion Bank. 527640(01/22)

MR MATTHEW WILSON

SPECIAL OFFERS AND INFORMATION

TDSTM21000_1349531_003 0108898 HRI - - 02 - 01 - 17 - - 138653

You might also like

- Waterbill UntilityDocument1 pageWaterbill UntilityJames Lucas MooreNo ratings yet

- John Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Document5 pagesJohn Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Paul Anderson100% (1)

- 407 Etr StatementDocument2 pages407 Etr StatementMichelNo ratings yet

- East West Bank StatementDocument1 pageEast West Bank StatementHalon GlenNo ratings yet

- Sunrun Statement: Power Purchase Agreement: Account Number (S) AmountDocument1 pageSunrun Statement: Power Purchase Agreement: Account Number (S) AmountDaleNo ratings yet

- ProblemDocument26 pagesProblemMengyao LiNo ratings yet

- Member checking statement July 2020Document2 pagesMember checking statement July 2020Devin GaulNo ratings yet

- Current Bill: Hello Miguel Jose Pedro, Here's What You Owe For This Billing Period. Energy Usage HistoryDocument2 pagesCurrent Bill: Hello Miguel Jose Pedro, Here's What You Owe For This Billing Period. Energy Usage HistoryAdriana BarcoNo ratings yet

- John Henry CFSB Card ActivitiesDocument1 pageJohn Henry CFSB Card ActivitiesSolomon100% (1)

- Futuresave 62785064660: Summary in Botswana Pula BWPDocument4 pagesFuturesave 62785064660: Summary in Botswana Pula BWPSnr Berel ShepherdNo ratings yet

- Document 0Document2 pagesDocument 0Juan AlonsoNo ratings yet

- 6 MonthDocument2 pages6 Monthharan5533No ratings yet

- TXN 26052021 10052021 26052021 NatWestDocument8 pagesTXN 26052021 10052021 26052021 NatWestJN AdingraNo ratings yet

- Total Amount Due by 06/13/2022: Electric Usage History - Current Charges For ElectricityDocument1 pageTotal Amount Due by 06/13/2022: Electric Usage History - Current Charges For ElectricitynovelNo ratings yet

- Ssno1 HEFOSoYl uSQClUQIS77Document2 pagesSsno1 HEFOSoYl uSQClUQIS77mondol miaNo ratings yet

- GO2 BankDocument1 pageGO2 Bank邱建华No ratings yet

- Statement 600611 35853301 05 11 2019 05 12 2019Document2 pagesStatement 600611 35853301 05 11 2019 05 12 2019jeffwork1976No ratings yet

- Disconnect Notice: Nipuna Indula 13035 Windfern RD Apt 219 Houston, TX 770643028Document3 pagesDisconnect Notice: Nipuna Indula 13035 Windfern RD Apt 219 Houston, TX 770643028Steven Andrew100% (1)

- Your Account Summary BalanceDocument1 pageYour Account Summary BalanceВиктория ГринькоNo ratings yet

- Metro Nash Water BillDocument1 pageMetro Nash Water Billblackson knightsonNo ratings yet

- Nov BIl PGRDocument2 pagesNov BIl PGRBryanNo ratings yet

- ATTBill 8591 May2023Document6 pagesATTBill 8591 May2023ursvenkatNo ratings yet

- BBAV Bank StatementDocument1 pageBBAV Bank StatementdaveNo ratings yet

- Washington Gas MD - 2Document2 pagesWashington Gas MD - 2Djibzlae0% (1)

- Willie de UtilityDocument5 pagesWillie de UtilityRobert KeyNo ratings yet

- Toronto BillDocument3 pagesToronto BillmassinissamassinissamassinissaNo ratings yet

- ReneeDocument2 pagesReneeAseadNo ratings yet

- Ohio Sample BilllDocument3 pagesOhio Sample BilllAlberto CayetanoNo ratings yet

- Your Koodo Bill: Account SummaryDocument6 pagesYour Koodo Bill: Account SummaryMark SloanNo ratings yet

- 澳洲383797123 Gas bill PDFDocument2 pages澳洲383797123 Gas bill PDFZheng YangNo ratings yet

- Account Summary Contact Us: Search DocumentDocument7 pagesAccount Summary Contact Us: Search Documentmr w hrNo ratings yet

- Electricity BillDocument2 pagesElectricity Billeddie chaouiNo ratings yet

- Jerry CoDocument4 pagesJerry CogarrettloehrNo ratings yet

- AffinityDocument1 pageAffinityvioletaNo ratings yet

- Monthly Report 2023 06 enDocument7 pagesMonthly Report 2023 06 enDustin Knechtel-wickertNo ratings yet

- HUDSON VALLEY Satement USADocument5 pagesHUDSON VALLEY Satement USAЮлия ПNo ratings yet

- February 01, 2020 Through February 29, 2020Document4 pagesFebruary 01, 2020 Through February 29, 2020Jimario SullivanNo ratings yet

- Sammysed June Done INSTRDocument3 pagesSammysed June Done INSTRAli HassanNo ratings yet

- E StatementDocument2 pagesE Statementinvincibilitized abdominizerNo ratings yet

- Take Charge Understanding Your Electricty BillDocument2 pagesTake Charge Understanding Your Electricty Billneww33No ratings yet

- Bill JANUARY 2022: Thank You For Making The Smarter Choice by Paying With Credit/Debit Card! - $34.41Document2 pagesBill JANUARY 2022: Thank You For Making The Smarter Choice by Paying With Credit/Debit Card! - $34.41XuaN XuanNo ratings yet

- 03KBH19z-51JH053EH6999 B43a99a8 PDFDocument4 pages03KBH19z-51JH053EH6999 B43a99a8 PDFPeter ChanNo ratings yet

- July 2020 E-StatementDocument2 pagesJuly 2020 E-StatementDân TríNo ratings yet

- Iesha Indi June Statement 2021Document1 pageIesha Indi June Statement 2021Sharon JonesNo ratings yet

- DocOrigin Utility Bill Tyler-TechnologiesDocument1 pageDocOrigin Utility Bill Tyler-TechnologiesazayNo ratings yet

- Gas Usage History - Current Charges For GasDocument2 pagesGas Usage History - Current Charges For GasChristianNo ratings yet

- Student bank statement summary for NovemberDocument2 pagesStudent bank statement summary for NovembertetsNo ratings yet

- East Kootenay Credit Union SampleDocument4 pagesEast Kootenay Credit Union SampleJoban SandhuNo ratings yet

- 2022 10 31 - StatementDocument7 pages2022 10 31 - StatementGiovanni SlackNo ratings yet

- Account StatementDocument2 pagesAccount StatementinashumedaNo ratings yet

- Your Gold Account StatementDocument1 pageYour Gold Account Statementmohamed elmakhzniNo ratings yet

- E-Pay Is E-Asy!: Contact UsDocument2 pagesE-Pay Is E-Asy!: Contact UsJean Pierre MourreNo ratings yet

- Chicago Il2Document2 pagesChicago Il2dylanmore1223No ratings yet

- TD Bank Statement - Scott W Springer#2Document2 pagesTD Bank Statement - Scott W Springer#2fehijan689No ratings yet

- Bill 06242018Document5 pagesBill 06242018JOANNENo ratings yet

- EbillDocument4 pagesEbillzeinab.rahmanabadiNo ratings yet

- Electronic Account Statements - 2915075275 - 1-1-2023 - 3-31-2023 - Elena In-Home Catering LLC - 364992205 - 050 - 00667 - 4-1-2023Document3 pagesElectronic Account Statements - 2915075275 - 1-1-2023 - 3-31-2023 - Elena In-Home Catering LLC - 364992205 - 050 - 00667 - 4-1-2023Naiver Arias MartinezNo ratings yet

- Total Amount Due: We Hope You're Enjoying Your Services. See Below For Ways To PayDocument11 pagesTotal Amount Due: We Hope You're Enjoying Your Services. See Below For Ways To Payshaliena leeNo ratings yet

- Texas Bank April30Document4 pagesTexas Bank April3076xzv4kk5vNo ratings yet

- Nettie R Glaze Bill TXDocument3 pagesNettie R Glaze Bill TXAlex NeziNo ratings yet

- Statement Date:: 4520 71XX XXXX 5156Document3 pagesStatement Date:: 4520 71XX XXXX 5156Dem ThomasNo ratings yet

- PFD-22-48 - Visa - Security Alert - Increase in PRA FraudDocument3 pagesPFD-22-48 - Visa - Security Alert - Increase in PRA FraudkenyrNo ratings yet

- Home Budget PlannerDocument137 pagesHome Budget Plannerjiguparmar1516No ratings yet

- Billing Invoice Summary Report - 2023-11-17T162845.221Document2 pagesBilling Invoice Summary Report - 2023-11-17T162845.221nayeemshaik.129No ratings yet

- Tax Invoice SummaryDocument3 pagesTax Invoice SummaryHarsh PatelNo ratings yet

- 7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFDocument6 pages7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFanorith88No ratings yet

- Accounting for Income TaxesDocument18 pagesAccounting for Income TaxesAndrea Marie CalmaNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- C3Document16 pagesC3Aaliyah Manuel100% (1)

- Cash and Accrual BasisDocument36 pagesCash and Accrual BasisHoney LimNo ratings yet

- TAX1 OBTL Syllabus 1s 20-21Document12 pagesTAX1 OBTL Syllabus 1s 20-21Paula Rodalyn MateoNo ratings yet

- VAT On Sale of Goods and PropertiesDocument55 pagesVAT On Sale of Goods and PropertiesNEstanda100% (1)

- Bank statement summary for Rayudu PeyyalaDocument12 pagesBank statement summary for Rayudu PeyyalaDr V SaptagiriNo ratings yet

- MST 1295Document1 pageMST 1295digital lifeNo ratings yet

- ABC Chapter 1 Solman - 2020 millan abcDocument10 pagesABC Chapter 1 Solman - 2020 millan abcJessaNo ratings yet

- Caltex V COA DigestDocument2 pagesCaltex V COA DigestMichael SanchezNo ratings yet

- CP PLUS Certified IP Training Programme (CSE Level-I) : Participant Registration Form (CSE - 011/CHENNAI)Document1 pageCP PLUS Certified IP Training Programme (CSE Level-I) : Participant Registration Form (CSE - 011/CHENNAI)giri xdaNo ratings yet

- CRN9641568439 - Ola BillDocument3 pagesCRN9641568439 - Ola Billmohamad chaudhariNo ratings yet

- TPoints RedemptionDocument24 pagesTPoints RedemptionApple KWNo ratings yet

- E-CASH': A Seminar ReportDocument15 pagesE-CASH': A Seminar ReportPushkar WaneNo ratings yet

- Bank cheque return documentDocument6 pagesBank cheque return documentJagdish BadlaniNo ratings yet

- General Accounting Framework FlowDocument22 pagesGeneral Accounting Framework FlowCherry AldayNo ratings yet

- Checking Account StatementDocument4 pagesChecking Account StatementsherrieNo ratings yet

- Chapter 10 - Introduction To Government FinanceDocument26 pagesChapter 10 - Introduction To Government Financewatts175% (4)

- CRYPTOCURRENCYDocument5 pagesCRYPTOCURRENCYCLINT SHEEN CABIASNo ratings yet

- Inu 2216 Idt - Question PaperDocument5 pagesInu 2216 Idt - Question PaperVinil JainNo ratings yet

- PayslipDocument1 pagePayslipJay MehtaNo ratings yet

- Track Transaction Status ID 202107021323939929Document2 pagesTrack Transaction Status ID 202107021323939929Ridayat SisNo ratings yet

- Invoice 20154352Document2 pagesInvoice 20154352Milan NayekNo ratings yet

- FY19 - QBDT Client - Lesson-11 - Track and Pay Sales Tax - BDB - v2Document22 pagesFY19 - QBDT Client - Lesson-11 - Track and Pay Sales Tax - BDB - v2Nyasha MakoreNo ratings yet