100% found this document useful (2 votes)

797 views22 pagesAccounting Process Flow

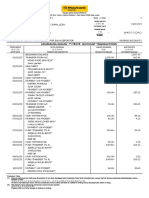

The document outlines the general accounting system framework and flow of financial transactions from source documents to final reports. It shows the process from initial financial transactions, to recording in source documents and subsidiary books, to the general ledger and trial balance, and finally to generating financial reports. Subsidiary books and the general ledger form the basis for preparing various financial reports needed by management.

Uploaded by

Cherry AldayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

797 views22 pagesAccounting Process Flow

The document outlines the general accounting system framework and flow of financial transactions from source documents to final reports. It shows the process from initial financial transactions, to recording in source documents and subsidiary books, to the general ledger and trial balance, and finally to generating financial reports. Subsidiary books and the general ledger form the basis for preparing various financial reports needed by management.

Uploaded by

Cherry AldayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

- General Accounting System Framework

- Cash Receipt Transactions

- Cash Disbursement Transactions

- Petty Cash Disbursement & Replenishment

- Cash Advances & Liquidations

- Personnel Costs or Salaries

- Procurement of Materials

- Materials/Supplies Requisition & Issuances

- Account Payables

- Training Expenses