Professional Documents

Culture Documents

Assignment 1

Uploaded by

KRYSTELLE BOLIVAROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1

Uploaded by

KRYSTELLE BOLIVARCopyright:

Available Formats

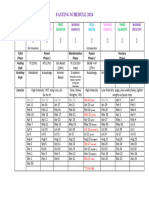

Group Assignment #1

Remember: The report should be no longer than two pages.

The main objective of this assignment is to collect data for the country assigned

to your group during the first four sessions of the course and then produce a

report at the end that summarizes the key macroeconomic conditions of your

economy. I provide below a possible structure for the report, that follows very

closely the data that needs to be collected session after session.

When presenting the numbers, you need to add some text interpreting how the

numbers help you understand economic conditions in your economy. For

example, when you present GDP per capita, do not simply write the number, but

also comment on the level of development of the economy (advanced, emerging,

etc.).

Section 1. Overall assessment of macroeconomic conditions (most recent year).

Provide an overview of the basic macroeconomic variables for your country in

the most recent year. In particular:

1. GDP per capita (current US$)

2. GDP per capita, PPP (current international $)

3. Population

4. Total GDP in current US$

Section 2. Understand the components of GDP (most recent year).

1. General Government Final Consumption Expenditure (% of GDP)

2. Gross Capital Formation (% of GDP)

3. Household Final Consumption Expenditure, etc. (% of GDP)

4. Exports of Goods and Services (% of GDP)

5. Imports of Goods and Services (% of GDP).

What do you learn about your country in this year?

Section 3. Understand the saving/investment imbalance (most recent year)

1. Current Account Balance (% of GDP)

2. General Government Net Lending/Borrowing (% of GDP)

3. Subtract the General Government Net Lending/Borrowing number (this is

the government balance) from the current account number (i.e. Variable #1

- Variable #2). This is the private sector balance or the difference between

private saving and investment.

What do you learn about this country/year?

Section 4. Apply the 4I’s framework to your country

Using GDP per capita, PPP (constant International $) assess whether your

economy is today closer to the US economy than what it was in the first year for

which you have data. Plot the ratio of your country’s GDP per capita to US GDP

per capita to see if there is any convergence.

Now use the following steps to apply the 4I’s framework to your economy and

forecast future growth rates:

1. Start with GDP per capita in the first year where data is available. This

will give you a sense of "Initial Conditions". How much potential does the

country have to grow?

2. Look at the investment in physical capital as % of GDP (this is what is

listed in Section 2 above as Gross Capital Formation as % of GDP). You

can also use this interactive tool to see investment in previous years.

3. Given what we saw in Sessions 3 and 4, what type of growth rates would

you expect if investment remained at this level?

4. Use the interactive tool we used in class in order to get a measure of the

quality of institutions (and you can speculate, if you want, about whether

reform will follow in the years to come).

Given all the information you have, what do you expect the growth rate of GDP

per capita be over the next 2 or 3 decades?

You might also like

- Economic Indicators and The Business CycleDocument149 pagesEconomic Indicators and The Business Cyclehassankazimi23No ratings yet

- Openness To Experience: Intellect & Openness: Lecture Notes 8Document8 pagesOpenness To Experience: Intellect & Openness: Lecture Notes 8Danilo Pesic100% (1)

- Scientology Abridged Dictionary 1973Document21 pagesScientology Abridged Dictionary 1973Cristiano Manzzini100% (2)

- Year 10 Maths PlaneDocument62 pagesYear 10 Maths Planehal wangNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- MATHEMATICAL ECONOMICSDocument54 pagesMATHEMATICAL ECONOMICSCities Normah0% (1)

- Economy Notes 14 Chapters on Key Economic ConceptsDocument85 pagesEconomy Notes 14 Chapters on Key Economic ConceptsvishalNo ratings yet

- Second Quarterly Examination Math 9Document2 pagesSecond Quarterly Examination Math 9Mark Kiven Martinez94% (16)

- S06 - 1 THC560 DD311Document128 pagesS06 - 1 THC560 DD311Canchari Pariona Jhon AngelNo ratings yet

- Macroeconomics 9th Edition Mankiw Solutions ManualDocument25 pagesMacroeconomics 9th Edition Mankiw Solutions ManualBethCastillosmoe98% (54)

- What Is GDP?: Kimberly AmadeoDocument44 pagesWhat Is GDP?: Kimberly AmadeobhupenderkamraNo ratings yet

- Macroeconomics 9th Edition Mankiw Solutions ManualDocument35 pagesMacroeconomics 9th Edition Mankiw Solutions Manualmargaretjacksonch3nin100% (25)

- Understanding GDP and Economic Growth MeasuresDocument4 pagesUnderstanding GDP and Economic Growth MeasuresAli Zaigham AghaNo ratings yet

- 2021 en Tutorial 7Document5 pages2021 en Tutorial 7Hari-haran KUMARNo ratings yet

- Economy: Cse Prelims 2020: Value Addition SeriesDocument83 pagesEconomy: Cse Prelims 2020: Value Addition SeriesKailash KhaliNo ratings yet

- FRED Assignment: US GDP Components 2006-2022Document2 pagesFRED Assignment: US GDP Components 2006-2022zhuozhi fangNo ratings yet

- Ecn 230 Assignment Three - 1Document5 pagesEcn 230 Assignment Three - 1Nurul Fetty LyzzNo ratings yet

- E - Portfolio Assignment-1 Econ 2020 Valeria FinisedDocument7 pagesE - Portfolio Assignment-1 Econ 2020 Valeria Finisedapi-317277761No ratings yet

- Activity 2, Module 1 Perspective B.Document15 pagesActivity 2, Module 1 Perspective B.Azalea Patrisse Cosico ArbuesNo ratings yet

- Measuring national income and its categoriesDocument2 pagesMeasuring national income and its categoriesirwanNo ratings yet

- Functions-Of-Gdp-Ndp-Nnp-Bop NotesDocument7 pagesFunctions-Of-Gdp-Ndp-Nnp-Bop Notesvaibhavi soniNo ratings yet

- E - Portfolio Assignment Mike KaelinDocument9 pagesE - Portfolio Assignment Mike Kaelinapi-269409142No ratings yet

- Macro AssignmentDocument8 pagesMacro Assignmentfahad nstuNo ratings yet

- E - Portfolio Assignment MacroDocument8 pagesE - Portfolio Assignment Macroapi-316969642No ratings yet

- CH 7 Measuring GrowthDocument15 pagesCH 7 Measuring GrowthAdam XuNo ratings yet

- Assignment Mitra, Haniya, Mehreen, TalhaDocument17 pagesAssignment Mitra, Haniya, Mehreen, Talhavotodex924No ratings yet

- CH 1 - Hillman - Prof. Levitchi - Sept 18thDocument25 pagesCH 1 - Hillman - Prof. Levitchi - Sept 18thLora LevitchiNo ratings yet

- Final Econ e PortfolioDocument7 pagesFinal Econ e Portfolioapi-317164511No ratings yet

- PD Survey JuneDocument3 pagesPD Survey JuneZerohedgeNo ratings yet

- 3-Final Paper Macroeconomics MBA 2018-19Document5 pages3-Final Paper Macroeconomics MBA 2018-19Gabriel FernandesNo ratings yet

- Problem Set 2 textbook questions & data exerciseDocument3 pagesProblem Set 2 textbook questions & data exerciseDarrek F CrisslerNo ratings yet

- Quantitative Research Methodology Project Interpretation Marin Adrian Cosmin LMADocument14 pagesQuantitative Research Methodology Project Interpretation Marin Adrian Cosmin LMAAdrian MarinNo ratings yet

- Assignment 2Document2 pagesAssignment 2KRYSTELLE BOLIVARNo ratings yet

- Basu, Huato, Jauregui y Wasner, World Profit Rates, 1960-2019Document41 pagesBasu, Huato, Jauregui y Wasner, World Profit Rates, 1960-2019Joel Oviedo SeguraNo ratings yet

- Hamilton WoodDocument198 pagesHamilton WoodRojonegroNo ratings yet

- What Is Macroeconomics?Document14 pagesWhat Is Macroeconomics?ahmad7malikNo ratings yet

- Ethiopia TaxDocument60 pagesEthiopia TaxvillaarbaminchNo ratings yet

- Principles of Economics Fall 2002 Review #3Document18 pagesPrinciples of Economics Fall 2002 Review #3Kalen CarneyNo ratings yet

- F20110208 MD Shafequl IslamDocument5 pagesF20110208 MD Shafequl IslamASNo ratings yet

- ECO201 Pricniples of Macroeconomics Final ExaminationDocument5 pagesECO201 Pricniples of Macroeconomics Final ExaminationGinoh K.No ratings yet

- Weekly Economic Commentary 4/29/2013Document6 pagesWeekly Economic Commentary 4/29/2013monarchadvisorygroupNo ratings yet

- Unit 2ndDocument42 pagesUnit 2ndBhavesh PasrichaNo ratings yet

- HW1 MepDocument4 pagesHW1 MepsivaNo ratings yet

- IE End Term Paper 2018 SolutionsDocument18 pagesIE End Term Paper 2018 SolutionsBharti MittalNo ratings yet

- Determinants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaDocument41 pagesDeterminants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaHay JirenyaaNo ratings yet

- State GDP Analysis and Education CorrelationDocument5 pagesState GDP Analysis and Education CorrelationAmit GunjanNo ratings yet

- Strategy 0518Document30 pagesStrategy 0518derek_2010No ratings yet

- Economic ForecastingDocument4 pagesEconomic ForecastingAssignmentLab.comNo ratings yet

- FOMC Minutes July 2014 Key TakeawaysDocument51 pagesFOMC Minutes July 2014 Key TakeawaysAngela Herman AutreyNo ratings yet

- Fin 1107 - Midterm - DalDocument3 pagesFin 1107 - Midterm - DalDyan LuceroNo ratings yet

- Chinn-Ito Index Updated for Financial Openness in 2017Document14 pagesChinn-Ito Index Updated for Financial Openness in 2017rameeztariq20No ratings yet

- Economic Development: Prepared By: Cristeta A. Baysa, DBA Oct 2020Document4 pagesEconomic Development: Prepared By: Cristeta A. Baysa, DBA Oct 2020Cristeta BaysaNo ratings yet

- FOMC Economic Projections and Policy AssessmentsDocument5 pagesFOMC Economic Projections and Policy AssessmentsTREND_7425No ratings yet

- ECON2020 Final Exam ReviewDocument3 pagesECON2020 Final Exam ReviewTrevor TwardzikNo ratings yet

- Ron 019Document15 pagesRon 019JohnNo ratings yet

- ECONOMY_(1)_20221213084912Document191 pagesECONOMY_(1)_20221213084912Shivani LohiaNo ratings yet

- Chapter 1 - Monitoring Macroeconomic Performance PDFDocument29 pagesChapter 1 - Monitoring Macroeconomic Performance PDFshivam jangidNo ratings yet

- Principles of Macroeconomics - Online Exam 2 Information Time and PlaceDocument6 pagesPrinciples of Macroeconomics - Online Exam 2 Information Time and Placeacmrb57No ratings yet

- Francis M CAT 4Document6 pagesFrancis M CAT 4francis machariaNo ratings yet

- ECO6433 Term Paper Jason KrausDocument14 pagesECO6433 Term Paper Jason KrausCristian CernegaNo ratings yet

- Chapters 13 14Document62 pagesChapters 13 14Andréa Castagna M LimaNo ratings yet

- Measuring The Macroeconomy: Brief Chapter SummaryDocument21 pagesMeasuring The Macroeconomy: Brief Chapter Summarybernandaz123No ratings yet

- Monitoring Guide Ratio Computations LongDocument13 pagesMonitoring Guide Ratio Computations LongmanirNo ratings yet

- Our Lady of Fatima University: Topic: Gross Domestic Product Topic OutlineDocument3 pagesOur Lady of Fatima University: Topic: Gross Domestic Product Topic OutlineYeppeuddaNo ratings yet

- Understanding The Turn of The Year EffectDocument4 pagesUnderstanding The Turn of The Year EffectSounay PhothisaneNo ratings yet

- Translation of Japanese Onomatopoeia Into Swedish (With Focus On Lexicalization)Document20 pagesTranslation of Japanese Onomatopoeia Into Swedish (With Focus On Lexicalization)Aldandy OckadeyaNo ratings yet

- Fashion Cycle StepsDocument2 pagesFashion Cycle Stepssaranya narenNo ratings yet

- United Airlines Case Study: Using Marketing to Address External ChallengesDocument4 pagesUnited Airlines Case Study: Using Marketing to Address External ChallengesSakshiGuptaNo ratings yet

- ProjectDocument86 pagesProjectrajuNo ratings yet

- Durand Et Al JHRC 1997 Experimental Design Optimization of The Analysis of Gasoline by Capillary Gas ChromatographyDocument6 pagesDurand Et Al JHRC 1997 Experimental Design Optimization of The Analysis of Gasoline by Capillary Gas ChromatographyCatalinaSalamancaNo ratings yet

- Manual Handling Risk Assessment ProcedureDocument6 pagesManual Handling Risk Assessment ProcedureSarfraz RandhawaNo ratings yet

- Internal Peripherals of Avr McusDocument2 pagesInternal Peripherals of Avr McusKuldeep JashanNo ratings yet

- College of Physical Therapy Produces Skilled ProfessionalsDocument6 pagesCollege of Physical Therapy Produces Skilled ProfessionalsRia Mae Abellar SalvadorNo ratings yet

- Liquid Analysis v3 Powell-Cumming 2010 StanfordgwDocument28 pagesLiquid Analysis v3 Powell-Cumming 2010 StanfordgwErfanNo ratings yet

- Administracion Una Perspectiva Global Y Empresarial Resumen Por CapitulosDocument7 pagesAdministracion Una Perspectiva Global Y Empresarial Resumen Por Capitulosafmqqaepfaqbah100% (1)

- Catalogo Head FixDocument8 pagesCatalogo Head FixANDREA RAMOSNo ratings yet

- Hanwha Engineering & Construction - Brochure - enDocument48 pagesHanwha Engineering & Construction - Brochure - enAnthony GeorgeNo ratings yet

- Moon Fast Schedule 2024Document1 pageMoon Fast Schedule 2024mimiemendoza18No ratings yet

- 10 Tips To Support ChildrenDocument20 pages10 Tips To Support ChildrenRhe jane AbucejoNo ratings yet

- BOQ - Hearts & Arrows Office 04sep2023Document15 pagesBOQ - Hearts & Arrows Office 04sep2023ChristianNo ratings yet

- Guillermo Estrella TolentinoDocument15 pagesGuillermo Estrella TolentinoJessale JoieNo ratings yet

- CP Mother's Day Lesson PlanDocument2 pagesCP Mother's Day Lesson PlanAma MiriNo ratings yet

- The Interview: P F T IDocument14 pagesThe Interview: P F T IkkkkccccNo ratings yet

- Barcelona Smart City TourDocument44 pagesBarcelona Smart City TourPepe JeansNo ratings yet

- DCAD OverviewDocument9 pagesDCAD OverviewSue KimNo ratings yet

- Financial Accounting IFRS 3rd Edition Weygandt Solutions Manual 1Document8 pagesFinancial Accounting IFRS 3rd Edition Weygandt Solutions Manual 1jacob100% (34)

- Proposed Panel Antenna: Globe Telecom ProprietaryDocument2 pagesProposed Panel Antenna: Globe Telecom ProprietaryJason QuibanNo ratings yet

- spl400 Stereo Power Amplifier ManualDocument4 pagesspl400 Stereo Power Amplifier ManualRichter SiegfriedNo ratings yet

- Serendipity - A Sociological NoteDocument2 pagesSerendipity - A Sociological NoteAmlan BaruahNo ratings yet