Professional Documents

Culture Documents

.npstoragefiles1MobileBankingMobile Banking Form PDF

Uploaded by

SIJUBS INFOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

.npstoragefiles1MobileBankingMobile Banking Form PDF

Uploaded by

SIJUBS INFOCopyright:

Available Formats

Rastriya Banijya Bank Limited

MOBILE BANKING REGISTRATION FORM

Date: ...................................

The Manager

Rastriya Banijya Bank Limited

_______________________ Branch

I/We hereby request RASTRIYA BANIJYA BANK to register my/our bank account and mobile numbers mentioned

below for Mobile Banking facility

Details of Account(s) and Mobile Number are as follows:

Personal Information

Applicant’s Name:

__________________________________________________________________________________________

Address:

_________________________________________________________________________________________________

Mobile No: _________________________________ Email: ____________________________________

Account Details

Primary Account No. _____________________________

Details of other accounts, if the service is intended for other accounts as well

1. Account No: ______________________________ 2. Account No: __________________________________

Please select Mobile Banking features you desire to register (cross the not desired one)

Transaction alerts

Inquiry (Balance, Mini statement), Request (cheque book, statement, stop cheque)

Financial transaction (Utility bill payments, Topups/Recharge, Merchant Payments, Fund Transfer to accounts

(predefined or any) within the bank/Inter member bank and more)

For

fund Transfer to Predefined accounts only, please specify (up to five) accounts:

1. ___________________________ 2. ___________________________ 3. ___________________________

4. ____________________________ 5. ___________________________

I have read and understood the terms and conditions listed back and agree to abide them.

____________________________

Signature of the Account Holder(s)

FOR BANK’S USE ONLY

Application received on (Date): ____________________ Approved by: _____________________Emp. Id: __________

Entered by: ________________Emp. Id: ____________ Date:______________________________________________

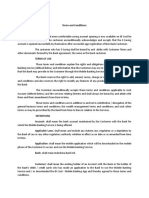

Terms & Conditions for RBB Mobile Banking Service

These Terms of Service form an agreement between you and Rastriya Banijya Bank Limited (hereafter referred to as the Bank) that governs your

access to and use of Mobile Banking Service provide by the Bank.

1. Requirements for Registration: Your valid mobile number will be mapped to your bank account number as a Payment Instrument to make

Payment Transactions and pay fees and other obligations arising from your use of the service. You must provide current, complete and accurate

information. The Bank may require you to provide additional information as a condition of continued use of the service, or to assist in determining

whether to permit you to continue to use the service.

The Bank, in its sole and absolute discretion, may refuse to approve or may terminate existing registrations with or without cause or notice, other

than any notice required by any applicable law, and not waived herein.

By agreeing to these Terms of Service for Buyers, you represent that you are: 16 years old or older; and Capable of entering into a legally binding

agreement.

2. Username and Password/PIN Information: You are responsible for: 1) maintaining the confidentiality of your PIN, 2) any and all transactions

by persons that you give access to or that otherwise use such PIN, and 3) any and all consequences of use or misuse of your PIN. You agree to notify

us immediately of any unauthorized use of your PIN or any other breach of security regarding the Service of which you have knowledge. You also

undertake to delete all

Confidential information relating to the service from the mobile phone.

You shall be responsible for all actions by agents, representatives and others, regardless of whether authorized by you that access the service using

your PIN.

3. Permissible Payment Transactions: You may only use the Service to process a Payment Transaction for a Product that is purchased from a

Merchant through a legitimate, bona fide sale of the Product and nothing else whatsoever.

You agree that you will not use the service to process Payment Transactions for any Products that violate these Terms of Service, other policies or

rules applicable to the Service, or applicable law. The current policy that establishes the Products and other transactions that may not be paid for with

the Service include: 1) Firearms 3) Explosives 4) Pornography materials and services of any kind whatsoever 5) Live animals 6) Banned / illegal

drugs or other controlled substances 7) Fireworks or pyrotechnic devices or supplies 8) Hazardous materials, combustibles, corrosives 9) Web site

access and / or web site memberships of pornography or illegal sites. 10) Gambling transactions. Failure to comply with these limitations may result

in suspension or termination of your use of the Service.

4. Payment Transaction Processing: The Service facilitates the processing of Payment Transactions to complete a payment for a purchase between

you and a Merchant. The Service will store information from you, such as your payment instruments and shipping information, and will process

Payment Transactions on behalf of Merchants through the appropriate debit card network. You authorize the charge or debit to your payment

instrument as necessary to complete processing of a Payment Transaction. You also authorize the crediting to your Payment Instrument in

connection with reversals, refunds, or adjustments through the Service.

You acknowledge and agree that your purchases of products are transactions between you and the merchant and not with the Bank. The Bank is not a

party to your purchase of products/services, and the Bank is not a buyer or a merchant in connection with any Payment Transaction.

5. Service Fees and Transaction Limit: You agree that the service charges levied for the use the facility may be debited to your account from time

to time. The Bank will limits concerning use of the Service, including individual or aggregate transaction limits on the rupee amount or number of

Payment Transactions during any specified time period(s) The Bank is at liberty to change/modify the service charges as well transaction limit

associated with the facility. These changes will be communicated through the Banks website www.rbb.com.np.

6. Refunds: The Bank is only a facilitator in making payments to the merchants. Any Refunds related to non-delivery/ defective goods/service

should be taken up with the merchant concerned.

7. Limitations on the Use of Service: The Bank reserves the right to change, suspend or discontinue any aspect of the service at any time, including

hours of operation or availability of the Service or any Service feature, without notice and without liability. The Bank also reserves the right to

impose limits on certain service features or restrict access to parts or all of the Service without notice and without liability. The Bank may decline to

process any Payment Transaction without prior notice to you or Merchant.

The Bank does not warrant that the functions contained in the Service will be uninterrupted or error free and shall not be responsible for any service

interruptions (including, but not limited to, power outages, system failures or other interruptions that may affect the receipt, processing, acceptance,

completion or settlement of Payment Transactions or the Service).

8. No Responsibility of Products: The Bank does not undertake any responsibility of the product or the merchant whatsoever. Bank shall not be

held liable for any type of misrepresentation on the product including its safety, quality, accuracy, reliability, integrity or legality of any Product.

9. Download of application: You are liable to use the authorized application product and download and installation only by the bank’s web site or

other storage location provided by bank. And you are also liable to safe handling of application.

10. Electronic Communication: The Bank may communicate with you regarding and relating to this service including any changes and

amendments there to by means of electronic communications, including mail/text message to the email address/Mobile number you provided during

registration, or posting notices or communications on the Bank’s website www.rbb.com.np. Electronic communications shall be deemed received by

you when the Bank sends the electronic communication to the email address/mobile number or published in bank’s web site.

11. Responsibility for Taxes: The reporting and payment of any applicable taxes arising from the use of the Service is your responsibility.

12. Indemnification: You agree to indemnify, defend and hold harmless activities about the Bank

13. Termination of Service: The Bank may with sole and absolute discretion without liability to you or any third party, terminate your use of the

Service for any reason, including without limitation inactivity or violation of these Terms of Service or other policies the Bank may establish from

time to time.

Upon termination, the Bank has the right to prohibit your access to the Service, including without limitation by deactivating your PIN, and to refuse

future access to the Service by you (or your relatives or known acquaintances or if a business entity, its parent, affiliates or subsidiaries or its or their

successors).

14. Limitations of Liability, Force Majeure: To the fullest extent permissible by law, in no event shall the Bank be responsible or liable to you or

any third party under any circumstances for any indirect, consequential, special, punitive or exemplary, damages or losses. In addition to and without

limiting any of the foregoing, the Bank shall not have any liability for any failure or delay resulting from any condition beyond the reasonable

control of such party, including but not limited to governmental action or acts of terrorism, earthquake, fire, and flood or other acts of God, labor

conditions, power failures and Internet disturbances.

15. Jurisdiction, Governing Law: This agreement shall be governed by and construed in accordance with the relevant Contract laws of Nepal. The

Parties agree to submit to the exclusive jurisdiction of the Courts located in Kathmandu, Nepal

Rastriya Banijya Bank

Central Office, Singhadurwar Plaza, Kathmandu, Nepal

You might also like

- Personal loan details letterDocument4 pagesPersonal loan details letterchelladuraik25% (4)

- Cmif (Front)Document1 pageCmif (Front)Ronnie Pacilona MacalaladNo ratings yet

- RTGS FormDocument2 pagesRTGS FormravilotusNo ratings yet

- Mobile Banking FormDocument2 pagesMobile Banking FormSanjiv GuptaNo ratings yet

- CC GiroDocument2 pagesCC GiroAaron Bourne LeeNo ratings yet

- Bankof BarodaDocument2 pagesBankof Barodajaideep333No ratings yet

- M-PAWA and M-STIMA registration formDocument6 pagesM-PAWA and M-STIMA registration formAnonymous L7XrxpeI1zNo ratings yet

- Access Indian Bank accounts onlineDocument5 pagesAccess Indian Bank accounts onlineBala Murugan ThangaveluNo ratings yet

- Insurance Thru AtmDocument1 pageInsurance Thru AtmKoolPalNo ratings yet

- Access your bank accounts online with Mi-b@nkDocument81 pagesAccess your bank accounts online with Mi-b@nkkoolmaverickNo ratings yet

- Request Letter for Pensioner Personal LoanDocument7 pagesRequest Letter for Pensioner Personal LoanPrudhuu PrudhviNo ratings yet

- Jiyo Easy: HandbookDocument60 pagesJiyo Easy: HandbookkvchandrareddyNo ratings yet

- Terms and ConditionDocument4 pagesTerms and ConditionRachna GuptaNo ratings yet

- Auto Debit Mandate FormDocument2 pagesAuto Debit Mandate FormRaj Herg100% (1)

- PNB MetLife withdrawal requestDocument2 pagesPNB MetLife withdrawal requestShantu ShirurmathNo ratings yet

- RTGS ApplicationDocument2 pagesRTGS ApplicationChidanandCkm50% (2)

- Medical Billing Service AgreementDocument5 pagesMedical Billing Service AgreementGary AndersonNo ratings yet

- Si Eft Mandate FormDocument1 pageSi Eft Mandate FormdSolarianNo ratings yet

- Final ApplicaFinal Application Form For IMPS With TC - Pdftion Form For IMPS With TCDocument5 pagesFinal ApplicaFinal Application Form For IMPS With TC - Pdftion Form For IMPS With TCdreamrunNo ratings yet

- MLAMU Account Opening Form 1Document4 pagesMLAMU Account Opening Form 1Tumwine Kahweza ProsperNo ratings yet

- Mitc PDFDocument3 pagesMitc PDFShreeNo ratings yet

- Union Bank of India - Terms and ConditionsDocument5 pagesUnion Bank of India - Terms and ConditionsUmesh KaneNo ratings yet

- Smart Pay Appllication FormDocument2 pagesSmart Pay Appllication FormTony M.TomyNo ratings yet

- Terms and Conditions (Mobile Banking Service)Document5 pagesTerms and Conditions (Mobile Banking Service)PriyaNo ratings yet

- Ustomer Equest ORM: Record UpdateDocument1 pageUstomer Equest ORM: Record UpdateShuja MarwatNo ratings yet

- Sms Alerts Mandate Form For Greater BankDocument4 pagesSms Alerts Mandate Form For Greater BankDhanish MehtaNo ratings yet

- Terms & Conditions SummaryDocument28 pagesTerms & Conditions SummaryGAGAN PRASADNo ratings yet

- Citizenship Charter of DBDocument13 pagesCitizenship Charter of DBPrathyusha KothaNo ratings yet

- Account Closure FormDocument2 pagesAccount Closure FormchanduvermaNo ratings yet

- Terms and Conditions - E-LDocument14 pagesTerms and Conditions - E-Lpaxy sengoudoneNo ratings yet

- Personal-Banking Insta-Banking PDF Net Registration NewDocument3 pagesPersonal-Banking Insta-Banking PDF Net Registration NewTej AsNo ratings yet

- Terms and ConditionsDocument8 pagesTerms and Conditionshariganesh37No ratings yet

- Bank of BarodaDocument99 pagesBank of BarodaYash Parekh100% (2)

- 4 1 4 4 1 8 4 S.Seeni Hamsa Abdul Salam KeelakaraiDocument2 pages4 1 4 4 1 8 4 S.Seeni Hamsa Abdul Salam KeelakaraiAafiya AafiyaNo ratings yet

- Ecs New Form LicDocument4 pagesEcs New Form LicAtul Thakur0% (1)

- ZTBL SMS Alerts Facility Application FormDocument3 pagesZTBL SMS Alerts Facility Application FormAtif IdreesNo ratings yet

- Mm/Dd/YyyyDocument1 pageMm/Dd/YyyyKaushaljm PatelNo ratings yet

- Sole Proprietor YES MSME Mobile Banking DeclarationDocument2 pagesSole Proprietor YES MSME Mobile Banking DeclarationSuraj SinghNo ratings yet

- Declaration: Fax Copy To CO:DIT. Please Retain The Application Form at Branch For Record PurposeDocument1 pageDeclaration: Fax Copy To CO:DIT. Please Retain The Application Form at Branch For Record Purposedrmas009No ratings yet

- Banc@Cell Banc@Cell Banc@Cell: The Shamrao Vithal Co-Operative Bank Limited Banc@Cell Registration FormDocument4 pagesBanc@Cell Banc@Cell Banc@Cell: The Shamrao Vithal Co-Operative Bank Limited Banc@Cell Registration FormRAMESHKUMAR.S MCE-LECT/MECHNo ratings yet

- HSBC - Personal Banking Agreement en PDFDocument52 pagesHSBC - Personal Banking Agreement en PDFRuslan ParisNo ratings yet

- Inactive and Dormant Account Activation FormDocument1 pageInactive and Dormant Account Activation Formmani mNo ratings yet

- Terms and Conditions for IndusNet Internet BankingDocument21 pagesTerms and Conditions for IndusNet Internet Bankingspsg95No ratings yet

- Online Banking and Bill Payment Agreement (CeB)Document18 pagesOnline Banking and Bill Payment Agreement (CeB)Chisom Chidi100% (1)

- One Click 1Document2 pagesOne Click 1Donna OnitnelotNo ratings yet

- One Click PDFDocument2 pagesOne Click PDFAlbanNo ratings yet

- Registration Form For Sms Alerts For Current AccountsDocument1 pageRegistration Form For Sms Alerts For Current AccountsDashrath ManjhiNo ratings yet

- I B ApplicationfdfddfdfdfdfDocument3 pagesI B ApplicationfdfddfdfdfdfRitesh MistryNo ratings yet

- Savings Accounts TNCDocument8 pagesSavings Accounts TNCShivi ChauhanNo ratings yet

- Savings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Document4 pagesSavings Bank/Current Account Opening Form (For Individuals and Joint Accounts)Sri JaiNo ratings yet

- Application FormDocument2 pagesApplication Formapi-3738358No ratings yet

- Application For Corporate Net BankingDocument9 pagesApplication For Corporate Net BankingGosswin Gnanam G100% (1)

- Terms and Conditions - Debit CardsDocument7 pagesTerms and Conditions - Debit CardsAshan SanNo ratings yet

- RegistrationForm Southeast BankDocument2 pagesRegistrationForm Southeast BankAbdullah Al Jahid100% (1)

- NEFTForm MAX LIFE PDFDocument1 pageNEFTForm MAX LIFE PDFdrantozux100% (1)

- Internet Banking, Mobile Banking, and Bill Payment AgreementDocument7 pagesInternet Banking, Mobile Banking, and Bill Payment AgreementJhomer ClaroNo ratings yet

- Application Form For Mobile Banking: Branch: Sol Id: DateDocument2 pagesApplication Form For Mobile Banking: Branch: Sol Id: DateKaran chetryNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!From EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Rating: 1 out of 5 stars1/5 (1)