Professional Documents

Culture Documents

Copy Firstamericanbank Creditdefaultswaps 110814015406 Phpapp02

Copy Firstamericanbank Creditdefaultswaps 110814015406 Phpapp02

Uploaded by

Akshay GajghateCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy Firstamericanbank Creditdefaultswaps 110814015406 Phpapp02

Copy Firstamericanbank Creditdefaultswaps 110814015406 Phpapp02

Uploaded by

Akshay GajghateCopyright:

Available Formats

AY 2010-12

FIRST AMERICAN BANK:

CREDIT DEFAULT SWAPS

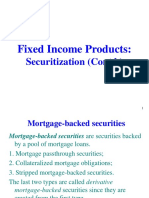

Advanced Fixed Income securities

FIRST AMERICAN BANK: CREDIT DEFAULT SWAPS

CASE INTRODUCTION:

CapEx Unlimited is banking customer of Charles Bank International and is going through tough times

with a loss of 82 million for the year 2000-01. It is in middle of an industrial shake-out and requires $

50 to finance the expansion of its network. The company has already accumulated $100 million in

previous loans from CBI and was depending on relations with bank for additional funding. CBI’s

exposure to CEU would exceed permissible limits if it agreed to lend the amount. Kittal managing

director of FAB envisioned helping CBI by mitigating credit risk through single-name credit default

swap.

First American Bank (FAB) is one of the largest bank in America with asset value of $ 50 billion and

businesses in 50 countries. First American Credit Derivatives was an independent business unit

housed within Firrst American’s structured products branch.

CapEx Unlimited (CEU) is a company primarily into telecommunication focused on Northeast and

Midwest United States, providing services like high-speed internet, Web hosting, Web hosting, data

networking, voice communication, and video/tele-conferencing.

Kittal was contemplating using credit default swap for the current situation, because it made credit

risk accessible to a broad range of investors in a way that was simple and confidential. In credit

default CBI would make periodic fee payment to FAB in exchange for receiving credit protection.

Counterparty risk is lower here given high rating of FAB, another way to reduce counterparty risk

was to issue credit linked notes. In a way CBI would be playing the role of intermediate between FAB

and CEU.

Through a single name credit default swap, party could buy protection from another party with

respect to various predefined credit events occurring in certain reference identity. Party buying

protection was called “protection buyer” and party providing protection was called “protection

seller”. In case of a credit event protection seller makes payment to protection buyer.

CEU has total outstanding long term debt of $ 5 billion. Additional lending of 50 million won’t impact

the credit rating of CEU. CEU’s publicly traded debt was already below investment grade (B2 rating

from Moody’s). The term of new loan included a coupon rate of approximately 9.8% and a maturity

of two years. CEU’s existing debt had an average maturity of five years, with average semiannual

coupon of $ 130 million. In exchange for protection against a CEU credit event, CBI would make

semiannual swap fee payments to First American Bank that coincided with the interest payments it

received on the CEU loan.

Kittals was confused whether to keep the credit risk in-house or find some investors ready to take on

the credit risk. In case of transferring the risk to some other party with low rating there was high

counterparty risk, as the hedging is unfunded (high collaterals from low credit entities was not

possible). Another way he was contemplating to transfer the risk was issuing credit-linked note

which was attractive owing to its funded nature.

Advanced Fixed Income Securities Page 1

FIRST AMERICAN BANK: CREDIT DEFAULT SWAPS

Pricing a CDS:

Calculations:

Valuation of CDS involves finding out the spread which is to be added to the reference rate of the

derivative market. To calculate this spread we need to calculate the default probabilities each year

and this can de done in two ways:

1) Using the historical data and

2) Using Bond Prices

Both these methods have been demonstrated in the calculations below.

Default Probabilities based on Historical data

As per Exhibit

10(b)

Cummulative

Default Unconditional Survival

Time Probability Default Probability Rate

1 6.23% 6.23% 93.77%

2 13.70% 7.47% 86.77%

Default Probabilities based on Bond Prices

Risk Free Rate 0.045

Yield on B2 bond 0.098

Spread 5.30%

Recovery Rate 82.00% From Exhibit 14

Hazard Rate 29%

Cummulative

Default Unconditional Default

Time Probability Probability Survival Rate

1 26% 26% 74%

2 45% 19% 60%

Where

Q(t)= Cumulative default probability

S= spread over the risk free bond

Advanced Fixed Income Securities Page 2

FIRST AMERICAN BANK: CREDIT DEFAULT SWAPS

R=Recovery rate

Calculation of Spreads:

Using Bond prices to calculate the Default probability

Calculation of the present value of expected payments

Expected Discount PV of expected

Time Probability of Survival Payment Factor payment

1 0.74 0.74 0.955997482 0.712165861

2 0.60 0.60 0.913931185 0.551470088

Total Payment 1.263635949

Probability of Discount PV of expected

Time Default Recovery Rate Expected Payoff Factor payoff

1 0.255054669 0.82 0.04590984 0.955997482 0.04389

2 0.190001785 0.82 0.034200321 0.913931185 0.031257

Total Payoff 0.075146

So value of spread = (Total PV of expected payoff)/ (Total PV of expected payment)

=5.5%

Using Historical data to calculate the Default probability

Expected Discount PV of expected

Time Probability of Survival Payment Factor payment

1 0.94 0.94 0.955997482 0.896438839

2 0.87 0.87 0.913931185 0.792975875

Total Payment 1.689414714

Calculation of the present value of expected payoffs

Advanced Fixed Income Securities Page 3

FIRST AMERICAN BANK: CREDIT DEFAULT SWAPS

Probability of Discount PV of expected

Time Default Recovery Rate Expected Payoff Factor payoff

1 0.0623 0.82 0.011214 0.955997482 0.010721

2 0.0747 0.82 0.013446 0.913931185 0.012289

Total Payoff 0.023009

So value of spread = (Total PV of expected payoff)/ (Total PV of expected payment)

=1.3%

So the spread should be in the range of 1.3% to 5.5%

Assumptions:

1) Risk free rate is 4.5% which is for 5 years and not 2 years

2) Default probability annually is used and not semi-annually which is the actual coupon

payment schedule.

Hedging Credit Default Swaps

The CDS can be hedged through two main mechanism s

1. Create synthetic assets

2. Hedging using Cash Assets

Create synthetic assets:

For unleveraged investors, the generic synthetic asset strategy is to write default protection, post

the required margin and invest the remaining principal in a near-money-market equivalent asset.

Triple-A-rated floating-rate credit-card asset-backed securities are usually the cheapest type of asset

for creating synthetic assets. These assets have negligible default risk because of early amortization

features and credit enhancement achieved through subordination (12 percent to 15 percent) and

excess servicing (3 percent to 6 percent). In addition, the potential loss of premium associated with

early amortization events is mitigated by the floating-rate structure of the instruments. The

combination of a floater and a default swap equates to a synthetic floating-rate note.

Investors are motivated to use default swaps to create synthetic assets for two reasons. First,

relative value. There are times when a synthetic asset is cheaper than the cash-market equivalent.

This is especially true when the implied repo rate in the default swap is trading at Libor. As a result,

an investor can monetize the repo premium implied in the default swap, without having to finance

the trade. Meanwhile, since out-of-favor or volatile credits tend to trade at higher repo premiums,

investors can use default swaps to take views relative to the forward credit spreads implied by the

default swap market.

Advanced Fixed Income Securities Page 4

FIRST AMERICAN BANK: CREDIT DEFAULT SWAPS

A second motivation to use credit default swaps is that the instruments enable investors to tap into

a market that's bigger than that of tradable securities. A desired credit exposure that is not available

in the cash market can be synthetically created via a default swap. Given the historically low levels of

interest rates and the flatness of the yield curve, a disproportionate share of new-issue volume has

been both fixed and dated. As a result, the supply of corporate floaters and short-dated fixed-rate

bonds has been concentrated in a handful of credits—generally in the financial services.

Hedge cash assets:

One of the most important applications of default swaps is hedging. All hedges incur basis risk; the

basis risk in a default swap stems from the volatility in the implied repo premium. Since this

premium will be more volatile for low-rated and distressed credits, these types of credits will be

subject to more basis risk than their investment-grade counterparts. As a rule, the cheapest time to

implement a hedge is when the market is not concerned about the risk.

One way to illustrate the effectiveness of default swaps in hedging is to assess how a hedge

performed in the past. Consider a hypothetical hedge employed by a money manager benchmarked

to the Merrill Lynch Corporate Aggregate, who held 10 percent of the portfolio in Hilton Hotels

(Baa1/BBB). In September 1997, this $500 million portfolio had $50 million in Hilton five-year bonds,

which were originally purchased at a discount and now have a four-point gain. The remaining 90

percent of the portfolio matches the index in terms of duration and credit quality. Note that this

hedge can be viewed generically. One way to reduce a portfolio's exposure to the REIT market, for

instance, would be to buy default protection on the most representative credit.

The exposure of the portfolio can be brought back to index levels with either an outright sale of the

bonds or a hedge using a default swap. There are three reasons why the portfolio manager might

opt to hedge rather than sell: because of adverse tax events (four points of capital gain position),

because the cost of hedging is relatively inexpensive (basis could work in favor of hedge), or because

of the high transaction cost resulting from low liquidity in the cash market (credit is out-of-favor).

Advanced Fixed Income Securities Page 5

FIRST AMERICAN BANK: CREDIT DEFAULT SWAPS

Delta hedging of reverses knock-outs

The first hedging strategy used by the seller of the reverse knock-out call will be to invest in the

underlying asset and continuously readjust that position according to the delta of the option. This

will protect the hedge against directional moves of the asset price. This hedge still leaves him with

gamma risk, however—a residual risk linked to the amplitude of spot moves, whose impact on his

P&L depends on the convexity of the option. When the option profile is convex, he will be hurt by

spot moves being higher than those given by his volatility assumption. This could happen at any level

when a trader is short a European option and around the strike when he is short a barrier option.

When the option profile is concave, which is the case around the barrier in our example, the trader

will be hurt by asset price moves being lower than anticipated.

The following two scenarios explain the consequences of these concepts and help us understand the

problem of pricing, hedging, and marking-to-market exotic options under a Black-Scholes regime.

We assume that a skew exists whereby vanilla options struck at or near the barrier are trading at 15

percent rather than the 20 percent implied volatility of at-the-money options.

First scenario: The trader chooses to price at the strike volatility (20 percent). If the spot ends up

around the barrier and its volatility is lower than 20 percent (as anticipated by the market in that

implied volatility at the barrier is lower), he will lose money.

Second scenario: The trader chooses to price at the barrier volatility (15 percent). If the spot ends up

around the strike and its volatility is 20 percent (as anticipated by the market), he will lose money.

Whatever his choice, he will be dependent on the underlying directional moves, which is to say that

his pricing and delta hedge are wrong and incompatible with the market expectations. A better

model is needed.

Advanced Fixed Income Securities Page 6

FIRST AMERICAN BANK: CREDIT DEFAULT SWAPS

The "smile” model

While Black-Scholes assumes volatility has to be constant, the simplest extension of Black-Scholes

that is compatible with market prices of European options and market expectation of volatility at

various levels of the underlying is a "smile” model. This model assumes that local volatility is a

function of current level and possibly time. In one form or another, it has been implemented by

many banks since the mid-1990s and is a major improvement for mark-to-market pricing and risk

management. Also, for our up-and-out reverse knock-out option, this model will be able to

incorporate different volatilities around the strike and the barrier: a large volatility around the strike

(where the option tends to be convex) will increase the price more than Black-Scholes. A lesser

volatility around the barrier (where the option tends to be concave) will also increase the price. The

compounding of those two effects often leads to a price higher than any Black-Scholes price.

Vega hedging

We have seen that properly taking into account the negative volatility skew can result in a higher

price to the reverse knock-out call than using the constant at-the-money volatility. Another knock-

out case could be built with a symmetrical profile with respect to the at-the-money option (100

percent). Let's assume we have a three-month option that is a reverse knock-out put struck at 100

percent with a barrier at 80 percent. Let's further assume that the market smile is as follows:

20 percent out-of-the-money vanilla puts are priced at 25 percent implied volatility;

at-the-money vanilla options are priced at 20 percent implied volatility;

20 percent out-of-the-money vanilla calls are priced at 17 percent implied volatility.

Implications

Three important properties of this strategy will impact risk management of barrier options in real

life:

This hedge is unfortunately not static and will vary as conditions such as the underlying asset price

and volatility surface change. There will often be a systematic rebalancing cost associated with the

strategy because of convexity in volatility, and hence the need for a stochastic volatility model for

even more accurate pricing.

1. Trading several European options for each barrier option will certainly have a tendency for

high transaction costs over time. Therefore, vega hedging has to be performed at the

portfolio level in order to benefit from any cancellation of risk between the exotics

contained in a market-maker's book.

2. We have only described hedging the proper volatility pricing and hedging of an exotic

option. It turns out, of course, that with knock-out barriers, when spot approaches the

barrier level, gamma becomes the main source of risk. At the extreme—on an expiration

day, for example—this risk will be unhedgeable. In other instances in which an option still

has a period of time to run, other hedging techniques, which are beyond the scope of this

article, have to be used as well.

Advanced Fixed Income Securities Page 7

You might also like

- First American Bank Case SolutionDocument13 pagesFirst American Bank Case Solutionharleeniitr80% (5)

- Strategic Capital Management Write-UpDocument2 pagesStrategic Capital Management Write-UpJosh BrodskyNo ratings yet

- FX Risk Hedging at EADSDocument14 pagesFX Risk Hedging at EADSAlexandra Ermakova100% (1)

- Valuing A Cross Border LBO - Yell GroupDocument5 pagesValuing A Cross Border LBO - Yell GroupSameer Kumar0% (1)

- Banc One Case StudyDocument10 pagesBanc One Case StudyRom Aure93% (29)

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Yell FinalDocument10 pagesYell Finalbumz1234100% (2)

- Arundel Partners - Real Options ValuationsDocument12 pagesArundel Partners - Real Options ValuationsJason WangNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Sleeping Beauty CaseDocument6 pagesSleeping Beauty CaseAlvaro Andrade Ramírez0% (2)

- First American Bank - Case ReportDocument2 pagesFirst American Bank - Case ReportFan Feng50% (2)

- Rabocase 105019Document6 pagesRabocase 105019CfhunSaatNo ratings yet

- Sleeping Beauties Bonds - Walt Disney CompanyDocument15 pagesSleeping Beauties Bonds - Walt Disney CompanyThùyDương Nguyễn100% (2)

- Walt Disney Case WaCDocument5 pagesWalt Disney Case WaCamina67% (3)

- Case 11 Group 1 PDFDocument56 pagesCase 11 Group 1 PDFRumana ShornaNo ratings yet

- LoewenDocument3 pagesLoewenAmit SurveNo ratings yet

- Buffet Bid For Media GeneralDocument21 pagesBuffet Bid For Media Generalshivam chughNo ratings yet

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- FBE 432 / Korteweg: Corporate Financial StrategyDocument24 pagesFBE 432 / Korteweg: Corporate Financial StrategyDragan PetkanovNo ratings yet

- 7 Annotated Slides - Chapter 17Document15 pages7 Annotated Slides - Chapter 17nitinNo ratings yet

- Metallgesellschafts Hedging Debacle - DRM Group 4Document2 pagesMetallgesellschafts Hedging Debacle - DRM Group 4vineet kabra100% (1)

- AQR CaseDocument3 pagesAQR CaseIni EjideleNo ratings yet

- Valuing A Cross-Border LBODocument17 pagesValuing A Cross-Border LBOasdhjshfdsjauildgfyh50% (6)

- Mci Takeover Battle AnalysisDocument13 pagesMci Takeover Battle AnalysisAastha Swaroop50% (2)

- Goodrich Rabobank 01Document25 pagesGoodrich Rabobank 01asdadsNo ratings yet

- Buffets Bid For Media GeneralDocument23 pagesBuffets Bid For Media GeneralTerence TayNo ratings yet

- Bidding On The Yell Group - Prasann S - 2015PGP334Document3 pagesBidding On The Yell Group - Prasann S - 2015PGP334Prasann ShahNo ratings yet

- PresentationDocument15 pagesPresentationapi-241493839No ratings yet

- FPL Dividend Policy-1Document6 pagesFPL Dividend Policy-1DavidOuahba100% (1)

- FPL SolutionsDocument4 pagesFPL SolutionsMegan Lo75% (4)

- Merger Arbitrage Case StudyDocument5 pagesMerger Arbitrage Case Studychuff6675100% (1)

- Case Analysis of Investment Banking at Thomas Weisel PartnersDocument2 pagesCase Analysis of Investment Banking at Thomas Weisel PartnersabhinavNo ratings yet

- Gemi RJRDocument6 pagesGemi RJRAjeng NurulNo ratings yet

- RJR Nabisco ValuationDocument33 pagesRJR Nabisco ValuationShivani Bhatia100% (4)

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Carrefour Group 8Document9 pagesCarrefour Group 8IzzaNo ratings yet

- 3-Way Collars For ProducersDocument5 pages3-Way Collars For Producerscblancovinas100% (1)

- Venture Capital Financing in IndiaDocument46 pagesVenture Capital Financing in IndiaHarish Shetty100% (1)

- Chapter 7Document10 pagesChapter 7rcraw87No ratings yet

- 1st American Bank CaseDocument6 pages1st American Bank CaseRenu EsraniNo ratings yet

- First American Bank CaseDocument3 pagesFirst American Bank CaseLakshya AgrawalNo ratings yet

- Case Write Up Sample 2Document4 pagesCase Write Up Sample 2veda20No ratings yet

- FX Concern at EDS PDFDocument8 pagesFX Concern at EDS PDFSarvagya JhaNo ratings yet

- Chase's Strategy V2.0Document33 pagesChase's Strategy V2.0Vinay Kumar100% (4)

- 2839 MEG CV 2 CaseDocument10 pages2839 MEG CV 2 CasegueigunNo ratings yet

- FPLDocument20 pagesFPLJasmani CervantesNo ratings yet

- Atlas Fin CaseDocument11 pagesAtlas Fin CaseAniruddhaNo ratings yet

- LTCMDocument18 pagesLTCMAbhirupa DebroyNo ratings yet

- MFIN 6205 Final ReportDocument26 pagesMFIN 6205 Final ReportAhmedMalikNo ratings yet

- Winfield PPT 27 FEB 13Document13 pagesWinfield PPT 27 FEB 13prem_kumar83g100% (4)

- BF RaboBankDocument8 pagesBF RaboBanknjwill100% (1)

- MEG CV 2 CaseDocument10 pagesMEG CV 2 Casegabal_m50% (2)

- Chasecase PaperDocument10 pagesChasecase PaperadtyshkhrNo ratings yet

- American Barrick - MP19006, 19015, 19016, 19026Document9 pagesAmerican Barrick - MP19006, 19015, 19016, 19026KshitishNo ratings yet

- American Barrick Resources CorporationDocument41 pagesAmerican Barrick Resources CorporationMridul SharmaNo ratings yet

- Strategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersDocument13 pagesStrategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersPrashant JhakarwarNo ratings yet

- Banc One Case My SolutionDocument5 pagesBanc One Case My SolutionБорче Шулески67% (3)

- Walt DisneyDocument10 pagesWalt DisneystarzgazerNo ratings yet

- Chapter-6 GITMAN SOLMANDocument24 pagesChapter-6 GITMAN SOLMANJudy Ann Margate Victoria67% (6)

- Liquidity RiskDocument25 pagesLiquidity RiskWakas Khalid100% (1)

- FIN2601-chapter 6Document28 pagesFIN2601-chapter 6Atiqa Aslam100% (1)

- Credit RiskDocument37 pagesCredit RiskWakas KhalidNo ratings yet

- Chapter09 IfDocument10 pagesChapter09 IfPatricia PamelaNo ratings yet

- Structured Products 2Document41 pagesStructured Products 2SCCEGNo ratings yet

- Hasfhi Rahmat - Tugas Ke-4Document4 pagesHasfhi Rahmat - Tugas Ke-4syuhayudaNo ratings yet

- Ch007 5170 HW Students Sol-1Document9 pagesCh007 5170 HW Students Sol-1evelynemoussallemNo ratings yet

- Poem 4Document7 pagesPoem 4Jenny ManalastasNo ratings yet

- Economy Current Affairs by Teju, Nextgen Ias - November 2020Document50 pagesEconomy Current Affairs by Teju, Nextgen Ias - November 2020akshaygmailNo ratings yet

- Compartaive Analysis of Mutual Fund Scheme by Harshil P HundiaDocument44 pagesCompartaive Analysis of Mutual Fund Scheme by Harshil P HundiaHarshil HundiaNo ratings yet

- Treasury Bills IFM PPT by Group 2Document18 pagesTreasury Bills IFM PPT by Group 2Sayyed LatifNo ratings yet

- Book - Keeping and AccountingDocument5 pagesBook - Keeping and AccountingAshish DhakalNo ratings yet

- APRIL - 2022 On Going Projects - N Square Projects PDFDocument19 pagesAPRIL - 2022 On Going Projects - N Square Projects PDFTodaySquareFeet HyderabadNo ratings yet

- Summary - Quality StocksDocument5 pagesSummary - Quality StockssumonNo ratings yet

- Economic ExposureDocument6 pagesEconomic ExposureAnshulGuptaNo ratings yet

- GSSDocument17 pagesGSSDR SAMUEL KENNEDY AGYEI TAKYINo ratings yet

- Financial ManagementDocument12 pagesFinancial Managementnorai abdullahNo ratings yet

- Project Report: Manufacturing of Masala PowderDocument10 pagesProject Report: Manufacturing of Masala PowderSuraj Singh RajvanshiNo ratings yet

- How To Make Money Trading With Charts PDFDocument459 pagesHow To Make Money Trading With Charts PDFDeven Zaveri77% (30)

- Free Sample Last Will and TestamentDocument6 pagesFree Sample Last Will and TestamentHenry DyNo ratings yet

- Qatar Deals Creating ValueDocument2 pagesQatar Deals Creating ValueMooneer El AssaadNo ratings yet

- Module 3 - Compound Financial Instruments and Debt RestructuringDocument21 pagesModule 3 - Compound Financial Instruments and Debt RestructuringAga Mathew MayugaNo ratings yet

- YeahDocument2 pagesYeahMoimen Dalinding UttoNo ratings yet

- BS Delhi English 26-08-2021Document26 pagesBS Delhi English 26-08-2021susgNo ratings yet

- Valeo 2017 Registration DocumentDocument454 pagesValeo 2017 Registration DocumentFadyNo ratings yet

- Econ Essay On Royal Mail Between PrivitisationDocument2 pagesEcon Essay On Royal Mail Between PrivitisationAhila100% (1)

- Kudimata Manual NNPC FoundationDocument33 pagesKudimata Manual NNPC Foundationmarshalsamson247No ratings yet

- LEASING Updated Version 2021Document7 pagesLEASING Updated Version 2021rifaiNo ratings yet

- LIC S Market Plus - 512L238V01Document9 pagesLIC S Market Plus - 512L238V01Sharath KotaNo ratings yet

- Financial Management 2E: Solutions To Numerical Problems Rajiv Srivastava - Dr. Anil MisraDocument8 pagesFinancial Management 2E: Solutions To Numerical Problems Rajiv Srivastava - Dr. Anil Misramanisha sonawaneNo ratings yet

- English TestsDocument6 pagesEnglish TestsmasaS SASANo ratings yet