0% found this document useful (0 votes)

607 views6 pagesCash Flow and Breakeven Formulas Guide

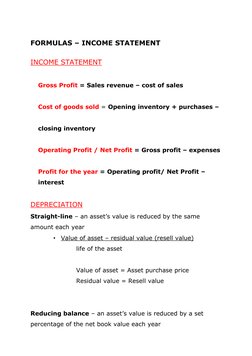

This document provides formulas and calculations for cash flow, breakeven analysis, income statements, balance sheets, and financial ratios. It defines key terms like net cash flow, total revenue, total costs, gross profit, operating profit, depreciation methods, assets, liabilities, and equity. Formulas are given for calculating breakeven point, contribution, margin of safety, gross profit margin, return on capital employed, current ratio, and inventory turnover.

Uploaded by

has choCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

607 views6 pagesCash Flow and Breakeven Formulas Guide

This document provides formulas and calculations for cash flow, breakeven analysis, income statements, balance sheets, and financial ratios. It defines key terms like net cash flow, total revenue, total costs, gross profit, operating profit, depreciation methods, assets, liabilities, and equity. Formulas are given for calculating breakeven point, contribution, margin of safety, gross profit margin, return on capital employed, current ratio, and inventory turnover.

Uploaded by

has choCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Formulas - Cash Flow & Breakeven

- Breakeven Point & Contribution

- Formulas - Income Statement

- Statement of Financial Position

- Financial Ratios

- Measuring Efficiency