Professional Documents

Culture Documents

Financial Accounting 1 - Solution 3

Financial Accounting 1 - Solution 3

Uploaded by

mardhiah0 ratings0% found this document useful (0 votes)

14 views2 pagesThe document provides an introduction to accounting concepts. It discusses reasons for increases and decreases in inventory, the use of debit and credit notes, and the effect of various transactions on accounts. Specifically, it states that increases in inventory can occur due to purchases or returns, decreases from sales or returns. Debit notes reduce payables for returned goods, while credit notes reduce receivables for customer returns. The effect of transactions like purchases, sales, payments and returns are explained in terms of increases and decreases to accounts like cash, inventory, payables and receivables.

Original Description:

Original Title

Financial Accounting 1_Solution 3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an introduction to accounting concepts. It discusses reasons for increases and decreases in inventory, the use of debit and credit notes, and the effect of various transactions on accounts. Specifically, it states that increases in inventory can occur due to purchases or returns, decreases from sales or returns. Debit notes reduce payables for returned goods, while credit notes reduce receivables for customer returns. The effect of transactions like purchases, sales, payments and returns are explained in terms of increases and decreases to accounts like cash, inventory, payables and receivables.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesFinancial Accounting 1 - Solution 3

Financial Accounting 1 - Solution 3

Uploaded by

mardhiahThe document provides an introduction to accounting concepts. It discusses reasons for increases and decreases in inventory, the use of debit and credit notes, and the effect of various transactions on accounts. Specifically, it states that increases in inventory can occur due to purchases or returns, decreases from sales or returns. Debit notes reduce payables for returned goods, while credit notes reduce receivables for customer returns. The effect of transactions like purchases, sales, payments and returns are explained in terms of increases and decreases to accounts like cash, inventory, payables and receivables.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Introduction to Accounting

Solution 3

QUESTION 1

State the TWO (2) reasons for increase in inventory and decrease in inventory.

TWO (2) reasons for increase in inventory

1) Purchase of inventory

2) Sales return/ return inwards

TWO (2) reasons for decrease in inventory

1) Sales of inventory

2) Purchase return/ return outwards

QUESTION 2

Explain the use of debit notes and credit notes.

Debit note is a document prepares by business and send to supplier when the

business return goods to supplier (known as purchase return/ return outwards) due

to damage or wrong items. This is to show the reduction in account payable by

debited the goods return amount.

Credit note is a document prepares by business and issue to

customers/debtors when customers/debtors return goods to business (known as

sales return/ return inwards). This is to show the reduction amount in account

receivable by credited the goods return amount.

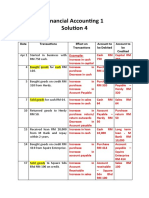

QUESTION 3

State the effect of the following transactions:

No. Transactions Effect

Example: Example:

1 Purchase goods using cash Increase in purchase

Decrease in cash

Increase in purchase

2 Purchase goods paying by cheque

Decrease in bank

Increase in purchase

3 Purchase goods from supplier on credit

Increase in account payable

Increase in sales

4 Sales of goods by cash

Increase in cash

5 Received a cheque when make a sale Increase in sales

Increase in bank

Increase in sales

6 Sold goods on credit to customers

Increase in account receivable

Decrease in cash/bank

7 Make a payment to creditors

Decrease in account payable

Increase in cash/bank

8 Receive payment from debtors

Decrease in account receivable

Increase in purchase return

Return goods to credit supplier due to

9 Decrease in account payable

wrong items received

Credit customer return goods and issue a Increase in sales return

10

debit notes to business Decrease in account receivable

You might also like

- Odyssey Private Equity Compensation Report 2023 Candidate Version 1Document42 pagesOdyssey Private Equity Compensation Report 2023 Candidate Version 1RMC123No ratings yet

- Accountancy Class 11th T.S. Grewal Book PDF New Edition (Part 2) Pdf. by HELPING HAND ?? PDFDocument128 pagesAccountancy Class 11th T.S. Grewal Book PDF New Edition (Part 2) Pdf. by HELPING HAND ?? PDFGehna Jain80% (40)

- Test Bank - Ifa Part 3 (2015 Edition)Document284 pagesTest Bank - Ifa Part 3 (2015 Edition)Fery Ann75% (8)

- Tutorial 1 Introduction To Accounting (Q)Document4 pagesTutorial 1 Introduction To Accounting (Q)lious liiNo ratings yet

- Coursebook Chapter 6 AnswersDocument2 pagesCoursebook Chapter 6 AnswersAhmed Zeeshan90% (10)

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- CONTROL ACCOUNT NotesDocument2 pagesCONTROL ACCOUNT Notesndumiso100% (3)

- Accounting CycleDocument6 pagesAccounting CycleMosheikh PlaysNo ratings yet

- Topic 2 Book of Prime Entry and Business DocumentsDocument7 pagesTopic 2 Book of Prime Entry and Business DocumentsHeavens MupedzisaNo ratings yet

- Basic Documentation and Books of Account: Topic 3Document32 pagesBasic Documentation and Books of Account: Topic 3vickramravi16No ratings yet

- FA 1 Chapter 1 Business Transactions and DocumentationDocument22 pagesFA 1 Chapter 1 Business Transactions and DocumentationS RaihanNo ratings yet

- Caie As Level Accounting 9706 Theory v1Document28 pagesCaie As Level Accounting 9706 Theory v1BrizzyNo ratings yet

- Chapter 7 Cash: Learning ObjectivesDocument29 pagesChapter 7 Cash: Learning ObjectivesErana TerefaNo ratings yet

- Fin Accounting 2 EquationDocument25 pagesFin Accounting 2 EquationIqbal Hanif100% (1)

- MBA - Accounting Management: Group 2 Ms. Odessa Jarina Ms. Beatrix Rose Beltijar Mr. Edmer GatchalianDocument10 pagesMBA - Accounting Management: Group 2 Ms. Odessa Jarina Ms. Beatrix Rose Beltijar Mr. Edmer Gatchaliancluadine dinerosNo ratings yet

- Control AccountDocument6 pagesControl AccountPranitha RaviNo ratings yet

- Grade 8 Control Accounts: Item Source of InformationDocument2 pagesGrade 8 Control Accounts: Item Source of Informationmohamed sobahNo ratings yet

- Accounting For MerchandisingDocument2 pagesAccounting For MerchandisingEvelyn MaligayaNo ratings yet

- Accounting ConceptsDocument10 pagesAccounting ConceptsOmer AliNo ratings yet

- Control AccountsDocument4 pagesControl AccountsTyanna TaylorNo ratings yet

- As Accounting Unit 1 RevisionDocument12 pagesAs Accounting Unit 1 RevisionAhmed NiazNo ratings yet

- AccountancyDocument2 pagesAccountancyJohn Calvin GerolaoNo ratings yet

- Accounting Chapter 4Document21 pagesAccounting Chapter 4MUHAMMAD ZULHAIRI BIN ROSLI STUDENTNo ratings yet

- Togdher University Course: Audit IDocument50 pagesTogdher University Course: Audit ICabdixakiim-Tiyari Cabdillaahi AadenNo ratings yet

- Credit NoteDocument6 pagesCredit NotehenryvijayfNo ratings yet

- Bought To You by Please Donate To Keep Us Alive AS-Level Accounting Unit 1 Revision Notes Mrs Carpenter-Unit 1 Accounting Revision NotesDocument12 pagesBought To You by Please Donate To Keep Us Alive AS-Level Accounting Unit 1 Revision Notes Mrs Carpenter-Unit 1 Accounting Revision Notesmuhtasim kabirNo ratings yet

- Chapter 6 - Business Documents Accounting NotesDocument3 pagesChapter 6 - Business Documents Accounting Notesaysilislam528No ratings yet

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Document10 pagesNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNo ratings yet

- Periodic Inventory PDFDocument33 pagesPeriodic Inventory PDF48pgcw62kkNo ratings yet

- Chapter 1Document13 pagesChapter 1vinh88No ratings yet

- IGSCE Accounts Theory NotesDocument3 pagesIGSCE Accounts Theory NotesThe Xplorer In Me CooksNo ratings yet

- Day 6 Cash and Receivables 2024 FinalDocument18 pagesDay 6 Cash and Receivables 2024 FinalKit KatNo ratings yet

- A StockDocument3 pagesA Stocktengku rilNo ratings yet

- As Level Accounting Notes.Document75 pagesAs Level Accounting Notes.SameerNo ratings yet

- As Level Accounting NotesDocument77 pagesAs Level Accounting NotesRoHan ChooramunNo ratings yet

- Chapter 3Document37 pagesChapter 3ENG ZI QINGNo ratings yet

- 3.4 Control AccountsDocument12 pages3.4 Control Accountsnurainbello8No ratings yet

- Ffa W12343Document22 pagesFfa W12343DaddyNo ratings yet

- Accounting - Lesson 5Document11 pagesAccounting - Lesson 5Richel ArmayanNo ratings yet

- CH 5 - Returns, Discounts and Sales Tax - UpdatedDocument31 pagesCH 5 - Returns, Discounts and Sales Tax - Updatedgolooz43No ratings yet

- Bac2664auditing l9 Purchase CycleDocument37 pagesBac2664auditing l9 Purchase CyclesueernNo ratings yet

- Theory NotesDocument7 pagesTheory NotesThe Xplorer In Me CooksNo ratings yet

- Accounts ReceivableDocument6 pagesAccounts Receivablejustinenakpil09No ratings yet

- Revision of Double Entry SystemDocument2 pagesRevision of Double Entry SystemHasan ShoaibNo ratings yet

- Professional Accounting PackageDocument72 pagesProfessional Accounting PackageAnmol poudelNo ratings yet

- Lecture 9Document33 pagesLecture 9lawlokyiNo ratings yet

- Working Capital Management November 2021Document32 pagesWorking Capital Management November 2021Abubakar OthmanNo ratings yet

- Chapter 6Document17 pagesChapter 6Thùy Vân NguyễnNo ratings yet

- PDFDocument42 pagesPDFHerbert B. Bañas IVNo ratings yet

- IGCSE Grade 9th & 10thDocument6 pagesIGCSE Grade 9th & 10thThe Xplorer In Me CooksNo ratings yet

- Accounting Principles and Policies: Transaction Relevant PrincipleDocument5 pagesAccounting Principles and Policies: Transaction Relevant PrincipleKenshin HayashiNo ratings yet

- Merchandising Business: Buying and Selling ActivitiesDocument50 pagesMerchandising Business: Buying and Selling ActivitiesjaisahNo ratings yet

- AUD02 - 03 Cash and Accrual BasisDocument16 pagesAUD02 - 03 Cash and Accrual BasisMark BajacanNo ratings yet

- Ch-6 (Expenses, Sales, Drawing)Document16 pagesCh-6 (Expenses, Sales, Drawing)Kie RubyjaneNo ratings yet

- ACC 102 - Accounts ReceivableDocument3 pagesACC 102 - Accounts Receivablewerter werterNo ratings yet

- Accounting For Merchandising CompaniesDocument40 pagesAccounting For Merchandising CompaniesAnonymous mnAAXLkYQC100% (1)

- Accounting For Merchandising CompaniesDocument40 pagesAccounting For Merchandising CompaniesAnonymous mnAAXLkYQCNo ratings yet

- Fa Transes FinalDocument36 pagesFa Transes FinalAlex VillanuevaNo ratings yet

- ACC117 - NotesDocument5 pagesACC117 - NotesNenny CandyNo ratings yet

- CH 5 Returns, Discounts and Sales Tax N5Document16 pagesCH 5 Returns, Discounts and Sales Tax N5Soputivong NhemNo ratings yet

- INTACC 1 - REVIEWER - MIDTERMS (Receivables)Document3 pagesINTACC 1 - REVIEWER - MIDTERMS (Receivables)olerianaryzzsc.56No ratings yet

- Control AccountsDocument4 pagesControl AccountsTyanna TaylorNo ratings yet

- L01 - Introduction To Financial AccountingDocument12 pagesL01 - Introduction To Financial AccountingmardhiahNo ratings yet

- L06 - Capital ExpenditureDocument7 pagesL06 - Capital ExpendituremardhiahNo ratings yet

- CH 04Document77 pagesCH 04mardhiah100% (1)

- Financial Accounting 1 - Solution 2Document3 pagesFinancial Accounting 1 - Solution 2mardhiahNo ratings yet

- Financial Accounting 1 - Solution 4Document3 pagesFinancial Accounting 1 - Solution 4mardhiahNo ratings yet

- Abu L&T SoaDocument2 pagesAbu L&T Soaமானங்கெட்ட மனசுNo ratings yet

- 11 Sps Silos Vs PNBDocument7 pages11 Sps Silos Vs PNBNaomi InotNo ratings yet

- Terms & CondDocument1 pageTerms & ConddreamrioNo ratings yet

- Conso-Summative - BTSDocument34 pagesConso-Summative - BTSVon Andrei Medina100% (1)

- Chapter 1 - Structure of Financial SystemDocument18 pagesChapter 1 - Structure of Financial SystemNur HazirahNo ratings yet

- Accounting Round 1 Ans KeyDocument21 pagesAccounting Round 1 Ans KeyMalhar ShahNo ratings yet

- PDF Chapter 2 Sol Man BAYSA 2008Document18 pagesPDF Chapter 2 Sol Man BAYSA 2008michNo ratings yet

- Wa0064Document5 pagesWa0064Coid CekNo ratings yet

- IRAC Declaration For Mortgage Loan +overdraftDocument3 pagesIRAC Declaration For Mortgage Loan +overdraftushakiranNo ratings yet

- IDirect Zomato IPOReviewDocument13 pagesIDirect Zomato IPOReviewSnehashree SahooNo ratings yet

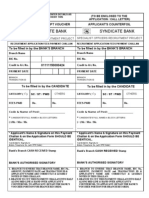

- Synd BNK Payment Challan Rec 2148Document1 pageSynd BNK Payment Challan Rec 2148kiranram007No ratings yet

- Behavioral Finance Money ManagementDocument23 pagesBehavioral Finance Money Managementparvati anilkumarNo ratings yet

- Corporate StoriesDocument18 pagesCorporate StoriesverosNo ratings yet

- Documemt - UCO BankDocument68 pagesDocumemt - UCO BankRahul Kumar VishwakarmaNo ratings yet

- KZN Accounting Grade 11 Scope 2024Document5 pagesKZN Accounting Grade 11 Scope 2024ADITINo ratings yet

- Peter Fritz Permata Statement PDFDocument10 pagesPeter Fritz Permata Statement PDFSeptian PambudiNo ratings yet

- FINA3326 Tutorial 1 NotesDocument4 pagesFINA3326 Tutorial 1 NotesYining HongNo ratings yet

- Merchandising 2Document2 pagesMerchandising 2Desirre TransonaNo ratings yet

- Critique Paper Bdo - Far3Document10 pagesCritique Paper Bdo - Far3John Jet TanNo ratings yet

- NIA PREMIUM CHART 29sept18Document1 pageNIA PREMIUM CHART 29sept18Bob KratoNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementZoie JulienNo ratings yet

- Bfin 2ND QuarterDocument12 pagesBfin 2ND QuarterFrannie Grace BusogNo ratings yet

- Summary Statement: THELTA / Klosters Capital Madrid / Aug. 2023 - PresentDocument1 pageSummary Statement: THELTA / Klosters Capital Madrid / Aug. 2023 - PresentdaniluispepeNo ratings yet

- General Activities of Agricultural Development Bank Limited, Lagankhel BranchDocument44 pagesGeneral Activities of Agricultural Development Bank Limited, Lagankhel BranchPrajwol ThapaNo ratings yet

- 10 Lecture 10 PPE NOTEDocument2 pages10 Lecture 10 PPE NOTEmanadish nawazNo ratings yet