Professional Documents

Culture Documents

Consolidated Statement

Uploaded by

Lakshya Gandhi0 ratings0% found this document useful (0 votes)

16 views10 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views10 pagesConsolidated Statement

Uploaded by

Lakshya GandhiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

Numerical

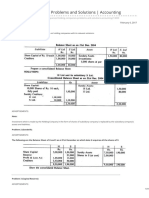

The following are the Balance Sheets of H Ltd. and its

subsidiary S Ltd. as on 31st December 2004.

Prepare consolidated Balance Sheet.

• Debtors of H Ltd. include Rs 2,000 due from S

Ltd. and Bills payable of H Ltd. included a bill

of Rs 500 accepted in favour of S Ltd. A Load of

Rs 1,000 given by H Ltd. to S Ltd. was also

included in the items of debtors and creditors

respectively. Rs 500 was transferred by S Ltd.

from Profit and Loss Account to Reserve out of

current year’s profit. Shares were purchased

on 30th June 2004 at par.

X Ltd. purchased 750 shares in Y Ltd. on 1.7.2006. The

following were their Balance Sheets on 31.12.2006.

1. Bills Receivable of X Ltd. include Rs. 10,000

accepted by Y Ltd.

2. Debtors of X Ltd. include Rs. 20,000 payable by Y

Ltd.

3. A cheque of Rs. 5,000 sent by Y Ltd. on 20th

December was not yet received by X Ltd. till 31st

December 2006.

4. Profit and Loss Account of Y Ltd. showed a

balance of Rs. 20,000 on 1st January 2006.

You are required to prepare a consolidated Balance

sheet of X Ltd. and Y Ltd. as on 31st December

2006.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Problem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsDocument9 pagesProblem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsRafidul IslamNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Holding Companies Problems and Solutions AccountingDocument11 pagesHolding Companies Problems and Solutions AccountingGenarul IslamNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Advanced AccountancyDocument4 pagesAdvanced AccountancyAbdul Lathif50% (2)

- G1 6.3 Partnership - DissolutionDocument15 pagesG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Holding Companies: Problems and Solutions - AccountingDocument17 pagesHolding Companies: Problems and Solutions - AccountingVaibhav MaheshwariNo ratings yet

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- Fundamental I AssignmentDocument4 pagesFundamental I AssignmentYisak wolasaNo ratings yet

- Accounting Final Sendup 2013Document3 pagesAccounting Final Sendup 2013Mozam MushtaqNo ratings yet

- Bram Wear CaseDocument2 pagesBram Wear CaseHabtamu Ye Asnaku Lij89% (9)

- Adjusting and Corporation Quiz 1Document13 pagesAdjusting and Corporation Quiz 1JEFFERSON CUTENo ratings yet

- Incomplete Records QDocument34 pagesIncomplete Records Qcharliedry1920No ratings yet

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Journal & LedgerDocument9 pagesJournal & Ledgeranushka100% (1)

- ACC300 Principles of AccountingDocument11 pagesACC300 Principles of AccountingG JhaNo ratings yet

- Amalgamation of FirmsDocument3 pagesAmalgamation of Firmsmohanraokp2279No ratings yet

- 12th Accounts Partnership Test 15 Sept.Document6 pages12th Accounts Partnership Test 15 Sept.SGEVirtualNo ratings yet

- Audit of LiabilitiesDocument6 pagesAudit of LiabilitiesEdmar HalogNo ratings yet

- 14 AdjustmentsssDocument7 pages14 AdjustmentsssZaheer Ahmed SwatiNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Introduction To Partnership AccountsDocument20 pagesIntroduction To Partnership Accountsanon_672065362100% (1)

- Branch Operation (1 Branch) : RequiredDocument2 pagesBranch Operation (1 Branch) : RequiredFadhlurrahmi JeonsNo ratings yet

- Accounts Test 23 Mar QPDocument3 pagesAccounts Test 23 Mar QPnavyabearad2715No ratings yet

- 9 Partnership Question 4Document7 pages9 Partnership Question 4kautiNo ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- Problem 1:: Company Final Accounts: Problems and Solutions - AccountingDocument28 pagesProblem 1:: Company Final Accounts: Problems and Solutions - AccountingRafidul Islam100% (1)

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- Fundamental - I WorksheetDocument3 pagesFundamental - I WorksheetuuuNo ratings yet

- Blossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentDocument3 pagesBlossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentPawanpreet KaurNo ratings yet

- Amalgamation, Absorption and Reconstruction - AccountingDocument15 pagesAmalgamation, Absorption and Reconstruction - Accountingnasir abdulNo ratings yet

- Papers of Financial AccountingDocument144 pagesPapers of Financial AccountingnidamahNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- Accounts ReceivablesDocument10 pagesAccounts ReceivablesYenelyn Apistar Cambarijan0% (1)

- Accounting ProjectDocument3 pagesAccounting ProjectdonNo ratings yet

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhNo ratings yet

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- Class 12 Accountancy Question PaperDocument5 pagesClass 12 Accountancy Question Papernatkaryash3No ratings yet

- AccountDocument67 pagesAccountchamalix100% (1)

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- BU127 Quiz Q&aDocument14 pagesBU127 Quiz Q&aFarah Luay AlberNo ratings yet

- FAR - Basic Concepts eDocument34 pagesFAR - Basic Concepts eAbinash MishraNo ratings yet

- Liquidation of CompanyDocument8 pagesLiquidation of CompanySeban Ks0% (2)

- AccountDocument3 pagesAccountSk SinghNo ratings yet

- Class 12 Accounts SC Sample Paper Dissolution 25.12.20 Que and AnsDocument6 pagesClass 12 Accounts SC Sample Paper Dissolution 25.12.20 Que and AnsvidhifalodiaNo ratings yet

- Asm 2670Document3 pagesAsm 2670Pushkar MittalNo ratings yet

- CAPE U1 Partnership Revaluation QuestionsDocument6 pagesCAPE U1 Partnership Revaluation QuestionsNadine DavidsonNo ratings yet

- Home Assinment 2021-22new Microsoft Office Word DocumentDocument4 pagesHome Assinment 2021-22new Microsoft Office Word DocumentGanesh AdhalraoNo ratings yet

- SuspenseDocument2 pagesSuspenseDipankar MallickNo ratings yet

- Accounting Test 1Document8 pagesAccounting Test 1Nanya BisnestNo ratings yet

- Cash and Accrual Discussion301302Document2 pagesCash and Accrual Discussion301302Gloria BeltranNo ratings yet

- Accounts Worksheet 1.4 Class XIDocument4 pagesAccounts Worksheet 1.4 Class XIMuskan AgarwalNo ratings yet

- AccountancyDocument18 pagesAccountancyMeena DhimanNo ratings yet

- Sums On Consolidation 2020 PDFDocument3 pagesSums On Consolidation 2020 PDFRohan DharneNo ratings yet