Professional Documents

Culture Documents

PDF 979375070110323

Uploaded by

Aditi Goel0 ratings0% found this document useful (0 votes)

2 views1 pageITR format

Original Title

Pdf_979375070110323

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentITR format

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pagePDF 979375070110323

Uploaded by

Aditi GoelITR format

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

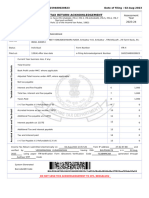

INDIAN INCOME TAX UPDATED RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Updated Return of Income is filed in Form ITR-1

(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 and verified] 2020-21

(Please see Rule 12 and Rule 12AC of the Income-tax Rules, 1962)

PAN FHXPB8059M

Name RUPAM BISWAS

PANIKHAITI, PANIKHAITI GAON, PANIKHAITI B.O, PANIKHAITI GAON, KAMRUP, , 781026

Address

Status Individual Form Number ITR-4

Filed u/s 139(8A) - Updated Return e-Filing Acknowledgement Number 979375070110323

Current Year business loss if any 1 0

Total Income as per Updated return 2 316600

Total Income as per earlier return 3 0

Taxable Income and Tax details

Book Profit under MAT, where applicable as per Updated return 4 0

Adjusted Total Income under AMT, where applicable as per Updated return 5 0

Amount payable (+) / Refundable (-) as per Updated return 6 0

Additional income-tax liability on updated income 7 0

Net amount payable 8 1000

Tax paid u/s 140B 9 1000

Tax due 10 0

Updated Income Tax Return submitted electronically on __________________from

11-03-2023 09:55:56 IP address ___________________

223.238.101.222

RUPAM BISWAS

and verified by ____________________________________________________________________________________

having PAN _________________

FHXPB8059M on ________________

11-03-2023 from IP address _________________________________

223.238.101.222 using

Electronic Verification Code _____________________ generated through _________________________________ mode.

7IAEIIT9EI Aadhaar OTP

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Indian Income Tax Updated Return AcknowledgementDocument1 pageIndian Income Tax Updated Return AcknowledgementSanjay SabharwalNo ratings yet

- PDF 979194380110323Document1 pagePDF 979194380110323Aditi GoelNo ratings yet

- PDF 934654820260123Document1 pagePDF 934654820260123Sanjay SabharwalNo ratings yet

- PDF 979868730130323Document1 pagePDF 979868730130323Abhilash Bhavan SasiNo ratings yet

- Indian Income Tax Updated Return Acknowledgement TitleDocument1 pageIndian Income Tax Updated Return Acknowledgement TitleDKINGNo ratings yet

- Updated ITR Ack: Rs 1,000 Tax DueDocument1 pageUpdated ITR Ack: Rs 1,000 Tax DuemohilNo ratings yet

- PDF 979700560110323Document1 pagePDF 979700560110323Abhilash Bhavan SasiNo ratings yet

- ACK148945220210324Document1 pageACK148945220210324chandasoumik2002No ratings yet

- Samir MultaniDocument1 pageSamir MultaniRajendra SharmaNo ratings yet

- Dilbagh Singh Itr 2022-2023 - UnlockedDocument1 pageDilbagh Singh Itr 2022-2023 - UnlockedmohitNo ratings yet

- Indian Income Tax Updated Return AcknowledgementDocument1 pageIndian Income Tax Updated Return AcknowledgementPanwar JiNo ratings yet

- PDF 934630540250123Document1 pagePDF 934630540250123Sanjay SabharwalNo ratings yet

- Afta 2023 ReDocument1 pageAfta 2023 ReMantajul SkNo ratings yet

- Acknowledgement Fy 2020-21Document1 pageAcknowledgement Fy 2020-21Prajwal ShettyNo ratings yet

- ITR4Document1 pageITR4Vijay PatilNo ratings yet

- Ack FSTPS4465R 2021-22 119652530180423Document1 pageAck FSTPS4465R 2021-22 119652530180423BIKRAM KUMAR BEHERANo ratings yet

- 2021-22 Acknowledgement PDFDocument1 page2021-22 Acknowledgement PDFSidvik InfotechNo ratings yet

- Itr Ay 22-23Document1 pageItr Ay 22-23venkataika6No ratings yet

- Chaganti Maheswara Reddy 21-22Document5 pagesChaganti Maheswara Reddy 21-22cherrylucky81No ratings yet

- Ack Byaps0479j 2021-22 SuryawanshiDocument1 pageAck Byaps0479j 2021-22 Suryawanshisunil mauryaNo ratings yet

- Ack MCZPS2922L 2022-23 135862180050523 PDFDocument1 pageAck MCZPS2922L 2022-23 135862180050523 PDFsandeep kuamr ChoubeyNo ratings yet

- PDF - 991545680240323 21-22Document1 pagePDF - 991545680240323 21-22Shubham SutarNo ratings yet

- Indian Income Tax Updated Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Updated Return Acknowledgement 2021-22: Assessment YearAashna jainNo ratings yet

- Ack Ahspl5476c 2022-23 139418980080523Document1 pageAck Ahspl5476c 2022-23 139418980080523Abhilash Bhavan SasiNo ratings yet

- Ack 907104420190124Document1 pageAck 907104420190124vishalsoni4452No ratings yet

- ACK935369090080224Document1 pageACK935369090080224jdas7061No ratings yet

- PDF 926408220190123Document1 pagePDF 926408220190123Hotel SkyviewNo ratings yet

- Ack Ivbpk7326b 2022-23 138470560080523Document1 pageAck Ivbpk7326b 2022-23 138470560080523Vishal GoyalNo ratings yet

- Ack GBPPB5000M 2022-23 134694230060324Document1 pageAck GBPPB5000M 2022-23 134694230060324Abbas WaniNo ratings yet

- Indian Income Tax Updated Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Updated Return Acknowledgement 2021-22: Assessment Yearjasssaini899No ratings yet

- Ack Eiips8233p 2022-23 465009670301023Document1 pageAck Eiips8233p 2022-23 465009670301023VIJAyNo ratings yet

- ACK612243300050124 (1)Document1 pageACK612243300050124 (1)knowthebest787No ratings yet

- Paramjeet Kaur 2022-2023Document1 pageParamjeet Kaur 2022-2023thinkpadt480tNo ratings yet

- Parmjit Singh Itrv Ay 202324Document1 pageParmjit Singh Itrv Ay 202324SANJEEV KUMARNo ratings yet

- Ack Pybps5960r 2021-22 914796000060123Document1 pageAck Pybps5960r 2021-22 914796000060123itie anejaNo ratings yet

- ACK134780470060324Document1 pageACK134780470060324Abbas WaniNo ratings yet

- Ack 935358350080224Document1 pageAck 935358350080224jdas7061No ratings yet

- Ack Amhpd0653k 2022-23 120306800310723Document1 pageAck Amhpd0653k 2022-23 120306800310723Bhavesh JainNo ratings yet

- ITR AY 22-23 Narinder BhatiaDocument1 pageITR AY 22-23 Narinder BhatiaAshwani KumarNo ratings yet

- Ack 138236980090324Document1 pageAck 138236980090324piyush882676No ratings yet

- ACK - KIIPK2548R - 2021-22 - 110330000060423 ItrDocument1 pageACK - KIIPK2548R - 2021-22 - 110330000060423 Itrkhan sa bnNo ratings yet

- Mohd Thahir Itr.Document1 pageMohd Thahir Itr.Air DropNo ratings yet

- ACK180225870190424Document1 pageACK180225870190424vikash865138No ratings yet

- Ack Dthpb3505e 2022-23 113382020110423Document1 pageAck Dthpb3505e 2022-23 113382020110423satyanarayanbej925No ratings yet

- ACK - KIIPK2548R - 2021-22 - 11033000060423 Itr-1Document1 pageACK - KIIPK2548R - 2021-22 - 11033000060423 Itr-1khan sa bnNo ratings yet

- Harcharan Singh 2022-2023Document1 pageHarcharan Singh 2022-2023thinkpadt480tNo ratings yet

- itr simpal kumari 23 24Document1 pageitr simpal kumari 23 24prateek gangwaniNo ratings yet

- Priya Darshani - Itr Ay 2023-24Document1 pagePriya Darshani - Itr Ay 2023-24caasky.aurangabadNo ratings yet

- Ack 134753410060324Document1 pageAck 134753410060324Abbas WaniNo ratings yet

- Itr Ay 22-23Document1 pageItr Ay 22-23Bandari GoverdhanNo ratings yet

- Gurleen Kaur Mother 2 Year ItrDocument6 pagesGurleen Kaur Mother 2 Year ItrSajan SharmaNo ratings yet

- Ack FNNPS3431L 2022-23 427757050110723Document1 pageAck FNNPS3431L 2022-23 427757050110723CA Anil SahuNo ratings yet

- Ranjit ItrrDocument1 pageRanjit ItrrRadha SureshNo ratings yet

- Ack CMZPK1005L 2021-22 896532450110124Document1 pageAck CMZPK1005L 2021-22 896532450110124Mukesh KumarNo ratings yet

- 2022-23Document4 pages2022-23manishgoyani225No ratings yet

- ACK160159480020823Document1 pageACK160159480020823SanthoshRajNo ratings yet

- It Reply Merge - PavaniDocument5 pagesIt Reply Merge - Pavanibharath reddyNo ratings yet

- PDF 342588850310722Document1 pagePDF 342588850310722Shree shyamNo ratings yet

- ACK_LJUPK3835M_2022-23_103449470300323 (2)Document1 pageACK_LJUPK3835M_2022-23_103449470300323 (2)knowthebest787No ratings yet

- Law On PledgeDocument7 pagesLaw On PledgeLesterNo ratings yet

- Report of Summit Power Ltd.Document64 pagesReport of Summit Power Ltd.Shaheen Mahmud50% (2)

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- ACT26 - Ch02 Donors TaxDocument7 pagesACT26 - Ch02 Donors TaxMark BajacanNo ratings yet

- klontz-money-script-inventory-r-kmsi-r-11112023-0830-amDocument6 pagesklontz-money-script-inventory-r-kmsi-r-11112023-0830-amCornel VisserNo ratings yet

- Monetary Authority of SingaporeDocument29 pagesMonetary Authority of Singaporerahulchoudhury32No ratings yet

- Corporate Counsel GuideDocument112 pagesCorporate Counsel GuideWinnifred Antoinette100% (1)

- Reaction Paper - Cost CapitalDocument1 pageReaction Paper - Cost CapitalMerrylyn VargasNo ratings yet

- Strengths and weaknesses of direct tax system in IndiaDocument12 pagesStrengths and weaknesses of direct tax system in Indiabipin kumarNo ratings yet

- Dec2017Document8 pagesDec2017dhande mayurNo ratings yet

- NABARDDocument37 pagesNABARDsanjayyadav007100% (1)

- Land Titles and Deeds - Purpose of The Torrens System of RegistrationDocument29 pagesLand Titles and Deeds - Purpose of The Torrens System of RegistrationAnonymous 7BpT9OWPNo ratings yet

- ITM - Capstone Project ReportDocument53 pagesITM - Capstone Project ReportArchana Singh33% (3)

- Exercise 1Document2 pagesExercise 1Anshu ParasharNo ratings yet

- Accounting-1 Reading Materials#1Document53 pagesAccounting-1 Reading Materials#1Nardsdel RiveraNo ratings yet

- Nye, Soft Power For Politics, 1990Document20 pagesNye, Soft Power For Politics, 1990Irina Andreea CristeaNo ratings yet

- ROHA - ProjectDocument29 pagesROHA - ProjectNidhish DevadigaNo ratings yet

- Caltex Philippines, Inc. vs. Commission On AuditDocument41 pagesCaltex Philippines, Inc. vs. Commission On AuditJayson Francisco100% (1)

- Types of PPP PPP Advantages and Disadvantages Criteria To Evaluate Projects For PPPDocument31 pagesTypes of PPP PPP Advantages and Disadvantages Criteria To Evaluate Projects For PPPswatiNo ratings yet

- De Ramos Vs CaDocument15 pagesDe Ramos Vs CaFrances Grace ParconNo ratings yet

- Bank Management System-ShitalDocument35 pagesBank Management System-ShitalDhruti GadhiyaNo ratings yet

- Understand Your Self Assessment Tax Bill - GOV - UKDocument3 pagesUnderstand Your Self Assessment Tax Bill - GOV - UKLenvion LNo ratings yet

- RRB NTPC Sunday Quant (Question) : WWW - Careerpower.inDocument6 pagesRRB NTPC Sunday Quant (Question) : WWW - Careerpower.inRahul SinghNo ratings yet

- Module 3 Homework Answer KeyDocument7 pagesModule 3 Homework Answer KeyMrinmay kunduNo ratings yet

- Tata Capital Financial Services LTD TCFPL0631000011147040 Fort Mumbai Rahul Vishwanath Mayee 42Document6 pagesTata Capital Financial Services LTD TCFPL0631000011147040 Fort Mumbai Rahul Vishwanath Mayee 42Rahul MayeeNo ratings yet

- LSP SMK NEGERI 51 JAKARTA Entry Journal WorksheetDocument7 pagesLSP SMK NEGERI 51 JAKARTA Entry Journal WorksheetSams YogxNo ratings yet

- Accounting for leased building, bank loan, land purchase, vines and disease risksDocument3 pagesAccounting for leased building, bank loan, land purchase, vines and disease risksFrancisco MarvinNo ratings yet

- Solar PV Financial Modeling Impacts v1.2Document16 pagesSolar PV Financial Modeling Impacts v1.2Andre S100% (1)

- The President's Committee on Urban Housing ReportDocument264 pagesThe President's Committee on Urban Housing ReportGabrielGaunyNo ratings yet

- Unit 7 - Wiley Plus ExamplesDocument14 pagesUnit 7 - Wiley Plus ExamplesMohammed Al DhaheriNo ratings yet