Professional Documents

Culture Documents

ACCG1000 In-Class Activity W4

ACCG1000 In-Class Activity W4

Uploaded by

Tanya Shaik0 ratings0% found this document useful (0 votes)

23 views1 pageThis document outlines various transactions undertaken by John for his new business over the month of January. It records the date, details of each transaction, and their impact on the accounting equation through increases or decreases to different accounts via debits and credits. Key transactions include John contributing $15,000 cash on opening the business, purchasing computer equipment for $3,500 cash, buying office supplies on credit, providing a quote but no transaction, withdrawing $1,000 cash, and paying the supplies account.

Original Description:

accounting practices, this is a worksheet on closing entries and ethics

Original Title

ACCG1000 in-class activity W4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines various transactions undertaken by John for his new business over the month of January. It records the date, details of each transaction, and their impact on the accounting equation through increases or decreases to different accounts via debits and credits. Key transactions include John contributing $15,000 cash on opening the business, purchasing computer equipment for $3,500 cash, buying office supplies on credit, providing a quote but no transaction, withdrawing $1,000 cash, and paying the supplies account.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views1 pageACCG1000 In-Class Activity W4

ACCG1000 In-Class Activity W4

Uploaded by

Tanya ShaikThis document outlines various transactions undertaken by John for his new business over the month of January. It records the date, details of each transaction, and their impact on the accounting equation through increases or decreases to different accounts via debits and credits. Key transactions include John contributing $15,000 cash on opening the business, purchasing computer equipment for $3,500 cash, buying office supplies on credit, providing a quote but no transaction, withdrawing $1,000 cash, and paying the supplies account.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

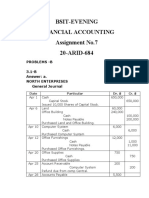

SOLUTION TO IN-CLASS ACTIVITY

Jan Transactional details Accounting equation

impact and double

entry effect

1 John contributed $15,000 cash to Increase assest Increase equity

commence the business (cash) debit (capital) credit

$15,000 $15,000

3 Purchased computer equipment for $3,500 Increase assets Increase cash

cash from ComputerLand Ltd debit $3,500 credit $3,500

11 Purchased office supplies for $550 on Increase assets Increase

credit from Omega Officeworks (supplies) debit liabilitoies

$550 (accounts

payable) credit

$550

18 John provided a quote for $4,500 to the No transaction No transaction

local primary school to provide tennis

coaching to the school’s students every

Thursday afternoon for 3 months

28 John withdrew $1,000 cash from the Decrease equity Decrease assets

business to pay for his daughter’s wedding (drawings) debit (cash) credit

$1,000 $1,000

30 Paid Omega Officeworks for office supplies Decrease liability Decrease assets

purchased on January 11 above, (accounts (cash) credit

payable) debit

You might also like

- 2015 MSE Accounting Sample QuestionsDocument12 pages2015 MSE Accounting Sample QuestionsDharniNo ratings yet

- Week 4 Tutorial Workbook - 1Document4 pagesWeek 4 Tutorial Workbook - 1Lawrence wenNo ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- Accounting EquationDocument24 pagesAccounting EquationApsara GunarathneNo ratings yet

- Eshetu Gelagay Ind Ass Acc - For ManagersDocument12 pagesEshetu Gelagay Ind Ass Acc - For ManagersabiyNo ratings yet

- Transaction AnalysisDocument33 pagesTransaction AnalysisIzzeah RamosNo ratings yet

- Lesson 4Document3 pagesLesson 4EstherNo ratings yet

- Chapter-3 1Document5 pagesChapter-3 1Gabrielle Joshebed AbaricoNo ratings yet

- Accounting Transaction Processing Chapter 3Document73 pagesAccounting Transaction Processing Chapter 3Rupesh PolNo ratings yet

- The Accounting Equation: Business EducationDocument44 pagesThe Accounting Equation: Business EducationMarcus WongNo ratings yet

- Jane Kent Is A Licensed Cpa During The First Month PDFDocument1 pageJane Kent Is A Licensed Cpa During The First Month PDFAnbu jaromia0% (1)

- Tugas 2. Proses Pencatatan-Ricky Andrian K. RumereDocument12 pagesTugas 2. Proses Pencatatan-Ricky Andrian K. RumererickyNo ratings yet

- Journal Entries Ledger Trial Balance Problem and SolutionDocument7 pagesJournal Entries Ledger Trial Balance Problem and SolutionArgha DuttaNo ratings yet

- ACC203 Notes-2Document7 pagesACC203 Notes-2mariamghader80No ratings yet

- Chap 12 ANSWERS Review Problem To Understand Indirect Method of Statement of Cash FlowsDocument1 pageChap 12 ANSWERS Review Problem To Understand Indirect Method of Statement of Cash FlowskathrynNo ratings yet

- Christine Ewing Is A Licensed Cpa During The First Month PDFDocument1 pageChristine Ewing Is A Licensed Cpa During The First Month PDFAnbu jaromiaNo ratings yet

- Accounting and The Business Environment: Short Exercises S 1-1Document52 pagesAccounting and The Business Environment: Short Exercises S 1-1iLessNo ratings yet

- Dicky Irawan - C1i017051 - Tugas SoalDocument6 pagesDicky Irawan - C1i017051 - Tugas SoalDICKY IRAWAN 1No ratings yet

- Indi 1Document6 pagesIndi 1Minh Van NguyenNo ratings yet

- ACNT 1313 Exam 1 Question 3Document1 pageACNT 1313 Exam 1 Question 3Lauralee L Allen MuellerNo ratings yet

- Chapter 3 Lesson 1: Analyzing Changes in Financial PositionDocument22 pagesChapter 3 Lesson 1: Analyzing Changes in Financial PositionSneha DasNo ratings yet

- Docx. Journal SampleDocument21 pagesDocx. Journal SampleRHIAN B.No ratings yet

- L02 App of Acc Equation Wo ExerciseDocument7 pagesL02 App of Acc Equation Wo ExercisecalebNo ratings yet

- Financial AccountingDocument9 pagesFinancial AccountingAnonymous VmhXGNlFyNo ratings yet

- Exam 2 QuestionsDocument17 pagesExam 2 QuestionsAntonio Salas ChavezNo ratings yet

- Accounting and The Business Environment: Short Exercises S 1-1Document66 pagesAccounting and The Business Environment: Short Exercises S 1-1XXXNo ratings yet

- Soal Latihan Chapter 01Document3 pagesSoal Latihan Chapter 01Indrian Sibi todingNo ratings yet

- TT03 Ques 110523 UpdateDocument2 pagesTT03 Ques 110523 UpdateTrần Ngọc NhưNo ratings yet

- Answer Key Chapter 3Document60 pagesAnswer Key Chapter 3HectorNo ratings yet

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- Traditional HW 10, 11Document1 pageTraditional HW 10, 11gShOnEy8No ratings yet

- Week2 Slides PDFDocument11 pagesWeek2 Slides PDFWais SadatNo ratings yet

- Final Exam - Jenny BonillaDocument4 pagesFinal Exam - Jenny Bonillajennibonilla19No ratings yet

- Chapter 7 Brief ExercisesDocument6 pagesChapter 7 Brief ExercisesPatrick YazbeckNo ratings yet

- Cover FadilDocument42 pagesCover FadiltitirNo ratings yet

- ACCT 2211 Assignment 2Document17 pagesACCT 2211 Assignment 2Tannaz SNo ratings yet

- Assignment-4 and 8Document15 pagesAssignment-4 and 8Carla Sader0% (1)

- The Accounting EquationDocument8 pagesThe Accounting EquationcherinetNo ratings yet

- Introduction To Accounting EXE 1Document6 pagesIntroduction To Accounting EXE 1ntxthuy04No ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet

- Accounting AssignmentDocument16 pagesAccounting AssignmentAarya SharmaNo ratings yet

- BINUS University Answer Sheet Accounting - Ariella HeliyawanDocument5 pagesBINUS University Answer Sheet Accounting - Ariella HeliyawanRiella DellaNo ratings yet

- Bookkeeping - Course Notes (2022)Document1 pageBookkeeping - Course Notes (2022)Karan KhannaNo ratings yet

- Century 21 Accounting - Multicolumn Journal - 9780357704868 - Exercise 2 - QuizletDocument4 pagesCentury 21 Accounting - Multicolumn Journal - 9780357704868 - Exercise 2 - QuizletPresley KwasniewskiNo ratings yet

- Camtasia Comprehensive Review Problem 4-1Document30 pagesCamtasia Comprehensive Review Problem 4-1AC ConNo ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Tugas Kelompok TM 3 Pengantar AkuntansiDocument4 pagesTugas Kelompok TM 3 Pengantar AkuntansiYuni ArtaNo ratings yet

- Case Study 1Document5 pagesCase Study 18142301001No ratings yet

- What Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingDocument41 pagesWhat Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingMd. Haseeb KhanNo ratings yet

- POA Assignment Week 4Document16 pagesPOA Assignment Week 4Rara Rarara30No ratings yet

- The Role of Accounting in Decision Making: Transaction AnalysisDocument10 pagesThe Role of Accounting in Decision Making: Transaction AnalysisHashara WarnasooriyaNo ratings yet

- Journal Entry and LedgerDocument23 pagesJournal Entry and LedgerValerie BognotNo ratings yet

- Lecture02-Introduction To AccountingDocument38 pagesLecture02-Introduction To Accounting錢永健No ratings yet

- Zany Delivery Service Is Owned and Operated by Joey PDFDocument1 pageZany Delivery Service Is Owned and Operated by Joey PDFAnbu jaromiaNo ratings yet

- Example 2:: Adjustments To The Bank BalanceDocument8 pagesExample 2:: Adjustments To The Bank BalanceTERRIUS AceNo ratings yet

- Week 5 Tutorial Homework WorkbookDocument9 pagesWeek 5 Tutorial Homework WorkbookTanya ShaikNo ratings yet

- Edit Week 9 Tutorial WorkbookDocument10 pagesEdit Week 9 Tutorial WorkbookTanya ShaikNo ratings yet

- Week 7 Tutorial HomeworkDocument17 pagesWeek 7 Tutorial HomeworkTanya ShaikNo ratings yet

- Deferrable DebtsDocument1 pageDeferrable DebtsTanya ShaikNo ratings yet