Professional Documents

Culture Documents

1902 Jul 2021 ENCS - Final

Uploaded by

Danielle DavidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1902 Jul 2021 ENCS - Final

Uploaded by

Danielle DavidCopyright:

Available Formats

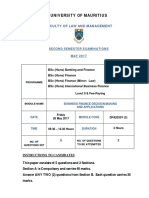

(To be filled out by BIR) DLN: __________________________

BIR Form No.

Republic of the Philippines

Department of Finance

Bureau of Internal Revenue

Application for Registration 1902

July 2021 (ENCS) P1

For Individuals Earning Purely Compensation Income - - - 0 0 0 0 0

(Local and Alien Employee) New TIN to be issued, if applicable (To be filled out by BIR)

Fill in all applicable white spaces. Mark all appropriate boxes with an “X”

1 BIR Registration Date 2 PhilSys Card Number (PCN)

(To be filled out by BIR) (MM/DD/YYYY)

Part I - Taxpayer/Employee Information

3 Taxpayer Identification Number (TIN) 4 RDO Code 5 Taxpayer Type

(For Taxpayer with existing TIN) (To be filled out by BIR)

- - - 0 0 0 0 0 Local Resident Alien Special Non-Resident Alien

6 Taxpayer’s Name

(Last Name) (First Name)

(Middle Name) (Suffix) 7 Gender

Male Female

8 Civil Status Single Married Widow/er Legally Separated

9 Date of Birth (MM/DD/YYYY) 10 Place of Birth

11 Mother’s Maiden Name (First Name, Middle Name, Last Name, Suffix)

12 Father’s Name (First Name, Middle Name, Last Name, Suffix)

13 Citizenship 14 Other Citizenship, if applicable

15 Local Residence Address

Unit/Room/Floor/Building No. Building Name/Tower

Lot/Block/Phase/House No. Street Name

Subdivision/Village/Zone Barangay

Town/District Municipality/City

Province ZIP Code

16 Foreign Address

17 Municipality Code 18 Tax Type INCOME TAX 19 Form Type BIR Form No. 1700 20 ATC II 011

(To be filled out by BIR)

21 Identification Details [government issued ID (e.g., passport, driver’s license, etc.), company ID, etc.]

Type Number Effectivity Date (MM/DD/YYYY) Expiry Date (MM/DD/YYYY)

Issuer Place/Country of Issue

22 Preferred Contact Type

Landline Number Fax Number Mobile Number

Email Address

(required)

Part II - Spouse Information (if applicable)

23 Employment Status of Spouse Unemployed Employed Locally Employed Abroad Engaged in Business/Practice of Profession

24 Spouse Name

(Last Name) (First Name)

(Middle Name) (Suffix) 25 Spouse TIN

- - - 0 0 0 0 0

26 Spouse Employer’s Name (If Individual, Last Name, First Name, Middle Name, Suffix) (If Non-Individual, Registered Name) (Attach additional sheet/s, if necessary)

27 Spouse Employer’s TIN - - -

Page 2 – BIR Form No. 1902

Part III – For Employee with Two or More Employers (Multiple Employments) Within the Calendar Year

28 Type of Multiple Employments

Successive Employments (With previous employer/s within the calendar year)

Concurrent Employments (With two or more employers at the same time within the calendar year)

(If successive, enter previous employer/s; if concurrent, enter secondary employer/s )

Previous and/or Concurrent Employments During the Calendar Year (Attach additional sheet/s, if necessary)

29A Name of Employer

29B Employer’s TIN - - -

30A Name of Employer

30B Employer’s TIN - - -

31A Name of Employer

31B Employer’s TIN - - -

32 Declaration

I declare under the penalties of perjury that this application, and all its attachments, have been made in good faith, verified by me and to the best of my knowledge and belief, is

true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I give my consent to the processing of

my information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

______________________________

Taxpayer (Employee)/Authorized Representative

(Signature over Printed Name)

Part IV – Primary/Current Employer Information

33 Type of Registered Office 34 TIN 35 RDO Code

Head Office Branch Office - - -

36 Employer’s Name (If Individual, Last Name, First Name, Middle Name, Suffix) (If Non-Individual, Registered Name)

37 Employer’s Address

Unit/Room/Floor/Building No. Building Name/Tower

Lot/Block/Phase/House No. Street Name

Subdivision/Village/Zone Barangay

Town/District Municipality/City

Province ZIP Code

38 Contact Details

Landline Number Fax Number Mobile Number

39 Relationship Start Date/Date Employee was Hired 40 Municipality Code (To be filled out by BIR)

(MM/DD/YYYY)

41 Declaration Stamp of BIR Receiving Office

I declare under the penalties of perjury that this application and all its attachments, have been made in good faith, verified by me and to the and Date of Receipt

best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations

issued under authority thereof. Further, I give my consent to the processing of my information as contemplated under the *Data Privacy Act of 2012

(R.A. No. 10173) for legitimate and lawful purposes.

____________________________________________ _____________________________

EMPLOYER/AUTHORIZED REPRESENTATIVE Title/Position of Signatory

(Signature over Printed Name)

*NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph)

Documentary Requirements: If transacting through a Representative:

2.1 Special Power of Attorney (SPA); (1 original)

2.2 Any government-issue ID of the taxpayer and authorized representative. (1 photocopy)

For Local Employee: In the case of employer securing TIN in behalf of its employee:

1. Any government-issued ID (e.g., Birth Certificate, Passport, Driver’s License, Community Tax

(a) Letter of Authority (LOA) with company letterhead (if applicable) signed by the President or

Certificate, PhilID) that shows the name, address and birthdate of the applicant. In case the ID

HR Head indicating the company name and its authorized representative; (1 original)

has no address, any proof of residence; (1 photocopy)

(b) Any government-issued ID of the signatory (for signature validation); (1 certified true copy)

2. Marriage Contract, for married female. (1 photocopy)

(c) Any government-issued ID of the authorized person of the employer; (1 photocopy)

For Foreign Nationals/Alien Employee: (d) Transmittal List of Newly Hired Employees with a place of assignment and certifying that the

list is its newly hired employees; (1 original)

1. Passport (Bio page, including date of entry/arrival and exit/departure stamp, if applicable); (1 (e) Letter of Authority from the employee/s; (1 original)

photocopy) (f) Printed copy of eREG System message that the employee has a similar record, if applicable.

2. Employment Contract or equivalent document indicating the duration of employment, (1 original)

compensation and other benefits and scope of duties. (1 certified true copy)

POSSESSION OF MORE THAN ONE TAXPAYER IDENTIFICATION NUMBER (TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE

PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED.

You might also like

- BIR1902 FormDocument2 pagesBIR1902 FormShaira Miwa SantosNo ratings yet

- 1902 Jul 2021 ENCS - FinalDocument2 pages1902 Jul 2021 ENCS - FinalHR SCPCNo ratings yet

- Bir Form 1902 Jul 2021 Encs FinalDocument2 pagesBir Form 1902 Jul 2021 Encs Finalarseniouban510No ratings yet

- Bir Form 1902 New VersionDocument2 pagesBir Form 1902 New Versionchato law officeNo ratings yet

- 1902 Jul 2021 ENCS - FinalDocument2 pages1902 Jul 2021 ENCS - FinalNicole Anne LesiguesNo ratings yet

- BirForm PDFDocument2 pagesBirForm PDFTashnim MagarangNo ratings yet

- 1902 January 2018 ENCS Final DOH Signature Employer PDFDocument2 pages1902 January 2018 ENCS Final DOH Signature Employer PDFkadisha oryecioNo ratings yet

- 1902 - Updated Signatory2023Document2 pages1902 - Updated Signatory2023joshuavillanueva477No ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form Noexonyeoshidae 05No ratings yet

- Application Form For Tin IDDocument3 pagesApplication Form For Tin IDShanaia BualNo ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoChoco LebbyNo ratings yet

- BIR Form No. 1902 Application for Registration for Individuals Earning Purely Compensation Income (Local and Alien EmployeeDocument2 pagesBIR Form No. 1902 Application for Registration for Individuals Earning Purely Compensation Income (Local and Alien EmployeeMiles Patrick TantiadoNo ratings yet

- Application For Registration: (To Be Filled Out by BIR) DLNDocument2 pagesApplication For Registration: (To Be Filled Out by BIR) DLNBRF Services IncNo ratings yet

- BIR Tin Application (Form 1902)Document2 pagesBIR Tin Application (Form 1902)Mara Martinez74% (27)

- Application For Registration: Last Name First NameDocument2 pagesApplication For Registration: Last Name First NameCarl Ivan AbiogNo ratings yet

- 1902 Jul 2021 ENCS - FinalDocument3 pages1902 Jul 2021 ENCS - FinalryanmarcelinosalvaNo ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoBernardino PacificAceNo ratings yet

- Application For Registration: BIR Form NoDocument1 pageApplication For Registration: BIR Form NoJordan P HunterNo ratings yet

- 1902 Form 2Document2 pages1902 Form 2vamvamadelantarNo ratings yet

- BIR Form RegistrationDocument2 pagesBIR Form RegistrationDanielle Abarentos100% (2)

- 1902 FormDocument2 pages1902 FormMos KovNo ratings yet

- Application For Registration: Last Name First Name Middle Name SuffixDocument3 pagesApplication For Registration: Last Name First Name Middle Name SuffixJohnzzkiiee 29No ratings yet

- BIR Form 1700 Registration for Individuals Earning Purely Compensation IncomeDocument3 pagesBIR Form 1700 Registration for Individuals Earning Purely Compensation IncomeAaron AlimurongNo ratings yet

- Bir Form 1904Document2 pagesBir Form 1904luizzasharraNo ratings yet

- TIN Application 1901Document7 pagesTIN Application 1901isabelle.malapad.shsNo ratings yet

- Application For Registration: Taxpayer Identification Number (TIN)Document4 pagesApplication For Registration: Taxpayer Identification Number (TIN)Levi Tomol0% (2)

- BIR Form2305 April 2017 Updated FormDocument2 pagesBIR Form2305 April 2017 Updated FormEPIPHANY80% (15)

- Bir 1904Document2 pagesBir 1904Ann C PalomoNo ratings yet

- BIR Form NoDocument1 pageBIR Form NoAlden Christopher LumotNo ratings yet

- Application For Registration: BIR Form NoDocument1 pageApplication For Registration: BIR Form NoNy Li NamNo ratings yet

- BIR Form No. 1901 Application For RegistrationDocument4 pagesBIR Form No. 1901 Application For RegistrationRAUL BECERRONo ratings yet

- Bir Form 1901 New VersionDocument4 pagesBir Form 1901 New Versionchato law office80% (5)

- Bir Form 1904Document2 pagesBir Form 1904Kate Brzezinska50% (4)

- BIR Form 1902 ApplicationDocument2 pagesBIR Form 1902 ApplicationFaye DavidNo ratings yet

- Registration for Self-Employed IndividualDocument4 pagesRegistration for Self-Employed IndividualEugene D Napster100% (1)

- Application For Registration: Date of Birth/Organization Date (In Case of Estate/Trust)Document3 pagesApplication For Registration: Date of Birth/Organization Date (In Case of Estate/Trust)MyPc ServicesNo ratings yet

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument1 pageApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal RevenueBRF Services IncNo ratings yet

- 1902 January 2018 ENCS FinalDocument2 pages1902 January 2018 ENCS FinalrbelduaNo ratings yet

- BIR Form 1901 ApplicationDocument4 pagesBIR Form 1901 ApplicationCarl PedreraNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas Internasal wynNo ratings yet

- 1901 (Encs) 2000Document2 pages1901 (Encs) 2000chennieNo ratings yet

- For Self-Employed and Mixed Income Individuals, Estates and TrustsDocument2 pagesFor Self-Employed and Mixed Income Individuals, Estates and TrustsJeffrey TolentinoNo ratings yet

- Application For Registration: For Self-Employed and Mixed Income Individuals, Estates and TrustsDocument2 pagesApplication For Registration: For Self-Employed and Mixed Income Individuals, Estates and TrustsMarson Andrei DapanasNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument1 pageApplication For Registration: Kawanihan NG Rentas InternasLouie Ann ArdanNo ratings yet

- Application For Registration: Delmiguez JoybethDocument2 pagesApplication For Registration: Delmiguez JoybethkablasNo ratings yet

- BIR Form 1902Document1 pageBIR Form 1902Digal AlfieNo ratings yet

- CANELO - CERILO - BIR 1901 FormDocument4 pagesCANELO - CERILO - BIR 1901 FormSam Sam OsmeniaNo ratings yet

- BIR FORM 1902 - Application For RegistrationDocument1 pageBIR FORM 1902 - Application For RegistrationJenny Racadio100% (1)

- Bir Form 2305 Etis-1 OnlyDocument2 pagesBir Form 2305 Etis-1 OnlyNPScribAccount100% (2)

- 1901 Jul 2021 ENCS FinalDocument4 pages1901 Jul 2021 ENCS FinalJed Baylosis (JBL)No ratings yet

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form NoDocument4 pagesApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form Nophoebemariealhambra1475No ratings yet

- Bir Form 1901Document2 pagesBir Form 1901blahblahblueNo ratings yet

- 2305 April 2017 ENCS FinalDocument2 pages2305 April 2017 ENCS FinalMichael PerezNo ratings yet

- 1903 January 2018 ENCS FinalDocument4 pages1903 January 2018 ENCS FinalJames E. NogoyNo ratings yet

- Application For Registration: FilipinoDocument1 pageApplication For Registration: FilipinoLeo PactorNo ratings yet

- BIR FORM NO 1902 Application For RegistrationDocument2 pagesBIR FORM NO 1902 Application For RegistrationJeffrey TrazoNo ratings yet

- FAC1502 Bank Reconcilliation NotesDocument22 pagesFAC1502 Bank Reconcilliation NotesMichelle Foord0% (1)

- Newcastle University Dissertation Cover PageDocument5 pagesNewcastle University Dissertation Cover PageThesisPaperHelpUK100% (1)

- BF PP 2017Document4 pagesBF PP 2017Revatee HurilNo ratings yet

- Final Results Report: Curative Labs Inc. 3330 New York Ave NE Washington, DC 20002Document1 pageFinal Results Report: Curative Labs Inc. 3330 New York Ave NE Washington, DC 20002Aidan NicholsNo ratings yet

- RidleyBoxManual1 17Document63 pagesRidleyBoxManual1 17Sergio Omar OrlandoNo ratings yet

- Relay ProtectionDocument26 pagesRelay Protectionnogeshwar100% (1)

- Volatility Index 75 Macfibonacci Trading PDFDocument3 pagesVolatility Index 75 Macfibonacci Trading PDFSidibe MoctarNo ratings yet

- Satyam GargDocument2 pagesSatyam GargSatyam GargNo ratings yet

- Zomato Food Order Receipt SummaryDocument1 pageZomato Food Order Receipt SummarySHUBHAM KUMARNo ratings yet

- Jurnal Chapter 1 Diesel Bhs - InggrisDocument4 pagesJurnal Chapter 1 Diesel Bhs - Inggrisandino yogaNo ratings yet

- Automotive Workshop Practice 1 Report - AlignmentDocument8 pagesAutomotive Workshop Practice 1 Report - AlignmentIhsan Yusoff Ihsan0% (1)

- Technical Report Documentation PageDocument176 pagesTechnical Report Documentation Pagepacotao123No ratings yet

- Impact of Child Labour On School Attendance and Academic Performance of Pupils in Public Primary Schools in Niger StateDocument90 pagesImpact of Child Labour On School Attendance and Academic Performance of Pupils in Public Primary Schools in Niger StateJaikes100% (3)

- Clinical Assignment 1Document5 pagesClinical Assignment 1Muhammad Noman bin FiazNo ratings yet

- Crime MappingDocument13 pagesCrime MappingRea Claire QuimnoNo ratings yet

- Gas Extra Inc LTD.-MT103 MD-PGL Draft-WbDocument10 pagesGas Extra Inc LTD.-MT103 MD-PGL Draft-WbwayneNo ratings yet

- C Socket Program Serves HTML and ImagesDocument3 pagesC Socket Program Serves HTML and ImagesSyahid FarhanNo ratings yet

- Assessment E - Contract - LaundryDocument5 pagesAssessment E - Contract - LaundrySiddhartha BhusalNo ratings yet

- Stochastic Frontier Analysis of Productive Efficiency in Chinas Forestry IndustryDocument9 pagesStochastic Frontier Analysis of Productive Efficiency in Chinas Forestry Industrynoemie-quinnNo ratings yet

- 12 THINGS TO KNOW FOR A SWEDISH MASTER'S SCHOLARSHIPDocument51 pages12 THINGS TO KNOW FOR A SWEDISH MASTER'S SCHOLARSHIPEmmanuel GeraldNo ratings yet

- Mergers and Acquisitions in Pharmaceutical SectorDocument37 pagesMergers and Acquisitions in Pharmaceutical SectorAnjali Mehra100% (2)

- Delhi To Indore Mhwece: Jet Airways 9W-778Document3 pagesDelhi To Indore Mhwece: Jet Airways 9W-778Rahul Verma0% (1)

- S.No Company Name Location: Executive Packers and MoversDocument3 pagesS.No Company Name Location: Executive Packers and MoversAli KhanNo ratings yet

- Trench Infill Catalog Sheet Euro Version PDFDocument3 pagesTrench Infill Catalog Sheet Euro Version PDFricbxavierNo ratings yet

- Security+ Guide To Network Security Fundamentals, Fifth EditionDocument52 pagesSecurity+ Guide To Network Security Fundamentals, Fifth EditionVitæ ÆgisNo ratings yet

- CW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Document3 pagesCW 3 - Non-Profit Making Organisation Sekolah Harapan Bangsa ACADEMIC YEAR 2020/2021Adrian WensenNo ratings yet

- MEP Works OverviewDocument14 pagesMEP Works OverviewManoj KumarNo ratings yet

- Afirstlook PPT 11 22Document20 pagesAfirstlook PPT 11 22nickpho21No ratings yet

- Beer Benefits From Aerator TreatmentDocument2 pagesBeer Benefits From Aerator TreatmentSam MurrayNo ratings yet

- 01 04 2018Document55 pages01 04 2018sagarNo ratings yet