Professional Documents

Culture Documents

22-23 - 3ca and 3CD

22-23 - 3ca and 3CD

Uploaded by

Subramanyam Jonna0 ratings0% found this document useful (0 votes)

21 views29 pagesOriginal Title

22-23_ 3CA AND 3CD

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views29 pages22-23 - 3ca and 3CD

22-23 - 3ca and 3CD

Uploaded by

Subramanyam JonnaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 29

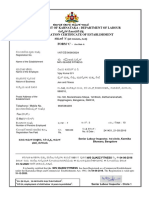

Acknowledgement Number:625466590071022

FORM 3CA. [Seo rule 6G(1 Xa)

‘Audit report under section 44AB of the Income-tax Act, 1961, in a case where the accounts ofthe business or profession of a person.

hhave been audited under any other law

1. We report that the statutory audit of

Name MR ProTech Pvt Ltd

Address 10, Cme Complex, Beh Road

15+ Karnataka , 91-India,

Pincode - 560098

PAN

AAGOMS696K

Aadhaar Number of the assessee, ifavailable

Wes conducted by us MSPR&Co in pursuance of the provisions of the Companies Act, 2013,

‘and We annex ereto a copy of our audit report dated 09-Sep-2022 along with a copy each of

a, the audited profit and loss account for the period beginning from @1-Apr-2021 to ending on

31-Mar-2022

b. the audited balance sheet as at 31-Mar-2022 ; and

c. documents declared by the said Act to be part of, or annexed to, the profit and loss account

‘and balance sheet.

2, The statenent of particulars required to be furnished under section 44AB is annexed herewith in Form No.

300.

3. In our opinion and to the best of our information and

according to examination of books of account including other retevant documents and explanations given to

us, the particulars given in the Said Form No, 3CD are true and correct subject to

‘the following observations/qualifications, if any.

Sh No. Qualifcation Type Observations /Quatfcations

No records ued

Accountant Details

Name Voruganti Madhusudhan

Membership Number 208701

FAN (Fim Registration Number) ooxois2s

Address 2768,

lock, Defence Colony

15- Karnataka , Si-india

Pincode - 560092

Acknowledgement Number:625466590071022

Date of signing Tax Aust Report 26-Sep-2022

Place 49,205.147.195,

Date 07-00t-2022

This form has been digitally signed by MADHUSUDHAN VORUGANTI having PAN ABVPVO444P fron IP Address

449.205.147.195 on 07/10/2022 06:53:12 PMDsc Sl.No and issuer

.CN=IDSign sub CA for Consumers 2014,0U=Certifying Authority,0=QCID Technologies Private Limited

Acknowledgement Number:625466590071022

FORM3CD [See rule 6 G(2)]

‘Statement of particulars required to be furnished under section 44AB of the Income-tax Act, 1961

PART-A

1. Name of the Assessee MR Pro Tech Pve Ltd

2. Address of the Assessee 20, cme Complex, Bch Road ,

15+ Karnataka, Sicindia

Pincode - 560098

3, Permanent Account Number (PAN)

Aadhaar Number of the assessee, ifavallable

‘5. Whether the assessee is liable to pay indirect tax like excise duty, service tax, Yes

sales tax, goods and services tax,customs duty,ete. ifyes, please furnish the

registration number or,GST number or any other identification number allotted

for the same?

SLNo, Type Registration /dentifestion Number

1 (Goods and Services Tax 29 AAGENBOSEK 12

15-rarnataka

2 (Goods and Sensces Tax 33 AAGCHBGS6K 172

29-Tam Nadu

3 Goods and Serdces Tox 36 AAGCMB696K 12W

36-Telangane

4 Goods and seruces Tax 37 ANGCHBED6K 12

o2andara Pradesh

s. Statue company

6. Previous year ‘1-Apr-2023 to 31-Mar-2022

7, Assessment year 2022-23

8. Indicate the relovant: clause of section A4AB under which the audit has been conducted,

Sl.No, Relevant clause of section 4448 under which the audithas been conducted

‘Third Provise to See 44A8 : Audited under any ether aw

8{a). Whether the assessee has opted for taxation under section 115BA/ 115BAA ves

(JVISBAB / T15BAC /L15BAD ?

Section under which option exercised

aaseaa

PART ~ B

Acknowledgement Number:625466590071022

942). Iffirm or Association of Persons, indicate names of partners/members and their

profit sharing ratios. In case of AOP, vibether shares of members are

Indeterminate or unknown?

Ske. Nome Profit Sharing Ratio (%)

(©). Ifthere is any change in the partners or members or in their proft sharing ratio,

since the last date of the preceding year, the particulars of such change ?

SLNo. Date ofchange Name of Type ofchange Old proft'sharing New proftSharing Remarks

Partner/Member ratio (9) Ratio (%)

No records edd

10.02). Nature of business or profession (if more than one business or profession is

‘carried on during the previous year, nature of every business or profession)

SLNo. Sector Sub Sector Code

1 Cconstaucnion Other construction aetivty 9.0. ‘06010

2 ‘CONSTRUCTION Construction and maintenance of roads, ral, briiges, unnels, ports, harbour, 05005

runways ete.

3 ‘CONSTRUCTION ‘ullting of complete constructions or parts cla contractors ‘05002

(0). If there is any change in the nature of business or profession, the particulars of No

such change?

she. Business Sector Sub Sector Code

No records adaes

21.02). Whether books of accounts are prescribed under section 44AA, list of books so No

prescribed?

SI.No. Books prescribed

(©), List of hooks of account maintained and the address at which the books of

‘accounts are kept. (in case books of account are maintained in a computer

‘system, mention the books of account generated by such computer system. ifthe

‘Books of accounts are not kept at one location, please furnish the addresses of

locations slong with the details of books of accounts maintained at each location.)

0 same as 12(a} above

Acknowledgement Number:625466590071022

sk

No.

Books

maintained

cash book

Jourmal

Ledger

Purchase re

gist

Sales resist

Stock ragist

‘Adaress

Line 1

20, cme

‘complex.

Beh Roa

4, Rare

Jeshwart

Nagar

20, cme

Complex.

Ben

Rapa

Jeshwart

Nagar

0, cme

Complex

Bens

s.fajara

Jeshwatt

Nagar

20, cme

Complex,

Beh Roa

6, Ral

Jeshwart

Nagar

‘Address Line 2 cy or Town or

District

Bangalore

Sanger

Bangalore

Bangalore

Bangalore

Bangalore

Bangalore

Zip Code | Pin

code

60098

0008

60098

e000

60098

560098

560098

(©. List of books of account and nature of relevant documents examined,

(1 Same as 11(b) above

Sk No.

Books examined

fank book

‘cash book

Journal

ledger

Purcnase register

Sales register

Stock register

county

s1nda

sings

ouinga

ouindio

sting

orn

15-tamataka

25-Kamataka

25-farnataka,

25-Kamnataka,

15: Karnataka

15- Karnatake

15-Kamatake

Acknowledgement Number:625466590071022

12. Whether the profit and loss account includes any profits and gains assessable on No.

presumptive basis, ifyes, indicate the amount and the relovant soction (44D,

S4ADA, UAE, A4AF, 448, 44BB, 44BBA, 44BBB, Chapter XII-G, First Schedule or

‘ny other relevant section.) ?

SLNo. Section ‘Amount

No records sade

13,02). Method of accounting employed in the previous year Mercantile system

(0). Whether there had been any change in the method of accounting emplayed vis-2- No.

vis the method employed In the immediately preceding previous year ?

(<1. Ifanswer to (b) above is in the affirmative, give details of such change , and the

foffect thereof an the profit or loss ?

SkWo. Particulars Increase in prof Decrease in proft

—_ ‘ ro ro

(). Whether any adjustment is required to be made to the profits or loss for Yes

‘complying with the provisions of iacome computation and disclosure standards

notified under section 145(2) ?

(). ifanswor to (@) above is in the affirmative, give details of such adjustments:

sk ps Increase in profit, Decrease in proft Net effect

No.

a construction Contracts 5.00515 = 1,09,603 €3,90672

Totet 5.00515 109,883 3.90672

(f. Disclosure as per IDS:

SLNO. IDS Disclosure

No records added

1V4.(a). Method of valuation of closing stock employed in the previous year Lower of Cost or Market rate

(bt. tn ease of deviation from the method of valuation prescribed under section 145A,

‘and the effect thereof on the profit or loss, please furnish:

SLNO. Particulars: Increase in profit Decrease in proft

Acknowledgement Number:625466590071022

No records added

15, Give the following particulars of the capital assot converted into stockc-in-trade

SLNo, Description of capital asset Date of acquistion Costofacauisiton Amount at which the

(a) o) (assets converted into

‘stock-in trade

@

tie records assed

16. Amounts not credited to the profit and loss account, being,

(2). The items falling within the scope of section 28;

io, Description Amount

‘ to

(). the proforma credits, drawbacks, refunds of duty of customs or excise or service

tax or refunds of sales tax or value added tax or Goods & Services Tax.where such

credits, drawhacks or refunds are admitted as due by the authorities concerned:

She. Desertion Amount

Wo records aaaes

ion claims accepted during the previous year;

Sho. —_Deserption Amount

No recors odes

(@). any other item of income;

Sl.No. Description Amount

No records added

(cl. Capital receipt, sfany.

SLNo, Description Amount

No records added

Acknowledgement Number:625466590071022

17. Where any land or building or both is transferred during the previous year for a

consideration less than value adopted or assessed or assessable by any authority,

of State Government referred to in section 43CA or 50C, please furnish:

Sk Details Address of Property

No. of

property Address Line Address ClyOr ZipCode County —_ State

1 line 2 Town Or /Pin

District Code

16, Particulars of depreciation allowable as per the Income-tax Act, 1961 in respect

‘of each asset or block of assets as the case may be, in te followig form:

eee ee ee

ie St. ae, See ee ars

ae eee ae =

oLenen Tere

Sr aen

mate

ay wail aaah

Fee uw aw

ae

. meee ema

; mee

29. Amount admissible under section-

Consideration

received or

‘accrued

Valle Whether

adopted or provisions

assessed or ofsecond

TG) asjusnenee ation

eo

assessable proviso to

sub-

section

ot

section

43CAor

fourth

proviso to

clause (»)

of sub-

section

Qief

section

56

applicable

epee as20

nes ta

Acknowledgement Number:625466590071022

SLWo. Section ‘Amount debited to proft Amounts admissible as per the provisions of the income-tax Act, 1961

and loss account ‘and also fulfils the conditions, irany specified underthe relevant

provsions of ncome-tax Act, 1961 or income-tax Rules, 1962 or any

‘other guidelines, circular, etc, (ssued in this behalf,

No records sued

20.(2). Any sum paid to.an employee as bonus or commission for services rendered,

‘where such sum was otherwise payable to him as profits or dividend. [Section

36,0)

SkNo. Description ‘Armount

No records added

4}. Details of contributions received from employees for various funds as referred to

‘in section 36(4)}(val:

SLNo. Nature offund ‘Sum received from Due date forpayment The actual amount paid The actual date of

‘employees payment to the

concemed authorities

a Provaent Fund € 26.100 15-may2021 26.100 15-mayz021

2 Provident Fund $26,100 154un-2022 26,200 154n-202

3 Prowse Fung ~~ e260 asyolzoa, 26300 13,2021

‘ Provident Fund #26100 15-Aug-2021 £26,100 12-4u92021

5 Prowdent Fund £26200 15Sep-2021 © 826:100 14-Sep-2021.

‘ Provident Fund "826.100 35082021 26,00 12-08-2021

7 Provident Fund £26100 1SHow2021— 7 £26,200 15-How2022,

a Provident Fund £26,100 15:086-2021 £26,100 15-Dec-2021 |

° Provident Fund 24300 15420-2022 €24,300 15400-2022

10 Provident Fund £24,300 15Fe02022 24300 15Fe02022

2 Provident Fund 26,00 15Mar2022 £26100 14072022 -

2 Provident Fund 22,500 15-89r2022 £22,500 14-apr2022 ~ |

fa ‘ey find setup under 22,070 154un-2021 2070 1540n2001

{he prvelons of S51

cas

u ‘ny fund setup unde "82,035 a5yuhz023 - €2.035 15982021

Ie ponent a

as ‘any und setup under 1,035 15-4092021 2,035 14-Aug-2021

the prowsions of ESIA

coisas

Acknowledgement Number:625466590071022

a6 ‘ny fund setup under £2,035 15:5ep-2021 £1,035 15-Sep-2022,

the provsions of Est 8

cela

y Any fund setup under 2.035 15-0ce2021 £1,035 15.0ct-2021

the provstons of ES1A

eu isse

a ‘Any fund setup under €2.035 S0-Nowz021 2,035 16-Nov2021

the provsians of e518

cbse

8 Any fund setup under £1,035 15-0ec-2021 £1,035 15:Dee-2021

the provsions of €318

Bec

20 ‘Any fund setup under ano 154an-2022 810 15Jan-2022

the provsioas of E818

a Any fund setup under ono 15-Feb-2022 emo 15-Feb-2022,

the provisions of ESIA

ce ibae

2 ‘ny fund setup under 10 15-Mar-2022 ea10 15-ar2022

the prowstons of €51 8

cise

2 ‘Any fund setup uncer 674 30-Apr-2022 674 16.Apr2022

fhe provsions of E518

1948

21.(9). Please furnish the details of amounts debited to the profit and loss account, Being

fn the nature of capital, personal, advertisement expenditure etc.

Capital expenditure

Sho. Particulars

a

Personal expenditure

Slo. Particulars

No records added

Advertisement expenditure in any souvenir, brochure, tract, pamphlet or the hike published by a political party

SLNo, Particulars

No records addea

Expenditure incurred at clubs being entrance fees and subscriptions

SLNo. Particulars

‘Amount

ro

Amount

Amount

‘Amount

Acknowledgement Number:625466590071022

No records sides

Expenditure incurred at clubs being cost for club services and facilities used.

SLNo. Particulars Amount

No records added

Expenditure by way of penalty or fine for violation of any law for the time being in force

SiN Particulars ‘Amount

No records auided

Expenditure by way of any other penalty or fine not covered above

SLNo. Particulars

to records aed

‘Expenditure incurred for any purpose which is an offence or which is prohibited by law

SLNo, Particulars 4 Amount

No records agged

(b). Amounts inadmissible under section 40a);

1 as payment to non-resident referred to in sub-clause i)

|. Details of payment on which tax is not deducted:

Si, ate ot paynant—arount mature of Mane of the Ferment Account Aadaae lanber of the sade Retest City OF Zip Country State

. m or poment” pee poyees Stavaitotie” Uiae't Cine’? fawn Or eats /

ponent ater a

|B. Details of payment on which tax has been deducted but has not been paid on or

before the due date specified in sub-section (1) of section 139

5 pate ponent eresnant Account ASHhSOrtuneer of the Huse. satrezs City O° Zip Country State aunt

eit Bide Pin esuctet

Acknowledgement Number:625466590071022

1. as payment referred to in sub-clause (a)

‘A. Details of payment on which tax is not deducted:

SL. to, bate of payment Anunt ature ben of Parmnant Account Aadhasr Nooo of the Address. Agrees City Gr Zip Country State

Sr Of then omer of the poe, if vaitgnie” Line Line? Too OF Coue /

a

3. Details of payment on which tax has been deducted but has not been paid on or

before the due date specified in sub-section (1) of section 139.

7 ett parent face, chthe pres seitaie bikie. Bin sceies

1 eo eo ke

"as payment referred to in sub-clause (ib)

A. Details of payment on which levy is not deducted:

St ta, Date of payment "unt Hae ave af Peart Mecount Aner Minbar of the Addess Alans Ry OF Zip Coury. state

ot at Shee tummerat the pie it aa COD TRE? em Cee

iment porment Bove eras, If srelabte istrict pa

1 zo

®. Details of payment on which levy has been deducted but has not been paid on or

before the due date specified in sub-section (1) of section 139,

St. bate of Anon of payment Wacure le Permaonnt —Andhanr Amber Address Aress City OF Zip Country State

re ee Shyer the Money of the astnte MS MAP ST

1 vo

|| be Bringe benefit tax under sub-clause (i) 0

Acknowledgement Number:625466590071022

1% Wealth tax under sub-clause (ia)

4 Royalty, license fee, service fee etc, under sub-clause (ib)

ie Salary payable outside India/to a non resident without TDS ete. under sub-clause

aw

SLM. oate of payne noire Ka of Peranent Account Anaar aber of the Asians

te te poves stations Line

1 vo

vil, Payment to PF /other fund ete. under sub-clause ()

Tax paid by employer for perquisites under sub-clause (v)

(. Amounts debited to profit and loss account being, interest, salary, bonus,

‘commission or remuneration inadmissible under section 40(b)/40(ba) and

‘computation thereof;

SLNo. Particulars Section

PIL

Wo records added

(0). Disallowance/deemed income under section A0A(3):

1 On the hasis ofthe examination of books of account and other relevant

ocumentsfevitence, whether the expenditure covered under section 40A(3)

road with rule 6DD were made by account payee cheque drawn on a bank or

account payee bank draft. Please furnish the details ?

SLNo. Date ofPayment Nature of

Payment

‘Amount Name of the

payee

No records aided

8. On the basis of the examination of books of account and other relevant

documents/evidence, whether payment referred to in section 40AGA) read with

rule 6DD wore made by account payee choque drawn on a hank or account payee

bank draft, please furnish the details of amount deemed to he the profits and

‘gains of business or profession under section 40A(3A) ?

SLMo. Date of Payment Nature of

Payment

Amount Name ofthe

payee

Amount debited to Amount admissible

wo

to

tines? em SF ly SNM NE

fee

ro

0

Amount Remarks

inadmissible

Permanent Aadhaer Number of

‘Account Number the payee, Favallable

ofthe payee. if

available

Yes

Permanent Aadhaar Number af

Account Number the payee, ifavallable

ofthe payee, f

available

Acknowledgement Number:625466590071022

to records odes

(€). Provision for payment of gratuity not allowable under section 40A(7);

(0. Any sum paid by the assessoe as an omployer not allowable under section 404(9);

(a). Particulars of any liability of a contingent nature;

SLNo. Nature of Liabilty

(>). Amount of deduction inadmissible in terms of section 14A in respect of the

‘expenditure incurred in relation to income which does not form part ofthe total

SLNo, Particulars

to records added

(0. Amount inadmissible under 1

roviso to section 36(1 i.

22. Amount of interest inadmissible under section 23 of the Micro, Small and Medium

Enterprises Development Act, 2006.

to

zo

Amount

to

Amount

zo

x0

23. Particulars éf'any payments made to persons specified under section 40A(2)().

Sk Name ofRelated PANof Related AadhaerNumberofthe —_—Retation Nature of Payment Made

No. Person Person related person, ifavallable Transaction

No record adgea

24. Amounts deemed to be profits and gains under section 32AC or 32AD or 33AB or

S3AC of S3ABA.

SkNo. Section Description ‘Amount

No records added

Acknowledgement Number:625466590071022

25. Any Amount of profit chargeable to tax under section 41 and computation

thereat

Sl.No, Name of person ‘Amount of income Section Description of

Transaction

Wo records added

261, In respect of any sum raferred to in clause (a),(b)(€)(A)Ae).(f) oF (g) of section

438, the liability for which:-

A. prevexisted on the first day of the previous year but was not allowed in the

Assessment of any preceding previous year and was

2 paid during the previous year;

SLNo. Section Nature of fabilty

». not pald during the previous year;

SL No. Section ‘Nature of fabilty

®. was incurred in the previous year and was

2. paid on or before the due date for furnishing the return of income of the previous

year under section 139(1);

Sk No, Section Nature of fabilty

». not paid on or before the aforesaid date.

SL Ne. Section Nature of ability

‘Computation ifany

Amount

ro

Amount

zo

Amount

zo

Amount

Acknowledgement Number:625466590071022

State whether sales tax, goods & services Tax, customs duty, excise duty or any

ther indirect tax Jevy,cess,impast etc is passed through the profit and loss

‘account?

27.2. Amount of Central Value Added Tax Credits) Input Tax Credit(I7C) availed of or Not Applicable

utilised during the previous year and its treatment in profit and loss account and

treatment of outstanding Central Value Added Tax Credits/input Tax Credit(ITC)

in accounts,

CeNvar mre ‘Amount Treatment in Profit & Loss/Accounts

Ne records edd

», Particulars of income or expenditure of prior period credited or debited to the

profit and loss account.

SL No. Type Particulars ‘Amount Prior period to which it

relates (Yearin yyweyy

format)

No records added

28. Whether during the provious year the assessee has recelved any property, being Not applicable

share of a company not being a company in which the public are substantially

interested, without consideration or for inadequate consideration as referrod to in

section 56(2Mvila) ?

Please furnish the details ofthe same

Sl Name ofthe PANOfthe — Aadhaar Nameof ClNofthe No. of Shares ‘Amount of Fair Market value of

No. personffom person, if Number ofthe the company Receed consideration paid the shares

which shares avaliable payee. if company

recenes available whose

shares are

received

to records aed

29. Whether during the previous year the assessee received any consideration for

‘issue of shares which excoeds tho fair market value ofthe shares as referred to in

section 56(2)(vtb) ?

625466590071022

Acknowledgement Numbe1

Please furnish the details ofthe same

SL No. Nameofthe person from PAN ofthe AadhaarNumberof No.of ‘Amount of consideration

whom consideration person, ifthe payee, if shares recehed

recened'forissueof avaiable avalable issued

shares

No records added

‘Aa. Whethar any amount is tobe included as income chargeable under the head

“imcome from other sources’ as referred to in clause (ix) of sub-section (2) of

section 58?

». Please furnish the following details:

SLNo. Nature ofincome

No

records added

8.2, Whether any amount is to be included as income chargeable under the head

“income from other sources’ as referred to in clause (x) of sub-section (2) of

section 56?

», Please furnish the following details

Slo. Nature of income:

30. Details of an¥’amount borrowed on hundi or any amount

records edded

ue thereon (including

interest on the amount borrowed) repaid, otherwise than through an account

payee cheque. [Section 69D]

SL Name ot PANof Aadhaar Address Adaress City or

No. the the Number Line1 Une2 Town

person person, ofthe or

fom it person, District

whom avaiable i

amount available

borrowed

or repaid

‘on bund

Fair Market value of

the shares:

Amount

Amount

Amount Amount Date of

Zip Country State Amount Date of

Code borowed borewing due

Pin including

Code Interest

eo eo

‘Aa. Whether Primary adjustment to transfer price, as referred to in sub-section (1) of

section 92CE, has been made during the previous year ?

». Please furnish the following details:

repaid Repayment

ro

Acknowledgement Num ber:625466590071022

ome rsataeetion

of ection ae

praary ebastnene

tein

8.8. Whether the assessee has incurred expenditure during the previous year by way

of interest or of similar nature excoeding one crore rupees as referred to in sub-

section (1) of section 948?

». Please furnish the following details

srortisttion tala

arin the previous Yea

a. Whether the assessee has enterod into an impermissible avoidance arrangement,

ts

‘oun of orivary aélustant. Wtiar the excess

toner valiae

fequres te be

nether the eacess

Fapst elated wien

recites tine

io records odded

» ami baton of memes oy

allSeave Uni sues

Sov et EBITDA os per

Hn) sve:

ca

9s referred to in section 96, during the previous year.(This clause s kept in

abeyance til 31st March, 2022)?

». Please firnish the following details

| su, parevaraf oc on or dopo nan amount excoding the nt spect in

tio records added

section 2608S taken or accepted during the previous yoar =

‘owe on such excess ane) ropttaation oF

saseh as nt Been repatriated noe)

(a) et rotten 88.

; No.

srg in gee pre te he

Acknowledgement Number:625466590071022

su

No

»

Name of Addressof Permanent Aadhaar Amount of Whetherthe Maximum

the the lender or Account Number of loan or loanideposit amount

lenderor depositor — Number (the lender or deposit was outstanding in

depositor avaliable depositor, token or squared up the account at

with the avaiable accepted during the anytime during

assessee) previous the previous

ofthe year? year

lenderor

depositor

No records sadee

Particulars of each spocified sum in an amount exceeding the limit specified in

section 2698S taken or accepted during the previous year:

Name ofthe Address ofthe person Permanent Aadhaar Number of Amount of specified

person from fromwhom specified Account —_the person from sum taken or

whom sumis received Number(f whom specified sum accented

specified sum availble with i received, iF ;

Is received the assessee) available

ofthe person

from whom

specified sum

is recehed

No records sages

Note: Particulars at (a) and (b) need not be given in the case of a Government

company, a banking company or a corporation established by a Central, State or

Provincial Act.

a). Particulars of each receipt in an amount exceeding the limit specified in section

su

No.

2269ST, in aggregate from a person in a day or in respect of «single transaction or

in respect of transactions relating to one event or occasion from a person, during

the previous year, where such receipt is otherwise than by a cheque or bank draft

‘or use of electronic clearing system through a bank account

Whether the

loan or

deposit was

raken or

accepted by

cheque or

bank draft or

use of

electronic

clearing

system,

through &

‘bank account

Whetherthe

speciied sum

Was taken or

accepted by

‘cheque or

bank drat or

use of

electronic

clearing

‘system

through a

bank account

7

Incase the

loan or

deposit was

taken or

accepted by

cheque or

bank draft,

whether the

taken or

accepted by

fan account

payee

cheque or an

account

payee bank

drat

Incase the

specified sum

vas taken or

accepted by

‘cheque or

bank drat,

‘whether the

taken or

accepted by

{an account

payee cheque

fran account

payee bank

drat.

Name ofthe Address ofthe payer Permanent AadhaarNumberof Nature of Amount of receipt Date of

payer ‘Account the payer, ifavallable transaction

Number (it

available with

the assessee)

ofthe payer

No records added

receipt

Acknowledgement Number:625466590071022

bb). Particulars of each receipt in an amount excoeding the limit specified in section

269ST, in aggregate from a person in a day or in respect ofa single transaction or

im respect of transactions relating to one event or occasion from a person,

‘roceived by a choque or bank draft, not belng an account payee cheque oF an

account payee bank draft, during the previous year:-

SLNo. Name ofthe Address ofthe payer Permanent Account —_Aadhaar Number of the Amount of receipt

payer Number (favalabie with payer, itavalable

the assessee) of the

payer

No records erided

©), Particulars of each payment made in an amount exceeding the limit specified in

section 269ST, in aggregate from a person in aday or in respect ofa single

transaction or in respect of transactions relating to one event or occasion to a

person, otherwise than by a cheque or hank dra, or use of electronic clearing

system through a bank a¢count during the previous year

SLNo, Name of Address ofthe payee Permanent —AadhaarNumberof Nature of Amount of payment Date of

the payee Account the payee, if transaction payment

Number (if available

avaiable with

the assessee)

ofthe payee

tio records adied

(@). Particulars of each payment made in an amount exceeding the limit specified in

section 269ST, in aggrogate from a porson in a day or in rospoct ofa single

transaction or in respect of transactions relating to one event or eceasion toa

person, made by a cheque or bank draft, nat being an account payee cheque or

‘an account payee bank draft, during the previous year

Sle. Name ofthe Address ofthe payee «Permanent Account —_Aadhaar Number ofthe Amount of payment

| payee ‘Number (if available with payee, ifavailable:

| fs the assessee) ofthe

| payee

to records added

Note: Particulars at (ba), (bb), (be) and (bd) need not be given in the case of

receipt by or payment to a Government conpany, 2 banking Conpany, a post office

savings bank, @ cooperative bank or in the case of transactions referred to in

section 2698S or in the case of persons referred to in Notification No. $.0. 2065(E)

dated 3rd July, 2017

©. Particulars of each repayment of Joan or deposit or any specified advance in an

amount exceeding the limit specified in section 269T made during the previous

year

Acknowledgement Number:625466590071022

SL Nameof Address ofthe Permanent Aadhaar Number Amount of Maximum amount

No. the payee ‘Account of the payee, if repayment outstanding in the

payee Number(if available ‘account at any

available with time during the

the previous year

assessee) of

the payee

No recoras added

4, Particulars of repayment of loan or deposit or any specified advance in an amount

exceeding the limit specified in section 2697 received othervise than by @ cheque

br bank draft or use of elactronic clearing system through a bank account curing

‘the previous year:

SLNo. Name ofthe Address of the payer Permanent Account —_Aadhaar Number ofthe

payer Number (available with payer, ifavallable

the assessee) of the

payer

No records added

‘©. Particulars of repayment of loan or deposit or any specifiod advance in an amount

exceeding the limit specified in section 2697 received by a cheque or bank draft

which is not an account payee cheque or account payee bank draft during the

previous year-

SLNo. Name ofthe Address of the payer Permanent Account _Aadhaar Number ofthe

payer Number (if available with payer, f available

the assessee) of the

payer

No records added

Note: Particulars at (c}, (d) and (e) need not be given in the case of @ repayment

of any loan or deposit or specified advance taken or accepted trom Government,

Government company, banking company or a corporation established by a Central, State

of Provincial Act

Whether incase the

the repayment

repayment was made by

was made cheque or

bycheque bank draft,

orbank — whetherthe

drafter same was

use of repaid byan

electronic account

clearing payee

system cheque oran

through a account

bank payee bank

account? draft,

Amount of repayment of

loan or deposit or any

specited advance

received atherwise than

bya cheque or bank

Graft or use of electronic

clearing system through

'2 bank account during

the previous year

‘Amount of repayment of

loan or deposit or any

specified advance

received bya cheque or

‘bank draft which is not

‘an account payee

cheque or account

payee bank draft during

the previous year

Acknowledgement Number:625466590071022

32a, Details of brought forward loss or depreciation allowance, in the following,

‘manner, to the extent available

Sl Assessment Nature of ‘Amount as. All ‘Amount as adjusted Amountas assessed Remarks:

No. Year lossjallowance retumed (ifthe lesses/allowances bywitdrawal of (ave reference to

assessed not alowed under ‘additional relevant order)

depreciation is section 115BAA/ depreciation on

fess and no 1158AC/115BAD account of opting for ‘Amount Order

appeal pending t@ation under section Us &

then take 125BAC/115BAD(To Date

assessed) be filed infor

assessment year

2021-22 only)

2 to zo eo zo

». Whether‘a change in share holding of the company has taken place in the previous year No

due to which the losses incurred prior to the previous year cannot be allowed to be

carried forward in terms of section 79 ?

© Whether the assessee has incurred any speculation loss referred to in section 73 during No

the previous year ?

Please furnish the dotals ofthe same, co

. Whether the assessee has incurred any loss referred to in section 7A in respect of ny * No

specified business during the previous year ?

Please furnish the details ofthe same. ro

«. In case of a company, please state that whether the company is deemed to’be carrying

on a speculation business as referred in explanation to section 73.

Please furnish the details ofthe same. to

33. Section-wise details of deductions, ifany atimissible under Chapter VIA or No.

Chapter Ill (Section 104, Section 108).

SLNo, Section under which deduction is claimed Amounts admissible as per the provision of the Income-tax Act: 1961 and fulfis

the conditons, ifany, specified under the relevant prowsions of Income-tax Act,

1961 or ncome-tax Rules, 1962 or any other guidelines, circuler, etc, issued in

‘this behart

io records added

34.10). Whether the assessee is required to deduct or collect tax as per the provisions of Yes

Chapter XVIF-B or Chapter XVI-BB, please furnish ?

Acknowledgement Number:625466590071022

Sk Tax Section Nature Totalamount Totalamount Totalamount Amountof _Total_Amount of Amount of tax

No. deduction (2) of ofpaymentor on which tax on which tax tex amounton tex deducted or

and payment receiptofte was required Was deducted or whichtax deducted collected not

collection @) nature tbe deducted or collected ‘was orcollected deposited to

‘Account specified in deducted or collected at © outof(6) deducted on(8)_ the creditof

Number Column (3) colected out specified rate (7) orcellected (9) _ the Central

(TAN) ) oft#) out of (5) atless than Goverment,

a) 6) © speciied out of (6) anc

rate out of @)

a a9)

@

1 GLRMIS870 192 Solery-—-€1.31,64,000 € 2,31.64.000 © 1,31,68,000 © 16,42,000 to co to

8

2 BLRMLS870 196A Interest © 0.45.81 BO.AS.Ad) —-F BO.As.sA1 8.04504 ro eo ro

a otherthe

interes

ton secu

hee

2 BLAMIS870 194C Payment « e © 81,927,532 ro ro to

6 S@Cont 66,60.79.151 6660.73.151 65,60,73.191

4 uRM5870 196 €11,16,600 £11,160 € 11,2660 2,13,660 zo zo ro

6

‘iveuais

or Hinds

indies

‘amy

5 BLAMIS870 1961 Plant /M €45,46,600F 45,46,600 € 45,4660 90.912 to to ro

e achinery

© BIRMIS870 194) Fees for © 7,80,000 7.80.00 7,80,000 78,000 to oy to

e brotessio

fal or tee

finial se

7 BIAMIS870 194H Commssi_€ 19,00,000 € 19.00.00 19,00,000 ¢ 95,000 zo eo ro

e on arbre

erage

(0). Whether the assessoe is required to furnish the statement of tax deducted or tax. Yes

collected ?

Please furnish the details

Sl.No. Taxdeduetion and Type of Form

collection Account

Number (TAN)

1 etmse708 24g

2 eLRMI58708 240

2 stmise708

Due date for

fumishing fummished

asyuhz0a1

15.0ce-2021

314an-2022

Date of furnishing, f Whether the

Please fumish list of

detais/transactions

which are not reported.

statement of tax

deducted or

collected contains

information about all,

details) transactions,

which are required

to be reported

Yes

Acknowledgement Number:625466590071022

4 aumase70e 240 ‘34-Moy2022 ves

5 uRM158708 260 asyura021 Yes

6 BiRMI58708 260 35.0ct-2021 Yes

7 stawisa708 260 154an-2022 Yes

8 siwise7o8 260 s-Nay2022 yes

(Ch. Whether the assessee is liable to pay interest under section 201 (LA) or section No

206C(7)?

lease furnish;

SL No, ‘Tax deduction and collection Amount ofinterest under’ Amount paid aut of column (2) along with date of payment.

Account Numer (TAN) section 202(1A)/206C(7) is 8)

a payable

@ ‘Amount Date of payment:

zo zo

35.(a). In the case of a trading concern, give quantitative details of prinicipal tems of

goods trad

Sk Rem Unit Opening stock Purchases during the Seles during the Closing stock Shortage/excess itany

No. Name Name pervious year pervious year

a ° ° ° ° o

{). In the case of manufacturing concern, give quantitative details of the prinicipal

‘tems of raw materials, fnished products and by-products.

A. Raw materials:

SL Rem Unit Opening Purchases Consumption _—Sales-_«Closing—Yield of Percentage of Shortage/excess,

No. Name Name stock duringthe —duringthe durngthe stock —finishea veld ‘fany

penious pervious year pervious products

year year

No records added

8. Finished products :

Acknowledgement Number:625466590071022

Quantity. Sales during the

SL tem Unk Opening stock Purchases during

No. Name Name the pervious year manufactured pervious year

during the pervious

year

No records aulded

© By-products

SL tem Unt Opening stock Purchases during Quantity. Sales during the

No. Name Name the pervious year manufactured pervious year

during the pervious

year

36.(a). Whether the assessee has received any amount in the nature of dividend as

referred to in sub-clause (¢) of clause (22) of section 2 ?

Please furnish the following details

Shortage/excess, i

Closing stock

any

Shortage/excess, i

Closing stock

‘any

Date of receipt’

SL No. Amount received

No records added

237, Whether any cost audit was carried out ?

Give the details, if any, of disqualification or disegreement on.

‘matter/item/valuefquantity as may be reported identified by the cost auditor.

38. Whether any audit was conducted under the Central Excise Act, 1944 7

Givo the dotails,f any, of disqualification or disagreement on any

rmatteryitem/value/quantity as may be reported/identified by the auditer.

39. Whether any audit was conducted under section 72A of the Finance Act, 1994 in

relation to valuation of taxable services as may be reportedj/identified by the

auditor. ?

ive the details, fany, of disqualification or disagreement on any

matteryitem/value/quantity as may be reported/identifiod by the auditor.

‘Not applicable

[Not Appiicabl

Not Applicable

Acknowledgement Number:625466590071022

40. Details regarding turnover, gross profit, ete, for the previous year and preceding

Sl.No.

@

o

te

®

previous year

Paniculars Previous Year

2069472165

‘oat

of the

“ross

profit /

Furnover

1069472365

tet profit 63516981

Pturnover

osaa72365

stock-an-

Teer /

Turnover

fateriat

Consined

Finishea

000s,

Produces

% Preceding prevous Year %

1021371705,

1071371705

5.06 60024539 1021371708 sea

42, Please furnish the details of demand raised or refund! issued during the previous

year under any tax laws other than Income-tax Act, 1961 and Wealth-tax Act,

Sh No.

1957 alongwith details of relevant proceedings.

demand/refund relates aw

Financial yearto which Name ofotherTax ‘Type (Demand

Date of ‘Amount Remarks

rased/Refund demand

received) rrisediretund

received

No records ade

42.9. Whether the assessee is required to furnish statement in Form No. 61 or Form

No. 614 or Form No. 618?

Income tax Type of Form ue date for Date of furnishing,

Department fumishing furnished

Reporting Ently

‘dentifcation

Number

Whetherthe Form Please fumish Ist of the

contains detal/transactons

Information about ll which are not reported.

detalis/ furnished

transactions which

are required to be

reported ?

Acknowledgement Number:625466590071022

43.2. Whether the assessee or its parent entity or alternate reporting entity is able to No

furnish the report as referred to in subrsection (2) of section 286 ?

». Please furnish the following details:

Date of furnishing of report

c.Please enter expected date of furnishing the report

‘44. Breakup of total expenditure of entities registered or not registered under the

GST: (This Clause is kept in abeyance til 31st March, 2022)

sk Total amount of Expenditure in respect of entites registered under GST Expenditure relating

No. Expenditure to entities not

incured during the Relating to goods Relating toentities Relating to other Totalpayment to _ registered under

year orservces exempt faling under reglstered entties registered entities ost

‘rom GST composition

scheme

No records added

Accountant Details

Accountant Details

Name Voruganti Madhusudhan

Membership Number 208701

i oonoiszs

FRO (Fem Registration Number)

Address

Place

Date

Additions Details (From Point No.18)

12768, € Block, Defence Colony...

15 Karnataka, 91-ndl

Incode - 560092

Acknowledgement Num ber:625466590071022

To records added

rurcase Adjusts on count ot Tora

“ae of

‘| omar] on Purchases

ge in| subsityorgant PUSS

(2) ete orrembursement g 42430)

Sacnge| brat toe

@) called

te ri id —

Purcace delusion Acountot Total Ve

Vale of

2 cewwar| —changein| subsityorgrnt, "UCNES

(2) tet orrembursement 4245.0)

fscrange by tatver nae

° tes

e

No records added

purchase scjvstents on count ot Torave

Vahe is of

a purchases

ceWar—Changeinsubsayorgrnt MNES

(2)| Reo orremburseent 4243.0)

exchenge bynaterer ne

+3) called

@

oe

Purchase sajstments on count ot Total value

Voie cr

Hl cane purchases

engein_subsayorgant PE:

| alee! orrarburcerent 4243.0)

tschange. by mater name

3 Ses

w

Deductions Details (From Point No.18)

Description ofthe Block of | SL_ Date of —_—bate

Assets/Class of Assets No. Purchase put to

Use

Building @ 10%

Description ofthe Block of S_ Date of —_bate

Assels/Class of Assets No. Purchase put to

Use

Plant and Machinery@ 15%

Description ofthe Block of | SL_— Date of Date

Assets/Class of Assets [No. Purchase put to

use

Plant and Machinery @ 30%

Description ofthe Blockof S_|Date of —_—Date

Assets/Class of Assets No. |Purchase put to

Use

Plant ang Machinery @ &0% a

Description ofthe Block of | SI.No. Date of Sale

Assets/Class of Assets

‘Building @ 10%

Amount. Whether

deletons

are out of

purchases

put to use

forless

than 180

days

No records added

Acknowledgement Number:625466590071022

Description ofthe Block of | SLNo. | Dat of Sale ‘Amount, Whether

Assets/Class of Assets deletions

‘are out of

purchases

putto use

forless

than 180

days

Plant and Machinery @ 15%

No records added

Amount, vinether

[aston

late ovtot

purenaves

putto use

\fortess

than 180

|=

Description ofthe Block of | SLNo. | Date of Sale "Amount Whether

Assets/Class of Assets } deletions

Description ofthe Block of | SI.No. | Date of Sale

Assets/Class of Assets

Plant and Machinery @ 30%

Wo records added

are out of

purchases

putto use

Hforless |

than 180

ays:

lant and Machinery @ 40%

No records added

This form has been digitally signed by MADHUSUDHAN VORUGANTI having PAN ABVPVO444P fron IP Address

49,205,147,195'0n 07/10/2022 06:53:12 PMDsc Sl.tio and issuer

,CN=1DSign sub CA for Consumers 2014,0U=Certifying Authority,0=QCID Technologies Private Limited

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ANDHRA TIFFINS CertificateDocument6 pagesANDHRA TIFFINS CertificateSubramanyam JonnaNo ratings yet

- ENVIRONMENTALDocument2 pagesENVIRONMENTALSubramanyam JonnaNo ratings yet

- Labour Licence-Quadz Fitness-1Document2 pagesLabour Licence-Quadz Fitness-1Subramanyam JonnaNo ratings yet

- HI1Document3 pagesHI1Subramanyam JonnaNo ratings yet

- PayoutDocument1 pagePayoutSubramanyam JonnaNo ratings yet

- Food Licensce RajDocument4 pagesFood Licensce RajSubramanyam JonnaNo ratings yet

- New Licensce RenewedDocument2 pagesNew Licensce RenewedSubramanyam JonnaNo ratings yet

- Applicant PanDocument1 pageApplicant PanSubramanyam JonnaNo ratings yet

- Sushmitha - Adhar CardDocument2 pagesSushmitha - Adhar CardSubramanyam JonnaNo ratings yet

- Gas BillDocument2 pagesGas BillSubramanyam JonnaNo ratings yet

- Old Food LicensceDocument1 pageOld Food LicensceSubramanyam JonnaNo ratings yet

- Balance Sheet-2020-2021Document41 pagesBalance Sheet-2020-2021Subramanyam JonnaNo ratings yet

- K Balaji NocDocument1 pageK Balaji NocSubramanyam JonnaNo ratings yet

- App FormDocument3 pagesApp FormSubramanyam JonnaNo ratings yet

- Applicant - Adhar CardDocument2 pagesApplicant - Adhar CardSubramanyam JonnaNo ratings yet

- Loan AgreementDocument42 pagesLoan AgreementSubramanyam JonnaNo ratings yet

- Annual Report - 22-23Document15 pagesAnnual Report - 22-23Subramanyam JonnaNo ratings yet

- 2ND Partner PhotoDocument1 page2ND Partner PhotoSubramanyam JonnaNo ratings yet

- CC Famebalaji STMNT (146339)Document81 pagesCC Famebalaji STMNT (146339)Subramanyam JonnaNo ratings yet

- Company Pan and DeedDocument7 pagesCompany Pan and DeedSubramanyam JonnaNo ratings yet

- 2ND Partner Pan CardDocument1 page2ND Partner Pan CardSubramanyam JonnaNo ratings yet

- 2ND Partner Adhar CardDocument2 pages2ND Partner Adhar CardSubramanyam Jonna100% (1)