Professional Documents

Culture Documents

HR Complaince Audit Checklist Template

Uploaded by

OSAMA ABUSKAR0 ratings0% found this document useful (0 votes)

64 views3 pagesOriginal Title

Hr Complaince Audit Checklist Template

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

64 views3 pagesHR Complaince Audit Checklist Template

Uploaded by

OSAMA ABUSKARCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

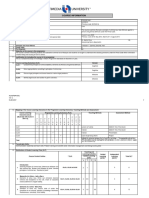

HR Compliance Audit Checklist

This document has been designed as a tool to monitor your small business’ HR compliance with

federal labor laws. Best practice recommendations and links to additional information are

provided to reduce your HR risk.

HR Verify these items... Issues &

Compliance Next Steps

Posters Mandatory postings are visible in a common

area, such as employee break room or lobby.

Required by DOL

& States Refer to federal labor laws.

Personnel Files Employee files are created, stored in a secure

location and contain all required forms.

Required by

multiple agencies Refer to personnel file checklist.

Policies Required policies are documented, stored in the

employee handbook and communicated to

Required by employees annually and upon hire.

multiple agencies

Refer to employee handbook essentials.

HR Verify these processes and forms... Issues &

Compliance Next Steps

Recruiting Job application forms, interview and selection

process are non-discriminatory.

Required by Applications, selection notes and rejection

EEOC, ADA, and

reasons are documented.

other agencies

State new-hire reporting completed on time.

Refer to how to hire.

Optional -- Best Practice:

Pre-employment screening in place.

Onboarding Hiring documents stored in employee files.

-9 forms completed and maintained separately.

Required by Employee contact information available.

EEOC, FLSA,

ADA and other

Refer to new employee orientation.

agencies

Payroll Employee classifications correct.

Equal pay for equivalent jobs.

Required by State payroll rules adhered to (minimum wage,

DOL, EEOC,

payroll cycles, overtime rules, paystub

FLSA, IRS,

States and other requirements, final paychecks)

agencies Workers’ compensation in insurance provided.

Federal & state taxes paid on time.

Optional -- Best Practice:

Employee self-service access to timesheets, pay

stubs and year-end tax forms.

Refer to payroll process setup.

Benefits Sick leave accruals and benefits documented and

adhered to (required by some states).

Required by ACA FMLA process documented and adhered to

and FMLA

(required if over 50 employees)

ACA-compliant health care offered (required if

over 50 FTE)

Refer to state sick leave laws.

Optional -- Best Practice:

Vacation and holiday pay offered and accrued.

People Sexual harassment addressed promptly.

Management Discrimination prevented.

OSHA safety requirements adhered to.

Workplace accommodations as needed.

At will employment doctrine communicated.

Optional -- Best Practice:

Performance reviews documented and fair.

Employee discipline process documented.

Annual anti-discrimination/anti-harassment

training provided.

Termination Termination rationale documented.

Final paychecks provided on time.

COBRA offered (if health insurance provided).

Refer to how to fire an employee.

Document Job applications destroyed after 3 years

Retention I-9 forms destroyed after 3 years

Payroll files maintained for 4-5 years

Retirement & 401(k) files maintained for 6 years

Terminated employee files maintained for 7 years

Refer to document retention.

As state and local labor laws may be more restrictive, and compliance needs vary by industry

and size, please refer to state and local labor law requirements. Then, modify the checklist

based on your organization’s size, industry, and location.

You might also like

- 7 Easy Steps to Conduct a Human Resources Audit and Protect Your Company!From Everand7 Easy Steps to Conduct a Human Resources Audit and Protect Your Company!No ratings yet

- Must Do HR ChecklistDocument5 pagesMust Do HR Checklistsoftdev11No ratings yet

- HR 2014 Audit Final ReportDocument8 pagesHR 2014 Audit Final ReportKirti PrabhuNo ratings yet

- HR Audit ChecklistDocument4 pagesHR Audit ChecklistModupeola Tunde-FabiyiNo ratings yet

- Conducting Human Resource AuditsDocument7 pagesConducting Human Resource AuditsJester BiluanNo ratings yet

- Recritment and Selection Midterm Review.Document6 pagesRecritment and Selection Midterm Review.Angelique ManningNo ratings yet

- HR Audit: Auditing Your HR Department Avoiding Individual Liability For The HR ProfessionalDocument6 pagesHR Audit: Auditing Your HR Department Avoiding Individual Liability For The HR ProfessionalPRAGYA SINGH BAGHEL STUDENTS JAIPURIA INDORENo ratings yet

- Conducting Human Resource Audits SHRMDocument7 pagesConducting Human Resource Audits SHRMMirzaMuhammadAbubakarNo ratings yet

- HR Audits: by Robin Bullock PHR Conducting A Successful AuditDocument15 pagesHR Audits: by Robin Bullock PHR Conducting A Successful Audithellowin4uNo ratings yet

- The Importance of Internal ControlsDocument19 pagesThe Importance of Internal ControlsJohnCarloTigueNo ratings yet

- The 7-Step HR Audit Process ModelDocument6 pagesThe 7-Step HR Audit Process Modelzeeshanshani1118No ratings yet

- HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesHR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- May Include Interviewing Selected HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesMay Include Interviewing Selected HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- What Is An HR Audit?: Employee OnboardingDocument7 pagesWhat Is An HR Audit?: Employee OnboardingAyodele DareNo ratings yet

- HR Audit Process: 7 Steps to Assess ComplianceDocument6 pagesHR Audit Process: 7 Steps to Assess Compliancezeeshanshani1118No ratings yet

- O Learn Whether Certain Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesO Learn Whether Certain Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- Conducting HR Audits to Improve ComplianceDocument7 pagesConducting HR Audits to Improve ComplianceSithet ThaiNo ratings yet

- Include Interviewing Selected HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesInclude Interviewing Selected HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- Human Resource AuditDocument10 pagesHuman Resource AuditSara RiazNo ratings yet

- HR Audit: A Comprehensive Review of HR Policies, Procedures & ComplianceDocument5 pagesHR Audit: A Comprehensive Review of HR Policies, Procedures & ComplianceRani NayakNo ratings yet

- HR Management Written Assignment Unit 6 December 2020Document5 pagesHR Management Written Assignment Unit 6 December 2020Ephrem GetiyeNo ratings yet

- Mid Term Chapt 1 7Document7 pagesMid Term Chapt 1 7Mohammed AllauddinNo ratings yet

- The HR Audit Process: A Model: Certain Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesThe HR Audit Process: A Model: Certain Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- The Audit Also May Include Interviewing Selected HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesThe Audit Also May Include Interviewing Selected HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- The HR Audit Process: A Model: Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesThe HR Audit Process: A Model: Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- The HR Audit Process: A Model: and AcceptedDocument6 pagesThe HR Audit Process: A Model: and Acceptedzeeshanshani1118No ratings yet

- BSBHRM405 Support The Recruitment, Selection and Induction of StaffDocument7 pagesBSBHRM405 Support The Recruitment, Selection and Induction of StaffGreysonNo ratings yet

- Ensure Legal Compliance & Improve HR Practices with an HR AuditDocument22 pagesEnsure Legal Compliance & Improve HR Practices with an HR Audithellowin4uNo ratings yet

- The HR Audit Process: A Model: Stood, Practiced and AcceptedDocument6 pagesThe HR Audit Process: A Model: Stood, Practiced and Acceptedzeeshanshani1118No ratings yet

- HR Audit Process ModelDocument6 pagesHR Audit Process Modelzeeshanshani1118No ratings yet

- What Is A Human Resources Audit?: Sections of Review IncludeDocument2 pagesWhat Is A Human Resources Audit?: Sections of Review IncludeBalajireddy ReddyNo ratings yet

- Order#1158099Document6 pagesOrder#1158099Gaddafi PhelixNo ratings yet

- The HR Audit Process: A Model: Procedures Are Understood, Practiced and AcceptedDocument6 pagesThe HR Audit Process: A Model: Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- PoliciesDocument5 pagesPoliciesrashmiamittalNo ratings yet

- Formulation of Employee S HandbookDocument5 pagesFormulation of Employee S HandbookMohammad AzharNo ratings yet

- Master Certificate in Human Resources ILRHRMC2Document19 pagesMaster Certificate in Human Resources ILRHRMC2Prn CebuNo ratings yet

- Importance of HR Audit For An OrganizationDocument10 pagesImportance of HR Audit For An OrganizationRubel ChowdhuryNo ratings yet

- HRM4Document15 pagesHRM4Dev D InvincibleNo ratings yet

- Contemporary Issue in HRDDocument5 pagesContemporary Issue in HRDsridevi100% (1)

- Top 50 Online MSHR ProgramsDocument2 pagesTop 50 Online MSHR ProgramswaqasNo ratings yet

- HR Audit ChecklistDocument10 pagesHR Audit ChecklistIbrah1mov1chNo ratings yet

- How To Terminate An EmployeeDocument11 pagesHow To Terminate An EmployeeRenato BarbieriNo ratings yet

- Conducting Human Resource Audits PDFDocument6 pagesConducting Human Resource Audits PDFNhat ToanNo ratings yet

- P.roberts - GrievancesDocument54 pagesP.roberts - GrievancesKiara KhanNo ratings yet

- Final Draft SIP ProjectDocument22 pagesFinal Draft SIP ProjectLovish JhanjiNo ratings yet

- HR Audit and Recruitment AnalysisDocument3 pagesHR Audit and Recruitment AnalysisHiral RajpalNo ratings yet

- Working With and Leading PeopleDocument42 pagesWorking With and Leading Peoplesheran23No ratings yet

- Lecture 3. Personnel ManagementDocument10 pagesLecture 3. Personnel ManagementAnonymous DgPsK0oQNo ratings yet

- What Is Employee Background Check - Richard EditedDocument12 pagesWhat Is Employee Background Check - Richard EditedNicole ChimwamafukuNo ratings yet

- For The People, Sept/Oct 2010Document4 pagesFor The People, Sept/Oct 2010perfectpeoplesolsNo ratings yet

- How To Develop A Job DescriptionDocument3 pagesHow To Develop A Job DescriptionNana TsilamuyNo ratings yet

- Supervisor Job DescriptionDocument4 pagesSupervisor Job DescriptionshareyyyyyNo ratings yet

- 1st Lec Organization PolicyDocument18 pages1st Lec Organization PolicyRCC NPCCNo ratings yet

- Personal RecordDocument15 pagesPersonal RecordRicha YadavNo ratings yet

- Human Resources Management Policy TemplateDocument5 pagesHuman Resources Management Policy Templateparthshah302No ratings yet

- TNA Staff and Administration Skills AnalysisDocument12 pagesTNA Staff and Administration Skills AnalysisAmitoj SinghNo ratings yet

- Research Paper On Employment LawDocument8 pagesResearch Paper On Employment Lawtug0l0byh1g2100% (3)

- Necessary Laws For Compliance Week 2Document32 pagesNecessary Laws For Compliance Week 2jseymalaaNo ratings yet

- Citibank HR PolicyDocument4 pagesCitibank HR PolicyAnshik JainNo ratings yet

- Trademark Intellectual Property Business Organization Logo: Trade Mark-A Fundamental ConceptDocument9 pagesTrademark Intellectual Property Business Organization Logo: Trade Mark-A Fundamental ConceptMonish RcNo ratings yet

- Biblical Commentary On The Prophecies of Isaiah FR PDFDocument267 pagesBiblical Commentary On The Prophecies of Isaiah FR PDFAbigailGuido89No ratings yet

- Indeterminate Sentence LawDocument4 pagesIndeterminate Sentence LawVee DammeNo ratings yet

- Fundamentals of WorshipDocument2 pagesFundamentals of Worshipreedell_aragonNo ratings yet

- BHI SEC Cert & Amended Articles of Incorporation PDFDocument9 pagesBHI SEC Cert & Amended Articles of Incorporation PDFkimberly_uymatiaoNo ratings yet

- Mid-Term Examination-February, 2019 B.A. LL.B. (Hons.) Semester-IV Subject: Family Law-IIDocument5 pagesMid-Term Examination-February, 2019 B.A. LL.B. (Hons.) Semester-IV Subject: Family Law-IISom Dutt VyasNo ratings yet

- Kant & ColoniesDocument9 pagesKant & ColoniesMark TrentonNo ratings yet

- Christopher D. Bates ResumeDocument2 pagesChristopher D. Bates ResumeChristopher Bates100% (1)

- Comparison of RA 7653 and RA 11211 on Bangko Sentral ReformsDocument33 pagesComparison of RA 7653 and RA 11211 on Bangko Sentral ReformsMary Licel Regala75% (4)

- Business Development Capability Maturity ModelDocument152 pagesBusiness Development Capability Maturity ModelGabrielGarciaOrjuelaNo ratings yet

- TheftDocument14 pagesTheftimran khanNo ratings yet

- Last Revised: February 3, 2020Document7 pagesLast Revised: February 3, 2020Abhishek GhoshNo ratings yet

- People V Collado DigestDocument3 pagesPeople V Collado DigestErika PotianNo ratings yet

- Republic vs. RosemoorDocument2 pagesRepublic vs. RosemoorYong Naz100% (3)

- Ra 7877Document37 pagesRa 7877Jordan CabaguingNo ratings yet

- Kashato ShirtsDocument24 pagesKashato ShirtslalaNo ratings yet

- Case Digest - Tupas vs. CADocument2 pagesCase Digest - Tupas vs. CArobert gapasangraNo ratings yet

- United States v. Guido Halayn de La Torre, 11th Cir. (2015)Document10 pagesUnited States v. Guido Halayn de La Torre, 11th Cir. (2015)Scribd Government DocsNo ratings yet

- C TS410 2020-SampleDocument5 pagesC TS410 2020-Samplerahulg.sapNo ratings yet

- LufthansaDocument18 pagesLufthansakritiangraNo ratings yet

- What Is Gendered LanguageDocument3 pagesWhat Is Gendered LanguageMaria Agustina SabatéNo ratings yet

- Regulations.guidelinesDocument29 pagesRegulations.guidelinesSunnyDeolGNo ratings yet

- Drug Awareness and Prevention Program PDFDocument6 pagesDrug Awareness and Prevention Program PDFMarcos Bulay OgNo ratings yet

- Steps How To Apply Tax ClearanceDocument2 pagesSteps How To Apply Tax ClearanceFenny TampusNo ratings yet

- 10 20F - 516878aDocument349 pages10 20F - 516878aBaikaniNo ratings yet

- (Clatexam20 - Official) Le Ailet Mock 3 - 220302 - 095009Document29 pages(Clatexam20 - Official) Le Ailet Mock 3 - 220302 - 095009Ram Shankar TiwariNo ratings yet

- UCR2612 Criminal Law I 2020Document4 pagesUCR2612 Criminal Law I 2020NBT OONo ratings yet

- Maharashtra Private Forests Acquisition) Act 1975Document23 pagesMaharashtra Private Forests Acquisition) Act 1975Asmita AlkarNo ratings yet

- Nazism and The Rise of HitlerDocument6 pagesNazism and The Rise of HitlerKunal Bhunsali100% (1)

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument13 pagesIncome Tax in India - Wikipedia, The Free EncyclopediaAnonymous utfuIcnNo ratings yet