Professional Documents

Culture Documents

IRD (IT) - 05-01 Eng Version

Uploaded by

Zawtun MinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRD (IT) - 05-01 Eng Version

Uploaded by

Zawtun MinCopyright:

Available Formats

According to Section 389 of the Constitution of the Republic of the Union of Myanmar,2008,every citizen has the

obligation to pay taxes due to the law

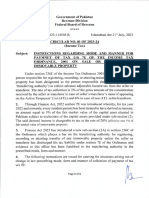

IRD(IT)-05-01

Withholding Tax Certificate

(Under Section 16 ၊ Sub-section(b) of the Income Tax Law)

The person from whom tax was withheld Withholding Tax Agent

Taxpayer Name--------------------------------------------------------- Taxpayer Name----------------------------------------------------------

--------------------------------------- ---------------------------------------

Taxpayer Identification No.__________________________ Taxpayer Identification No.__________________________

Revenue office ----------------------------------------- Revenue office----------------------------------------- -----

-------------------------------------------------------- ---------------------------------------------------

(If individual) (If individual)

Citizen/National Registration Card No.________________ Citizen/National Registration Card No._________________

(If Corporate) (If Corporate)

Registration No.___________________________________ Registration No.___________________________________

Detail Address ---------------------------------------------------------- Detail Address------------------------------------------------------------

--------------------------------------- --------------------------------------

Amount of

Sr Tax Date of Amount of

Type of Payment Withholding Remark

No. Rate payment payment

Tax

1. Interests

(a) Resident citizen and Resident

-

foreigner

( b) Non-Resident Foreigner 15%

2. Royalities for the use of Licenses,

Trademarks and Patent Right etc.

(a) Resident citizen and Resident

10%

foreigner

(b) Non-resident foreigner 15%

3. Payment by Union-Level Organiza-

tions, Union Ministries, Naypyitaw

Council, Regional or State Level

Organizations, State-Owned enterprises,

Municipal Development Organization

for purchase of goods, work performed

or supply of services within the country

under tender or quotation or auction

system or contract or agreement or

any other system.

(a) Resident citizen and Resident

2%

foreigner

( b) Non-Resident foreigner 2.5%

4. Payment by franchise business in

Myanmar, Partnership, Joint-venture,

Company, Association or Institution

formed and registered under the

existing law, co-operative societies,

foreign companies, foreign enterprises

for the purchase of goods, work

performed or supply of services within

the country under contract or

agreement or other modes.

(a) Resident citizen and Resident

-

foreigner

( b) Non-Resident foreigner 2.5%

Total Amount of payment and Total Amount of WT

Total Amount of WT (In letter)

Warning

I hereby certify that the particulars given above are true.

1. Withodlding tax shall be deposited to the relevant tax

office within 15 days from the date on with withholding

Affix corporate

was made. (Income Tax Regulation 14(b))

seal of

2. If a person who fails to make the withholding payment, withholding tax

will be treated as default and liable to make the payment agent

of the amount that has failed to withhold. (Tax

Administration Law Section 74 (c)) Sign ---------------------------------------------

Name ---------------------------------------------

3. If a person who fails to make the withholding payment,

Position ---------------------------------------------

within the specified period, must pay a late payment

NRC --------------------------------------------

penalty of 10 percent of the amount so failed to pay. (Tax

Company/ --------------------------------------------

Administration Law Section 74 (d))

Department/Organization

-------------------------------------------------------

4. Details information about withholding tax shall be sent to

Date of issuing certificate ----------/-----------/--------

the relevant tax office within 15 from the date on with

withholding was made. ( Income Tax Regulation 14(c)) ( DD / MM / YYYY )

Notes

1. Withholding tax agent shall prepare (3) copies of certificate and send (1) copy to the person from whom tax was with-

held, (1) copy to the relevant tax office and keep the remaining one.

2. Please provide the tax rate and name of the country that has concluded a DTA with Myanmar in the “Remark” column if

the payment is due for Sr.no.1(b) and Sr.no.2 (b) of type of payment.

3. Countries that have concluded a DTA with Myanmar are United Kingdom, Vietnam, Republic of Korea, India, Malaysia,

Singapore, Laos and Thailand.

You might also like

- Somatic TherapiesDocument170 pagesSomatic TherapiesDelyn Gamutan Millan100% (2)

- UCLA-Career Preparation ToolkitDocument61 pagesUCLA-Career Preparation ToolkitCaelulalaNo ratings yet

- 50 Studies Every Anesthesiologist Shoud Know 2019Document305 pages50 Studies Every Anesthesiologist Shoud Know 2019pcut100% (2)

- Social Studies Lesson Plan 3Document4 pagesSocial Studies Lesson Plan 3api-260708940No ratings yet

- FW 8 BenDocument1 pageFW 8 BenTales Santos PereiraNo ratings yet

- Salary Bill For Gazetted Government ServantsDocument2 pagesSalary Bill For Gazetted Government Servantsمحمد حمزة الشاذلي100% (1)

- Afternoon Quiz Set 4Document66 pagesAfternoon Quiz Set 4pchakkrapani100% (1)

- Basic English Grammar ChartDocument3 pagesBasic English Grammar Chartm1eme1mNo ratings yet

- Hydraulic Components Manufacturing PDFDocument14 pagesHydraulic Components Manufacturing PDFabyzenNo ratings yet

- CostcoDocument12 pagesCostcoThảo Nguyên PhạmNo ratings yet

- Capital Gains TaxDocument10 pagesCapital Gains TaxVangie AntonioNo ratings yet

- Withholding Tax (Eng)Document10 pagesWithholding Tax (Eng)WN TV programsNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- WHT 47 - 2018 English TranslationDocument3 pagesWHT 47 - 2018 English TranslationWUTYI THINNNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- 1402 Gain On Transfer SharesDocument2 pages1402 Gain On Transfer SharesMaddahayota CollegeNo ratings yet

- Application For Condonation of Delay in Filing of Form VII & VIII ToDocument2 pagesApplication For Condonation of Delay in Filing of Form VII & VIII Tokrishna gattaniNo ratings yet

- Ayment of AX: Learning OutcomesDocument38 pagesAyment of AX: Learning OutcomesJaymin JogiNo ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- 74822bos60500 cp13Document48 pages74822bos60500 cp13Looney ApacheNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- Internal Revenue Service: Third Party Communication: None Date of Communication: Not ApplicableDocument5 pagesInternal Revenue Service: Third Party Communication: None Date of Communication: Not ApplicabletaxcrunchNo ratings yet

- 2023 Winter Storm Penalty WaiverDocument2 pages2023 Winter Storm Penalty WaiverFOX54 News HuntsvilleNo ratings yet

- Certificate of Residence Form For Nigerian ResidentsDocument2 pagesCertificate of Residence Form For Nigerian ResidentsEngr Kingsley AguNo ratings yet

- Internal Revenue Service: Third Party Communication: None Date of Communication: Not ApplicableDocument6 pagesInternal Revenue Service: Third Party Communication: None Date of Communication: Not Applicableivan_mitev9979No ratings yet

- Application For Exemption of Customs DutyDocument10 pagesApplication For Exemption of Customs DutyFahad BataviaNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- IndividualDocument1 pageIndividualjeannaldocNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- 2301 Turnover Tax Declaration FormDocument3 pages2301 Turnover Tax Declaration FormMaddahayota CollegeNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- L314 FPD 6 2020 2Document6 pagesL314 FPD 6 2020 2OBERT CHIBUYENo ratings yet

- CREBA Vs RomuloDocument10 pagesCREBA Vs RomuloAndrea Peñas-ReyesNo ratings yet

- Article On Composition Scheme With Case StudyDocument12 pagesArticle On Composition Scheme With Case StudySejal GuptaNo ratings yet

- FW 8 BenDocument1 pageFW 8 BenMario Vargas HerreraNo ratings yet

- 66522bos53752 cp9Document39 pages66522bos53752 cp9Chandan ganapathi HcNo ratings yet

- Payment of TaxDocument40 pagesPayment of TaxMayur samdariyaNo ratings yet

- Sample in QDocument8 pagesSample in QMOHD SUHAILNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayerscharmedbytinnieNo ratings yet

- Internal Revenue Service: Legend LegendDocument7 pagesInternal Revenue Service: Legend LegendtaxcrunchNo ratings yet

- 31jan24 Draft Reply To Notice For IGST CGST SGST Issue ARRDocument11 pages31jan24 Draft Reply To Notice For IGST CGST SGST Issue ARRsakshi sharmaNo ratings yet

- BIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesDocument5 pagesBIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesPilosopo LiveNo ratings yet

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocument4 pagesComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Acknowledgement of Indebtedness (Pengakuan Hutang)Document6 pagesAcknowledgement of Indebtedness (Pengakuan Hutang)Savara MarhabanNo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- Professional (Regular and COS/Job Order) Percentage Tax Expanded Withholding Tax Without Sworn Declaration 3% 10% With Sworn DeclarationDocument5 pagesProfessional (Regular and COS/Job Order) Percentage Tax Expanded Withholding Tax Without Sworn Declaration 3% 10% With Sworn Declarationblessa elaurzaNo ratings yet

- Sales Tax - 03Document6 pagesSales Tax - 03Bilal ShaikhNo ratings yet

- 74823bos60500 cp14Document32 pages74823bos60500 cp14Looney ApacheNo ratings yet

- SG ITAD Ruling No. 019-03Document4 pagesSG ITAD Ruling No. 019-03Paul Angelo TombocNo ratings yet

- General Principles CasesDocument294 pagesGeneral Principles CasesAnne OcampoNo ratings yet

- CIR Vs Citytrust Investment Philippines, G.R. No. 139786, 140857, September 27, 2006Document9 pagesCIR Vs Citytrust Investment Philippines, G.R. No. 139786, 140857, September 27, 2006christie joiNo ratings yet

- Mygov 1445315831190667 PDFDocument72 pagesMygov 1445315831190667 PDFjitendraktNo ratings yet

- Individual Return IT-Gha (2023) 1Document2 pagesIndividual Return IT-Gha (2023) 1monir7898No ratings yet

- A. Letter of Authority (La)Document15 pagesA. Letter of Authority (La)ZengardenNo ratings yet

- 2023721217646921CircularNo 1of2023-2024Document4 pages2023721217646921CircularNo 1of2023-2024krebs38No ratings yet

- Unit 18Document20 pagesUnit 18Raja SahilNo ratings yet

- Pa Taxpayers - GREATDocument20 pagesPa Taxpayers - GREATBlaiberteNo ratings yet

- Form Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Document1 pageForm Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Krishan ChanderNo ratings yet

- G.R. No. 160756Document16 pagesG.R. No. 160756Meah BrusolaNo ratings yet

- RMC No 1-2018Document3 pagesRMC No 1-2018Larry Tobias Jr.No ratings yet

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 3.3 Cell MembraneDocument19 pages3.3 Cell MembraneHanaa WazzanNo ratings yet

- Ten Questions Concerning Hybrid Computational Physical Mod - 2016 - Building andDocument10 pagesTen Questions Concerning Hybrid Computational Physical Mod - 2016 - Building andQU DAUPNo ratings yet

- Distress Manual PDFDocument51 pagesDistress Manual PDFEIRINI ZIGKIRIADOUNo ratings yet

- RCD PDFDocument6 pagesRCD PDFsanjay975No ratings yet

- Leta 2022Document179 pagesLeta 2022Bigovic, MilosNo ratings yet

- Social Change Theme in The Cherry Orchard - LitChartsDocument17 pagesSocial Change Theme in The Cherry Orchard - LitChartsShivashankar. DNo ratings yet

- CMNS Week 3.2 Memo AssignmentDocument2 pagesCMNS Week 3.2 Memo AssignmentPulkit KalhanNo ratings yet

- AY2017 2018CourseworkFees MOEDocument22 pagesAY2017 2018CourseworkFees MOEYotrisno LangNo ratings yet

- Lesson 12 FastenersDocument9 pagesLesson 12 FastenersEmerson John RoseteNo ratings yet

- Ms. Louise Lim Mr. Ivan Cyrus DaldeDocument27 pagesMs. Louise Lim Mr. Ivan Cyrus DaldeJazlyn Andria JarafaNo ratings yet

- CH 121: Organic Chemistry IDocument13 pagesCH 121: Organic Chemistry IJohn HeriniNo ratings yet

- CRC Ace Far 1ST PBDocument9 pagesCRC Ace Far 1ST PBJohn Philip Castro100% (1)

- Pressure Transducer Davs 311-1-0 Volt - XCMG PartsDocument1 pagePressure Transducer Davs 311-1-0 Volt - XCMG Partsej ejazNo ratings yet

- Cancer Registry Standard Operating ProceduresDocument3 pagesCancer Registry Standard Operating ProceduresAnan AghbarNo ratings yet

- Sokkia MagnetDocument9 pagesSokkia Magnetbbutros_317684077No ratings yet

- TT21 28112019BNN (E)Document40 pagesTT21 28112019BNN (E)Thanh Tâm TrầnNo ratings yet

- Gamla Stan PDFDocument4 pagesGamla Stan PDFAlexandra FricosuNo ratings yet

- II If en April2015 EquitycompoundersDocument8 pagesII If en April2015 EquitycompoundersbgyggghjkkNo ratings yet

- Chilis Allergen Vegetarian GenericDocument6 pagesChilis Allergen Vegetarian Genericsuresh jkNo ratings yet

- Ready. Set. IELTS. Idioms.Document45 pagesReady. Set. IELTS. Idioms.Renatochka BakirovaNo ratings yet

- Zip 8-MBDocument9 pagesZip 8-MBThuan Van LeNo ratings yet