Professional Documents

Culture Documents

38 Impact and Problems of Macroeconomic Policies

Uploaded by

Leah Brocklebank0 ratings0% found this document useful (0 votes)

11 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pages38 Impact and Problems of Macroeconomic Policies

Uploaded by

Leah BrocklebankCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

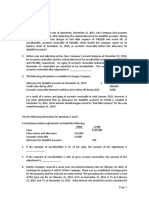

1.

Expansionary fiscal and monetary policies were used as a response to the

Global Financial Crisis of 2008. Which one of the following would show that

expansionary policies were used?

a. Fiscal deficits fell for governments during the crisis.

b. Government spending rose at a slower rate than tax revenue.

c. The central banks bought financial assets, from commercial banks, in

exchange for money to increase the availability of credit. Quantitative easing.

d. Interest rates rose during the crisis.

2. Read the above extracts and answer the following questions.

a. Explain what is meant by the phrase ‘fiscal deficit reduction’ (Extract A)

fiscal deficit reduction is a macroeconomic policy objective of governments in

which they attempt to reduce government spending or increase government

revenue in order to decrease the fiscal deficit. An example of this is fiscal

austerity measures which are typically employed by the UK and US.

According to economists, fiscal austerity measures lead to decreased

aggregate demand in the long run due to a lack of capital expenditure.

b. With reference to Extract A, examine the likely impact of expansionary

fiscal policy in 2008/09, as a response to the Global Financial Crisis, on

real GDP. Expansionary fiscal policy consists of the government attempting

to increase aggregate demand in the economy through the increase in

government spending and decreasing taxation. In 2008/09 there was a

severe economic recession in which aggregate demand greatly contracted.

Expansionary fiscal policy of increasing government capital expenditure

would increase real GDP in the long run. With increased investment in the

economy, such as education, healthcare, and infrastructure, the derived

demand for investment goods would increase short run demand, while in the

long run there would be an increase in the productive potential of the

economy, hence increasing aggregate demand and employment, therefore

real GDP would rise. However, this may be limited if the increased

government spending crowds out private sector spending. Nevertheless,

there would be derived demand for goods produced by the private sector

therefore crowding out may not occur. Furthermore, the expansionary policy

of decreasing taxation would also increase real GDP. With decreased direct

or indirect taxation, there would be an increased demand for goods and

services and the supply of labour would increase, pushing up employment

and consumption, hence increasing aggregate demand and leading to real

GDP growth. However, this is assuming that the taxation is progressive. If the

taxation is regressive, meaning the lower income brackets are taxed highly,

then there may not be an increase in consumption or employment.

c. With reference to Extract B, analyse the likely impact of the rise in US

interest rates on the Indonesian economy. Increased US interest rates

placed pressure on the Indonesian economy due to decreased derived

demand for Indonesian produced goods. With an increase in interest rates in

the United States economy, aggregate demand for goods and services has

decreased, hence the derived demand for Indonesian goods has decreased,

leading to decreased aggregate demand in the Indonesian economy which is

a primarily manufacturing economy. Furthermore, an increase in interest rates

may lead to increased saving and investment in the American economy which

could lead to capital flight from Indonesia.

d. With reference to the information available, discuss the problems facing policy

makers.

External shocks are a significant problem facing policy makers. For example

the 2008 Global Financial Crisis led to a global decrease in aggregate

demand. This had an especially negative impact on the global economy due

to the peak of globalisation which is the interconnectedness of national

markets into a single international market, making domestic economies

especially vulnerable to supply and demand shocks. The global financial

crisis was provoked by excessive risk taking by financial institutions and

predatory subprime mortgage lending to low income households which

generated an extreme contraction of aggregate demand due to the increased

cost of housing and increased unemployment. For example, the extreme

contraction of aggregate demand in the American economy led to decreased

derived aggregate demand in the European economy due to overdependence

of trade between the two regions.

Another factor is imperfect information which may lead to the misuse of

policies or incorrect policy objectives. An example of this is tax evasion which

may severely impact the governments

Risk

You might also like

- Macroeconomic - UlangkajiDocument12 pagesMacroeconomic - UlangkajiAnanthi BaluNo ratings yet

- Finance For DevelopmentDocument6 pagesFinance For Developmentsyeda maryemNo ratings yet

- Week 12 - Tutorial QuestionsDocument9 pagesWeek 12 - Tutorial Questionsqueeen of the kingdomNo ratings yet

- Macro Economy Week 14 HWDocument1 pageMacro Economy Week 14 HWrichiealdo7No ratings yet

- Things We Should KnowDocument32 pagesThings We Should KnowPrakash SinghNo ratings yet

- Macro Economics FinalDocument9 pagesMacro Economics FinalDeepa RaghuNo ratings yet

- FISCAL POLICY Case Study (Answers)Document3 pagesFISCAL POLICY Case Study (Answers)Shiqing wNo ratings yet

- Coalition Government Policy EssayDocument8 pagesCoalition Government Policy Essayzbarcea99No ratings yet

- Macro Economics NotesDocument6 pagesMacro Economics NotesPrastuti SachanNo ratings yet

- ECO-20054 Fiscal Policy FinallDocument4 pagesECO-20054 Fiscal Policy FinallTendesai SpearzNo ratings yet

- EC1009 May ExamDocument10 pagesEC1009 May ExamFabioNo ratings yet

- Changes in Economic GrowthDocument6 pagesChanges in Economic GrowthMmapontsho TshabalalaNo ratings yet

- Macro Answer - ChaDocument7 pagesMacro Answer - Chashann hein htetNo ratings yet

- Ans of Macro Q1-Q10Document5 pagesAns of Macro Q1-Q10Nishakumari PrasadNo ratings yet

- Macro Tutorial 7Document4 pagesMacro Tutorial 7RonNo ratings yet

- Macroeconomic and Industry AnalysisDocument4 pagesMacroeconomic and Industry AnalysisFajar TaufiqNo ratings yet

- Principles of Economics - Part BDocument5 pagesPrinciples of Economics - Part BCarol HelenNo ratings yet

- Unit VI Essay AssignmentDocument8 pagesUnit VI Essay AssignmentVirginia EdwardsNo ratings yet

- Order 5121077 Read Instructions - EditedDocument7 pagesOrder 5121077 Read Instructions - EditedJimmi WNo ratings yet

- Chap 16Document8 pagesChap 16Humaid SaifNo ratings yet

- Fiscal Policy A Tool To Beat RecessionDocument8 pagesFiscal Policy A Tool To Beat RecessionNadeem YousufNo ratings yet

- C E S - C I W S: Urrent Conomic Cenario AN Ndia Eather The TormDocument5 pagesC E S - C I W S: Urrent Conomic Cenario AN Ndia Eather The TormAbhishek DattaNo ratings yet

- Demand Deficient UnemploymentDocument3 pagesDemand Deficient UnemploymentRosmarie Derimais100% (1)

- IrelandDocument6 pagesIrelandMayank KumarNo ratings yet

- Evaluate The View That The Growth of Credit Is Likely To Have An Adverse Effect On The Uks Macroeconomic PerformanceDocument4 pagesEvaluate The View That The Growth of Credit Is Likely To Have An Adverse Effect On The Uks Macroeconomic Performanceapi-294123260No ratings yet

- Greece IE Alexander 3.UDocument19 pagesGreece IE Alexander 3.UElek 31No ratings yet

- Faculty of Commerce Department of Finance Group2 Student Name Student NumberDocument9 pagesFaculty of Commerce Department of Finance Group2 Student Name Student NumberRumbidzai KambaNo ratings yet

- Fiscal PolicyDocument12 pagesFiscal PolicyPule JackobNo ratings yet

- Causes of InflationDocument6 pagesCauses of Inflationrafi rowatulNo ratings yet

- Expansionary (Or Loose) Fiscal PolicyDocument4 pagesExpansionary (Or Loose) Fiscal PolicyFaisal HameedNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policynoor fatimaNo ratings yet

- Money, Banking, Public Finance and International Trade.Document119 pagesMoney, Banking, Public Finance and International Trade.mahim johnNo ratings yet

- Aggregate Demand Exam QuestionsDocument6 pagesAggregate Demand Exam Questionsvngo0234No ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicsBurhan barchaNo ratings yet

- C Compare Net Export Effect and Crowding Out Effect With The Help of GDP?Document5 pagesC Compare Net Export Effect and Crowding Out Effect With The Help of GDP?M Waqar ZahidNo ratings yet

- EC101 Revision Questions - Graphical Analysis - SolutionsDocument10 pagesEC101 Revision Questions - Graphical Analysis - SolutionsZaffia AliNo ratings yet

- Fiscal Policy - The Basics: A) IntroductionDocument7 pagesFiscal Policy - The Basics: A) IntroductionmalcewanNo ratings yet

- 18e Key Question Answers CH 30Document3 pages18e Key Question Answers CH 30pikachu_latias_latiosNo ratings yet

- The Fiscal Deficit: Themes Economic BriefsDocument2 pagesThe Fiscal Deficit: Themes Economic BriefsVirendra PratapNo ratings yet

- Tutorial Question Practice Section 1 and 2Document8 pagesTutorial Question Practice Section 1 and 2Jennifer YoshuaraNo ratings yet

- Effect of Public ExpenditureDocument5 pagesEffect of Public ExpenditureSantosh ChhetriNo ratings yet

- BED1201Document3 pagesBED1201cyrusNo ratings yet

- Module 3 Economic GrowthDocument9 pagesModule 3 Economic Growthexequielmperez40No ratings yet

- Types & CritisismDocument4 pagesTypes & Critisismsgaurav_sonar1488No ratings yet

- Economics Essay TaskDocument11 pagesEconomics Essay TaskHaris ZaheerNo ratings yet

- Case Study MacroDocument6 pagesCase Study MacroPaveentida TrakolkarnNo ratings yet

- S11. Exercise - DiscussionDocument3 pagesS11. Exercise - DiscussionAzka AliNo ratings yet

- Case Study - JunayedDocument2 pagesCase Study - JunayedgurujeeNo ratings yet

- Macro EconomicsDocument20 pagesMacro EconomicskhalilNo ratings yet

- Economics Today 18th Edition Roger LeRoy Miller Solutions Manual DownloadDocument17 pagesEconomics Today 18th Edition Roger LeRoy Miller Solutions Manual DownloadJeremy Jackson100% (26)

- End of Unit 6 QuestionsDocument4 pagesEnd of Unit 6 Questionscuentas valeriaNo ratings yet

- Economic Policies To Control InflationDocument2 pagesEconomic Policies To Control InflationNaveed ArshadNo ratings yet

- AnthonyDocument2 pagesAnthonyAsan Godwin JnrNo ratings yet

- Week 12 - Tutorial Questions-1Document5 pagesWeek 12 - Tutorial Questions-1Mai AnhNo ratings yet

- Rineesh Uog - Essay Project - EditedDocument9 pagesRineesh Uog - Essay Project - EditedJiya BajajNo ratings yet

- IGCSE Economics Self Assessment Exam Style Question's Answers - Section 4Document5 pagesIGCSE Economics Self Assessment Exam Style Question's Answers - Section 4Desre0% (1)

- EIB Investment Report 2023/2024 - Key Findings: Transforming for competitivenessFrom EverandEIB Investment Report 2023/2024 - Key Findings: Transforming for competitivenessNo ratings yet

- Chapter 1 - Concept Questions and Exercises StudentDocument19 pagesChapter 1 - Concept Questions and Exercises StudentHương NguyễnNo ratings yet

- Business Finance Final Çalışma ÖrneğiDocument8 pagesBusiness Finance Final Çalışma ÖrneğiMustafa EyüboğluNo ratings yet

- Sales Tax Return 16353854Document1 pageSales Tax Return 163538547799349No ratings yet

- BA 114.1 - Module2 - Receivables - Exercise 1 PDFDocument4 pagesBA 114.1 - Module2 - Receivables - Exercise 1 PDFKurt Orfanel0% (1)

- Tvs CreditDocument1 pageTvs CreditorugalluNo ratings yet

- Implementation of International Public Sector Accounting Standards and Transparency & Accountability in The Public SectorDocument10 pagesImplementation of International Public Sector Accounting Standards and Transparency & Accountability in The Public SectorMame HazardNo ratings yet

- IPODocument4 pagesIPORameezNo ratings yet

- DSTechStartupReport2015 PDFDocument70 pagesDSTechStartupReport2015 PDFKhairudiNo ratings yet

- Habbah TrustDocument9 pagesHabbah TrustHasnain KhanNo ratings yet

- FM12 CH 02 ShowDocument88 pagesFM12 CH 02 ShowIbrahim AbdallahNo ratings yet

- Advance Paper Corp. vs. Arma Traders Corp., Et - Al. (G.R. No. 176897, Dec. 11, 2013)Document8 pagesAdvance Paper Corp. vs. Arma Traders Corp., Et - Al. (G.R. No. 176897, Dec. 11, 2013)Michelle CatadmanNo ratings yet

- Roe To CfroiDocument30 pagesRoe To CfroiSyifa034No ratings yet

- Mbaproject - Kotak Sec PDFDocument63 pagesMbaproject - Kotak Sec PDFNAWAZ SHAIKHNo ratings yet

- Kanika Khurana: 2018. Clients Experience IncludesDocument3 pagesKanika Khurana: 2018. Clients Experience IncludesjfrNo ratings yet

- InvoiceDocument1 pageInvoiceUdit jainNo ratings yet

- SYLLBS2023Document6 pagesSYLLBS2023AMBenedicto - MCCNo ratings yet

- Accounting Cycle Quiz - Comprehensive ProblemDocument2 pagesAccounting Cycle Quiz - Comprehensive ProblemAdrianIlaganNo ratings yet

- Financial Accounting Thesis TopicsDocument5 pagesFinancial Accounting Thesis TopicsNaomi Hansen100% (2)

- Petunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretDocument4 pagesPetunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretriadNo ratings yet

- Sri Lalitha Nissima MahimaDocument56 pagesSri Lalitha Nissima MahimaPrathap Vimarsha100% (1)

- Quiz Conceptual Framework WITH ANSWERSDocument25 pagesQuiz Conceptual Framework WITH ANSWERSasachdeva17100% (1)

- Motor Bill 97cDocument2 pagesMotor Bill 97cShahNo ratings yet

- Project On HDFC BANKDocument70 pagesProject On HDFC BANKAshutosh MishraNo ratings yet

- Cost Accounting Jobs: The Role of A Cost AccountantDocument2 pagesCost Accounting Jobs: The Role of A Cost AccountantchokieNo ratings yet

- Financial Ratio AnalysisDocument53 pagesFinancial Ratio AnalysisLaurentia Nurak100% (4)

- GST Retail InvoiceDocument1 pageGST Retail Invoicesachin sharmaNo ratings yet

- Great Ministry FinanceDocument5 pagesGreat Ministry FinanceERAnkitMalviNo ratings yet

- VH7 IBZy JEQLl 4 NQXDocument14 pagesVH7 IBZy JEQLl 4 NQXmadhur chavanNo ratings yet

- Sick Unit ProjectsDocument62 pagesSick Unit ProjectsPratik Shah100% (1)

- Tax Compliance MonitoringDocument44 pagesTax Compliance MonitoringAcademe100% (2)