A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21,

1, 8:37 PM

012);6L5)!)9355)K5KM53N18>O)PB13-5P)>59B)B;-P)K18B;Q)?-D8)27)913)&5<-2K)68<)D5B)68)5RB36)185

!"#$"%&&'($)*+*#"'%,

!"#$%&'()'#$%&"*+,-%"./

(+,0-,12"3".43-,12"(/$"51"!1)

64/24377,12"8312+32%

!-./)0123)456718)19):;1-.5)68<)'=>>)?;1@)012)A1@)B1)C-D;B

06//1)&6E23- C1>>1@

%2D)FG)HIHI)·)FJ)K-8)356<

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 1 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

*%'+,%&'-.!/!0-+!1%2&)(3

43%5

*;5)#99-.-6>)T12386>)S>1D

C1>>1@

UQFV FW

!;1B1)MO)&Q)SQ)&Q

!"#$%&'()'!*%'+

I am not quali,ed to o/er investment, legal, or any other advice, nor am I

trying to do so. This is a programming tutorial aimed at teaching you how

to build a trading bot for learning purposes. Any decisions, investments, or

risks you take as a result of building a trading bot are your responsibility.

I cannot be held responsible for any decisions you make as a result of

reading this tutorial. Remember: Bots can lose a lot of money, so you should

be careful.

Quite regularly, we all come across some variation of this article: “10

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 2 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

Quite regularly, we all come across some variation of this article: “10

Projects You Should Build as a Programmer”.

And most times that list includes a Trading Bot.

So, since I think trading bots are great projects, I thought I’d take some time

to teach you how to build one.

However, rather than giving you all the code line by line, I decided it would

be best to go through all the concepts you should be familiar with to take on

this project.

After all, the whole point is that you code it yourself.

Hence, this article will go through everything you need to know and have to

build a trading bot (from the exchange to a simple trading strategy), as well

as the basic architecture, concepts, and design of a simple bot.

And the great thing is: I’ll be using pseudocode, so you can follow this

tutorial in the language of your choice.

As such, you can feel comfortable and focus on the actual programming,

rather than ,guring out all the setup for yourself.

So let’s go!

6'+$!78!9:;<!(!=+($%)

The ,rst step in this tutorial is just selecting a language to use. This is

entirely up to you.

Some languages like Python could be helpful if you want to later expand

your bot to use Machine Learning, for example, but the main goal here is

that you pick a language you’re comfortable with.

Want to read this story later? Save it in Journal.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 3 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

6'+$!>8!9:;<!(!4(''3+5&%2)?

!;1B1)MO)%2PB-8)X-PB5>

An often overlooked step in trading bot tutorials is the selection of the

exchange.

For a trading bot to work, you need to have access to an exchange where

you can trade assets. This is just as important as knowing how to program.

So, for this step, you need to decide what assets you will be trading (e.g.

stocks, currencies, cryptocurrencies), and where you will be trading.

Regarding the asset, I would strongly suggest cryptocurrencies. The reason

for this is not that I’m a blockchain/crypto advocate (full disclosure), but

simply because cryptocurrency markets operate 24/7 i.e. all day, every day. *17);-D;>-D;B

Most “traditional” assets can only be traded during certain times, and often

only on weekdays. Stock markets, for instance, are generally open sometime

between 9AM-4PM and do not operate on weekends. FOREX (foreign

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 4 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

currency exchange) markets can go on for 24h, but are also usually closed

during the weekend.

As such, it is easier and nicer to have your bot running 24/7, which is what

crypto markets allow for. Additionally, cryptocurrencies are known to be

very volatile, which means that a) you can lose a lot of money, but b) they

are a great way to learn and test trading strategies.

Since we’ve covered the asset class, let’s now go over the two requirements

for picking an exchange for your trading bot.

1. You must be legally allowed to trade on the exchange and the assets it

o/ers. Some countries don’t allow cryptocurrency trading, for instance.

2. The exchange must have a Public API available. One cannot build a bot

without an endpoint to send requests to.

With the two requirements above ful,lled, you may also wish to consider

things like the fees charged by the exchange, if it is well-rated or well-

known, and how good the API docs are.

Last but not least, I would also recommend checking the daily volume of

trades on the exchange. Exchanges with very low volumes tend to lag

behind in price movements, as well as make it harder for limit orders to be

,lled (more on this terminology later).

If you decide to go with cryptocurrencies as your asset class, here’s a useful

list of the top exchanges, their volumes, and various other important pieces

of information to help you choose.

6'+$!@8!9:;<!(!4(A+

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 5 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

!;1B1)MO)A633-P18)S316<M58B

If the exchange is the battleground, you need a place to ship your troops

from. And I need to stop with this stupid analogy.

What I’m talking about is a server. You need a server to send requests to the

exchange’s API.

For testing purposes, you can obviously run the server from your own

computer. However, if you want your bot to be operating constantly, your

computer is de,nitely not a good choice.

Hence, I have two suggestions:

1. Use a Raspberry Pi as a server (Cooler)

2. Use a Cloud Provider (Better)

I think running a bot from your Pi is a pretty cool idea, so you should try it if

it also sounds nice to you.

However, most people will probably resort to a cloud hosting service like

AWS, Azure, GCS, or Digital Ocean.

Most large cloud service providers o/er a good free tier, so you might even

be able to host your bot for free.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 6 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

Regarding servers, I’ll just leave it at that. You should pick whatever suits

you best, and, for a small project like this, the choice shouldn’t make much

of a di/erence.

6'+$!B8!42:3?:)5!'-+!4%'C

!;1B1)MO),58-8)YPB36<6

Now we’re getting to the fun part. Ensure that before you come to this step

you have:

1. Registered and been approved to use an exchange

2. Enabled API usage on the exchange and have an API key

3. Decided how you will be hosting your bot

Got that? Alright, let’s move on.

0-+!6:#$3+A'!%D!4%'A

My goal here is to get you from zero to bot in a simple and concise way. As

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 7 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

such, I’ll be teaching you how to build a simple trading bot, which you can

then expand and improve to suit your needs.

This bot will have a few constraints:

1. The bot will only ever be in one of two states: BUY or SELL. It will not

place various buy or sell orders consecutively at multiple price points. If

its last operation was a sale, it will try to buy next.

2. It will use ,xed thresholds for buying and selling. A smarter bot might be

able to tinker with the thresholds based on various indicators, but our

bot will have its strategy and thresholds set manually.

3. It will only trade one currency pair e.g. BTC/USD.

The constraints come with bene,ts, however. Keeping it simple makes the

bot easier to create and maintain, as well as allows us to deploy this very

quickly.

KISS.

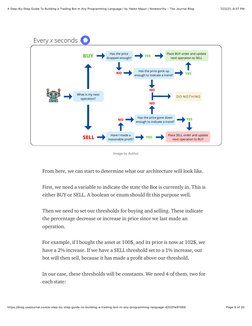

E+;:A:%)/F(<:)5!G3%,

Here’s a simple diagram providing an overview of how our bot will operate:

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 8 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

'K6D5)MO)%2B;13

From here, we can start to determine what our architecture will look like.

First, we need a variable to indicate the state the Bot is currently in. This is

either BUY or SELL. A boolean or enum should ,t this purpose well.

Then we need to set our thresholds for buying and selling. These indicate

the percentage decrease or increase in price since we last made an

operation.

For example, if I bought the asset at 100$, and its price is now at 102$, we

have a 2% increase. If we have a SELL threshold set to a 1% increase, our

bot will then sell, because it has made a pro,t above our threshold.

In our case, these thresholds will be constants. We need 4 of them, two for

each state:

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 9 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

BUY Thresholds (If the Bot is in SELL State)

DIP_THRESHOLD : Buys the asset if its price decreased by more than the

threshold. The idea of this is to follow the “buy low, sell high” strategy,

where you attempt to buy an asset when it is undervalued, expecting its

value to rise so you can sell.

UPWARD_TREND_THRESHOLD : Buys the asset if its price increased by more

than the threshold. This goes against the “buy low, sell high” philosophy,

but aims to identify when the price is going up and we don’t want to

miss an opportunity to buy before it goes even higher.

Here’s an illustration that might help:

'K6D5)SO)%2B;13

If we performed a SELL operation at the point marked “SELL” in the picture

above, we now have our thresholds set for the buy operation.

If the price ever goes below the bottom green line or above the top green

line we will perform a BUY operation. In this case, we surpassed the upper

threshold ,rst, so we bought based on the BUY_DIP_THRESHOLD .

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 10 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

SELL Thresholds (If the Bot is in BUY State)

PROFIT_THRESHOLD : Sells the asset if its price has increased above the

threshold since we bought it. This is how we pro,t. We sell at a higher

price than we bought.

STOP_LOSS_THRESHOLD : Ideally, we would only want our bot to sell when

it makes a pro,t. However, maybe the market is just going down

signi,cantly and we want to get out before it’s too late and then buy at a

lower price. Therefore, this threshold is used to sell at a loss, but with

the goal of stopping a bigger loss from happening.

Here’s an illustration:

'K6D5)SO)%2B;13

Here, we bought at the point marked with “BUY”. Then, we met our upper

threshold before the lower one, meaning we sold our asset for a pro,t. This

is how trading bots make money.

Now we already have a basic idea of how the bot works, so let’s get into

some (pseudo)code.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 11 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

H9"!I+3$+&!G2);':%)A

The ,rst thing our bot needs are some helper functions to get data from the

exchange’s API. We need:

The above should be self-explanatory, but you need to make sure you are

aware of what currencies the API POST requests ask for when doing a buy or

sell operation.

Often times, when you are trading USD for Gold, for example, you can

specify either how much Gold to buy, or how much USD to sell. Getting the

currencies right is very important.

4%'!J%%$!K.;3+

Now that we have our helper functions, let’s start to de,ne the workkow of

the bot. The ,rst thing we need is an in,nite loop with some sleep time.

Let’s say we want the bot to try to make an operation every 30 seconds.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 12 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

Here’s what that might look like:

Then, let’s set the variables and constants we talked about, as well as the

decision-making kow. API helper functions aside, our code would end up

something like this:

Note: The values for the thresholds here are just arbitrary values. You should

pick your own according to your own strategy.

If the above is paired up with the helper functions and the loop function,

which could also be main , we should now have ourselves the basic pillars of

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 13 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

a working bot.

At every iteration, our bot will check its current state (BUY or SELL) and

attempt to make a trade based on the thresholds hardcoded in. It will then

update the BUY/SELL state and the last price for an operation.

Then it does it all over again.

6'+$!L8!9%3:A-:)5!'-+!4%'

!;1B1)MO)&6BB;5@)X1./53O

The basic architecture of our bot is ready, but there’s probably a few things

we may still want to consider adding.

J%5A

When I ,rst built a variation of this bot, one thing that was essential for me

was having constant logging of the bot’s actions both to the terminal as well

as to a separate log ,le.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 14 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

At every step, I would create logs like:

[BALANCE] USD Balance = 22.15$

[BUY] Bought 0.002 BTC for 22.15 USD

[PRICE] Last Operation Price updated to 11,171.40 (BTC/USD)

[ERROR] Could not perform SELL operation - Insufficient balance

The logs that went to the ,le would also get a timestamp added to them, so

when I accessed the server after a whole day and found an error, for

example, I could trace it back exactly to where it happened, as well as ,nd

out everything else the bot did along the way.

This should be a matter of setting up a createLog function that is called at

every step. Something like this:

"?+)':D.:)5!0&+)?A

The main goal of our bot should be to buy at a low price and sell at a pro,t.

However, we have two thresholds that kind of contradict this

idea: UPWARD_TREND_THRESHOLD and STOP_LOSS_THRESHOLD .

These thresholds supposedly tell us when we should sell at a loss or buy at a

price increase. The idea is that we try to identify trends that fall outside of

the general strategy but may be harmful or bene,cial to us so we should act.

However, the way I structured it above is quite limited. A static snapshot of

a price is far from an indication of a trend.

Luckily, without much hassle, you can make this a little more reliable.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 15 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

All you need to do is also keep track of more prices than just lastOpPrice .

You could, for instance, keep track of price 10 or 20 iterations ago, and

compare that with the current price instead of lastOpPrice . This would

probably be better at identifying a trend because it checks for rapid shifts in

price rather than a shift that occurred over a long period of time.

E('(M(A+N

While it is running, this simple bot doesn’t actually need a database, since it

is handling very little data and can keep all the information in memory.

However, what happens when the bot fails, for example? How could it

determine the lastOpPrice without you checking it manually?

To prevent manual work on your end, you might want to keep some sort of

lightweight database to keep track of a few things, like lastOpPrice .

This way, when the bot starts up, rather than using the default values, it

will actually check its stored values and continue from there.

Depending on how simple you want to make this, you can even consider a

“database” of .txt or json ,les, since you might just be storing a few

values anyway.

E(A-M%(&?

If you want to facilitate the

visualization of your bot’s

operations, as well as manage it

without having to go in and

manually tinker with the code,

you may want to consider

connecting your bot to a

dashboard.

This would require that your bot

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 16 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

be connected to a web

!;1B1)MO),2/5):;5PP53

server/API of its own that

allows you to control its

functionality.

This way, you could change thresholds more easily, for example.

There are many free dashboard templates available so you don’t even have

to make your own. Check out Start Bootstrap and Creative Tim for some

examples.

0+A':)5!6'&('+5:+A!%)!9(A'!E('(

Many exchanges will o/er you access to past price data, as well as you can

usually easily get that data elsewhere if you need to.

This is very useful if you want to test your strategy before putting it to

action. You can run a simulation of your bot with past data and “fake

money” to see how well your de,ned thresholds would have worked and

adjust them for the real deal.

H??:':%)(3!9%:)'A!%)!0-&+A-%3?A!()?!O&?+&A

There are a few things you need to watch out for when placing orders.

First, you should understand that there are two types of orders: limit

orders and market orders. You should really read a little into this if you’re

not familiar with the concepts, but I’ll give you a basic overview here.

Market orders are orders that execute at the current market price,

e/ectively executing immediately in most cases.

Limit orders, on the other hand, happen when you place an order for a price

lower than market price (in the case of a BUY order) or higher than market

price (in the case of a SELL order). These are not guaranteed to execute,

since the price might not reach the threshold you set.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 17 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

The bene,t of limit orders is that you can anticipate market movements and

place an order regarding where you expect the market to go before such

movement happens.

In addition, limit orders are usually subject to lower fees than market

orders. This is because market orders are subject to what is commonly

called a “taker fee” whereas limit orders are subject to “maker fees”.

The reason for the names and their respective fees is that market orders are

just accepting (“taking”) the current market price, whereas limit orders

outside the market price are adding liquidity and hence “making a market”,

for which they are “rewarded” with lower fees.

Note that the bot in this article is best suited for market orders.

Lastly, on the topic of fees, when setting your PROFIT_THRESHOLD , remember

to take fees into consideration.

In order to make a pro,t, you need to perform a BUY and then a SELL

operation, which leaves you subject to 2 fees.

As such, you need to make sure that you only sell for a pro,t once you’re

able to at least cover your fees, otherwise you will actually be making a loss.

Think about it, assuming fees were kat, if you bought an asset for 100.00$,

incurring a 0.50$ fee, and then sold it for 100.75$, again with a 0.50$ fee,

you would have made a gross proFt of 0.75%, but, in actuality, you would

have a net loss of 0.25%.

Now imagine your bot was always selling for a net loss. You’d lose a lot of

money rather quickly…

G:)(3!P+#(&<A

That’s it for our bot. I hope this tutorial was useful.

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 18 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

The idea was to focus on all the concepts you need to know to build a

trading bot even if you’ve never traded before, not teach you how to

program.

The assumption is that all readers are able to do HTTP requests in their

language of choice, so it would be best to focus on other aspects.

It is the ,rst tutorial I ever write like this (pseudocode-based), so please do

let me know what you thought of the concept.

Thanks for reading! And if you think this article was useful, feel free to

support me with some claps .

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 19 of 20

�A Step-By-Step Guide To Building a Trading Bot In Any Programming Language | by Yakko Majuri | Noteworthy - The Journal Blog 7/22/21, 8:37 PM

Save this story in Journal.

!31D36KK-8D ?19B@635)Y8D-8553-8D !OB;18 *5.;81>1DO X6B6)?.-58.5

J+(&)!#%&+Q F(<+!F+?:2#!.%2&AQ =&:'+!(!A'%&.!%)!F+?:2#Q

&5<-2K)-P)68)1758)7>6B913K)@;535)FWI C1>>1@)B;5)@3-B53PG)72M>-.6B-18PG)68< '9)O12);6L5)6)PB13O)B1)B5>>G)/81@>5<D5)B1

K->>-18)356<53P).1K5)B1)9-8<)-8P-D;B92>)68< B17-.P)B;6B)K6BB53)B1)O12G)68<)O12=>>)P55 P;635G)13)6)753P75.B-L5)B1)19953)Z

<O86K-.)B;-8/-8DQ)A535G)5R753B)68< B;5K)18)O123);1K576D5)68<)-8)O123 @5>.1K5);1K5Q)'B=P)56PO)68<)9355)B1)71PB

28<-P.1L535<)L1-.5P)6>-/5)<-L5)-8B1)B;5 -8M1RQ)YR7>135 O123)B;-8/-8D)18)68O)B17-.Q)?B63B)6)M>1D

;563B)19)68O)B17-.)68<)M3-8D)85@)-<56P)B1

B;5)P2396.5Q),5638)K135

%M12B 43-B5 A5>7 ,5D6>

https://blog.usejournal.com/a-step-by-step-guide-to-building-a-trading-bot-in-any-programming-language-d202ffe91569 Page 20 of 20