Professional Documents

Culture Documents

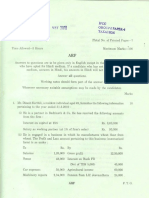

Profession Tax-Schedule 1

Uploaded by

SAYAN BHATTAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profession Tax-Schedule 1

Uploaded by

SAYAN BHATTACopyright:

Available Formats

RATE OF TAX ON THE ASSAM PROFESSIONS, TRADES,CALLINGS AND

EMPLOYMENT TAXATION ACT, 1947

SL

CLASS OF PERSONS RATE OF TAX

NO

Salary and wage earners such persons whose monthly salaries or wages

1 are (With Effect From 15-10-2014)

(i) Up to Rs.10,000/- Nil

(ii) More than Rs.10,000/- but less than Rs.15,000/- Rs.150/- per month

(iii) Rs.15,000/- or more but less than Rs.25,000/- Rs.180/- per month

(iv) Rs.25,000/- and more Rs.208/- per month

2 (a) Legal practitioner including Solicitor and Notaries Public;

(b) Medical practitioner including medical consultant and dentists;

(c) Technical and professional consultants including Architects, Engineers,

Chartered Accounts, Actuaries, Management consultants and Tax

consultants;

(d) Chief Agents, Principal Agents, Special agents and Surveyors

or loss Assessors registerd or licensed under Insurance act, 1938(

4 of 1938);

(e) Any other person who is engaged in any profession, trade, calling or

employment but not mentioned in any other entry of the Schedule;

Where the annual gross Income in the profession of any of the persons

mentioned above is (With Effect From 15-10-2014)

(i) Up to Rs.1,20,000/- Nil

(ii) More than Rs.1,20,000/- but less than Rs.1,80,000/- Rs.1800/- per annum

(iii) Rs.1,80,000/- or more, but less than Rs.3,00,000/- Rs.2160/- per annum

(iv) Rs.3,00,000/- or more Rs.2500/- per annum

Provided that any person, who is the recipient of any cultural, literary or

sports pension, shall not be required to pay any tax under this Act even

if such person is engaged in any other profession, trade, callings or

employment:

Provided further that the societies providing education to the physically

and mentally challenged persons shall not be required to pay any

tax under this Act.

(a) Members of Associations recognised under the Forward Contracts

3 (Regulations) Act, 1956 (42 of 1956) Rs.2500/ per annum

(b) (i) Members of Stock Exchange recognised under the Securities

Contracts (Regulations) Act,1956 (42 of 1956) Rs.2500/ per annum

(ii) Remisiers recognised by a stock exchange Rs.1800/ per annum

4 Estate agents or brokers or building contractors Rs.2500/ per annum

Directors(other than those nominated by Government) or Companies

5 Registered under the Companies Act,1956 ( 1 of 1956) Rs. 2500/- per annum

Dealers including owners of any mills/industry within the meaning of of a

6 sales tax law in Assam such dealers whose annual gross turnover of all

sales is (With Effect From 01-04-2008)

Nil

(i) Upto Rs.4,00,000/- Rs.1,000/- per annum

(ii) More than Rs.4,00,000/- and upto Rs.7,00,000/- Rs.1,500/- per annum

(iii) More than Rs.7,00,000/- upto Rs.10,00,000/- (iv)More than Rs.2,500/- per annum

Rs.10,00,000/-

Occupiers of factories as defined in the Factories Act, 1948( 63

7 of 1948) who are not dealers covered by entry 6: such occupiers of

factories-

(a) Where not more than five workers are working Rs.350/- per annum

(b) Where the number of workers is five or more but less than fifteen Rs.2000/ per annum

(c) Where the number of workers is more than fifteen Rs.2500/ per annum

Employers of shops and establishments within the meaning of the Assam

Shops and Establishment Act,1971 who are not dealers, covered

8 by entry 6: such employer's of

establishment-

(a) Where there are no employess Nil

(b) Where not more than five people are employed Rs.300/-

(c ) Where more than five, but not more than ten peoples are employed Rs.1500/- per annum

(d) Where more than ten peoples are employed Rs.2500/- per annum

Owners of lessees of Petrol/Diesel filling stations and service stations

9 Rs.2500/- per annum

(a) Licensed foreign liquor vendors and employers of residential hotels

10 Rs.2500/- per annum

(b) Proprietors of cinema houses and theatres Rs.2500/- per annum

Holders of permits for transport vehicles, granted under the Motor Vehicles

11 Act, 1988 (59 of 1988), which are used or adopted to be used for hire or

reward:

(a) in respect of each taxi owner and four wheelers smallgoodsvehicles Rs. 500/- per annum

( for carrying either goods or passenger)

(b) in respect of each truck or bus Provided that the total amount payable Rs. 2500/- per annum

by the same holder shall not exceed Rs.2500/-

Licensed money lenders under the Assam Money Lenders Act, 1934 Rs. 2500/-

12

Individuals or Institutions conducting Chit Funds Rs. 2500/-

13

Banking companies as defined in the Banking Regulation Act, 1949(10 of

14 1949)

(i) Scheduled Banks Rs.2500/- per annum

(ii) Other Banks Rs.2500/- per annum

Companies registered under the Companies Act, 1956 (1 of 1956)

15 and engaged in any profession, trade or calling Rs.2500/-

Firms registered under the Indian Partnership Act, 1932 (9 of 1932) and

16 engaged in any profession, trade or calling Rs.2500/-

Owners of nursing homes, X-Ray Clinics, Pathological testing

17 laboratories and Hospitals Rs.2500/-

Dry Cleaners, Interior decorators and owner of beauty parlours

18 Rs.2500/-

19 Film distributors and Travel agents Rs.2000/-

20 (A) Self employed person in the motion picture industry

(i) Directors, Actors and Actress( excluding junior artists) Play back Rs.2000/-

singers, Cameraman, Recordist, Editors and still Photographers.

(ii) Junior Artist, Production managers, Assistant directors, Assistant Rs.700/-

cameraman,Assistant recordist, Assistant editors, Musicians and Dancers

(B) Self employed person in the mobile theatre group Nil

You might also like

- Maharashtra State Tax On Professions, Trades, Callings and Employments ActDocument8 pagesMaharashtra State Tax On Professions, Trades, Callings and Employments ActswapnilswayamNo ratings yet

- Rates On Profession TaxDocument7 pagesRates On Profession Taxknikesh58No ratings yet

- RateDocument13 pagesRatejustndn4u6307No ratings yet

- Punjab Finance Act 2019Document14 pagesPunjab Finance Act 2019DETDGKHANNo ratings yet

- New Profession Tax Rates in W.BDocument5 pagesNew Profession Tax Rates in W.BUdayan GautamNo ratings yet

- Notfctn 29 2018 CGST Rate English RCM On SecurityDocument4 pagesNotfctn 29 2018 CGST Rate English RCM On SecurityA KumarNo ratings yet

- Tax Rates KPT PDFDocument16 pagesTax Rates KPT PDFAbhishek KumarNo ratings yet

- KPK Professional Tax Act SummaryDocument6 pagesKPK Professional Tax Act SummaryHumayunNo ratings yet

- PT Schedule Tax RatesDocument4 pagesPT Schedule Tax RatesMehar ThotaNo ratings yet

- Amended Professional Tax ScheduleDocument5 pagesAmended Professional Tax ScheduleACCT LVO 150No ratings yet

- PT Amendment BillDocument2 pagesPT Amendment BillSomashekarNo ratings yet

- M17MBA004 Tax AssignmentDocument9 pagesM17MBA004 Tax AssignmentZaibee 'zNo ratings yet

- Unit 3Document43 pagesUnit 3be pandaNo ratings yet

- Role of Small and Cottage Industries in IndiaDocument24 pagesRole of Small and Cottage Industries in IndiaTushar PunjaniNo ratings yet

- Income Tax Law and Practice Exam QuestionsDocument4 pagesIncome Tax Law and Practice Exam QuestionsÑìkíl G KårølNo ratings yet

- A Consent To Establish (Noc) : Industries Having Capital InvestmentDocument8 pagesA Consent To Establish (Noc) : Industries Having Capital InvestmentAnkit GuptaNo ratings yet

- Tax Rates KPTDocument14 pagesTax Rates KPTHitheswar ReddyNo ratings yet

- Stamp Act OdishaDocument19 pagesStamp Act OdishaRamesan CkNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- CDA Financial RulesDocument3 pagesCDA Financial RulesIftikhar KamranNo ratings yet

- 06 Modaraba Companies Ordinance 1980Document19 pages06 Modaraba Companies Ordinance 1980Nasir HussainNo ratings yet

- Instructions To Fill Up The Common Application Form For Clearances / Approvals / Services For Operation of An Industrial UnitDocument8 pagesInstructions To Fill Up The Common Application Form For Clearances / Approvals / Services For Operation of An Industrial UnitsuryanathNo ratings yet

- GST For Ca Nov 21Document23 pagesGST For Ca Nov 21shruti guptaNo ratings yet

- Changes Made in Income Tax Act 2058Document10 pagesChanges Made in Income Tax Act 2058shankarNo ratings yet

- Amendment of Income Tax Rules, 1962 Applicable For NOV 2010 Changes in Limits For Valuation of Car (Refer Page 38)Document25 pagesAmendment of Income Tax Rules, 1962 Applicable For NOV 2010 Changes in Limits For Valuation of Car (Refer Page 38)Gurpreet SinghNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Karnataka Tax On Profession, Trades, Callings and Employments Act, 1976Document232 pagesKarnataka Tax On Profession, Trades, Callings and Employments Act, 1976Latest Laws TeamNo ratings yet

- Tax SlabDocument4 pagesTax SlabWhizz-Kid RajNo ratings yet

- Excise Policy 2010-11Document13 pagesExcise Policy 2010-11smute20No ratings yet

- Registration With Coir Board As Exporter of Coir and Coir ProductsDocument4 pagesRegistration With Coir Board As Exporter of Coir and Coir ProductssaraeduNo ratings yet

- Andhra Pradesh Government Issues Guidelines for Rythu Bazar OperationsDocument10 pagesAndhra Pradesh Government Issues Guidelines for Rythu Bazar Operationssunil vinay0% (2)

- Bye Laws For Printing Updated 9.12.2022Document52 pagesBye Laws For Printing Updated 9.12.2022Tamsil khanNo ratings yet

- Unit 5 Micro Small and Medium Scale Industries (Msme) or Small Scale Industrial Undertakings DefinationDocument27 pagesUnit 5 Micro Small and Medium Scale Industries (Msme) or Small Scale Industrial Undertakings DefinationSiddharth ProGamerNo ratings yet

- Mock Test Series 2 QuestionsDocument10 pagesMock Test Series 2 QuestionsSuzhana The WizardNo ratings yet

- Company Incorporation ProceduresDocument12 pagesCompany Incorporation ProceduresharshaaadiNo ratings yet

- Professional Tax RulesDocument8 pagesProfessional Tax RulesSundasNo ratings yet

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- General Santos City Barangay Tax CodeDocument8 pagesGeneral Santos City Barangay Tax CoderoynepNo ratings yet

- Andhra Pradesh General Sales Tax Amendment Act 1986Document210 pagesAndhra Pradesh General Sales Tax Amendment Act 1986Latest Laws TeamNo ratings yet

- 22981qp Ipcc May10gp1 4Document7 pages22981qp Ipcc May10gp1 4HAYAGRIVAS 23No ratings yet

- Drill ABMDocument1 pageDrill ABMGeorge Gonzales78% (23)

- RTPS - SALES TAX BY SirTariqTunioDocument5 pagesRTPS - SALES TAX BY SirTariqTuniosyed saqib AliNo ratings yet

- West Pakistan ShopsDocument24 pagesWest Pakistan ShopsemailmeurNo ratings yet

- Kerala Panchayat Profession Tax RulesDocument17 pagesKerala Panchayat Profession Tax RulesBasil AbdulssalamNo ratings yet

- Taxes - Companies and Unincorporated Businesses: B17 Income Exempt FromDocument12 pagesTaxes - Companies and Unincorporated Businesses: B17 Income Exempt FromKen ChiaNo ratings yet

- TAX COMPUTATIONDocument5 pagesTAX COMPUTATIONRamzan AliNo ratings yet

- Toddy RulesDocument24 pagesToddy Rulesbharatheeeyudu100% (1)

- Statuatory ComplianceDocument9 pagesStatuatory Compliancescribd5378No ratings yet

- Co-operative Society Appeal on Section 80P Deduction EligibilityDocument23 pagesCo-operative Society Appeal on Section 80P Deduction EligibilitycadrjainNo ratings yet

- Amendments in Ilgl Cs 2015Document18 pagesAmendments in Ilgl Cs 2015RAHULNo ratings yet

- PT ScheduleDocument14 pagesPT ScheduleRaghavendra karekarNo ratings yet

- The Sales Tax Act, 1990Document509 pagesThe Sales Tax Act, 1990Muhammad Hassaan AhmadNo ratings yet

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Document6 pagesSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooNo ratings yet

- Tax AssignmentDocument4 pagesTax AssignmentkaRan GUptД100% (1)

- Various CalculatorsDocument24 pagesVarious Calculatorsshagun khandelwalNo ratings yet

- Guidelines For ListingDocument9 pagesGuidelines For ListingTarun LoharNo ratings yet

- Karnataka Tax on Professions Act 1976Document57 pagesKarnataka Tax on Professions Act 1976XNo ratings yet

- G G Engineering Limited Public Issue DetailsDocument25 pagesG G Engineering Limited Public Issue DetailsArun GirdharNo ratings yet

- Ahlada Engineers IPO detailsDocument33 pagesAhlada Engineers IPO detailsmealokranjan9937No ratings yet

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Delegation of Financial Powers Rules-2022Document78 pagesDelegation of Financial Powers Rules-2022SAYAN BHATTANo ratings yet

- ACR PDF Legal SizeDocument2 pagesACR PDF Legal SizeSAYAN BHATTANo ratings yet

- Syll FM 15 2023 29052023Document2 pagesSyll FM 15 2023 29052023ujjal kr nathNo ratings yet

- CSRF 1 (CPF) FormDocument4 pagesCSRF 1 (CPF) FormJack Lee100% (1)

- An Introduction To Indian Government Accounts and Audit 1930Document340 pagesAn Introduction To Indian Government Accounts and Audit 1930SAYAN BHATTANo ratings yet

- User Manual (Finassam)Document33 pagesUser Manual (Finassam)SAYAN BHATTA100% (1)

- Income Tax 2017-18 PDFDocument2 pagesIncome Tax 2017-18 PDFSAYAN BHATTANo ratings yet

- User Manual (Finassam)Document33 pagesUser Manual (Finassam)SAYAN BHATTA100% (1)

- Economic Globalization First Draft 1.9Document5 pagesEconomic Globalization First Draft 1.9BENJAPORNNo ratings yet

- SaurabhDocument16 pagesSaurabhAkshay Singh100% (1)

- Dusters Total Solutions Services Pvt. LTD.: Employee Personal File Check ListDocument1 pageDusters Total Solutions Services Pvt. LTD.: Employee Personal File Check Listswapnilchap100% (1)

- Labor and Social LegislationDocument10 pagesLabor and Social LegislationBochai BagolorNo ratings yet

- MessyDocument40 pagesMessyLittle, Brown Books for Young Readers100% (1)

- United Pepsi-Cola Union V LaguesmaDocument4 pagesUnited Pepsi-Cola Union V LaguesmaCZARINA ANN CASTRONo ratings yet

- Business Communication Résumé TipsDocument4 pagesBusiness Communication Résumé TipsLucano EranioNo ratings yet

- Ang Katangian at Kahalagahan NG Yamang Tao NGDocument31 pagesAng Katangian at Kahalagahan NG Yamang Tao NGRonnel Angelo Trevinio0% (1)

- JAIME GAPAYAO vs. JAIME FULODocument3 pagesJAIME GAPAYAO vs. JAIME FULOBert NazarioNo ratings yet

- Pro-Poor Growth and PoliciesDocument25 pagesPro-Poor Growth and PoliciesSteev Vega GutierrezNo ratings yet

- Job Analysis: Prepared By: Jhaven Mañas, RPMDocument42 pagesJob Analysis: Prepared By: Jhaven Mañas, RPMJhaven MañasNo ratings yet

- Training Joining Letter - Kaushal PDFDocument7 pagesTraining Joining Letter - Kaushal PDFKAUSHAL KUMAR MISHRA100% (2)

- City Gas DistributionDocument13 pagesCity Gas DistributionsruhilNo ratings yet

- 33Document12 pages33Pardeep SainiNo ratings yet

- Personality and Values ChapterDocument4 pagesPersonality and Values ChapterKen CruzNo ratings yet

- Presentation - Introduction To Industrial Democracy and Social DialogueDocument28 pagesPresentation - Introduction To Industrial Democracy and Social DialogueRamon CertezaNo ratings yet

- Internal Market Competence ReviewDocument38 pagesInternal Market Competence Reviewella96No ratings yet

- Purchasing Department Roles Duties and ResponsibilitiesDocument8 pagesPurchasing Department Roles Duties and Responsibilitiesrahul vermaNo ratings yet

- Team Labor Law #LLB 2-bDocument42 pagesTeam Labor Law #LLB 2-bHemsley Battikin Gup-ayNo ratings yet

- Chapter 7 Assn Questions.nDocument2 pagesChapter 7 Assn Questions.nelmsavingsNo ratings yet

- Fundamental Principles and PoliciesDocument115 pagesFundamental Principles and PoliciesLeo Carlo CahanapNo ratings yet

- Monthly Income of Newly Hired Computer TechniciansDocument11 pagesMonthly Income of Newly Hired Computer Technicianshayusa8214No ratings yet

- Qualification To Be A Registered Electrical ContractorDocument6 pagesQualification To Be A Registered Electrical ContractorJacinta Mediana EspelaNo ratings yet

- 2 PDFDocument71 pages2 PDFMayankJainNo ratings yet

- Osd PDFDocument7 pagesOsd PDFSHANTAMMA ARAVEETINo ratings yet

- CRG650 520 Q SET1 Sesi1Document7 pagesCRG650 520 Q SET1 Sesi1firdaus yahyaNo ratings yet

- Economics of EducationDocument11 pagesEconomics of EducationA KNo ratings yet

- Jet Airways Industrial DisputesDocument16 pagesJet Airways Industrial DisputesVinit Shah0% (1)

- An Organisational StudyDocument43 pagesAn Organisational StudyRytz sumi100% (2)

- Kartik Thakkar E043 Economics IcaDocument23 pagesKartik Thakkar E043 Economics IcaKARTIK THAKKARNo ratings yet