Professional Documents

Culture Documents

RBI Guidelines

Uploaded by

K B Temp0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

RBI_Guidelines

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesRBI Guidelines

Uploaded by

K B TempCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

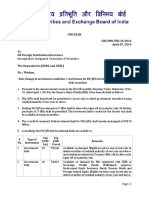

SOVEREIGN GOLD BOND (SGB) SCHEME

PRODUCT FEATURES AND TERMS AND CONDITIONS

SR. No. Item Details

1 Product name Sovereign Gold Bond Scheme

To be issued by Reserve Bank of India on behalf of the Government of

2 Issuance

India.

The SGBs will be restricted for sale to resident individuals, HUFs,

3 Eligibility

Trusts, Universities and Charitable Institutions.

The SGBs will be denominated in multiples of gram(s) of gold with a

4 Denomination

basic unit of One gram.

The tenor of the SGB will be for a period of eight years with an option

5 Tenor of premature redemption after 5th year to be exercised on the date on

which interest is payable.

6 Minimum size Minimum permissible investment will be One gram of gold.

The maximum limit of subscription shall be 4 Kg for individual, 4 Kg for

HUF and 20 Kg for trusts and similar entities per fiscal year (April-

March) notified by the Government from time to time. A self-declaration

7 Maximum limit

to this effect will be obtained. The annual ceiling will include SGBs

subscribed under different tranches, and those purchased from the

Secondary Market, during the fiscal year.

In case of joint holding, the investment limit of 4 KG will be applied to

8 Joint holder

the first applicant only.

Price of SGB will be fixed in Indian Rupees on the basis of simple

average of closing price of gold of 999 purity, published by the India

Bullion and Jewellers Association Limited (IBJA) for the last three

9 Issue price

working days of the week preceding the subscription period. The issue

price of the SGBs will be less by Rs.50 per gram for the investors who

subscribe online and pay through digital mode.

Payment for the SGBs will be through cash payment (upto a maximum

10 Payment option

of Rs.20,000) or demand draft or cheque or electronic banking.

The SGBs will be issued as Government of India Stock under

Government Securities Act, 2006. The investors will be issued a

11 Issuance form

Certificate of Holding for the same. The SGBs will be eligible for

conversion into demat form.

Redemption The redemption price will be in Indian Rupees based on simple

12 average of closing price of gold of 999 purity of previous three working

price days published by IBJA Ltd.

The SGBs will be sold through Commercial banks, Stock Holding

Corporation of India Limited (SHCIL), Clearing Corporation of India

Limited (CCIL), designated post offices (as may be notified) and

13 Sales channel

recognized stock exchanges viz., National Stock Exchange of India

Limited and Bombay Stock Exchange Limited, either directly or through

agents.

The investors will be compensated at a fixed rate of 2.50 percent per

14 Interest rate

annum payable semi-annually on the nominal value.

The SGBs can be used as collateral for loans. The loan to -value (LTV)

15 Collateral ratio is to be set equal to ordinary gold loan mandated by the Reserve

Bank from time to time.

Know-your-customer (KYC) norms will be the same as that for

purchase of physical gold. KYC documents such as Voter ID, Aadhaar

KYC

16 card/PAN or TAN /Passport will be required. Every application must be

documentation

accompanied by the ‘PAN Number’ issued by the Income Tax

Department to individuals and other entities.

The interest on SGBs shall be taxable as per the provision of Income

Tax Act, 1961 (43 of 1961). The capital gains tax arising on redemption

17 Tax treatment of SGB to an individual is exempted. The indexation benefits will be

provided to long term capital gains arising to any person on transfer of

the SGB.

18 Tradability The SGBs shall be eligible for trading.

You might also like

- Press Release - Issuance of Calendar of Sovereign Gold Bond Scheme For H2 of 2022-23Document2 pagesPress Release - Issuance of Calendar of Sovereign Gold Bond Scheme For H2 of 2022-23kpb hindujNo ratings yet

- Sovereign Gold Bond Scheme 2017-18 - Series IDocument2 pagesSovereign Gold Bond Scheme 2017-18 - Series IAnonymous UserNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 9th-15th December 2023Document45 pagesBeepedia Weekly Current Affairs (Beepedia) 9th-15th December 2023BRAJ MOHAN KUIRYNo ratings yet

- RBI Guide JointDocument2 pagesRBI Guide JointTHAVENDRA KUMARNo ratings yet

- RBI Guidelines PDFDocument2 pagesRBI Guidelines PDFpadmgovi23No ratings yet

- RBI Guidelines PDFDocument2 pagesRBI Guidelines PDFKrishna AdhinarayanNo ratings yet

- Sovereign Gold Bond Scheme (SGB)Document2 pagesSovereign Gold Bond Scheme (SGB)kptripathi1405No ratings yet

- Sovereign Gold Bond 8Document3 pagesSovereign Gold Bond 8sriniNo ratings yet

- SGB Scheme 2020-21 CalendarDocument3 pagesSGB Scheme 2020-21 Calendarkranti kiran kandimallaNo ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

- Sovereign Gold Bonds (SGBS) - 2016 - Tranche - Iii Issue: Retail ResearchDocument3 pagesSovereign Gold Bonds (SGBS) - 2016 - Tranche - Iii Issue: Retail ResearchDinesh ChoudharyNo ratings yet

- FAQs On Sovereign Gold Bond SCHEME Annx1Document6 pagesFAQs On Sovereign Gold Bond SCHEME Annx1Alok Kr MishraNo ratings yet

- Investment Management and Bond Dynamics - 13062023Document76 pagesInvestment Management and Bond Dynamics - 13062023Sreekanth GhilliNo ratings yet

- RBI NotesDocument443 pagesRBI NotesManish MishraNo ratings yet

- Frequently Asked Questions (Faqs) Sovereign Gold Bond SchemeDocument5 pagesFrequently Asked Questions (Faqs) Sovereign Gold Bond SchemeVikramNo ratings yet

- SGB FAQsDocument6 pagesSGB FAQskumararjan365No ratings yet

- Frequently Asked Questions - 2017Document4 pagesFrequently Asked Questions - 2017GautamDuttaNo ratings yet

- Frequently Asked Questions (Faqs) Sovereign Gold Bond Scheme Tranche IvDocument5 pagesFrequently Asked Questions (Faqs) Sovereign Gold Bond Scheme Tranche IvSaiNo ratings yet

- Sovereign Gold Bond - by AdarshDocument21 pagesSovereign Gold Bond - by AdarshAadarsh ChaudharyNo ratings yet

- Draft Outline of The Sovereign Gold Bond Scheme (For Discussion Purposes Only)Document3 pagesDraft Outline of The Sovereign Gold Bond Scheme (For Discussion Purposes Only)Anonymous nQtCpIqooNo ratings yet

- Floating Rate Savings BondsDocument2 pagesFloating Rate Savings BondsTarique SiddiqueNo ratings yet

- Frequently Asked Questions (FAQs) Sovereign Gold Bond (SGB) Scheme - 10092017 PDFDocument4 pagesFrequently Asked Questions (FAQs) Sovereign Gold Bond (SGB) Scheme - 10092017 PDFkamleshNo ratings yet

- Frequently Asked Questions: Sovereign Gold Bond Scheme 2015Document5 pagesFrequently Asked Questions: Sovereign Gold Bond Scheme 2015JaireddyNo ratings yet

- Group 5 SGBs TaxationDocument20 pagesGroup 5 SGBs Taxationpampa.mannaNo ratings yet

- SBI Global Connect November 2018Document6 pagesSBI Global Connect November 2018akguppee4491No ratings yet

- Retail InvestorDocument4 pagesRetail InvestorPrasenjit VighneNo ratings yet

- Press Information Bureau Government of India Ministry of FinanceDocument3 pagesPress Information Bureau Government of India Ministry of Financedebnathsuman49No ratings yet

- Branch Manager Central Bank of India - BranchDocument4 pagesBranch Manager Central Bank of India - BranchikmNo ratings yet

- Sovereign Gold Bonds (SGB) : Source-Reserve Bank of IndiaDocument6 pagesSovereign Gold Bonds (SGB) : Source-Reserve Bank of IndiaabhimanyaNo ratings yet

- Treasury ManagementDocument30 pagesTreasury ManagementAMAL CHRISTY GEORGENo ratings yet

- Analysis & Effects of Sovereign Gold Bonds: Priya BhandariDocument7 pagesAnalysis & Effects of Sovereign Gold Bonds: Priya BhandariPriyanshuNo ratings yet

- 6 B Treasury InstrumentsDocument10 pages6 B Treasury InstrumentsRavi kumarNo ratings yet

- Loan Checklist - List of Compliances For A Loan TransactionDocument6 pagesLoan Checklist - List of Compliances For A Loan TransactionDinesh GadkariNo ratings yet

- FGN Savings Bond Offer For Subscription August, 2023Document1 pageFGN Savings Bond Offer For Subscription August, 2023Inalegwu23No ratings yet

- 17 06 16 FAQ On Gold BondDocument2 pages17 06 16 FAQ On Gold BondPM LOgsNo ratings yet

- Rbi Notifies Voluntary Retention Route For Investment by Foreign Portfolio Investors in Indian Debt SecuritiesDocument5 pagesRbi Notifies Voluntary Retention Route For Investment by Foreign Portfolio Investors in Indian Debt SecuritiesAnshulNo ratings yet

- SGB Circular Tranche2Document4 pagesSGB Circular Tranche2ishan619No ratings yet

- Money Market & Its InstrumentsDocument16 pagesMoney Market & Its InstrumentsmanoranjanpatraNo ratings yet

- Sovereign Gold Bond - Product Features and FAQ'sDocument3 pagesSovereign Gold Bond - Product Features and FAQ'ssanjithchowdaryNo ratings yet

- BondsDocument6 pagesBondsDanish ShakeelNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2022Document36 pagesBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2022Aparajita AhujaNo ratings yet

- Certificate of DepositDocument14 pagesCertificate of DepositASHISH BHATNo ratings yet

- DM Cia 1aDocument20 pagesDM Cia 1aSahana SadanandNo ratings yet

- Money MarketDocument6 pagesMoney MarketredsaluteNo ratings yet

- The Presentation On Documentation of Broking FirmDocument28 pagesThe Presentation On Documentation of Broking FirmAnkit SharmaNo ratings yet

- Review Investment PolicyDocument33 pagesReview Investment PolicyRupesh MoreNo ratings yet

- 6670Document134 pages6670sandymadhu712715114024No ratings yet

- Drishtee Diaries 2020Document21 pagesDrishtee Diaries 2020Smriti ShahNo ratings yet

- Bai Mujjal of Sukuk 31.3.2014Document11 pagesBai Mujjal of Sukuk 31.3.2014Shaikh GMNo ratings yet

- Debt MarketDocument21 pagesDebt Marketmamta jainNo ratings yet

- Guidelines Islamic Negotiable InstrumentsDocument27 pagesGuidelines Islamic Negotiable Instrumentskarim meddebNo ratings yet

- EligibilityDocument3 pagesEligibilityGurdit KhalsaNo ratings yet

- FM AssignmentDocument19 pagesFM Assignmentpinky nsNo ratings yet

- Money Market and Capital MarketDocument3 pagesMoney Market and Capital MarketThiên TrangNo ratings yet

- Sebi Investment LimitDocument2 pagesSebi Investment LimitJoydeep NtNo ratings yet

- Gop Ijara Sukuk V-2 FinalDocument10 pagesGop Ijara Sukuk V-2 FinalShah JeeNo ratings yet

- Certificates of DepositDocument3 pagesCertificates of DepositJitendra VirahyasNo ratings yet

- BSPsecuritiesDocument4 pagesBSPsecuritiescatherinemariposa001No ratings yet

- Crypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationFrom EverandCrypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationNo ratings yet

- Topic 8: Alternative Directions and Methods of DevelopmentDocument26 pagesTopic 8: Alternative Directions and Methods of DevelopmentClariza Mae BaisaNo ratings yet

- BBS 1st Year Business Economics 0009Document6 pagesBBS 1st Year Business Economics 0009Suzain Nath90% (10)

- Chapters and Cases SummaryDocument206 pagesChapters and Cases Summarynan100% (3)

- Production of 100% Organic Dry Fish in BangladeshDocument52 pagesProduction of 100% Organic Dry Fish in BangladeshAbu NayeemNo ratings yet

- Amitabh V CVDocument1 pageAmitabh V CVamitabhhelios7037No ratings yet

- Objectives of The Money Market in IndiaDocument13 pagesObjectives of The Money Market in IndiaVineet SinghNo ratings yet

- Why Do Stock Prices Go Up and DownDocument3 pagesWhy Do Stock Prices Go Up and DownclaudiatimanatNo ratings yet

- Cornerstones of Managerial Accounting 2e: Chapter TwelveDocument18 pagesCornerstones of Managerial Accounting 2e: Chapter TwelveNoel BajadaNo ratings yet

- Chapter 1: Defining Marketing For The 21st Century: General Concept Questions Multiple ChoiceDocument38 pagesChapter 1: Defining Marketing For The 21st Century: General Concept Questions Multiple ChoiceAmr A. MohamedNo ratings yet

- Utilisation Plan: Equity, Capacity Building & Business Development GrantDocument12 pagesUtilisation Plan: Equity, Capacity Building & Business Development GrantVijit PareekNo ratings yet

- Scope of E-Retailing in IndiaDocument84 pagesScope of E-Retailing in Indiacoolshubhang50% (2)

- Modigliani - Miller ApproachDocument12 pagesModigliani - Miller Approachtasneem89100% (1)

- Research Paper Synopsis: Country Attractiveness Parameters With Respect To The Polished Diamond SectorDocument5 pagesResearch Paper Synopsis: Country Attractiveness Parameters With Respect To The Polished Diamond SectorMitul Deepak ShahNo ratings yet

- Axis yDocument9 pagesAxis yErica DewiNo ratings yet

- Developing Pricing Strategies and ProgramsDocument28 pagesDeveloping Pricing Strategies and ProgramsJ83MEGHA DASNo ratings yet

- Treasury Bills (T-Bills) Meaning:: Prepared by Mohuddin Memon 1Document7 pagesTreasury Bills (T-Bills) Meaning:: Prepared by Mohuddin Memon 1moinmemon1763No ratings yet

- MKTG1100 Chapter 1Document40 pagesMKTG1100 Chapter 1Marcus YapNo ratings yet

- 재무관리 기말고사 족보Document14 pages재무관리 기말고사 족보yanghyunjun72No ratings yet

- Value Proposition Customer Segments Customer Relationship: Key Partners Key ActivitiesDocument7 pagesValue Proposition Customer Segments Customer Relationship: Key Partners Key ActivitiesHannah NolongNo ratings yet

- Getdocumento PDFDocument341 pagesGetdocumento PDFjlsantaNo ratings yet

- Case Study On Impact of AdvertisingDocument10 pagesCase Study On Impact of AdvertisingRavinder Kumar0% (1)

- Construction EconomicsDocument8 pagesConstruction EconomicsLokuliyanaNNo ratings yet

- Mishkin PPT Ch22Document24 pagesMishkin PPT Ch22Atul KirarNo ratings yet

- 123Document2 pages123Dilan WarnakulasooriyaNo ratings yet

- FMP Mechanics of Futures SSEIDocument1 pageFMP Mechanics of Futures SSEIDIVYANSHU GUPTANo ratings yet

- Evaluating Business StrategyDocument11 pagesEvaluating Business StrategycrazzcthNo ratings yet

- IFS - Chapter 2Document17 pagesIFS - Chapter 2riashahNo ratings yet

- Basic Economics Task Performance (Prelims)Document1 pageBasic Economics Task Performance (Prelims)godwill oliva0% (1)

- Non-Monetary CostDocument6 pagesNon-Monetary CostAkshit KalaNo ratings yet

- Showrooming at Best Buy: Case AnalysisDocument4 pagesShowrooming at Best Buy: Case AnalysisAnubhavChauhanNo ratings yet