Professional Documents

Culture Documents

ITuser

ITuser

Uploaded by

Sumit KushwahaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITuser

ITuser

Uploaded by

Sumit KushwahaCopyright:

Available Formats

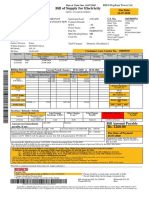

AS DRAWN PARTICULARS FOR THE COMPUTATION OF INCOME TAX FOR THE FINANCIAL YEAR: 2022-2023

(1stAPR-31stMAR)

LP

EMPLOYEE NO. 33307428170 NAME N.K.KUSHWAHA DESIGNATION STATION JHS BILL UNIT 3203619 PAN NUMBER AMVPK4095J

(GOODS)

HEAD MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR TOTAL

PAY 62200 62200 62200 62200 64100 64100 64100 64100 64100 64100 64100 64100 0 761600

DA 25067 27492 27492 27492 28332 28332 28332 31665 31665 31665 31665 31665 0 350864

AR DA 0 7275 0 0 0 0 0 9999 0 0 0 0 0 17274

HRA 14555 14555 14555 14555 14999 14999 14999 14999 14999 14999 14999 14999 0 178212

TRAN ALL(TAXABLE) 2358 2412 0 2412 2412 2412 2412 2484 2484 2484 2484 2484 0 26838

AR T/AL-G 0 162 0 0 0 0 0 216 0 0 0 0 0 378

PLB 0 0 0 0 0 0 0 17951 0 0 0 0 0 17951

NPST-GOV 0 0 0 0 0 0 0 0 0 0 0 0 0 0

KMA 0 47460 14960 16520 18340 12620 14800 10280 17040 9500 23280 7680 0 192480

SHUNT AL-S 0 208 0 0 0 0 0 0 0 0 0 0 0 208

ADL ALL(RG) 983 1005 0 1005 1005 1005 1005 1035 1035 1035 1035 1035 0 11183

LEAVE ALL(RG) 0 0 0 0 1244 0 3722 3846 0 5128 1241 0 0 15181

AR-ADL ALL(RG) 0 66 0 0 0 0 0 90 0 0 0 0 0 156

NDA 0 0 0 0 0 0 2465 1899 1899 922 2010 0 0 9195

NHA 0 630 0 0 630 0 1260 1260 630 0 630 0 0 5040

PF-SUBS 8034 8034 8034 8034 8280 8280 8280 8280 8280 8280 8280 8280 0 98376

CGIS-C 30 30 30 30 30 30 30 30 30 30 30 30 0 360

INC TAX 0 0 0 0 0 0 0 0 55471 57089 61326 63721 0 237607

1. GROSS INCOME....(EXCLUDING CHILD EDUALL. REBATE 0) 1586560

2. LESS DEDUCTION:-

(a) HR U/s. 10(13A) 0

(b) PROFESSIONAL TAX U/s 16(b) 0

(c) STANDARD DEDUCTION U/s 16(a) 50000

3. INCOME CHARGEBALE UNDER THE HEAD OF SALARIES(1-2) 1536560

4. (a) OTHER INCOME REPORTED BY EMPLOYEE 0

(b) GAIN FROM HOUSE PROPERTY 0

(c) LOSS FROM HOUSE PROPERTY 0

5. TOTAL INCOME (3+4) 1536560

6. DEDUCTIONS (VI-A)

SAVINGS UNDER SEC. 80C(MAX. 150000/-)

a) PF+VPF 98376

b) GIS 360

c) LIC & INSURANCE 59862

d) NSC/NSS/FD (5+ YEARS) 0

e) INT. ON NSC 0

f) HBA 0

g) MUTUAL FUND 0

h) PPF 0

i) TUTION FEES (FOR TWO CHILDREN) 69300

j) ULIP 0

k) PLI 0

l) CTD 0

m) SUKANYA YOJANA 0

TOTAL INVESTMENT 227898

80C : SAVING INCLUDING PENSION PLAN 0/-> 150000

80CCD(2): GOVT CONTRIBUTION REBATE 0

80CCF: INV FRA. STRU. BOND 0

80D : GIC MEDICAL INSURANCE PREMIA (MEDICLAIM) 0

80E : INTEREST ON EDUCATION LOAN 0

80DD : TREATMENT OF HANDICAPPED DEPENDENT 0

80GGA: DONATION FOR SCIENTIFIC R & D DEVELOPMENT 0

80RRA: FOREIGN SERVICE (SPONSERED) 0

80G : DONATIONS 0

80U : PHYSICALLY HANDICAPPED PERSON 0

80DDA: MAINTENANCE OF HANDICAP DEPENDANT 0

80DDB: MEDICAL TREATMENT 0

7. TOTAL DEDUCTIONS 150000

8. TOTAL INCOME 1386560 1386560

9. TAX ON TOTAL INCOME

(a) UPTO Rs. 250000/-.............................. NIL

(b) ON Rs. 250000 @ 5.0% ( UPTO Rs. 500000)..... 12500

(c) ON Rs. 250000 @ 10.0% ( UPTO Rs. 750000)..... 25000

(d) ON Rs. 636560 @ 15.0% ( ABOVE Rs. 750000)..... 95484

(e) TAX ON INCOME 0

10. EDUCATION CESS

(a) EDUCATION CESS 2%.OF 9(a) 9139

(b) EDUCATION CESS 1%.(Sec & Higher)OF 9(a) 0

TOTAL TAX INCLUDING CESS 237607

11. TOTAL TAX DEDUCTED 237607

12. TAX TO BE DEDUCTED 0

13. TAX TO BE DEDUCTED PER MONTH 0

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LOA Bupe Gideon Kisuse 72573 June 17 2022 Kygdost1Document5 pagesLOA Bupe Gideon Kisuse 72573 June 17 2022 Kygdost1Mary GideonNo ratings yet

- Your Bofa Core Checking: Account SummaryDocument4 pagesYour Bofa Core Checking: Account SummaryAnonymous pDXH2Z100% (1)

- Tax, Budget, InterstDocument10 pagesTax, Budget, InterstNegese MinaluNo ratings yet

- Bill of Supply For Electricity: Due Date: 16-07-2020Document1 pageBill of Supply For Electricity: Due Date: 16-07-2020Rãhûl SâïñíNo ratings yet

- G RaviDocument5 pagesG RavigarimellargNo ratings yet

- Inventory in Transit - ExampleDocument2 pagesInventory in Transit - Example44v8ct8cdyNo ratings yet

- Relocation - San Mateo (Agents)Document2 pagesRelocation - San Mateo (Agents)Macario Imbudo BukatotNo ratings yet

- 2 Residential StatusDocument30 pages2 Residential StatusVEDANT SAININo ratings yet

- Taxation Notes - DimaampaoDocument115 pagesTaxation Notes - DimaampaoNLainie OmarNo ratings yet

- Talenta - Payslip PT Otten Coffee Indonesia Jul 2023 Ari RohmanaDocument1 pageTalenta - Payslip PT Otten Coffee Indonesia Jul 2023 Ari RohmanaFuad RahmanNo ratings yet

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument5 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265No ratings yet

- Couples BudgetDocument6 pagesCouples BudgetIzamar RiveraNo ratings yet

- bt12 FormDocument1 pagebt12 FormKaixin GoNo ratings yet

- TWFSDocument1 pageTWFSSs PpNo ratings yet

- ASTPL - BCSS-T Course Registration FormDocument1 pageASTPL - BCSS-T Course Registration Formtengku amirNo ratings yet

- Electronic ChequesDocument4 pagesElectronic ChequesAtharvaNo ratings yet

- Long Quiz Fund. of AcctngDocument5 pagesLong Quiz Fund. of AcctngLorraine DomantayNo ratings yet

- Account Statement From 14 Jan 2019 To 19 Jan 2019Document2 pagesAccount Statement From 14 Jan 2019 To 19 Jan 2019NOOH EXPORTERNo ratings yet

- TLM Lease Deed of Agreement-17062020 PDFDocument20 pagesTLM Lease Deed of Agreement-17062020 PDFanirudhasNo ratings yet

- UntitledDocument1 pageUntitledUmairIsmailNo ratings yet

- Bill For Table and ChairsDocument1 pageBill For Table and ChairsRaguNo ratings yet

- Kitchen Basic Salary (SMW) OT Slwop LateDocument2 pagesKitchen Basic Salary (SMW) OT Slwop LateShairaCerenoNo ratings yet

- GST PPT TaxguruDocument30 pagesGST PPT Taxguru50raj506019No ratings yet

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)

- Bab 3 Materi Keu InterDocument10 pagesBab 3 Materi Keu InterMaya MorukNo ratings yet

- Board Resolution To Authorize The Director As Signing AuthorityDocument1 pageBoard Resolution To Authorize The Director As Signing AuthorityHarty Robert57% (14)

- An Overview of The National Payment Systems ActDocument4 pagesAn Overview of The National Payment Systems ActMukama DhamuzunguNo ratings yet

- Statement 28061472 USD 2023-01-30 2023-03-23Document6 pagesStatement 28061472 USD 2023-01-30 2023-03-23Prince Letam-tentenNo ratings yet

- Income VIVIDocument19 pagesIncome VIVISim BelsondraNo ratings yet

- IT II AnswerDocument4 pagesIT II AnswerChandhini RNo ratings yet