Professional Documents

Culture Documents

S1 S

Uploaded by

ROHIT PANDEY0 ratings0% found this document useful (0 votes)

4 views7 pagesOriginal Title

S1_S

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views7 pagesS1 S

Uploaded by

ROHIT PANDEYCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 7

A,L or E

1 Equipment A

2 Retained Earnings E

3 Common Stock E

4 Dividend Payable L

5 Prepaid Expense A

6 Inventory A

7 Accounts Receivable A

8 Land A

9 Goodwill developed by firm NA

10 Factory A

Satemen Balance Cash

t of P/L Sheet Flow

1 Consulting Revenue x

2 Land x

3 Interest Expense x

4 Accrued Salaries Payable x

5 Equity Share Capital x

6 Salaries Expense x

7 Net Cash generated by Operating Activities x

8 Retained Earnings x

9 Property Plant & Equipment x

10 Interest Income x

11 Dividend Payable x

12 Accounts Payable x

13 Total Stockholder's Equity x

14 Net Change in Cash x

15 Notes Payable x

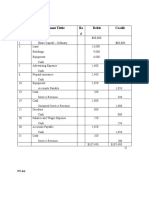

Assets = Liabilities + Equity

Accounts Share Retained

Cash Acco. Rec. Supplies Equipment Payable Capital Earnings

1 $ 30,000 F $ 30,000

2 (2,500) O $ 2,500

3 (26,000) I $ 26,000

4 7,100 $ 7,100

5 $ 4,200 O $ 4,200 Revenue

6a (1,000) O (1,000) Expense

6b (700) O (700) Expense

7a 1600 1600 Revenue

7b 300 300 Income

8 1900 O (1,900)

9 (900) O (900)

10 (200) F (200) Dividend

$ 4,800 $ - $ 9,600 $ 26,000 $ 6,200 ### $ 30,000 $ 4,200

Balance FF as at Statement of PL for the month ending

Assets Consulting revenue 5800

Cash 4800 Rental Income 300

Acco. Rec. 0 Total Income 6100

Supplies 9600 Salary Expe 700

Equipment 26000 Rental Exp 1000

Total Assets 40400 Total Expense 1700

L&E Profit 4400

Acc. Payable 6200 CFS

Share Capital 30000 CFO (A) 1000

Ret. Earnings 4200 CFI (B) -26000

Total L &E 40400 CFF © 29800

Cahnge in Cash 4800

Beg Cash 0

End Cash 4800

}T invests Rs 30,000 cash to start a company, Fast Forward a consulting comapny.

}Company purchased supplies paying $2,500 cash.

}Purchased equipment for $26,000 cash

}Purchased supplies of $7,100 on credit.

}Provided consulting services to a customer

and received $4,200 cash right away.

}Paid rent of $1,000 and

salaries of $700 to employees.

}Provided consulting services of $1,600 and rents facilities for $300 to a customer for credit.

}Client in previous transaction pays $1,900 for consulting services.

}FastForward pays $900 as partial payment for supplies purchased in transaction 4.

}Dividends of $200 are paid to shareholders.

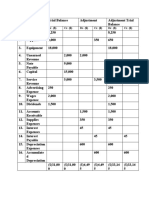

Assets = Liabilities + Equity

Accounts Share Retained

Cash Acco. Rec. Supplies Equipment Payable Capital Earnings

1 $ 25,000 $ 25,000 F 1. Owners invested Rs.25,000 in cas

2 (500) (500) O 2. The month’s rent of Rs.500 was p

3 $ 8,000 8000 3. Equipment costing Rs.8,000 was b

4 -500 500 O 4. Rs.500 was paid for office supplie

5 $ (750) $ (750) O 5. Advertising expenses of Rs.750 w

6 (3,000) (3,000) O 6. Paid Rs.3,000 employee salaries i

7 2,000 8000 10,000 O 7. Earned travel commissions of Rs.1

8 -5000 -5000 I 8. Paid Rs.5,000 of the Rs.8,000 owe

9 -100 -100 9. Used Rs.100 of the office supplies

10 1000 -1000 10. Charged Rs.1,000 of miscellaneo

$ 17,250 $ 8,000 $ 400 $ 8,000 $ 4,000### $ 25,000 $ 4,650

s invested Rs.25,000 in cash to start the business. They received common stock.

nth’s rent of Rs.500 was paid in cash.

ent costing Rs.8,000 was bought on credit.

was paid for office supplies.

sing expenses of Rs.750 was paid for with cash.

.3,000 employee salaries in cash.

travel commissions of Rs.10,000 of which Rs.2,000 was received in cash.

.5,000 of the Rs.8,000 owed to the equipment supplier.

s.100 of the office supplies.

ed Rs.1,000 of miscellaneous expenses on the corporate credit card.

You might also like

- The Doj - Chase $13 Billion Settlement Docs - Nov 2013Document162 pagesThe Doj - Chase $13 Billion Settlement Docs - Nov 201383jjmack100% (1)

- Fundamentals of Corporate Finance Canadian 9th Edition Ross Solutions ManualDocument5 pagesFundamentals of Corporate Finance Canadian 9th Edition Ross Solutions ManualMarcusAndersonsftg100% (63)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9Document17 pagesAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9elelai0% (1)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- 1-2-3 - Examples Transaction Analysis Using Basic Accounting Equation - SolutionDocument3 pages1-2-3 - Examples Transaction Analysis Using Basic Accounting Equation - SolutionAhmad AlayanNo ratings yet

- Accion Venture Lab - ESOP Best Practices PDFDocument44 pagesAccion Venture Lab - ESOP Best Practices PDFjeph79No ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- MT4 IndicatorsDocument99 pagesMT4 IndicatorsjhonniNo ratings yet

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9Document17 pagesAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 9AlexanderJacobVielMartinezNo ratings yet

- APC Ch9solDocument7 pagesAPC Ch9solBaymad67% (3)

- Cost Recovery in PSCDocument23 pagesCost Recovery in PSCdaniel_silabanNo ratings yet

- Prelim Quiz Preparation of Balance Sheet and Income StatementDocument8 pagesPrelim Quiz Preparation of Balance Sheet and Income StatementCHARRYSAH TABAOSARES100% (2)

- Investment Analysis and Portfolio Management OutlineDocument6 pagesInvestment Analysis and Portfolio Management OutlineHuan EnNo ratings yet

- Ass 4Document14 pagesAss 4Beza AbrNo ratings yet

- Chapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsDocument9 pagesChapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsSimran HarchandaniNo ratings yet

- TUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA NewDocument8 pagesTUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA Newrico anantaNo ratings yet

- Work Book, Income Statement, Balance Sheet (Page-13-15)Document3 pagesWork Book, Income Statement, Balance Sheet (Page-13-15)Greeni Marco100% (2)

- Practice 6 Consolidated Statement One Year After AcquisitionDocument10 pagesPractice 6 Consolidated Statement One Year After AcquisitionGloria Lisa SusiloNo ratings yet

- (Vertical) Balance Sheet of Geo PPV at Dd/mm/yy (FA) Fixed AssetsDocument8 pages(Vertical) Balance Sheet of Geo PPV at Dd/mm/yy (FA) Fixed AssetsHarsh ChhatrapatiNo ratings yet

- Trial - Intro To Accounting Ch. 2 (12th Ed)Document5 pagesTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasNo ratings yet

- Trial - Intro To Accounting Ch. 2 (12th Ed)Document5 pagesTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasNo ratings yet

- Intro To Accounting Ch. 2Document5 pagesIntro To Accounting Ch. 2Bambang HasmaraningtyasNo ratings yet

- Act 701 Assignment 2Document3 pagesAct 701 Assignment 2Nahid HawkNo ratings yet

- Chapter 4Document6 pagesChapter 4HelloWorldNowNo ratings yet

- Sloved Questions Financial AnalysisDocument12 pagesSloved Questions Financial AnalysisMurad KhanNo ratings yet

- Financial Accounting HomeworkDocument9 pagesFinancial Accounting HomeworkDương Nguyễn BìnhNo ratings yet

- Jawaban Individual AssignmentDocument3 pagesJawaban Individual AssignmentAtoy SomarNo ratings yet

- Chap 1Document14 pagesChap 1Nguyen Thi Diem Quynh (K17 HCM)No ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Accounting Cycle1Document4 pagesAccounting Cycle1Ahmer NaeemNo ratings yet

- Day 1 (Sole Trader Final Account)Document7 pagesDay 1 (Sole Trader Final Account)Han Thi Win KoNo ratings yet

- Kelompok AkuntansiDocument3 pagesKelompok AkuntansielskanjbtNo ratings yet

- APC Ch9sol.2014Document16 pagesAPC Ch9sol.2014Melissa RiolaNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- APC Ch9sol PDFDocument7 pagesAPC Ch9sol PDFBaymadNo ratings yet

- Chapter 14 Business CombinationDocument5 pagesChapter 14 Business CombinationAshNor Randy0% (1)

- 9 1Document2 pages9 1laale dijaanNo ratings yet

- (PDF) APC - Ch9solDocument11 pages(PDF) APC - Ch9solAdam SmithNo ratings yet

- Use Perpetual Inventory System For P6.3Document15 pagesUse Perpetual Inventory System For P6.3Giang LinhNo ratings yet

- Accounting Assignment 6Document2 pagesAccounting Assignment 6Nahid HawkNo ratings yet

- Practice+Quiz+ +quiz+#1 Solutions+to+PsDocument6 pagesPractice+Quiz+ +quiz+#1 Solutions+to+PsmareagodinezNo ratings yet

- IAS 7 Full Conso Statement of Cash Flows-Akorfa GroupDocument2 pagesIAS 7 Full Conso Statement of Cash Flows-Akorfa GroupeoafriyieNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- 3.1 Profit and Loss - Balance SheetDocument7 pages3.1 Profit and Loss - Balance Sheetjangirvihan2No ratings yet

- Problem 3.18 Liabilities and Shareholders' Equity $: Expense (Cogs) - 32000Document4 pagesProblem 3.18 Liabilities and Shareholders' Equity $: Expense (Cogs) - 32000Hendra RidwandhanaNo ratings yet

- AFR Session 4 ExercisesDocument10 pagesAFR Session 4 ExercisesSherif KhalifaNo ratings yet

- Transaction Analysis-Ch-1 Session 2, 3 4Document17 pagesTransaction Analysis-Ch-1 Session 2, 3 4Parvej ahmedNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Document2 pagesStatement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Alyssa AlejandroNo ratings yet

- Class Activity, Recording TransactionsDocument28 pagesClass Activity, Recording TransactionskhanNo ratings yet

- PR Pertemuan 1 - Yoga RamdhaniDocument7 pagesPR Pertemuan 1 - Yoga RamdhaniShafa Anggitar AzhariNo ratings yet

- ACCT101 9n10 SCFDocument17 pagesACCT101 9n10 SCFVedanshi BihaniNo ratings yet

- Financial Accounts Assingnment 3Document5 pagesFinancial Accounts Assingnment 3Zakarya KhanNo ratings yet

- 5 Income Statament BSE (1A)Document8 pages5 Income Statament BSE (1A)Armaan BalochNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- Accounting IAS Series 4 2007Document14 pagesAccounting IAS Series 4 2007Sergiu BoldurescuNo ratings yet

- Assignment ACC705 T2 2017Document5 pagesAssignment ACC705 T2 2017babar zuberiNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Week 4 - ch16Document52 pagesWeek 4 - ch16bafsvideo4No ratings yet

- Pricing TechniquesDocument10 pagesPricing Techniquesvijay_kumar1191No ratings yet

- PARCORDocument14 pagesPARCORChristine DaelNo ratings yet

- Limitations of Market SegmentationDocument6 pagesLimitations of Market SegmentationIQRA YOUSAFNo ratings yet

- Principles of Managerial Finance Brief 8Th Edition Zutter Test Bank Full Chapter PDFDocument67 pagesPrinciples of Managerial Finance Brief 8Th Edition Zutter Test Bank Full Chapter PDFSaraSmithdgyj100% (9)

- Chapter 6 Engineering EconomyDocument20 pagesChapter 6 Engineering EconomyArsalan AsifNo ratings yet

- 2010 07 06 - 010528 - Byp1 4Document3 pages2010 07 06 - 010528 - Byp1 4Muhammad RamadhanNo ratings yet

- Aditya Singh - Resume - IBDocument1 pageAditya Singh - Resume - IBVineet MaheshwariNo ratings yet

- RMDocument23 pagesRMVarun MoodbidriNo ratings yet

- Mathematics With Applications in The Management Natural and Social Sciences 11th Edition Lial Solutions Manual DownloadDocument77 pagesMathematics With Applications in The Management Natural and Social Sciences 11th Edition Lial Solutions Manual DownloadJames McclendonNo ratings yet

- Callable Range Accrual Pricing SupplementDocument8 pagesCallable Range Accrual Pricing SupplementHilton GrandNo ratings yet

- Kanchan YadavDocument14 pagesKanchan YadavNandini JaganNo ratings yet

- BBCF4073 202201F1168 20220429054802Document10 pagesBBCF4073 202201F1168 20220429054802Tron TrxNo ratings yet

- DocxDocument40 pagesDocxJamaica DavidNo ratings yet

- Investment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Document6 pagesInvestment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Jessie Dela CruzNo ratings yet

- Free Float Requirements at Indonesian Stock ExchangeDocument3 pagesFree Float Requirements at Indonesian Stock ExchangeIndra Tri JunialdiNo ratings yet

- AMplify 2021 - TeaserDocument4 pagesAMplify 2021 - TeaserVIVEK T VNo ratings yet

- Financial Management 3B LAO FinalDocument7 pagesFinancial Management 3B LAO Final221103909No ratings yet

- Tutorial 3 Risk and ReturnDocument3 pagesTutorial 3 Risk and ReturnVinay KumarNo ratings yet

- Image Image Image Image: Takeover Buybacks DelistingDocument5 pagesImage Image Image Image: Takeover Buybacks DelistingBhavin SagarNo ratings yet

- Ceres Power Prospectus 26 June 2023Document82 pagesCeres Power Prospectus 26 June 2023George SomanNo ratings yet

- HARVARD Management CompanyDocument4 pagesHARVARD Management CompanyMarshay HallNo ratings yet

- Tenets of Behavioral FinanceDocument3 pagesTenets of Behavioral FinanceAnubhavNo ratings yet

- Sr. NISM Exam Test Duration Fees (RS) Maximum Marks No. of Questions Pass Mark (%) Negative Marks (%) Certificate Validity (In Years)Document3 pagesSr. NISM Exam Test Duration Fees (RS) Maximum Marks No. of Questions Pass Mark (%) Negative Marks (%) Certificate Validity (In Years)Kripanshu JaiswarNo ratings yet