100% found this document useful (3 votes)

354 views11 pagesInternal Audit Framework

This document provides an overview of the Internal Audit Framework at the University of Sydney. It establishes that Internal Audit is governed by the Internal Audit Charter and aims to independently evaluate risk management, controls, and governance processes. Internal Audit reports to the Finance and Audit Committee and provides advisory services to senior management. Audits are conducted according to professional standards and focus on providing assurance and improving operations.

Uploaded by

Joe MashinyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (3 votes)

354 views11 pagesInternal Audit Framework

This document provides an overview of the Internal Audit Framework at the University of Sydney. It establishes that Internal Audit is governed by the Internal Audit Charter and aims to independently evaluate risk management, controls, and governance processes. Internal Audit reports to the Finance and Audit Committee and provides advisory services to senior management. Audits are conducted according to professional standards and focus on providing assurance and improving operations.

Uploaded by

Joe MashinyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Internal Audit Framework: Sets the context by providing the authority and classification details for the Internal Audit Framework document.

- Role of Internal Audit: Explains the function and responsibilities of the Internal Audit, emphasizing its importance in risk management and compliance.

- Overview: Outlines the purpose and role of the Internal Audit at the University of Sydney, including its objectives and compliance requirements.

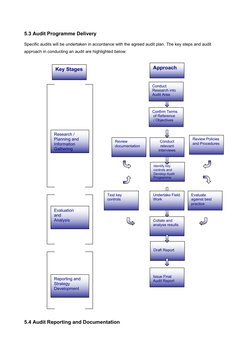

- Internal Audit Process: Details the methodology and strategic plan for conducting audits, focusing on process efficiency and adherence to standards.

- Audit Programme Delivery: Describes the stages of the audit programme, detailing the approach for conducting and reporting audits.