Professional Documents

Culture Documents

Funding Last Updated August 2011mix

Uploaded by

prsddyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Funding Last Updated August 2011mix

Uploaded by

prsddyCopyright:

Available Formats

Funding Last updated August 2011

MFIs in India rely heavily on local debt funding due to restrictions on foreign investments as well as subsidized local investment by commercial banks under priority sector regulations. From March 2008 to March 2010, there was a 216% increase in lending to MFIs. However, in the last year (March 2010 to March 2011), lending to MFIs declined by 11.6% resulting in a significant decline in the ratio of borrowings to loans in the same period from 85.8% in to 77.9% (See Figure 3). This impacted MFIs ability to expand their loan portfolios significantly. As borrowings constitute a major share of the total MFI assets, a similar pattern of growth during March 2008 March 2010 (203%) followed by subsequent decline in 2010 2011 (5.4%) is evident in the total assets of MFIs. This trend may be attributed to the A.P. crisis as banks stopped lending to MFIs with significant portfolio exposure in that region. Overall, the decline in lending has adversely impacted MFI funding [1]. Figure 3: Funding Structure, medians

Source: MIX Market. Data represent totals. Capital-to-asset ratios (See Figure 3) have been consistent from 2008 to 2011, and indicative of high leverage in the sector. Higher leverage may make it easier for MFIs to satisfy shareholder expectations as well as to provide loans at lower interest rates to their clients. Figure 4: Liability & Equity Structure, Totals

Source: MIX Market, Data Represents Totals Bank lending to MFI and SHGs With an outstanding loan portfolio of USD 6.2B (INR 28,038.3 crore) as on March 31, 2010, the SHG-Bank linkage channel is 2.8 times larger than the bank loans outstanding with MFIs. During March 2009 - March 2010, however, the outstanding loan portfolio of MFIs increased by 102%, while that of SHGs increased by only 23.6%. A similar trend in growth rates is evident in the bank loans disbursed to MFIs during this period. As per the Malegam Committee report, one of the reasons for this increasing dominance of MFIs is that banks find it easier to meet their priority sector targets when they lend to MFIs. Moreover, the SHG program is limited in its capacity to grow rapidly to scale, primarily due to the requirement that monthly savings be made by SHG members for six months before the first loan can be disbursed to the group by the bank it is linked to. Annual Growth Rates of Outstanding Bank Loans to SHGs and MFIs Mar 2009 Mar 2010 Amount (USD Growth Amount (USD billions) (%) billions) Bank Loans Outstanding with SHGs 5 33.4 6.2 Bank Loans Outstanding with MFIs 1 82.2 2.2 Source: Status of Micro Finance in India 2009-2010 (2010, NABARD) Equity Funding In recent years, MFIs have also attracted equity investors and the share of equity in MFI funding increased from 12.8% in March 2008 to 17.7% in March 2010 (See Figure 4), while the actual value of equity more than doubled (106%) from USD 423.5M (INR 1,912.1 crore ) in March 2009 to USD 874.4M (INR 3,947.9 crore ) in March 2010 [2]. In contrast, between March 2010 and March 2011, equity investments grew by only 0.3% to USD 877M (INR 3,959.7 crore). Over 60% of the equity in MFIs is in the form of share capital. Thus,

Growth (%) 23.6 102

investors, and not clients or donors, provide the majority of equity financing to Indian MFIs. This could be partly attributed to the SKS IPO that alone mobilized USD 350M (INR 1,580.3 crore) from the capital market, representing 40% of current equity based funding of the sector. After the success of the SKS IPO, other MFIs such as Spandana Spoorthy and Share also planned to enter the market with IPOs. They deferred their plans, however, due to the crisis in A.P. In late July 2011, L & T Finance Holdings Ltd, an NBFC with microfinance exposure launched an IPO. The company has an outstanding loan portfolio of around USD 45.3M (INR 204.5 crore) in A.P. Given the regulatory constraints on savings mobilization, deposits account form a very small percentage of MFI funding and primarily comprise compulsory deposits tied to the loan portfolio. Financing for MFIs Post-A.P. Crisis The reduction in bank lending to MFIs since October 2010 has had a significant and adverse impact on the sector. While banks have not completely stopped lending to MFIs, there have been instances where they have recalled loans. For instance, in January 2011, Yes Bank recalled loans worth USD 22M (INR 100 crore) made to MFIs. As MFI portfolios contract due to non-repayment of loans and debts mature on schedule, they need re-financing in order to continue lending. As per MIX Market analysis, around 20% to 50% of all MFI debt financing will require refinancing within the calendar year ending December 2011. RBI has permitted banks to offer a Corporate Debt Restructuring (CDR) package for MFIs, where debts of USD 1.4B (INR 6,400 crore) have been re-cast without being classified as non-performing loans. In June 2011, the terms of the CDR were finalized with five MFIs Trident Microfin Pvt. Ltd, Share Microfin Ltd, Asmitha Microfin Ltd, Future Finance Services and Spandana Sphoorty Financial Ltd. The terms of the CDR entail conversion of loans into shares, in case the MFI fails to repay the loan. This has raised concerns among existing investors as it could lead to dilution of their present shareholdings. Recent media reports highlight a funding crisis at Bhartiya Samruddhi Finance Limited (BSFL), popularly known as BASIX, due to an accumulation of bad loans. As of 30 June 2011, BSFLs net worth was USD 28.3M (INR 128 crore) down from USD 50.9M (INR 230 crore) in September 2010. This net worth is expected to completely erode due to accumulated bad loans of USD 99.7M (INR 450 crore), mostly in A.P. Since repayment rates have dropped to 10% in A.P., the only way for MFIs to cover costs would be to lend in other states in India. BSFL has been unable to do so as banks are unwilling to extend further loans to the MFI. Resumption of bank lending to the microfinance sector is likely to be further delayed as the A.P. government has not endorsed the central governments Micro Finance Sector Bill, 2011.

[1] Discussed in detail in the, Financing for MFIs Post A.P Crisis section [2] MIX Market Data

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Determinants of Disclosure Level of Related Party Transactions in IndonesiaDocument25 pagesDeterminants of Disclosure Level of Related Party Transactions in IndonesiafidelaluthfianaNo ratings yet

- Financial Analysis and Reporting ModuleDocument163 pagesFinancial Analysis and Reporting ModuleMarc JeromeNo ratings yet

- Idfc ReportDocument10 pagesIdfc ReportKumar RajputNo ratings yet

- December 2022Document2 pagesDecember 2022Zolani100% (1)

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- MmiDocument11 pagesMmiaadeezusmanNo ratings yet

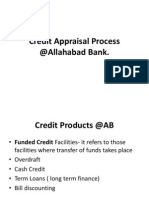

- Credit Appraisal Process Followed in Allahabad BankDocument42 pagesCredit Appraisal Process Followed in Allahabad BankParthapratim DebnathNo ratings yet

- Term Deposits PDFDocument312 pagesTerm Deposits PDFAdeel Ahmed MinhasNo ratings yet

- Contracting StrategyDocument9 pagesContracting Strategyhunkydee100% (1)

- ESigned TVSCS PL ApplicationDocument13 pagesESigned TVSCS PL ApplicationSATHISH KUMARNo ratings yet

- Digitizing Govt Payments Kenya Study - FINALDocument32 pagesDigitizing Govt Payments Kenya Study - FINALICT AUTHORITY0% (1)

- Project Report On Retail BankingDocument42 pagesProject Report On Retail Bankingprasad alahitNo ratings yet

- Product Booklet English VersionDocument88 pagesProduct Booklet English VersionUday Gopal100% (2)

- List of BilderbergDocument21 pagesList of BilderbergBinaya ShresthaNo ratings yet

- Faculty of Management: Syllabus For Master of Business AdministrationDocument19 pagesFaculty of Management: Syllabus For Master of Business AdministrationSri NandhuNo ratings yet

- Experience and Satisfaction of Bancassurance Customers of SBI - Final AbhijeetDocument97 pagesExperience and Satisfaction of Bancassurance Customers of SBI - Final AbhijeetGanesh TiwariNo ratings yet

- Mass Communication Project Topics With Materials in CameroonDocument7 pagesMass Communication Project Topics With Materials in CameroonHashmi SutariyaNo ratings yet

- Percentage TaxesDocument11 pagesPercentage TaxesAce Hulsey TevesNo ratings yet

- ACBS Commercial Loan System Fact SheetDocument4 pagesACBS Commercial Loan System Fact SheetRajitNo ratings yet

- Narrative ReportDocument30 pagesNarrative ReportClevin CabuyaoNo ratings yet

- Zoltan Pozsar: Global Money Notes #1-31 (2015-2020)Document607 pagesZoltan Pozsar: Global Money Notes #1-31 (2015-2020)pruputusluNo ratings yet

- Model Q Paper LLM Sem-IIDocument7 pagesModel Q Paper LLM Sem-IIpiyush_maheshwari22No ratings yet

- "A Study On Ratio Analysis of Axis Bank Hosur": Submitted byDocument70 pages"A Study On Ratio Analysis of Axis Bank Hosur": Submitted byUsha SinhaNo ratings yet

- 0452 Accounting: MARK SCHEME For The May/June 2013 SeriesDocument11 pages0452 Accounting: MARK SCHEME For The May/June 2013 SeriesIronMechKillerNo ratings yet

- Techcombank PresentationDocument41 pagesTechcombank PresentationbinhNo ratings yet

- Mark Scheme (Results) January 2020Document14 pagesMark Scheme (Results) January 2020AhmadNo ratings yet

- IFC KenyaDocument2 pagesIFC KenyaSakshi SodhiNo ratings yet

- Bank Management SystemDocument5 pagesBank Management SystemShreenath SrivastavaNo ratings yet

- Amex CaseDocument25 pagesAmex Caseankit2104No ratings yet

- RFP Data EntryDocument29 pagesRFP Data EntrykrmcharigdcNo ratings yet