Professional Documents

Culture Documents

CALCULATE YOUR TAX FTP VJ

Uploaded by

Ashu Kushwaha0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

CALCULATE YOUR TAX Ftp VJ

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageCALCULATE YOUR TAX FTP VJ

Uploaded by

Ashu KushwahaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

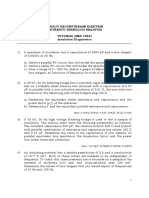

INCOME TAX CALCULATION SHEET (OLD TAX REGIME)

(FINANCIAL YEAR 2022-23) (ASSESSMENT YEAR 2023-24)

PAN AADHAAR ADDRESS

NAME DISTRICT Sitapur

DOB EHRMS BLOCK

POST AT MOB.NO. SCHOOL PS

INCOME DETAILS DEDUCTION DETAILS

GRADE BASIC NPS by GROSS NPS from NET PAY IN

MONTH DA HRA HCA GPF/PPF GIS ADV IT

PAY PAY Employer SALARY Salary A/C

Mar-22 4,200 42,300 13,113 1,340 0 56,753 0 87 56,666

Apr-22 4,200 42,300 13,113 1,340 0 56,753 0 87 56,666

May-22 4,200 42,300 13,113 1,340 0 56,753 0 87 56,666

Jun-22 4,200 42,300 13,113 1,340 0 56,753 0 87 56,666

Jul-22 4,200 43,600 13,516 1,340 0 58,456 0 87 58,369

Aug-22 4,200 43,600 14,824 1,340 0 59,764 0 87 59,677

Sep-22 4,200 43,600 14,824 1,340 0 59,764 0 59,764

Oct-22 4,200 43,600 16,568 1,340 0 61,508 0 61,508

Nov-22 4,200 43,600 16,568 1,340 0 61,508 0 61,508

Dec-22 4,200 43,600 16,568 1,340 8424 0 69,932 0 6,017 63,915

Jan-23 4,200 43,600 16,568 1,340 8424 0 69,932 0 6,017 63,915

Feb-23 4,200 43,600 16,568 1,340 8424 0 69,932 0 6,017 63,915

DA Arrear (31%-34%) 8,922 0 8,922

DA Arrear (34%-38%) 5,232 0 5,232

BONUS 6,908 6,908

OTHER ARREAR(S) 0

TOTAL 16,080 25272 0 758,870 0 0 ### 0 740,297

SECTION 80C SAVINGS DETAILS GROSS INCOME 758,870 OTH. INCOME

(01-04-2022 to 31-03-2023) 1 TOTAL INCOME 758,870

GPF/PPF 50,000 NON TAXABLE INCOME (ATTACH DOCUMENTS)

GIS 18,573 A STANDARD DEDUCTION u/s 16 (1a) 50,000

PENSION FUND B HRA EXEMP. u/s 10(13A) 16,080

LIC 22,660 C DEDUCTION u/s 80C 126,477

MUTUAL FUND ELSS D NPS DEDUCTION u/s 80CCD(1B) (Max 50,000)

NPS u/s 80CCD(1) E NPS DEDUCTION u/s 80CCD(2) 0

FD (Tax Saver) 6,348 F HOME LOAN INTEREST

NSC G 80D, 80DD, 80DDB, 80E 25,272

TUITION FEE 14,511 H EXEMP. FOR DISABILITY u/s 80U

H. LOAN PRINCI. I OTHER REBATE(S)

SUKANYA 2 TOTAL NON TAXABLE INCOME 217,829

OTHERS 14,385 3 TAXABLE INCOME (1-2) 541,041

TOTAL 126,477 INCOME TAX CALCULATION

i Upto 250,000 0

ii From 2,50,001 to 5,00,000 250,000 5% 12,500

iii From 5,00,001 to 10,00,000 41,041 20% 8,208

0 iv Above 10,00,000 0 30% 0

(A T) P S 4 REBATE u/s 87A 0

5 TOTAL TAX 20,708

6 HEALTH & EDUCATION CESS @4% 828

7 GROSS TAX LIABILITY (5+6) 21,536

8 REBATE u/s 89(10E)

9 TOTAL TAX PAYABLE (7-8) 21,536

B.E.O. D. D. O. 10 ADVANCE I.T. DEDUCTION 0

0 Sitapur 11 TAX PAYABLE 21,536

You might also like

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Income Tax CalculatorDocument3 pagesIncome Tax CalculatordpdohisarNo ratings yet

- Final Computaion For Government OfficeDocument24 pagesFinal Computaion For Government OfficeGagan Deep PathakNo ratings yet

- March 2023 CapgeminiDocument1 pageMarch 2023 CapgeminimanojkallemuchikkalNo ratings yet

- File2707202312075557Document3 pagesFile2707202312075557Ankit ShuklaNo ratings yet

- I.O.T Current Account 08-2023Document123 pagesI.O.T Current Account 08-2023canttconstiescoNo ratings yet

- Dec 22 TibDocument1 pageDec 22 TibsareenckNo ratings yet

- Incometax Calculation Worksheet (Old Regime) : Nippon Koei India Private Limited Ascent PayrollDocument2 pagesIncometax Calculation Worksheet (Old Regime) : Nippon Koei India Private Limited Ascent Payrollraz sharmaNo ratings yet

- Project Report Va Tika ProjectionsDocument37 pagesProject Report Va Tika Projectionsprateek goyalNo ratings yet

- Report 21Document1 pageReport 21Mastrina Manik, S.pdNo ratings yet

- Pay SlipDocument3 pagesPay Slipsharma_annilNo ratings yet

- Income Tax Calculation ChartDocument29 pagesIncome Tax Calculation Chartnaveed ansariNo ratings yet

- Validationheaderstart (CG Ps 46298703 Feb 2023 Default) ValidationheaderendDocument1 pageValidationheaderstart (CG Ps 46298703 Feb 2023 Default) Validationheaderendలునావత్ నరేందర్ నాయక్No ratings yet

- 2024 2025PensionSlipDocument1 page2024 2025PensionSlipdivyansh19122007sharmaNo ratings yet

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- Web Payslip 332429 202305 PDFDocument3 pagesWeb Payslip 332429 202305 PDFN.SATHYAMOORTHY MoorthyNo ratings yet

- PKS Tanjung Keliling - Detail Summary Estimate 2021-2022Document24 pagesPKS Tanjung Keliling - Detail Summary Estimate 2021-2022marlina elisabethNo ratings yet

- Monitored Cap. (MW)Document35 pagesMonitored Cap. (MW)Data CentrumNo ratings yet

- 1 14 PDFDocument1 page1 14 PDFPramila PatilNo ratings yet

- Certificación Vs Marco Presupuestal - 2020: (En Nuevos Soles)Document2 pagesCertificación Vs Marco Presupuestal - 2020: (En Nuevos Soles)Leslye JackelineNo ratings yet

- June 2022 TibDocument1 pageJune 2022 TibsareenckNo ratings yet

- Tib May 22Document1 pageTib May 22sareenckNo ratings yet

- Financials Plaza Del PradoDocument14 pagesFinancials Plaza Del PradoSteve WilliamNo ratings yet

- Lembar Kerja Edit (AutoRecovered)Document9 pagesLembar Kerja Edit (AutoRecovered)reiNo ratings yet

- Programmed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Document3 pagesProgrammed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Barangay SamputNo ratings yet

- Linnhoff Gearbox Parts NoDocument1 pageLinnhoff Gearbox Parts NoLavu ChandrasekharNo ratings yet

- Oct 22 TibDocument1 pageOct 22 TibsareenckNo ratings yet

- Anand June PayslipDocument1 pageAnand June PayslipNani NaniNo ratings yet

- Budget of Expenditures and Resources Financing F.Y. 2021: Barangay Samput Municipality of Paniqui Province of TarlacDocument4 pagesBudget of Expenditures and Resources Financing F.Y. 2021: Barangay Samput Municipality of Paniqui Province of TarlacBarangay SamputNo ratings yet

- July 2022 TibDocument1 pageJuly 2022 TibsareenckNo ratings yet

- CG FEB 2023 46280987 PayslipDocument1 pageCG FEB 2023 46280987 PayslipHR DucallNo ratings yet

- Emp Annual Statement-2Document1 pageEmp Annual Statement-2shivamrajsingh12042001No ratings yet

- C Statment - Ivan Maleakhi - Aug 2020Document4 pagesC Statment - Ivan Maleakhi - Aug 2020Budi ArtantoNo ratings yet

- File 07092023201232728Document3 pagesFile 07092023201232728dummysold7No ratings yet

- Sno. Sections Amount (Inr) Sep-21 Civil and Structural ADocument4 pagesSno. Sections Amount (Inr) Sep-21 Civil and Structural AJay UseitNo ratings yet

- Celina-CSD-MER-CFAP-2021 - Active: Header InformationDocument4 pagesCelina-CSD-MER-CFAP-2021 - Active: Header Informationmj05j6cgw3No ratings yet

- New Microsoft Office Excel WorksheetDocument19 pagesNew Microsoft Office Excel WorksheetSaghirNo ratings yet

- Golabh May'23Document1 pageGolabh May'23krishanNo ratings yet

- LTTSL - L&T Technology Services Income Tax Computation SheetDocument3 pagesLTTSL - L&T Technology Services Income Tax Computation SheetdhruvNo ratings yet

- Report e 20230412112240Document17 pagesReport e 20230412112240mikiNo ratings yet

- P 3 KDocument23 pagesP 3 KlaudyaNo ratings yet

- Iit Ropar - Collection Details 30.5.2019Document2 pagesIit Ropar - Collection Details 30.5.2019VINOD SACHDEVANo ratings yet

- SDR - Hayley - 4 UnitsDocument50 pagesSDR - Hayley - 4 UnitsRBV DESIGN & BUILD SERVICESNo ratings yet

- SDR - NTP01 - 4 Units - XLSX - SonDocument3 pagesSDR - NTP01 - 4 Units - XLSX - SonRBV DESIGN & BUILD SERVICESNo ratings yet

- DSR SahidLippo 2022 V7Document142 pagesDSR SahidLippo 2022 V7Adivia DragunsonNo ratings yet

- Daftar Gaji THR Bireuen PDFDocument161 pagesDaftar Gaji THR Bireuen PDFJoko TriyanNo ratings yet

- Web Payslip 266675 202309Document3 pagesWeb Payslip 266675 202309prabhat.finnproNo ratings yet

- VLPK PF StatementDocument1 pageVLPK PF StatementhariveerNo ratings yet

- Account Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Document6 pagesAccount Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Khaja Naseeruddin MuhammadNo ratings yet

- EDocument26 pagesEDeepak kumawatNo ratings yet

- E6d Nov BangsriDocument65 pagesE6d Nov BangsriAzka TralalaNo ratings yet

- Informe General de Facturación-20210505183014Document3 pagesInforme General de Facturación-20210505183014omar perezNo ratings yet

- Nov 22 TibDocument1 pageNov 22 TibsareenckNo ratings yet

- SDR - NTP01 - 4 UnitsDocument3 pagesSDR - NTP01 - 4 UnitsRBV DESIGN & BUILD SERVICESNo ratings yet

- Gaji Induk PNS Mei 2022 InhilDocument102 pagesGaji Induk PNS Mei 2022 Inhilfajri sabtiNo ratings yet

- Artistic Apparels (PVT) LTD.: Salary Comparison Sheet of October-2017 and November-2017Document2 pagesArtistic Apparels (PVT) LTD.: Salary Comparison Sheet of October-2017 and November-2017Pwc ApparelsNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Summary of 1601c Year 2023 PaidDocument3 pagesSummary of 1601c Year 2023 PaidjonjonNo ratings yet

- Akhtar Finishing + CMT Contractor (2021)Document3 pagesAkhtar Finishing + CMT Contractor (2021)Waris KhanNo ratings yet

- Presentation On Plant LayoutDocument20 pagesPresentation On Plant LayoutSahil NayyarNo ratings yet

- Sanction For TestDocument1 pageSanction For Testkarim karimNo ratings yet

- Sfa 5.22 PDFDocument36 pagesSfa 5.22 PDFLuis Evangelista Moura PachecoNo ratings yet

- Supercal 539: Universal Compact Heat MeterDocument6 pagesSupercal 539: Universal Compact Heat MeterVladimir ZaljevskiNo ratings yet

- Amt in A Nutshell - ExplainedDocument2 pagesAmt in A Nutshell - ExplainedMis El100% (2)

- Nilfisck SR 1601 DDocument43 pagesNilfisck SR 1601 DGORDNo ratings yet

- Experiment No 9 - Part1Document38 pagesExperiment No 9 - Part1Nipun GosaiNo ratings yet

- Income Tax Banggawan Chapter 10Document18 pagesIncome Tax Banggawan Chapter 10Earth Pirapat100% (5)

- Investigating The Determinants of Internet Banking Adoption in GreeceDocument10 pagesInvestigating The Determinants of Internet Banking Adoption in GreeceEman MostafaNo ratings yet

- MBFI Quiz KeyDocument7 pagesMBFI Quiz Keypunitha_pNo ratings yet

- Mcqs Ethics and CSR)Document9 pagesMcqs Ethics and CSR)Maida TanweerNo ratings yet

- Tire Size ComparisonDocument1 pageTire Size ComparisonBudi DarmawanNo ratings yet

- QP02Document11 pagesQP02zakwanmustafa0% (1)

- Elo BLP Neutral en Web.5573Document8 pagesElo BLP Neutral en Web.5573Ichsanul AnamNo ratings yet

- Tutorial MEP1553 - Insulation DiagnosticsDocument4 pagesTutorial MEP1553 - Insulation DiagnosticsSharin Bin Ab GhaniNo ratings yet

- Serial Number Microsoft Office Professioanal 2010Document6 pagesSerial Number Microsoft Office Professioanal 2010Kono KonoNo ratings yet

- Area & Perimeter - CRACK SSC PDFDocument10 pagesArea & Perimeter - CRACK SSC PDFSai Swaroop AttadaNo ratings yet

- EconiQ High Voltage Roadmap 1629274842Document1 pageEconiQ High Voltage Roadmap 1629274842Daniel CaceresNo ratings yet

- 2010 LeftySpeed Oms en 0Document29 pages2010 LeftySpeed Oms en 0Discord ShadowNo ratings yet

- Managing Apps in Windows 10Document29 pagesManaging Apps in Windows 10CourageMarumeNo ratings yet

- Human Resource Information Systems 2nd Edition Kavanagh Test BankDocument27 pagesHuman Resource Information Systems 2nd Edition Kavanagh Test BankteresamckenzieafvoNo ratings yet

- Marine Products: SL-3 Engine ControlsDocument16 pagesMarine Products: SL-3 Engine ControlsPedro GuerraNo ratings yet

- CIMICDocument228 pagesCIMICKehinde Olaoluwa100% (1)

- Hyundai Monitor ManualDocument26 pagesHyundai Monitor ManualSamNo ratings yet

- E Sevai RegistrationDocument18 pagesE Sevai RegistrationSatheesh PNo ratings yet

- Final ME Paper I IES 2010Document18 pagesFinal ME Paper I IES 2010pajadhavNo ratings yet

- Mechanical FPD P.sanchezDocument9 pagesMechanical FPD P.sanchezHailley DensonNo ratings yet

- SPMT Stability of Hydraulic EngDocument4 pagesSPMT Stability of Hydraulic Engparamarthasom1974No ratings yet

- Test P1 Chapter 10Document10 pagesTest P1 Chapter 10Prince PersiaNo ratings yet

- UNV EZAccess Datasheet - V1.2-EN - 883121 - 168459 - 0Document3 pagesUNV EZAccess Datasheet - V1.2-EN - 883121 - 168459 - 0Agus NetNo ratings yet